BlackRock and Fidelity Fuel $524M Bitcoin ETF Inflows as Whales Accumulate

0

0

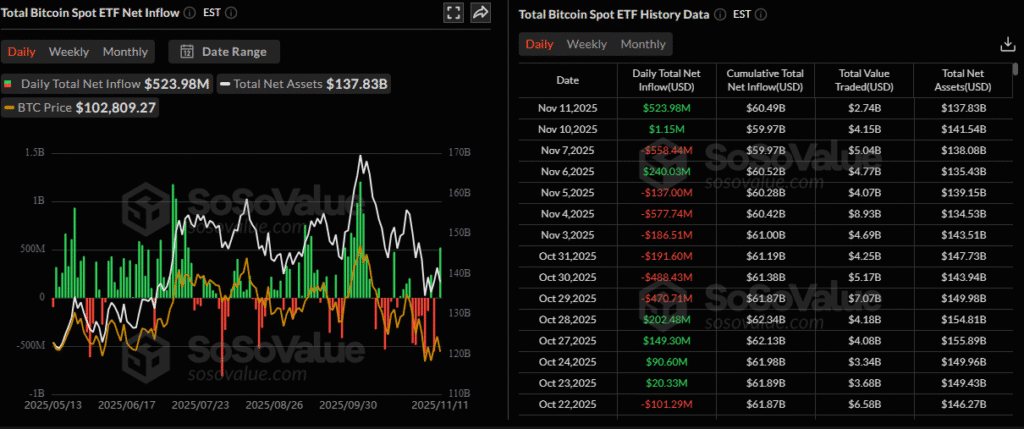

The Bitcoin price stayed steady this week as U.S. spot Bitcoin ETFs brought in $523.98 million in net inflows on Tuesday. BlackRock and Fidelity led the surge, signaling renewed interest from major institutions.

The Bitcoin price held near $104,111, showing stability after weeks of volatility. Market sentiment remains cautious but leaning positive.

ETF Inflows Signal Renewed Institutional Demand

All eyes on Spot Bitcoin ETFs once more by large financial giants. These investment products allow institutions to access Bitcoin through regulated markets. The influx of $523.98 million is one of the biggest days for Bitcoin ETFs in recent months.

Analysts see the increase in fund inflows as a sign of confidence in digital assets. This kind of action frequently gives, stability and a bright future to the Bitcoin price for the mid-term.

Bitcoin Price Holds Within Tight Range

Bitcoin price has been moving in a tight range of $104,000 and $107,200. This low-volatility phase implies consolidation as we are waiting for a clear direction.

Also Read: Bitcoin Whale Accumulation Surges as Major Holders Add 29,600 BTC During Market Dip

A move above $108,000 might clear the path for a push toward $110,000 or $112,000. Conversely, inability to protect the $104,000 support may possibly results in a short-term downside correction towards the $102,000 and $100,500 levels.

Technical Indicators Show Steady Momentum

Technical signals indicate that the Bitcoin price continues to form higher lows above $104,000. This pattern often points to underlying strength in buyer demand. Analysts say this steady movement suggests accumulation by strong hands.

| Month | Min. Price | Avg. Price | Max. Price | Change |

|---|---|---|---|---|

| Nov 2025 | $ 104,768 | $ 121,461 | $ 141,245 |

34.70%

|

| Dec 2025 | $ 113,368 | $ 129,886 | $ 146,260 |

39.48%

|

If this support can hold, the market might be gearing up for another leg higher. Next few sessions could be key in determining whether Bitcoin will break resistance or fall back in correction.

BlackRock and Fidelity Lead ETF Surge

BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund led the ETF inflows, confirming growing institutional participation. These vehicles give investors traditional access to Bitcoin exposure without directly holding the asset.

The Bitcoin price has historically done well as ETF inflows increase because they are reflective of real demand from professional investors. Analysts predict that the flow into the funds will help sustain momentum in the weeks ahead.

OG Wallets Begin to Sell

On-chain data shows that some of Bitcoin’s oldest wallets, often called OG wallets, have started to move funds. According to CryptoQuant, these wallets sold around 21,300 BTC worth roughly $2.25 billion last week.

It marks the biggest reduction since July. While such selling may create short-term pressure on the Bitcoin price, it is likely driven by profit-taking rather than fear. These long-term holders typically sell only when conditions favor realizing gains.

