DefiLlama Review [The Ultimate Guide 2022]

5

3

Decentralized Finance (DeFi) is one of the biggest trends in the blockchain industry and has the potential to overtake the traditional financial system in a decentralized and permissionless way through distributed ledger technology (DLT), and DApps built on the blockchain. DeFi aims to bring everyone secure, efficient, and transparent financial services.

The DeFi market has experienced exponential growth since the summer of 2020, referred to as "the DeFi summer," when the number of DeFi projects reached 235, and the TVL, total value of crypto-assets locked in DeFi applications, exceeded USD 200 bn in 2021.

The unprecedented growth of different DeFi projects and their decentralized nature make it difficult for crypto investors to track each project individually to keep up to date with the multi-chain world. DefiLlama was designed to offer a solution by providing cross-chain data on the state of Decentralized Finance and the popularity and liquidity of each protocol.

DefiLlama is one of the largest TVL aggregators that tracks the DeFi TVL (total value locked), i.e., the current value of cryptocurrencies deposited in a liquidity pool, lending pool, or staked on a DeFi protocol, of popular chains and their DApps.

Read on to learn everything you need to know about DefiLlama, its features and competitors, and how to make the most of it.

Since we mentioned DeFi above, are you ready to learn more? You're welcome to check the CoinStats guides "What Is DeFi," and "DeFi Solutions" to explore the concept further. As Sam Bankman Fried had proclaimed some time ago, DeFi is hot and full of potential, but it has a long way to go.

Let's get right to it!

What Is DefiLlama

DefiLlama is a decentralized analytics dashboard that tracks DeFi platforms and their Dapps and uses TVL to show which DeFi protocols are the largest and how they develop over time. The platform aggregates the cross-chain data on the state of Decentralized Finance, including cumulative data for all chains combined, and presents it to DeFi users for free.

DefiLlama claims it is committed to accurate data and transparency without ads or sponsored content. DeFiLlama lists DeFi projects from all chains and sources reliable data from open DeFi protocols, where blockchain data is available to the public, i.e., over 130 Layer 1 blockchains, 1750 DApps, etc. This data is maintained by a team from their respective communities and coordinated through the DefiLlama/DefiLlama-Adapters Github repository.

DefiLlama collects data on a protocol by calling some endpoints or making some blockchain calls. Currently, the SDK only supports EVM chains, so if your project is in any of these chains, you should develop an SDK-based adapter, while if your project is on another chain, you will need a fetch adapter. The adapter is a function that returns the balances of tokens in your protocol's smart contract at that time and takes a timestamp (on Ethereum).

The platform acts as a one-stop protocol where users can keep track of all the popular blockchains and the DeFi protocols, DApps, etc., associated with them. At the time of writing, DeFiLlama tracks over 1750 DeFi protocols and over 130 different blockchains.

Apart from the accurate data on TVL, the DeFiLlama product keeps track of DeFi analytics for the following:

- DeFi Applications

- DeFi Chains

- DeFi Oracles

- DeFi Forks

- DeFi Airdrops

- NFTs.

What Is Total Value Locked

The total value locked is the most important data available on DeFiLlama. The TVL or total value locked is the total amount of crypto assets/tokens deposited into DeFi protocols. The TVL growth for a DeFi protocol strongly indicates increasing user confidence and activity in DeFi protocols. TVL is computed based on the USD-denominated value of the tokens locked in smart contracts such as:

- Staking Pools: The assets, including staked lp tokens where one of the coins in the pair is the governance token, are locked across various staking pools on a Proof-of-Stake blockchain. Stakers earn interest in proportion to the assets locked up in staking.

- Lending: DeFi protocols act as a lending platform and use smart contracts to process the loans. The tokens locked across various lending platforms are part of the TVL calculations. DeFi users lending their tokens earn interest on them.

- Liquidity: Liquidity in the DeFi projects is one of the major indicators of people's trust and support of those projects. Users locking their tokens in a project are provided with liquidity mining incentives.

Remember that TVL is not a metric to measure how much one can earn on their deposits; it's simply the total value of tokens locked within the ecosystem. The TVL for a particular DeFi protocol can change when:

- Users withdraw or deposit crypto assets into a DeFi project.

