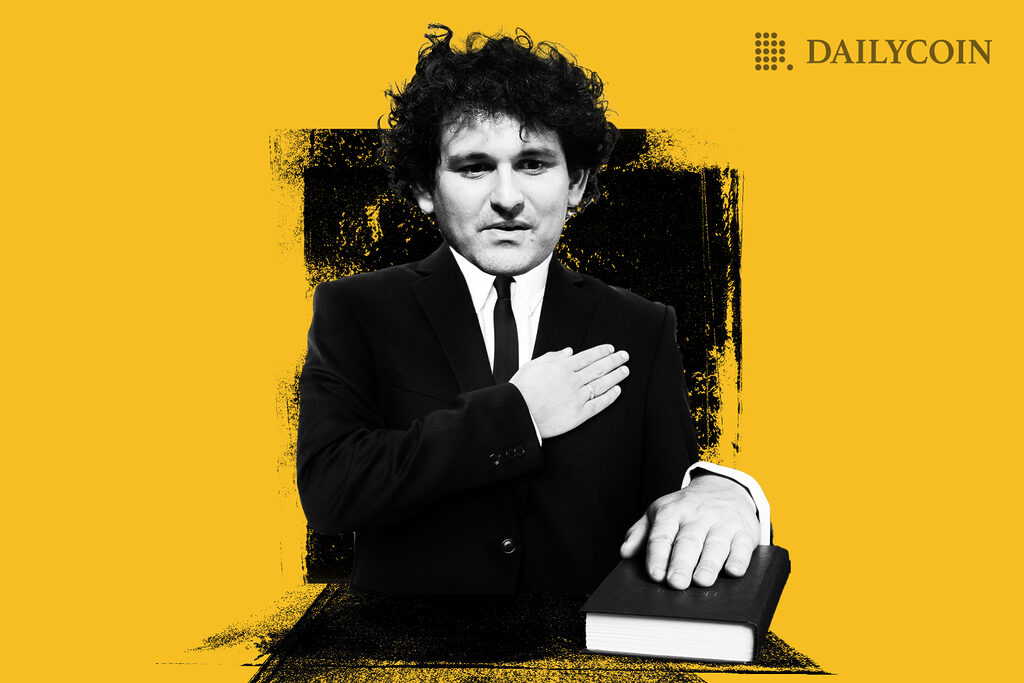

Bankman-Fried says he will Testify before the House, Crypto Community Reacts

Sam Bankman-Fried, the founder of the failed crypto exchange FTX, has announced that he will honor the December 2nd invitation from U.S. Representative Maxine Waters to testify in a December 13th hearing before the U.S. House Committee on Financial Services.

Responding to the invitation, Bankman-Fried tweeted that he would testify before the House after he finished “learning and reviewing” the events that led to the collapse of his cryptocurrency exchange.

However, SBF says he’s not sure he will finish learning and reviewing by the 13th. His recent tweet has earned him criticism from the crypto community, who have questioned his actions.

Attorney Jake Chervinsky, the Blockchain Association Head of Policy, explained that Bankman-Fried was reluctant to take part in the December 13th hearing because “lying to Congress under oath is less appealing.”

The hearing, which was called to discuss “what happened” at FTX, could provide insight into what went wrong at one of the world’s biggest crypto exchanges.

Aggrieved AAX Users Storm Exchange’s Nigerian Offices, Attack Employees

A group of disgruntled Nigerian clients of the Atom Asset Exchange (AAX), which suspended withdrawals on November 12th, have reportedly stormed the company’s office in the country, attacking employees in the process.

According to the report from local media, the aggrieved clients of AAX stormed the company’s office located in Lagos, reportedly demanding the lifting of a freeze on withdrawals.

Although the report doesn’t state when the attack occurred, advocacy group Stakeholders in Blockchain Technology Association of Nigeria (SIBAN) has urged AAX users to stop victimizing the beleaguered crypto exchange’s workers.

The advocacy group also appealed to the Hong-Kong headquartered crypto exchange’s senior executives, who have stopped communicating with their Nigeria-based workers, to “immediately take steps to close the gaps by bridging communication.”

The ongoing crypto winter is global, and seeing its impact manifest into physical violence should worry everyone, regardless of location.

Mike Novogratz’s Galaxy Digital to Buy Self-Custody Firm GK8 from Celsius

Galaxy Digital Holdings, an investment firm led by the billionaire Mike Novogratz, has won the auction to buy self-custody platform GK8 from the bankrupt crypto lender Celsius Network.

Celsius purchased GK8 in November 2021 for $115 million. Although the terms of the deal weren’t disclosed in the official announcement, Galaxy spokesman Michael Wursthorn said the price was materially less than what Celsius paid in 2021.

Galaxy Digital explained in its press release that the deal remains subject to regulatory approval. The acquisition would expand Galaxy’s global footprint with a new office in Tel Aviv, Israel, if approved.

According to Novogratz, “adding GK8 to our prime offering at this pivotal moment for our industry also highlights our continued willingness to take advantage of strategic opportunities to grow Galaxy in a sustainable manner.”

The acquisition of GK8 will see Galaxy Digital expand its prime brokerage offering, recruiting 40 people to join Galaxy’s team.

Chinese Court Rules that NFT Collection Should be Protected by Property Law

A Chinese court in Hangzhou has applied its property law to nonfungible token (NFT) collections, ruling that digital arts should be considered online virtual property protected under Chinese law.

According to the court, NFTs are “unique digital assets” that “belong to the category of virtual property.” The court also deemed it necessary to spell out the “legal attributes of NFT digital collections.”

The court concluded that NFTs share characteristics of traditional property, including value, scarcity, disposability, and tradability. This means they can receive the same protection as physical property under Chinese law.

The ruling was made when an unnamed user sued an unnamed NFT company for refusing to complete a sale and canceling their NFT purchase from a “flash sale” because the user’s name and phone number didn’t match their information.

The court ruling is a favorable milestone for NFTs in China. The country’s government began to crack down on cryptocurrencies in 2021.

ByBit to Cut Workforce by 30% in the Second Round of Layoff in 2022

As the crypto contagion from the FTX fallout spreads, crypto exchange ByBit has announced that it will cut its workforce by 30% – the second time they would lay off staff in a tough year for the crypto industry.

Bybit’s CEO, Ben Zhou, explains that the reduction of the workforce is part of an ongoing “re-organization of the business as we move to refocus our efforts for the deepening bear market.”

According to Zhou, the layoffs “will be across the board,” affecting 30% of the company’s staff. He explains that the move is a result of the overall downturn in crypto markets and the struggle of crypto firms BlockFi and Genesis.

Zhou has assured ByBit users that the layoffs will not affect the company’s operations. He explained that the move is designed to ensure the “long-term sustainability” of the trading platform.

Through the layoffs, ByBit looks to focus on building the right structure and resources to “navigate the market slowdown.”