Best Bitcoin ETF 2025: Top Spot Crypto Fund to Buy

1

0

If you are looking for the best Bitcoin ETF, you’re not alone. Many investors want a simple way to gain Bitcoin exposure without handling wallets or exchanges, and a reliable crypto ETF can make that process much easier. With several new funds competing for attention this year, understanding which one stands out can help you make a smarter, more secure investment choice.

In this guide, we take you through what a Bitcoin ETF is, why investors are paying attention, the best spot Bitcoin ETFs for 2025, how to choose the right one, how to buy them, the benefits and risks, Bitcoin strategy ETFs, and the future outlook for these funds. If you want a clear, friendly breakdown that helps you make a confident choice, keep reading.

Best Bitcoin ETFs for 2025: A Detailed Comparison of Top Picks

| Ticker | ETF Name | Issuer | Expense Ratio | Assets Under Management (AUM) |

| IBIT | iShares Bitcoin Trust | BlackRock | 0.25% | ~$87.3B |

| FBTC | Fidelity Wise Origin Bitcoin Fund | Fidelity | 0.25% | ~$24.2B |

| BTC | Grayscale Bitcoin Mini Trust | Grayscale | 0.15% | ~$5.4B |

| EZBC | Franklin Bitcoin ETF | Franklin Templeton | 0.29% | ~$627.4M |

| BITB | Bitwise Bitcoin ETF | Bitwise | 0.20% | ~$4.8B |

| ARKB | ARK 21Shares Bitcoin ETF | ARK Invest / 21Shares | 0.21% | ~$5.8B |

| HODL | VanEck Bitcoin Trust | VanEck | ~0.20% | ~$1.9B |

| BTCW | WisdomTree Bitcoin Fund | WisdomTree | 0.25% | ~$186.3M |

Best Spot Bitcoin ETFs to Buy for 2025: Our Expert Picks

Spot Bitcoin ETFs give you direct access to Bitcoin and how it works through regular brokerage accounts. You get the price movement of Bitcoin without needing a wallet or private keys. These funds continue to grow fast as investors look for simple and regulated ways to add the best bitcoin ETF to buy to their portfolios. Before you choose one, it helps to compare size, liquidity, fees, and how each fund operates. Below are our expert picks for 2025, backed by clear figures and easy to understand details.