- Prices of the tokens supported by DeFi projects, including native tokens, change.

Note: As crypto prices are highly volatile, the TVL also keeps changing. However, if the prices are down, it doesn't necessarily imply an outward capital flow from the project.

If a DeFi protocol is built on multiple chains, its TVL across those chains would be different. Since most DeFi projects are built on Ethereum, it makes Ethereum the most extensive network in terms of TVL.

Tip: The market cap of a DeFi protocol shows active and passive investors' support for a protocol. On the contrary, the total value locked is a clear indicator of the performance of a protocol in the DeFi ecosystem.

How Does DefiLlama Work

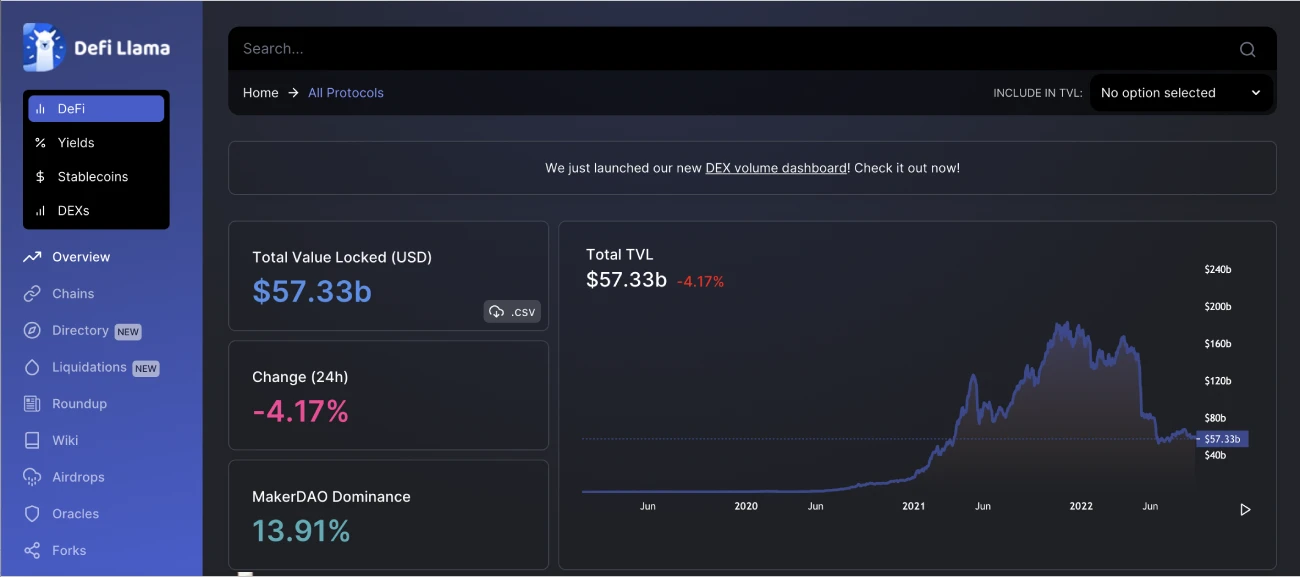

When visiting the DeFiLlama site, you’ll go straight to its dashboard, displaying a chart of TVL across different DeFi activities. The home page includes TVL rankings for DApps based on USD, the TVL of different blockchains, profit generation and insurance protocols, decentralized exchanges, and the percentage change over one day, seven days, and a month.

You can scroll through TVL rankings based on separate chains such as Ethereum, Terra, Fantom, Binance Smart Chain, Tron, etc., or choose a generic overview of the market. Selecting a chain will enable you to view applications built for that particular chain based on TVL and select the top largest DeFi applications. You can also check if the application is compatible with other chains under the "Chains" tab.

This helps you find the best DeFi exchanges for the largest chains without doing individual research for each.

On the left-hand side of the dashboard, you can also find individual sections, including:

- Chains

- DeFi Forks

- Airdrops

- Oracles

- Stablecoins.

