0

0

This article was first published on The Bit Journal.

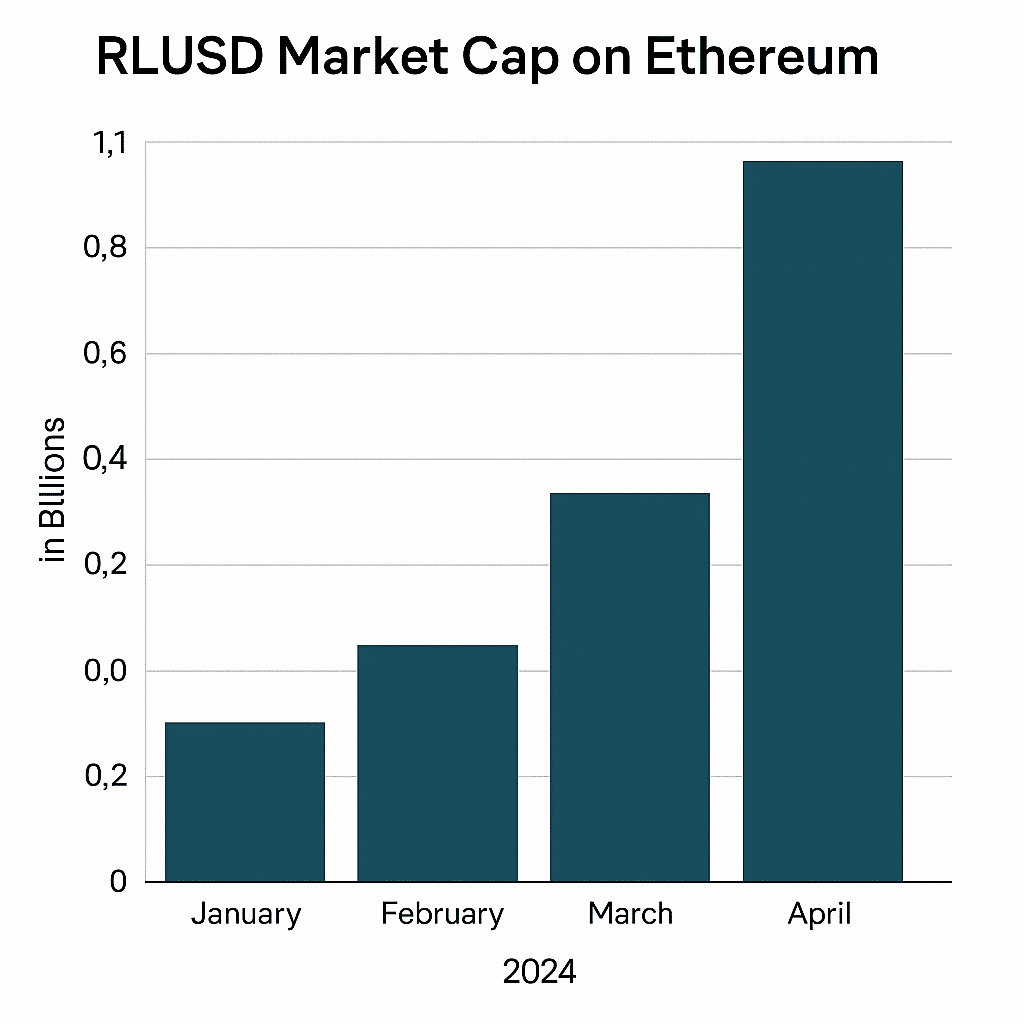

Ripple’s dollar-pegged stablecoin RLUSD has quietly stepped into the big league. Its market capitalization on Ethereum has climbed to about $1.1 billion, turning the token into one of the most closely watched experiments in regulated, multi-chain stablecoin design.

Fresh on-chain data shows that RLUSD now has a total supply near $1.29 billion across networks and more than 39,000 holders, with a large share still based on the XRP Ledger. Monthly transfer volume has risen to roughly $4.52 billion across Ethereum and XRPL, a sign that the token is being used for real settlement rather than idle parking.

For analysts who track high-quality crypto assets, these are key indicators: scale, breadth of holders, and active transfer volume all point to genuine utility instead of short-lived speculation.

Several numbers around RLUSD stand out and help frame the story:

$1.1B market cap on Ethereum signals meaningful liquidity for DeFi, trading desks, and institutional desks.

$1.29B total market cap across chains shows that the asset is not locked into a single ecosystem.

39,259 holders highlight broad distribution, which usually supports tighter spreads and deeper markets.

$4.52B in monthly transfers underlines active use in payments, treasury moves, and liquidity rotations.

In crypto markets, stablecoins are often judged by a similar checklist: reserve quality, regulatory status, market cap, user base, and transaction activity. RLUSD is now ticking several of those boxes at once.

The growth has also sparked a broader debate about how future stablecoins should be built.

