How to Buy Qredo | Where, How and Why

Qredo is rearchitecting digital asset ownership and blockchain connectivity. The Qredo network is an open-source permissionless protocol operating beyond geographical boundaries. It comes with a completely new method to bring liquidity and capital efficiency to the blockchain economy.

Moreover, Qredo or QRDO has introduced the first custodial network based on decentralized, trustless multi-party computation (MPC). This advancement enables Qredo to offer decentralized custody, native cross-chain swaps, and cross-platform liquidity access.

With the latest innovations and unique features, Qredo delivers a powerful global network for securing and trading digital assets.

Qredo has attracted millions of crypto enthusiasts worldwide, and if you are also excited with its radically new approach and want to buy the Qredo token, you are in the right place.

Read on to learn everything you need to know about the Qredo Network, the Qredo token, and how to buy QRDO.

What Is Qredo

Qredo has introduced the first custodial network based on decentralized multi-party computation (MPC), thereby offering cross-platform liquidity access, decentralized custody, and cross-chain swaps.

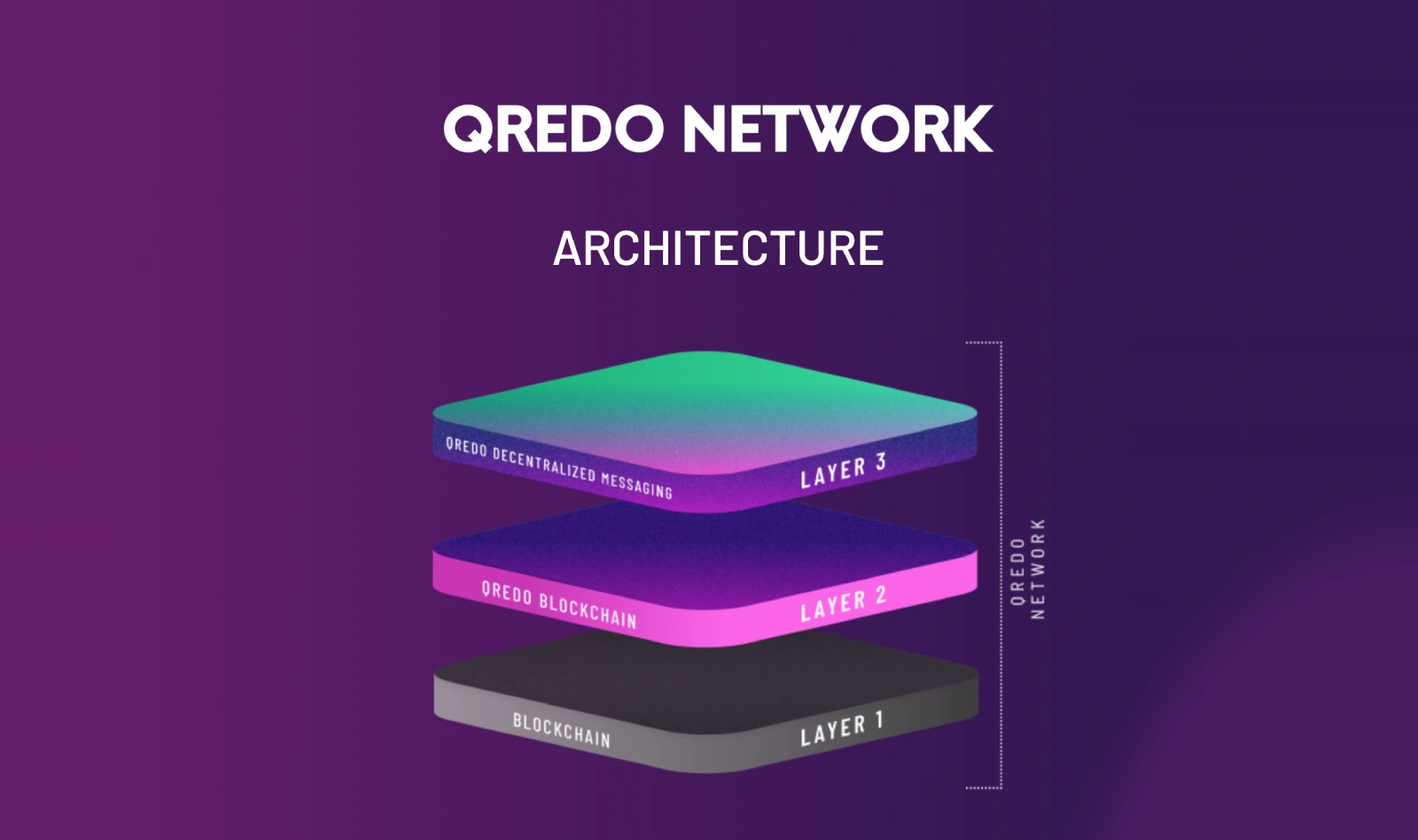

The ownership of a crypto asset is recorded on a distributed ledger technology, and a Consensus-Driven Multi-Party Computation (CD-MPC) protocol is used to securely sign transactions, which enables the transfer of portable ownership rights across chains on a Layer 2 network without counterparty risk.