How Do DeFiLlama Sections Work

As a multi-chain TVL dashboard, DefiLlama represents stats of DeFi activities related to the following:

DeFi Chains

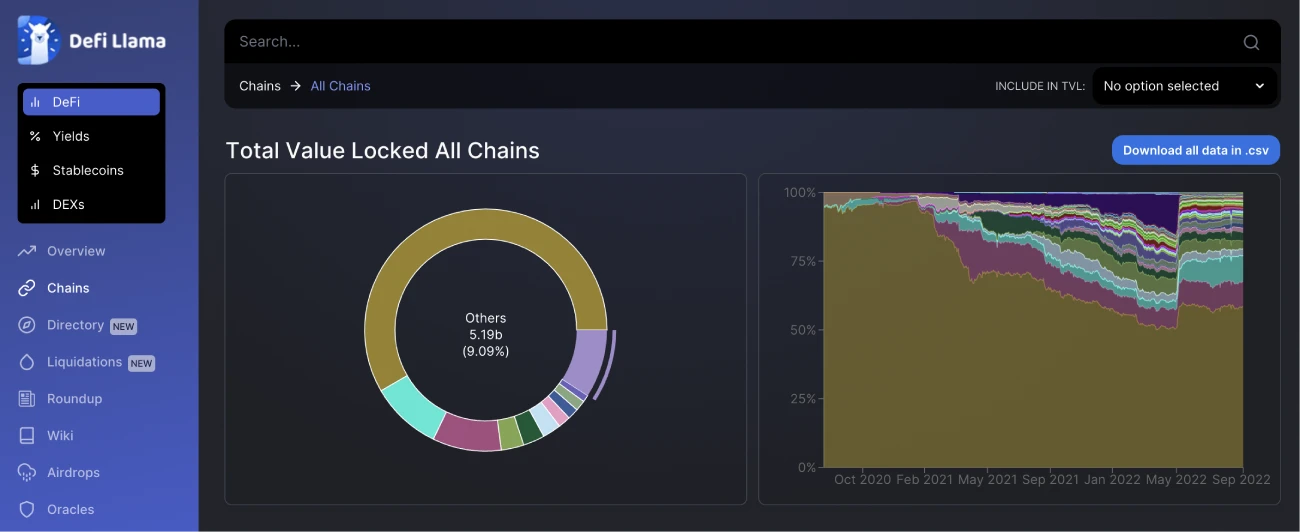

On the DeFiLlama dashboard, click “Chains” to view a list of Layer 1 chains and check the TVL of the largest blockchains. DeFiLlama only lists Layer 1 blockchains that are smart contract compatible and on which applications can be developed; therefore, Bitcoin is not there.

The Ethereum blockchain is the largest DeFi chain, with a market share of 57.88 percent and a TVL of USD 35.56 billion, at the time of writing. Ethereum supports EVM chains and enables developers to create ERC-20 tokens, DApps, etc. DeFi started with Ethereum, which allowed developers to create apps such as UniSwap, OpenSea, etc., and make the ground for decentralized trading, NFTs, etc. However, the Ethereum dominance has decreased drastically from nearly 95-97 percent in early 2021. A major reason behind this was the substantial increase in gas fees, leading users to move to competing chains such as Terra, BSC, and Avalanche.

DeFi Oracles

You can view the top oracle services in the market through the Oracles tab.Blockchain oracles help decentralized ecosystems communicate with the external world to validate data, improve security, and prevent chains from being isolated through smart contracts. They send data, such as price feeds, payment service data, weather data, etc.

DeFi Forks

A fork is a copy of original software that’s been slightly altered to make improvements. Most DeFi applications are open-source, so the code is commercially available and can be cloned for other projects. Forks can sometimes have more combined TVL than the original application.