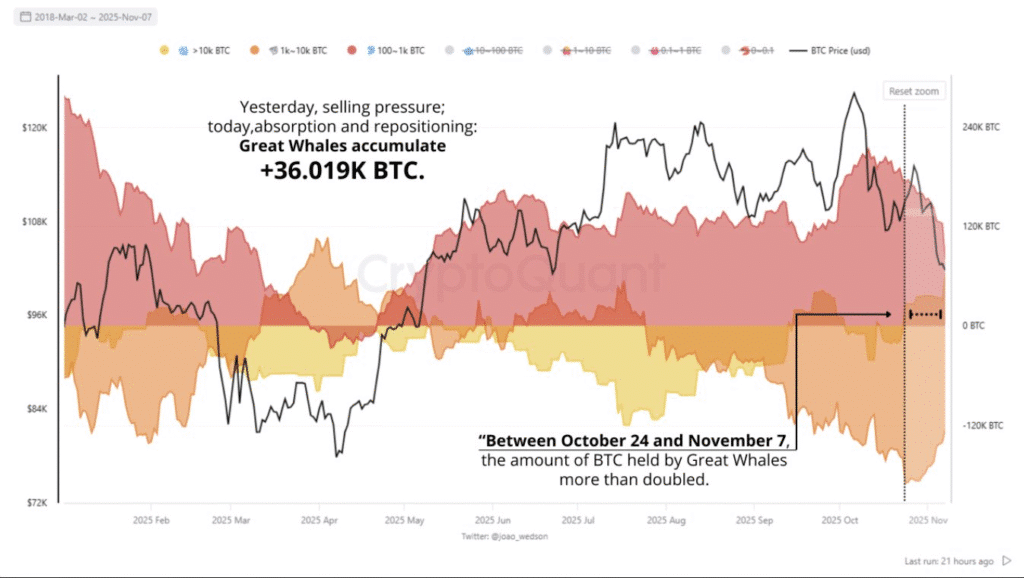

Whales Accumulate as Supply Shifts

While OG wallets reduce holdings, whales, and large investors controlling significant Bitcoin amounts are accumulating. Since late October, whales have added about 36,000 BTC, bringing total whale holdings to over 8.17 million BTC.

This accumulation shows that major investors remain confident in Bitcoin’s long-term potential. Historically, whale buying supports the Bitcoin price during consolidation periods and signals strong belief in the asset’s future growth.

Short-Term Traders Increase Market Volatility

Short-sellers have been relatively active in recent sessions. They frequently buy dips and sell little rallies to capture fast gains. This behavior magnifies short-term volatility even if the long-term trend remains up.

The price of Bitcoin has experienced dramatic shifts, but still manages to maintain its key levels. Analysts say that this increased activity is good because it helps in deepening liquidity and making the market more vibrant.

Market Sentiment and Outlook

On the whole, the Bitcoin price is still in a cautiously hopeful position. “ETF flows, technical support and whale accumulation are supportive of a bullish backdrop. But regaining $108,000 is crucial for the continuation of the bullish momentum.

Short-term corrections could follow if the price fails to stay above $104,000 alongside Bitcoin. For now, the market seems in balance as investors wait to see how macro factors and ETF demand evolve.

Conclusion

Bitcoin price found balance in the return of institutional interest and tame volatility. The strong ETF inflows from BlackRock and Fidelity highlight the increasing prominence of regulated products in crypto.

At the same time, OG sales and whale accumulation are simply a healthy rotation of the market. The next few days could dictate the direction Bitcoin is heading into the final quarter.

Also Read: How BlackRock IBIT Launch Fuels Bitcoin Institutional Demand Worldwide

Appendix: Glossary of Key Terms

Bitcoin Price: What one Bitcoin is worth on the open market, influenced by consumer demand, supply and investor sentiment.

ETF: Exchange-Traded Fund, a regulated investment product that follows a certain asset like Bitcoin.

USDC: A stablecoin pegged to the U.S. dollar that is widely used for trading and digital money transfers.

Whales: Big investors or institutions with large amounts of Bitcoin.

OG Wallets: Existing Bitcoin addresses that have held coins for many years with low activity.

Volatility: The frequency and magnitude of price movements in a given asset during a specific period.

Support: A price level that a series of injected buyers can be expected.

Resistance: Price levels where selling is expected to stop advancing.

Frequently Asked Questions Bitcoin Price

1. What is the current Bitcoin price?

The Bitcoin price is around $104,111, moving within a narrow trading range.

2- Why do ETF inflows matter for Bitcoin?

They express institutional credibility and generate a consistent flow of demand by the regulated trenches.

3- What might drive the Bitcoin price higher?

An advance beyond $108,000 or continued robust ETF inflows could drive further gains.

4- What are the main risks to consider?

A fall beneath $104,000 or lack of ETF demand could lead to a pullback

Read More: BlackRock and Fidelity Fuel $524M Bitcoin ETF Inflows as Whales Accumulate">BlackRock and Fidelity Fuel $524M Bitcoin ETF Inflows as Whales Accumulate

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.