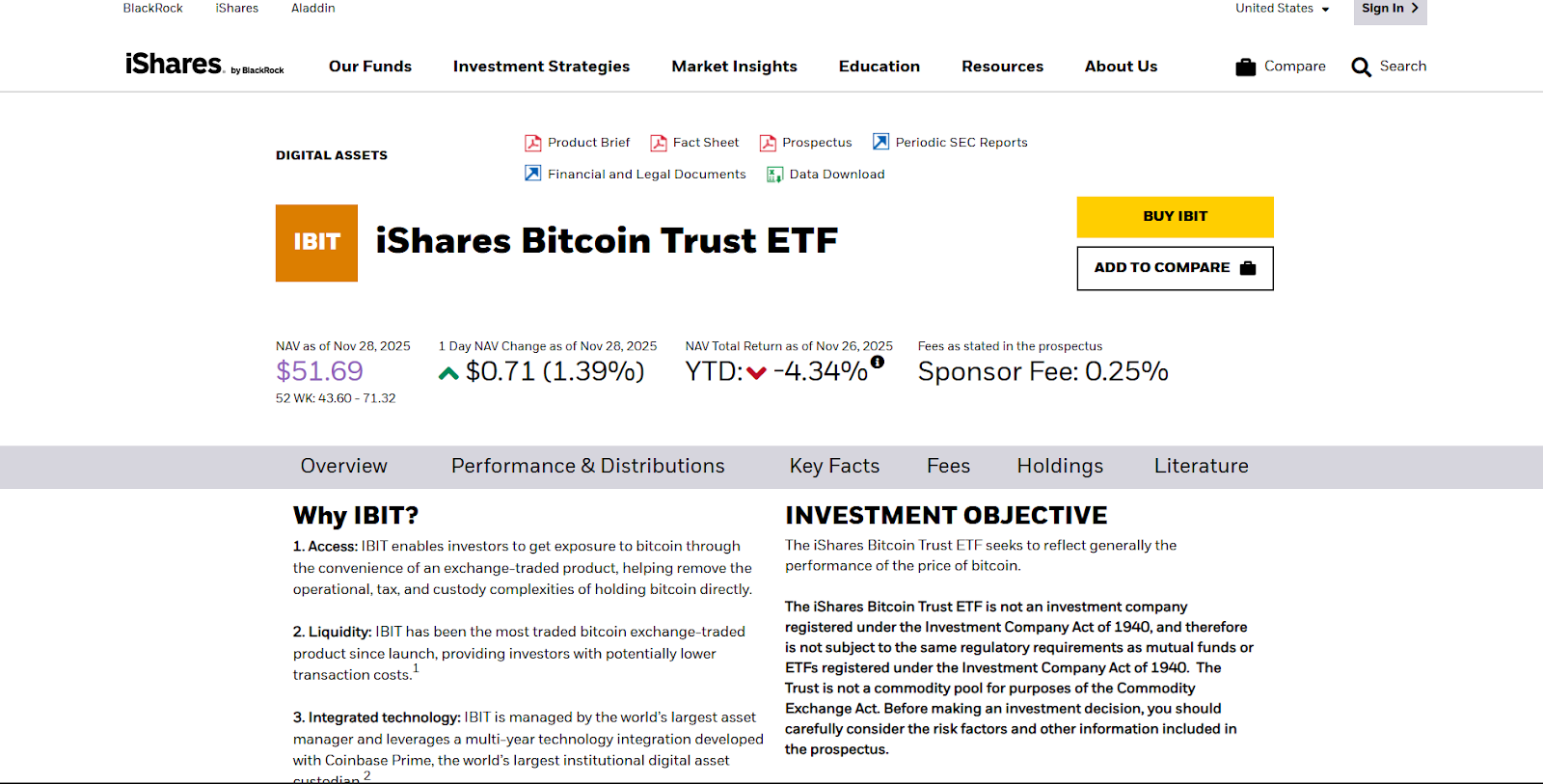

1. iShares Bitcoin Trust (IBIT)

IBIT is the largest spot Bitcoin ETF in the market and one of the most trusted options available today. It manages around US$80 billion in assets under management, which gives you strong liquidity and smooth trading. The fund charges a simple 0.25 percent expense ratio and tracks the spot price of Bitcoin. Many investors choose IBIT because its size helps reduce price slippage and creates a more stable trading experience. If you want a high-volume crypto ETF from a well known issuer, IBIT sits at the top of the list.

2. Fidelity Wise Origin Bitcoin Fund (FBTC)

FBTC is backed by a large asset manager with long experience in custody and research. This matters when you want secure storage of your Bitcoin exposure. The fund holds about US $23.27 billion in assets and charges a 0.25 percent fee. Custody is handled by Fidelity Digital Assets, which may attract those looking for strong security and solid operational controls. If you prefer a reputable traditional issuer for your spot Bitcoin ETF, FBTC gives you confidence and clean tracking performance.