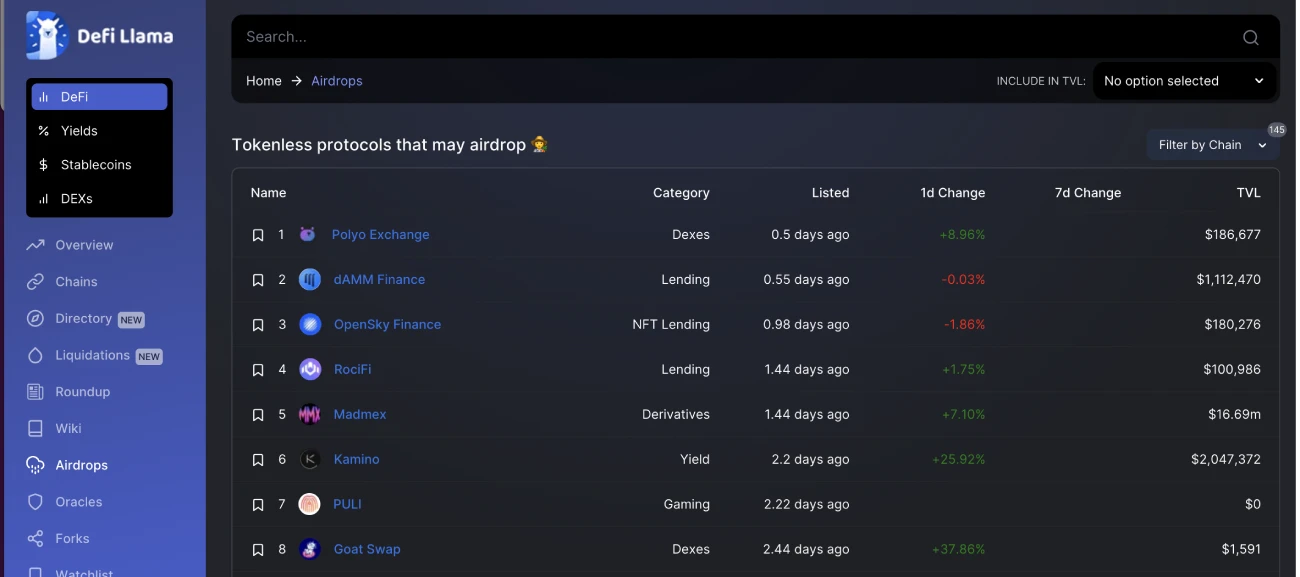

DeFi Airdrops

On the DefiLlama Airdrops tab, you can find protocols that may airdrop soon and get in early to optimize your earnings.A DeFi airdrop is a token giveaway usually completed when a new cryptocurrency is launched to promote the token, reward early users, and build a DeFi community.

DeFi Stablecoins

You can use the Stablecoins tab to view the market’s most popular stablecoins, ranked by market caps.

DefiLlama Features

DeFiLlama has added the following features to the TVL aggregator, such as:

Chain Breakdown

Anyone using DeFiLlama can access TVL data for a particular protocol across various chains. This breakdown provides users with an insight into which chains the protocol is deployed and the fragmentation of its TVL across chains.

Market Cap Data

Along with TVL data, DeFiLlama provides a protocol's market cap data to allow users to evaluate a protocol (Mcap/TVL).

Charts

DeFiLlama charts help users understand and track the protocol's total inflows and outflows, thereby providing insight into the future prospects of a DeFi project.

Chain TVL

DeFiLlama tracks over 130 blockchains and provides data on the TVL of each chain. You can click any of the chains and get a DeFi list of projects operating on that blockchain.

Stablecoin Market Cap

Another underused DeFiLlama product is the Stablecoin Market Cap chart. It provides a detailed breakdown of the total stablecoin market cap by asset and chain. The information includes the MCap, information about the chains, the stablecoin's price, etc.

