Here Is How Blockchain Is Transforming Gold Investment

1

0

The ongoing political instability in the world, combined with the outbreak of COVID-19 in recent months has left traditional economies reeling. The longstanding narrative of Bitcoin being a “safe-haven” asset has also been degrading. Perhaps the most historically important asset in human history has been experiencing difficulty that has not been seen in over thirty years.

People shouldn’t be shocked that both gold and Bitcoin are prone to changes in price. Furthermore, all opportunities and items must be considered for their long-term applications. Bitcoin has managed to invoke more confidence, but there is still a long road ahead. Gold already has proven credentials as an asset; regularly holding up well against inflation. This has led to an increase in gold-backed stablecoins. New innovations are also taking hold in the market.

Why Is Gold So Precious and Valued?

Even now, gold is still in demand from multiple different avenues, from being an investment opportunity, a sign of status and expense for purchasers, or, as an internal and integral part of numerous technologies. Not to mention that gold is still an incredibly popular reserve asset.

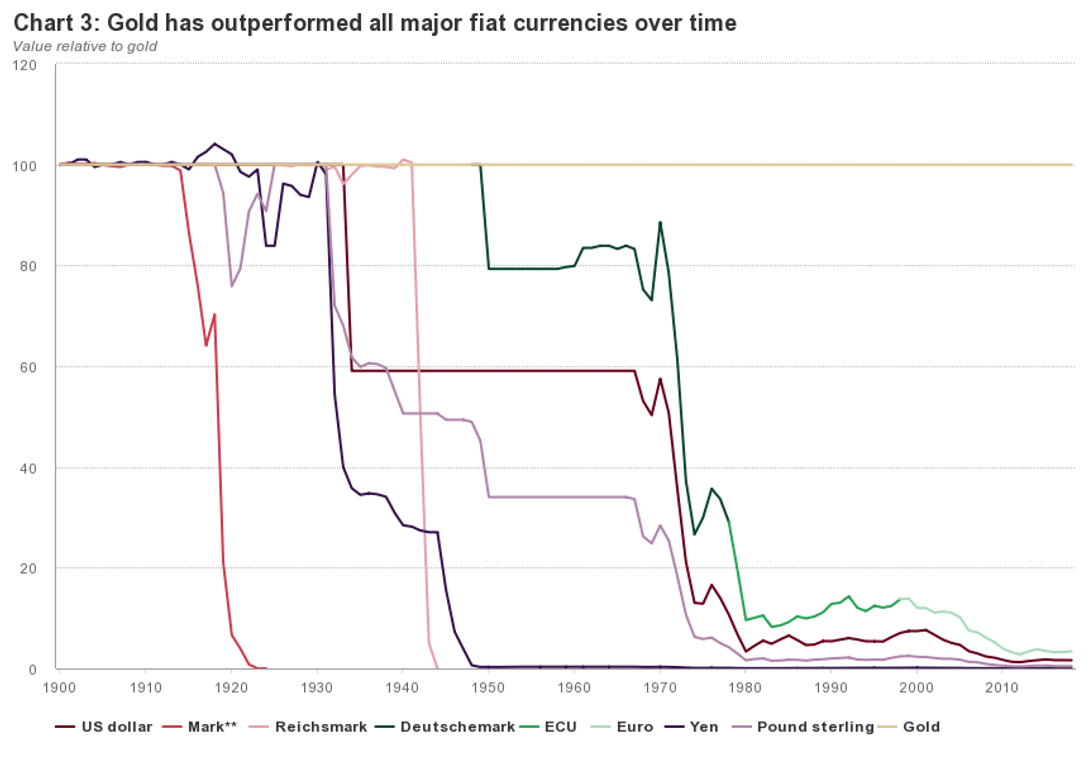

These factors have all played a very large role in the fact that gold has more often than not, been more effective than any fiat currency, even in the 20th century. The current trend of gold being one of the most stable stores of value does not seem to be declining. The main market development organization for this asset, the World Gold Council has even stated that over the previous two decades the demand for gold from investors has climbed by 15% each year.

The financial crash in 2008 and the recent gut-punch the economy has suffered from the COVID-19 outbreak has rejuvenated the emphasis on risk management and will play a big role in gold’s continued existence as a desirable investment.

Gold’s History And Potential On The Blockchain

Even so far back as the 1990s, there were efforts to digitize gold as an asset, which was most notoriously started by the now dead in the water E-Gold. Despite these efforts, it has been eleven years since the Bitcoin Blockchain appeared on the map of digital currencies and we have only recently seen the idea of gold as a digital asset gaining traction.

Stablecoins

Cryptographic tokens that are backed by gold, belong to the stablecoin cryptocurrency family. Hosted on a blockchain, stablecoins try to combat one of the main issues of many cryptocurrencies, which is price fluctuation. The way they attempt to combat this is by pegging their value against a tangible asset (ie. fiat currencies and other valued items).

There are a number of gold-backed stablecoins that have recently come into the fold of the cryptocurrency market, these can be found below.

As was previously mentioned, gold has proven more stable and effective as an asset in the face of worldwide financial difficulties than any other asset. The benefit for investors putting their money into stablecoins is that they are much less likely to experience a severe price crash than their fiat counterparts.

Early Investment Opportunity

As has been previously stated, the developments in gold on the blockchain are not only limited to stablecoins. A new and exciting method of investing in gold is being hosted by the Maltese digital asset exchange, AAX. The exchange was launched in November 2019 and it is the only exchange that is backed by the London Stock Exchange Group’s own technology provider.

The name of the development project itself is PhiGold. The launch of PhiGold on the platform took place on the 31st of March, 2020. This move makes PhiGold the first commodity finance token to appear on AAX.

It would be incorrect to assume that PhiGold is a direct competitor to the ever-growing number of gold-backed stablecoins that are currently in the market; it is something altogether different. The business model of PhiGold is quite simple to understand. Instead of getting funding from investment bankers, or other traditional avenues of fundraising, the company has released the PGX Token; the token runs on ERC-20 and they have been using it to raise the required capital to finance the operation of the PhiGold Barobo goldmine, which is located in the Philippines.

Each PGX Token is worth 1/100 ounces of gold and after a sustained period of time, it can be cashed in for actual gold, cryptocurrency or fiat currencies. The pricing for the tokens is currently listed at $10 each, however, if the owner of a token were to hold for 2-3 years, they would be able to redeem the token for the price of gold on that day. This is currently around $15 and by doing this, investors are able to effectively buy gold at a 33% discount.

Here are some key facts to know.

- The PhiGold Barobo mine is estimated to hold 272,000 ounces of gold.

- All extracted gold is sold to the central bank of the Philippines in exchange for fiat currency, which is then invested into London Bullion Market Association (LBMA) GLD 995 purity gold bullion, which is then held in London.

- Once a point is reached where the value of the trust meets the value of each token’s 1/100th of an ounce of gold, token holders will be able to exchange their tokens.

1

0