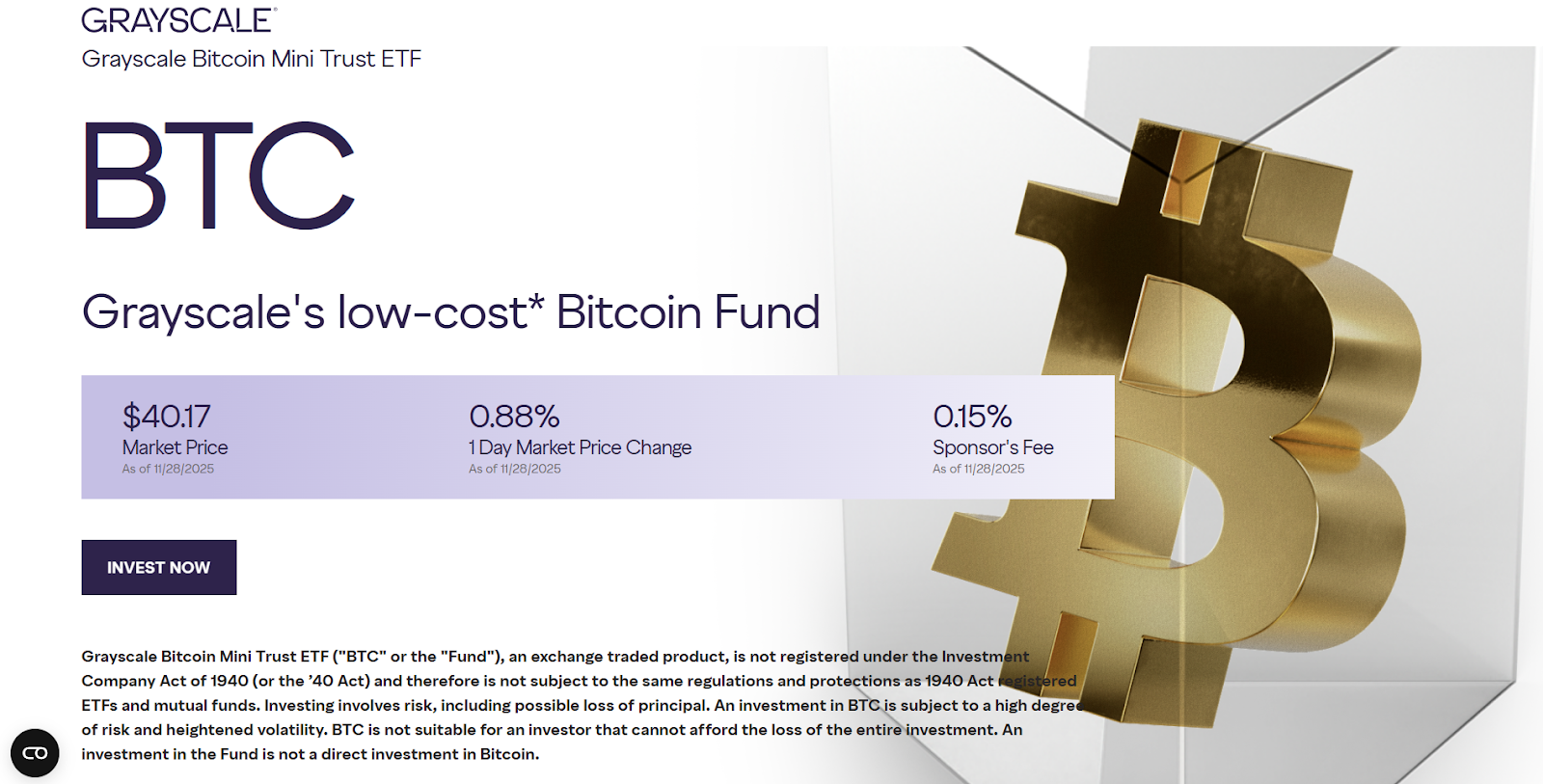

3. Grayscale Bitcoin Mini Trust (BTC)

BTC is one of Grayscale’s newer offerings and was created to provide a lower fee option, 0.15%, compared to older trust structures. It holds about US$4 billion in assets and gives you direct Bitcoin exposure without the premium issues seen in earlier funds. Grayscale has been active in Bitcoin products for years, so BTC benefits from that experience. If you want exposure through a brand that has been part of Bitcoin investing since the early days of institutional interest, this Bitcoin fund is a practical choice.