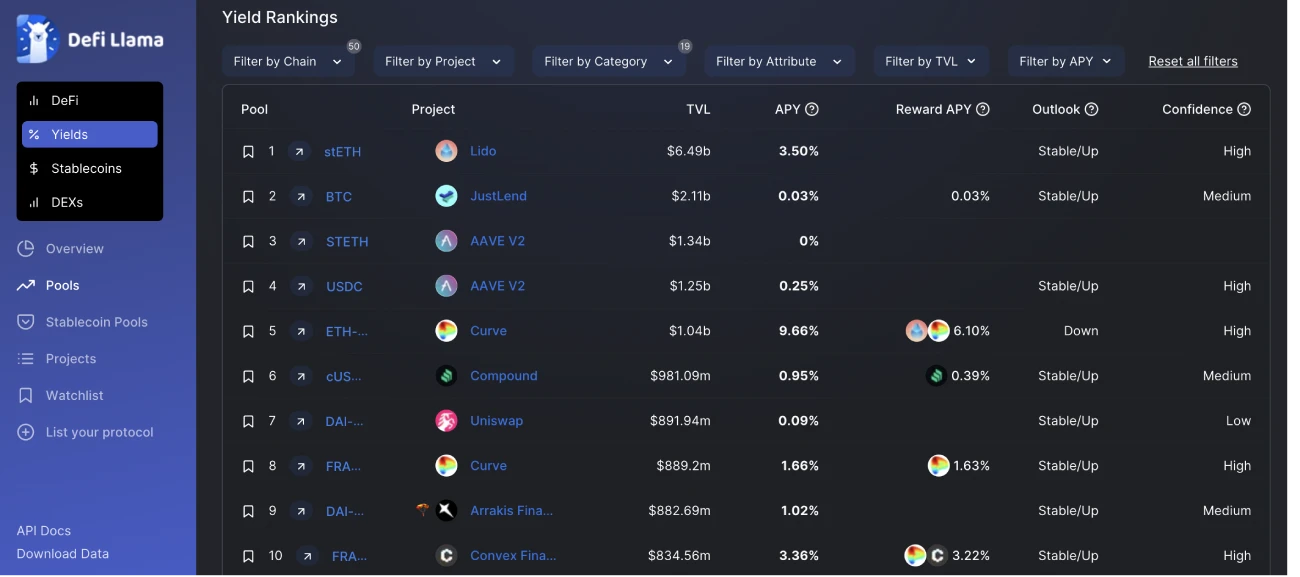

Yield Rankings

This DeFiLlama product is divided into three categories, namely:

- Pools: Pool information is divided into projects, chains, TVL, the percentage change in TVL, and APY predicted outlook.

- Overview: A heatmap of APY across different protocols and charts of APY average vs. volatility in the market.

- Projects: Information on a protocol’s number of pools, combined TVL, audits, and median APY.

Conclusion

DeFiLlama is one of the most fundamental and trusted web tools enabling you to learn about DeFi protocols and blockchains, their growth, and liquidity to make investment decisions based on actual data. DeFiLlama aggregates all the data and develops new tools to help you keep track of them in real time.

Although cryptocurrency prices on decentralized or centralized exchanges may look good, it’s hard to make an informed investment decision without all the data, such as price deviations.

You're welcome to apply DeFiLlama tools to look up the popular chains and try out the DeFi applications built on them.

FAQ

Are There Any DefiLlama Alternatives

DeFiLlama has many competitors, such as CoinMarketCap, CoinGecko, DappRader, etc. To get the most accurate data, we’d advise using a combination of data sources from DeFiLlama and its competitors.

You can also use software such as DeBank -DeBank's mission is to create a bridge between users, DeFi tech, and financial services; Ape Board - they support Ethereum, Binance Smart Chain, Terra, Solana, Binance Exchange, and Polygon; DeFi Pulse, etc., to check out the DeFi list which includes the best resources in DeFi and track and display all your DeFi activities across multiple chains.

What Other Applications or Services Does DefiLlama Integrate With

DefiLlama integrates with Aave, Arbitrum, Avalanche, BNB Chain, Celo, CoinGecko, Ethereum, Fantom, Fuse, Harmony, Instadapp, Polygon (Matic), Solana, SushiSwap, Terra, and Uniswap.

Does DefiLlama Have Integrations API

Yes, DefiLlama offers API access. Developers can use their API to integrate key statistics on their website and showcase the growth of the DeFi landscape.

To learn about wallets and exchanges, visit our "Wallet and Exchange Reviews. To discover how to keep track of all your DeFi activities across multiple chains for all your DeFi activities check out our "Crypto Portfolio Trackers."

5

3