This radical new blockchain infrastructure eliminates the need for private keys to manage the ownership of digital assets. It also provides a flexible way of signing transactions that meets institutional governance and security needs. Along with an interoperable Layer 2 network, it acts as an immutable asset registry, allowing for instant cross-chain settlement between blockchains and platforms. Additionally, a Layer 3 decentralized communication network supports encrypted trade negotiations and allows information to be attached to transactions.

Qredo has four main users in tokenomics: custody users, traders, market makers, and validators.

Qredo, also known as QRDO, is currently led by Anthony Foy, a serial entrepreneur and digital veteran. Brian Spector is the co-founder for Qredo and its Chief Product and Technology Officer (CPTO). Spector is a Cyber Security expert and serial entrepreneur with a background in advanced cryptography.

The QRDO token is a means of utility and governance to the Qredo Network. It comes with a user-centric incentive structure to reward users of the Qredo network, thus driving user adoption of the network. QRDO can be staked with validators, and staking yield earned. Being a unique characteristic of Qredo, unvested QRDO are automatically staked and accrue staking yield.

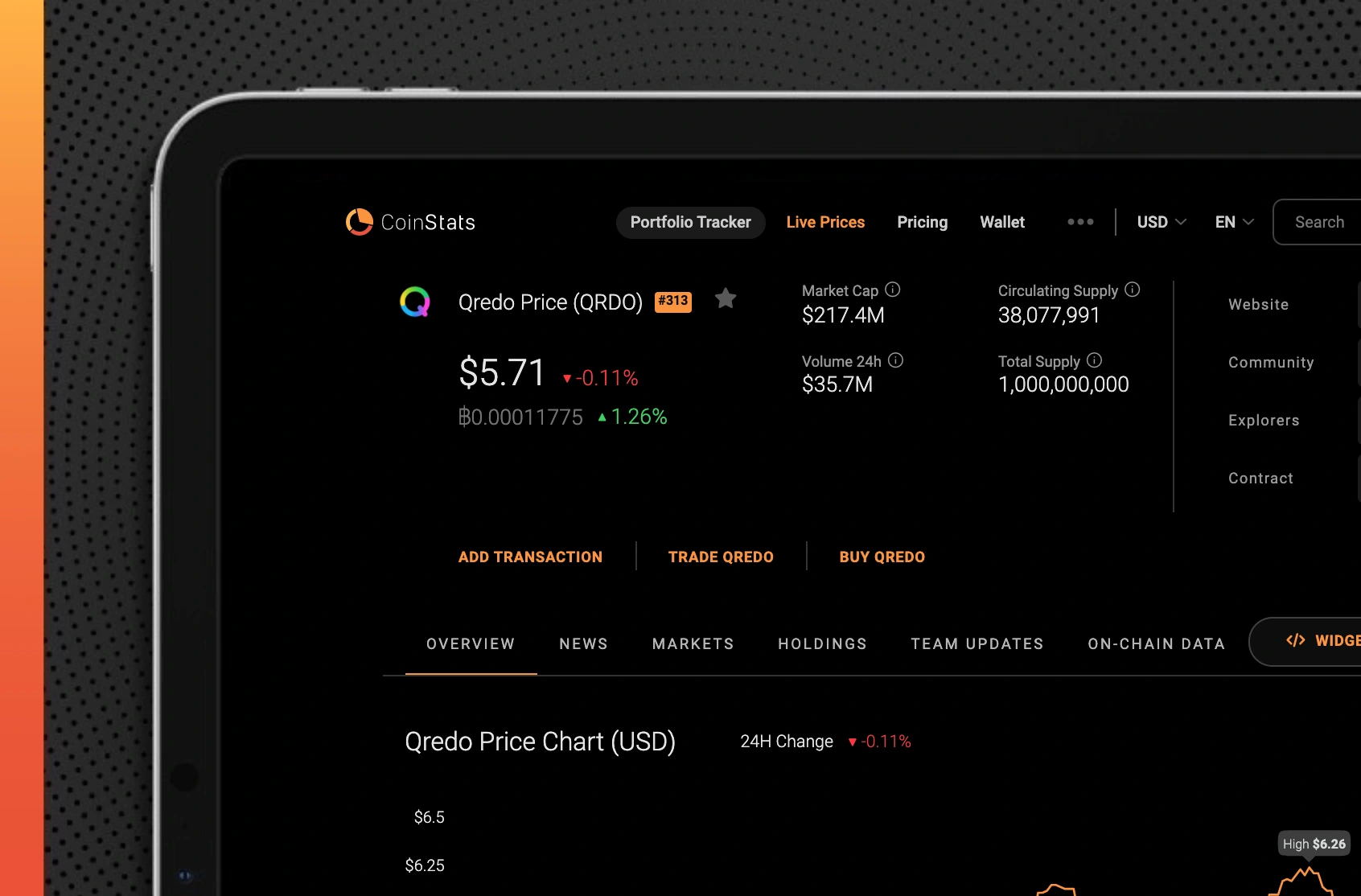

QRDO has been a tradable token since August 2021. It comes with a total supply of one billion tokens and has a market cap of around eight billion US dollars. Qredo price at the moment is $4.32. Qredo is available on several crypto exchange platforms, where you can purchase QRDO and exchange it for other currencies.