4. Franklin Bitcoin ETF (EZBC)

EZBC stands out for its low costs and simple operation. The fund charges one of the lowest expense ratios, 0.19% annually, among spot Bitcoin ETFs. The fund has reported net assets of about US $661.1 million in the recent months. This appeals to investors who are sensitive to fees and want long term value. EZBC focuses on straightforward tracking and ease of use. If you want a budget friendly option that still gives you clean exposure to Bitcoin, EZBC is worth serious consideration.

5. Bitwise Bitcoin ETF (BITB)

BITB is known for transparency. The fund publishes its Bitcoin holdings regularly so you can see exactly what it owns. It charges about 0.20 percent, which makes it one of the lower cost choices in the group. BITB holds about US$3.97 billion in assets and aims to track Bitcoin accurately. It holds actual Bitcoin in cold storage and delivers direct spot-crypto exposure via a traditional ETF structure. If you want the best performing bitcoin ETF that values openness and clear reporting, BITB is a strong fit.

6. ARK 21Shares Bitcoin ETF (ARKB)

ARKB brings together ARK Invest’s growth focused strategy and 21Shares’ experience with crypto products. This partnership creates a modern and competitive spot ETF that has gathered around US$4 billion in assets under management (AUM). Fees sit around 0.21 percent, and the fund holds real Bitcoin in regulated custody. ARKB is popular among investors who follow ARK’s broader innovation themes and want Bitcoin included in that long term vision. If you want a forward thinking crypto ETF, ARKB is a natural pick.