A well-known market commentator on X described the decision to deploy RLUSD on both Ethereum and XRPL as one of Ripple’s smartest moves, arguing that top projects need to meet users where liquidity already lives instead of waiting for traders to migrate to a single chain.

A crypto-focused lawyer added that platforms which remain tied to one network risk falling behind as cross-chain infrastructure matures and capital flows become more flexible. His remarks referenced data that shows a steady climb in RLUSD’s market cap on Ethereum, even while XRPL still plays a central role in payments.

Together, those views frame a simple reality: liquidity is no longer tribal. Assets that move easily across networks, or are issued on more than one, can capture flows that single-chain tokens cannot reach.

RLUSD’s design splits the work between two networks:

On Ethereum, the token taps DeFi protocols, institutional market structure, and a dense pool of arbitrage and liquidity providers.

On XRPL, RLUSD benefits from high throughput and low fees, which suits remittances, settlement flows, and business payments.

A recent card-settlement partnership that uses RLUSD illustrates this division of labor. Consumer-facing activity can sit on rails that feel familiar to traditional finance, while settlement can route through whichever chain offers the best mix of speed, cost, and regulatory comfort.

For observers, that kind of architecture is another indicator of crypto quality: the asset is not tied to a single hype cycle but is instead wired into concrete payment and settlement use cases.

The story doesn’t end with on-chain metrics. RLUSD has also received a significant regulatory boost.

Abu Dhabi’s Financial Services Regulatory Authority has recognized RLUSD as an Accepted Fiat-Referenced Token for use within the Abu Dhabi Global Market. Licensed institutions in that financial zone can now use the stablecoin for payments, collateral, custody, lending, and other regulated activities.

This approval adds several layers of credibility:

It confirms that RLUSD meets strict standards for reserve backing and transparency.

It opens the door for banks and payment providers in the Middle East to treat the token as infrastructure, not just a trading tool.

It places RLUSD in a small club of stablecoins that operate under clearly defined fiat-token rules in a major global hub.

In the wake of high-profile failures like TerraUSD in 2022, regulators and institutions now focus heavily on transparent reserves, enforceable redemption rights, and supervision by reputable authorities. RLUSD’s model is tailored to that new environment.

At protocol level, the XRP Ledger is also evolving alongside RLUSD.

One of XRPL’s original architects recently announced the launch of an XRPL performance hub that monitors validator behavior in real time and aims to reduce latency across the network. The goal is to strengthen reliability as traffic and use cases grow.

In parallel, XRPL has introduced a Multi-Purpose Token (MPT) standard designed to support tokenization of real-world assets and more complex financial instruments. This upgrade positions RLUSD as a natural settlement layer for tokenized bonds, funds, or other regulated products that require a stable dollar leg.

For investors who study fundamentals, these technical and governance steps count as additional quality signals. Strong infrastructure often sits behind sustainable market caps.

RLUSD’s rise to a $1.1 billion market cap on Ethereum is more than a headline number. It showcases how a regulated, reserve-backed stablecoin can leverage multi-chain issuance, institutional oversight, and technical upgrades to build durable demand.

Market cap and transfer volume point to scale and usage. Holder distribution shows broad adoption. Regulatory approval in Abu Dhabi validates the structure in a strict financial zone. Network upgrades on XRPL hint at a wider tokenization and payments strategy that uses RLUSD as the settlement core.

1. What is RLUSD?

RLUSD is a U.S. dollar-pegged stablecoin issued by Ripple, backed by cash and high-quality liquid assets, and designed for regulated payments and settlement.

2. Why is the $1.1B market cap on Ethereum important?

A $1.1B market cap on Ethereum signals deep liquidity, strong demand from traders and DeFi users, and growing institutional comfort with the asset.

3. How does Abu Dhabi’s approval affect RLUSD?

Recognition as an Accepted Fiat-Referenced Token in Abu Dhabi allows licensed firms to use RLUSD for regulated financial activities, which strengthens its institutional profile.

Stablecoin

A crypto asset that aims to maintain a stable price, usually pegged to a fiat currency such as the U.S. dollar, and backed by reserves or algorithmic mechanisms.

Market Capitalization (Market Cap)

The total value of a crypto asset in circulation, calculated by multiplying the current price by the circulating supply. It is a basic indicator of asset size.

Fiat-Referenced Token

A type of digital token whose value references a government-issued currency. In regulated frameworks, these tokens must follow strict rules on reserves and disclosures.

XRP Ledger (XRPL)

A public blockchain focused on fast, low-cost transactions, often used for cross-border payments, on which RLUSD is also issued.

Multi-Purpose Token (MPT)

A token standard on XRPL that supports tokenization of real-world assets and financial products, extending the network beyond simple payments.

Read More: Ripple Stablecoin RLUSD Hits $1.1 Billion On Ethereum">Ripple Stablecoin RLUSD Hits $1.1 Billion On Ethereum

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.