Why Should You Buy Qredo

DeFi protocols and the Qredo Network perfectly complement one another and make the adoption in financial firms that comply with compliance and governance workflows a much smoother process. It will also offer the ability to implement OTC dark pools, margin trading via exchange integrations, mint derivatives (qTokens), etc.

The combination of MPC with a blockchain to record asset ownership offered by Qredo Network is unique. Qredo offers key features such as compliance automation, CD-MPC, easy app development, transaction secrecy, the best digital asset security through decentralization, multi-party computation and advanced crypto protocols, economic security and incentives, etc.

Many people buy Qredo and believe in its future because of the professional core Qredo team. Others find the technology and the logic behind how it works very innovative and prospective in terms of its performance, potential market cap, safety, etc.

The recent announcement of using Qredo as a custodian within Metamask Institutional is another good step, giving users decentralized custody while accessing DeFi applications.

Finally, considering that buying QRDO is not a popular crypto purchase as it’s pretty new, it might have a significant potential for growth.

How to Buy Qredo QRDO

Buying Qredo is very straightforward and similar to how to buy Pirate Chain, Bitcoin, or other cryptocurrencies.

Follow our step-by-step guide on how to buy Qredo:

Step #1: Register on a Cryptocurrency Exchange

First, you need to research and find the best exchange platform for buying Qredo. The “best platform” definition may vary from buyer to buyer. Some look into the fees and want to work with the cheapest options; others consider the exchange’s reputation and reviews or whether it offers Futures trading. Most investors, especially when they consider making significant investments, look into the security features of the platforms, etc.

If you are looking for a secure fiat-to-crypto platform or if this is your first crypto purchase, then one of the world’s largest cryptocurrency exchanges – Binance, can be a good choice for you.

If you are interested in other exchanges, you might want to consider Cex.io. It supports users worldwide, as opposed to Binance; however, the fees here are relatively higher.

You should also note that most crypto exchanges require personal information such as your full name, phone number, proof of ID, social security number, and email address to register. You will also be required to undergo a standard KYC procedure.

After doing proper research and choosing the best crypto exchange for you, it’s time to move on to the next step.

Step #2: Choose Your Qredo Wallet

A cryptocurrency wallet is a virtual space where you can safely store your valuable crypto holdings. Software wallets like Coinbase Wallet and Metamask are good choices for many investors; however, consider acquiring a hardware wallet for safety. A Ledger wallet, like Ledger Nano S or X, offers you long-term secure storage and is highly recommended as a secure wallet by professionals. If you would like to send your Qredo tokens to an external address, this can be done at any time.

A Qredo wallet is essential because it will help you to:

- Store your QRDO securely, especially if you plan to keep it for a more extended period

- Use the token as a payment method

- Trade QRDO for other cryptocurrencies.

Step #3: Buy Qredo and Transfer It to Your QRDO Wallet

Once you make the crucial choices about the wallet and exchange platform, you’re all set to buy Qredo QRDO.

You need to choose a trading pair, whether fiat to QRDO or crypto to QRDO. You can track the cryptocurrency prices on platforms like Coinstats to make your decision as informed as possible. You might also seek some investment advice or financial advice to get the best out of your deal.

Upon signing up at the exchange, you should be shown easy-to-follow instructions to buy Qrdo with fiat currency from your bank account or credit or debit card. Once verified, you can deposit fiat currencies using the payment method that best suits you – bank transfer, credit or debit card, and wire transfer are all widely accepted.

After successfully purchasing Qredo, you need to transfer it to your wallet.

Final Thoughts

If you’re looking to invest in digital assets, consider buying QRDO and making it part of your portfolio. This is a prospective token for creating a diverse portfolio and if you’re interested in Qredo’s cutting-edge approaches.

The most significant part of buying it is finding the crypto exchange allowing you to buy QRDO and a secure Qredo wallet.

However, investing in cryptocurrencies involves significant risks due to their volatility. Consider your own circumstances and obtain your own advice before relying on this information. You should also carry out your own research, including the legal status and relevant regulatory requirements, and consult the relevant regulators’ websites before making any decision.

This content and any information contained therein are being provided to you for informational purposes only and do not constitute investment advice, financial advice, trading advice, or any other advice.