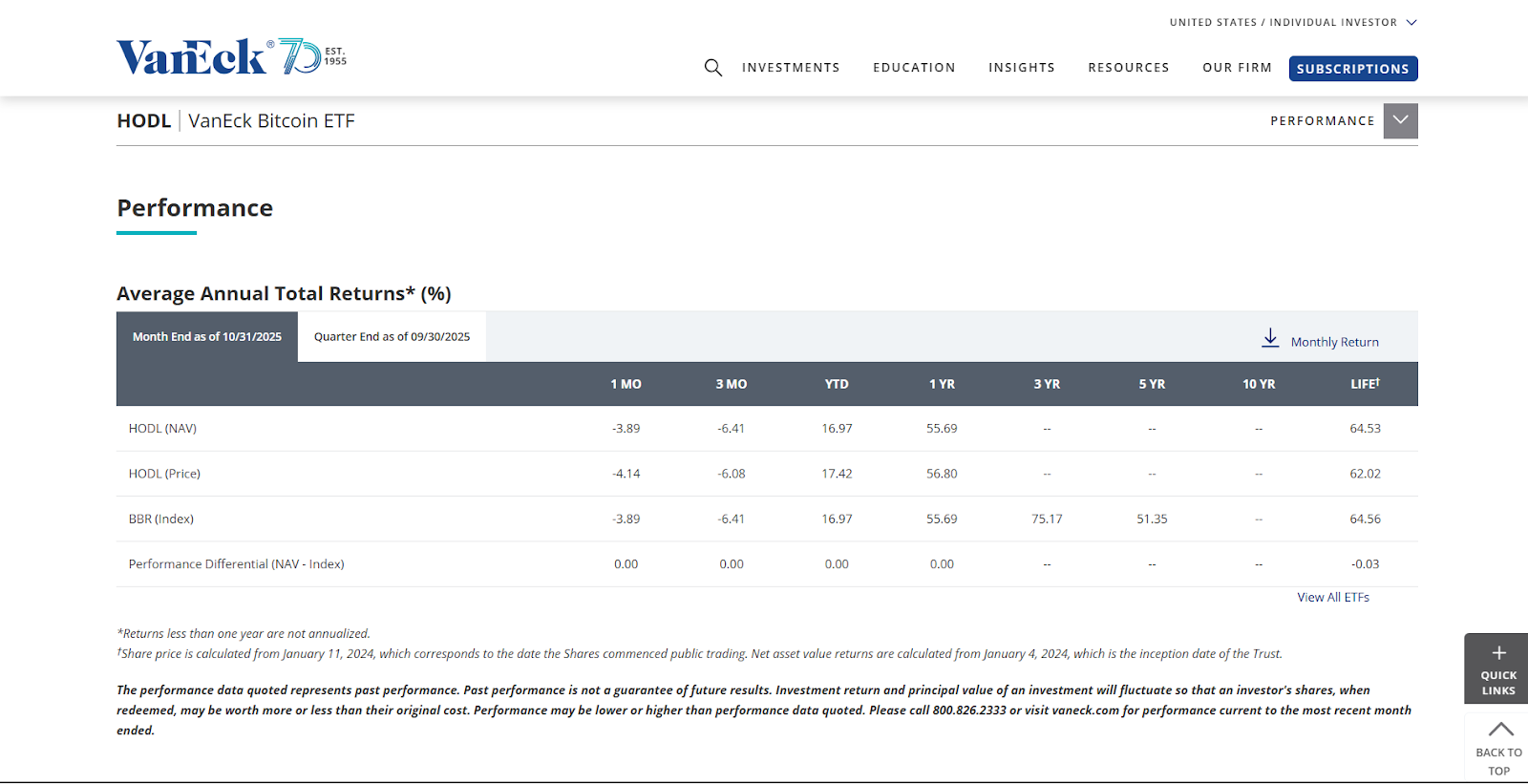

7. VanEck Bitcoin Trust (HODL)

HODL offers simple, cost-efficient Bitcoin exposure through a trusted issuer. The fund holds about US$1.52 billion in total net assets and keeps fees lower than many competitors. It invests 100% in Bitcoin, with the Trust owning roughly 17,485 BTC under custody. It focuses on direct spot holdings and easy trade execution through regular brokers. HODL works well for investors who want a clean, reliable option without extras they do not need. If you want a conservative and well structured Bitcoin fund, HODL is a solid choice.

8. WisdomTree Bitcoin Fund (BTCW)

BTCW is designed for investors who want a stable, regulated structure backed by a respected issuer. It carries a 0.25% expense ratio, making it a competitively-priced choice for straightforward Bitcoin exposure. While BTCW’s assets under management remain modest (in the low hundreds of millions), it remains a dependable option if you want steady exposure without complexity. It fits well for cautious investors comparing several crypto ETF choices for 2025.

What is a Bitcoin ETF?

A Bitcoin ETF is a fund that lets you buy Bitcoin exposure through a regulated fund instead of using a crypto exchange. You get the price movement of Bitcoin, but you never need to store coins, manage private keys, or deal with wallets.

A Bitcoin ETF works by holding Bitcoin or Bitcoin-related assets on your behalf. When you buy shares of the ETF, you’re buying a small piece of those holdings. This setup makes Bitcoin easier to access, especially for people who prefer regulated investment products. According to the CFTC (Commodity Futures Trading Commission), ETFs give you a more familiar structure while still tracking Bitcoin’s price.

How to Choose the Best Bitcoin ETF

When you compare Bitcoin ETFs, you want to focus on factors that affect cost, safety, and long term performance. The right choice depends on how you invest and how much risk you can handle. Here are the key things to look at before you decide.

- Fees: Expense ratios reduce your returns over time. Lower fees make a big difference if you plan to hold your ETF for years. Always compare the costs side by side.

- Liquidity: High trading volume helps you buy and sell without wide price gaps. Large funds with billions in assets usually offer smoother trade execution.

- Tracking Accuracy: A good ETF should follow the price of Bitcoin closely. Strong tracking means your returns match the real movement of Bitcoin without large deviations.

- Issuer Reputation: Trusted issuers use strong security, reliable custody, and clear reporting. This helps protect the underlying Bitcoin and gives you confidence in the product.

- Custody and Security: Spot ETFs store real Bitcoin in regulated custody. You want a fund that uses proven security practices to keep those holdings safe.

How to Buy Spot Bitcoin ETFs?

Buying a spot Bitcoin ETF is simple because the process is similar to buying a normal stock or traditional ETF. You do not need a crypto exchange or a digital wallet. Here are the steps to follow.

- Step 1. Open a brokerage account: You need to open an online brokerage account with a regulated brokerage that offers spot Bitcoin ETFs. This includes most major platforms. Make sure your account is verified and funded before you begin.

- Step 2. Search for the ETF ticker: Every Bitcoin ETF has a unique ticker. Examples include IBIT, FBTC, or BITB. Type the ticker into your broker’s search bar to pull up the fund’s details and current price.

- Step 3. Review the ETF information: Check the expense ratio, assets under management, trading volume, and recent price performance. This helps you understand how the fund behaves and whether it fits your goals.

- Step 4. Decide how many shares to buy: Choose the number of shares based on your budget and risk level. You can buy a single share or build your position over time. Many brokers support fractional investing.

- Step 5. Place your buy order: Submit a market order if you want to buy immediately, or use a limit order if you prefer a specific price. Once the order fills, the ETF appears in your portfolio and tracks the price of Bitcoin in real time.

Check out list of the best crypto exchanges and apps

Benefits and Risks of Investing in Bitcoin ETFs

Benefits

- Convenient access. You can buy a Bitcoin ETF through a regular brokerage account. You do not need a crypto wallet, private keys, or a crypto exchange. This makes it easier for beginners and long term investors.

- Regulated structure and custody. Spot Bitcoin ETFs hold real Bitcoin in regulated, institutional grade custody. This reduces security risks you often face when storing Bitcoin yourself.

- Simple tax reporting. You buy and sell shares the same way you trade stocks. This keeps your tax reporting straightforward and avoids the complex rules that come with direct Bitcoin ownership.

- Liquidity and easy trading. Most major Bitcoin ETFs trade with strong volume. High liquidity helps you enter and exit your position without wide price gaps.

- Direct Bitcoin exposure without complexity. A spot Bitcoin ETF tracks the price of Bitcoin closely. You get the full price movement without the stress of managing digital wallets or blockchain transfers.

Risks

- Bitcoin price volatility. Bitcoin can rise and fall quickly. Because the ETF tracks the price directly, your investment can move up or down in short periods.

- Management fees. Every ETF charges an expense ratio. Over time, fees reduce your total returns. Lower fee funds are usually better for long term investors.

- You do not own actual Bitcoin. When you buy the ETF, you own shares in a fund, not the Bitcoin itself. You cannot use the underlying Bitcoin for payments or transfers.

- Possible tracking differences. Sometimes the ETF does not follow the exact price of Bitcoin. Custody costs and fund operations can create small differences in performance.

- Custodian and regulatory concerns. Bitcoin ETFs depend on custodians to store the Bitcoin safely. Changes in regulations or issues at the custodian level can affect the fund.

What is a Bitcoin strategy ETF?

A Bitcoin strategy ETF is a type of crypto ETF that uses futures contracts instead of holding real Bitcoin. Unlike a spot Bitcoin ETF, which owns actual Bitcoin in custody, a strategy ETF gets exposure through regulated Bitcoin futures traded on exchanges. This means the fund tracks the general direction of Bitcoin but may not match the price perfectly, especially when you consider the contrast between futures exposure and physically backed Bitcoin ETFs.

These ETFs focus on short term market trends and usually suit investors who want active trading tools rather than long term holdings. The structure can create extra costs because futures contracts expire and need to be replaced. This process can affect performance, especially when compared to the best performing Bitcoin ETF that holds real Bitcoin.

A Bitcoin strategy ETF can still fit into your list of Bitcoin funds if you want a product that works inside traditional brokerage accounts and follows Bitcoin’s movement without direct ownership. It offers a simpler path for people who prefer futures exposure while staying in a regulated environment.

Top Bitcoin Strategy ETFs for 2025

- ProShares Bitcoin Strategy ETF (BITO). BITO is the most widely recognized Bitcoin futures ETF. It uses regulated Bitcoin futures to track the general direction of the Bitcoin market. Its size and strong trading volume make it a common choice for investors who want futures based exposure inside a traditional account.

- Valkyrie Bitcoin Strategy ETF (BTF). BTF invests in Bitcoin futures contracts and gives you short-term exposure to market trends. It appeals to investors who want tactical tools rather than long-term spot holdings. It is a practical addition for people who prefer strategy-style Bitcoin funds.

- VanEck Bitcoin Strategy ETF (XBTF). XBTF focuses on efficiency and futures based exposure. It uses a structure designed to manage costs and deliver smoother performance during contract roll periods. It works well if you want a futures-based option that fits inside your broader list of bitcoin funds.

Future Outlook for Bitcoin ETFs

The outlook for Bitcoin ETFs remains strong as more investors look for simple and regulated ways to gain Bitcoin exposure. Spot Bitcoin ETFs continue to attract steady inflows because they offer an easier path to the best bitcoin etf without the challenges of storing digital assets. This shift shows that many people prefer a structure they already understand.

Institutional interest is also growing. Large firms are studying how a crypto ETF can fit into long-term strategies, especially for diversification. As more institutions invest, the market gains deeper liquidity, which helps anyone searching for the best Bitcoin ETF to buy for long-term growth. Stronger liquidity often supports a smoother trading experience and more stable pricing.

Regulation is expected to guide the next phase of expansion. Clear rules around custody and reporting can help investors trust bitcoin funds even more. If the regulatory environment continues to develop, we may see more product innovation, including funds that aim to become the best-performing bitcoin ETF for different risk levels.

Conclusion

Choosing the best Bitcoin ETF depends on your goals, risk level, and how you prefer to invest. Spot funds offer simple, direct exposure to Bitcoin, while strategy-based ETFs use futures for a different type of market access. Each option has its strengths, whether it is lower fees, deeper liquidity, or stronger transparency. The right choice comes from comparing costs, issuer reputation, custody practices, and how closely the fund tracks Bitcoin. When you understand these factors, you can pick a crypto ETF that fits your long-term plan and feel confident knowing you made a well-informed decision about adding bitcoin funds to your portfolio.

FAQs

The best Bitcoin ETF to invest in depends on what you want. If you prefer size and liquidity, IBIT is a common choice. If you want strong custody and a trusted issuer, FBTC is popular. You should compare fees, tracking accuracy, and fund size to find the best fit for your goals.

Whether Bitcoin ETFs are a good investment depends on your risk tolerance and time horizon. A Bitcoin ETF gives you Bitcoin exposure in a regulated structure, but you still face the price volatility of Bitcoin. They can be useful for long term diversification if you are comfortable with these movements.

A Bitcoin ETF works by holding Bitcoin or Bitcoin futures and turning that exposure into shares you can buy through your brokerage account. When the price of Bitcoin moves, the value of the ETF shares moves in the same direction. This gives you Bitcoin exposure without needing a wallet or private keys.

The difference between a Spot Bitcoin ETF and a Bitcoin Futures ETF is how they gain exposure. A spot Bitcoin ETF holds real Bitcoin, while a futures ETF uses regulated futures contracts. Spot funds track Bitcoin more closely, while futures funds can behave differently during contract roll periods.

You cannot hold actual Bitcoin in an ETF, but you can hold ETF shares that represent Bitcoin exposure. The fund owns the Bitcoin or futures contracts, and you own shares of the fund. This gives you the price movement without needing your own wallet.

Yes, Bitcoin ETFs are available in the USA. Several spot Bitcoin ETFs and futures ETFs trade on major exchanges. You can buy these funds through most brokerage accounts without needing a crypto exchange.

Whether Bitcoin ETFs or direct Bitcoin investment is better depends on your needs. Bitcoin ETFs are easier and regulated, while direct Bitcoin gives you full control of the asset. If you want convenience, ETFs help. If you want full ownership, direct Bitcoin works better. The right choice depends on your comfort with wallets, security and long term goals.

The post Best Bitcoin ETF 2025: Top Spot Crypto Fund to Buy appeared first on NFT Plazas.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.