Best Web 3.0 Crypto Coins to Buy in 2022

48

14

In 2021, the worldwide crypto market capitalization surpassed $3 trillion, with lots of space for further expansion. Web 3.0 emerged as one of the new buzzwords in the crypto industry after the metaverse grabbed the internet by storm. While web 1.0 and web 2.0 aided in the growth of the internet, web 3.0 is more adventurous and focused on decentralization by giving users the ability to control their data. But, exactly, What is Web 3.0, and which are the best web 3.0 crypto coins to buy in 2022

Let’s jump right in!

What Is Web 3.0

Web 3.0 is one of the newest buzzwords for the internet's next major evolution. Web 1.0 took place between 1990 - 2004, when the majority of websites were static and created by corporations. During this period, many who recognized an opportunity purchased domain names with the intention of selling them later at a higher price to enterprises in need of these domains.

Web 2.0 was the period of social media and user-generated content. Users are encouraged to communicate and connect using social media platforms such as blogs, vlogs, and social media, which have since become popular. The transition results in a greater amount of content creation with the majority of data controlled by a smaller set of tech behemoths such as Google, Microsoft, and Facebook. This also led to the topic of whether or not the user's privacy is secure?

Web 3.0 focuses on decentralization, which is driven by the concept of peer-to-peer internet solutions, in which users have a choice over how their data is utilized. Web 3.0 is expected to improve data openness and content accessibility by depending on blockchain technology, as various applications and services begin to use blockchain technology, metaverse, and artificial intelligence (AI). The adoption of this technology helps to eliminate the need for a centralized authority to store data and helps to maintain security through widespread consensus. Essentially, Web 3.0 seeks to re-establish control in the hands of individuals – its users — rather than large corporations.

How Web 3.0 and the Metaverse Interoperability Works

According to Web 3.0, user interactivity and scalability are critical to facilitating user operations. To be really useful, Web 3.0 must satisfy three key features: decentralization, scalability, and security. The development of NFTs, in which users engage with one another through virtual reality technology, demonstrates the interoperability of Web 3.0 and Metaverse, while Web 3.0 facilitates trade and communication.

Because Web 3.0 is a collection of apps on a decentralized platform, interoperability can be achieved by connecting apps with the metaverse concept. Decentraland MANA, for example, provides an open link enabling a global network of users to administer a shared virtual environment by purchasing and selling digital real estate. To begin, users must buy LAND to identify ownership of their land, which represents their digital real estate. The MANA, on the other hand, is used to facilitate the purchase of LAND and products in Decentraland. The marketplace allows users to swap LAND tokens and simplifies user interactions to transact in-game items.

Top 10 Web 3.0 Coins

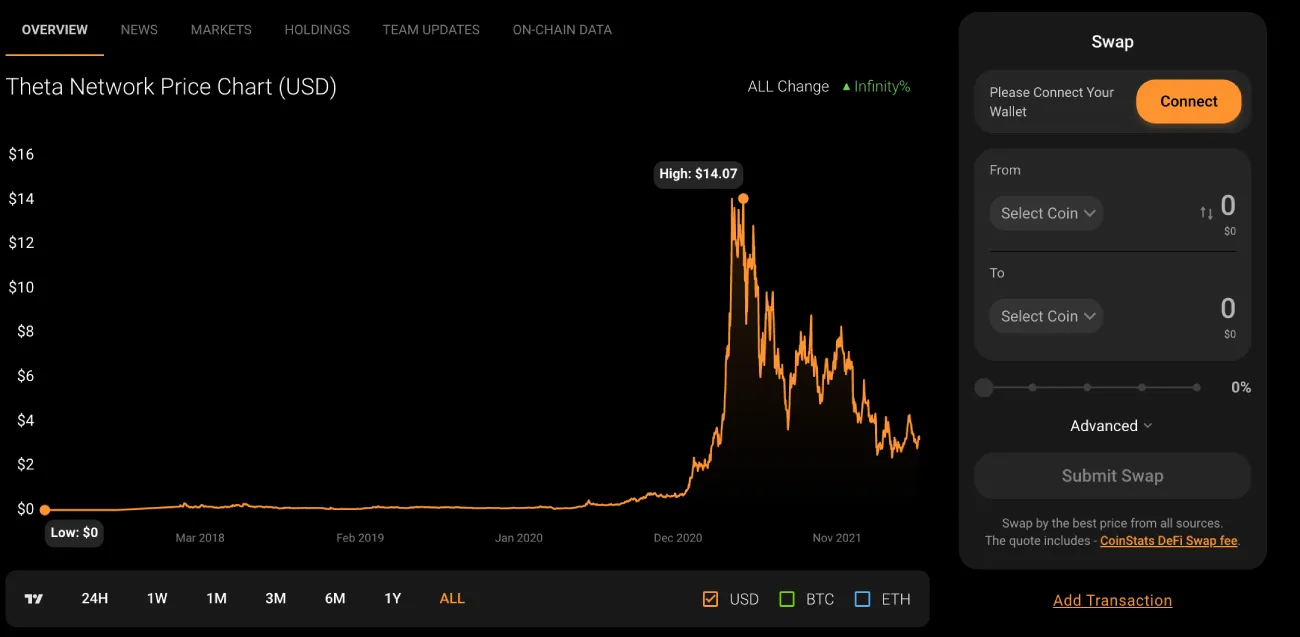

1. THETA (THETA)

Market Cap: $3.2B

Theta is similar to Airbnb for video streaming. On this Platform, viewers earn rewards for sharing extra bandwidth and computing resources. According to Steve Chen, co-founder of YouTube, Theta will disrupt the online video industry in the same manner that YouTube did in 2005, but in a different way. Theta solves the problem of delivering video to specific portions of the world by lowering costs while maintaining quality. As Theta feels it is critical to delivering high-quality streaming to all users.

When users share their bandwidth and computational resources, they are rewarded with the Theta Fuel token (TFUEL). The normal Theta token (THETA) is tied to the platform's governance. Another advantage of Theta is that it is an open-source platform, which allows for community innovation. Proof of stake (PoS) and multi-level Byzantine fault tolerance (BFT) consensus mechanisms are used to protect the network.

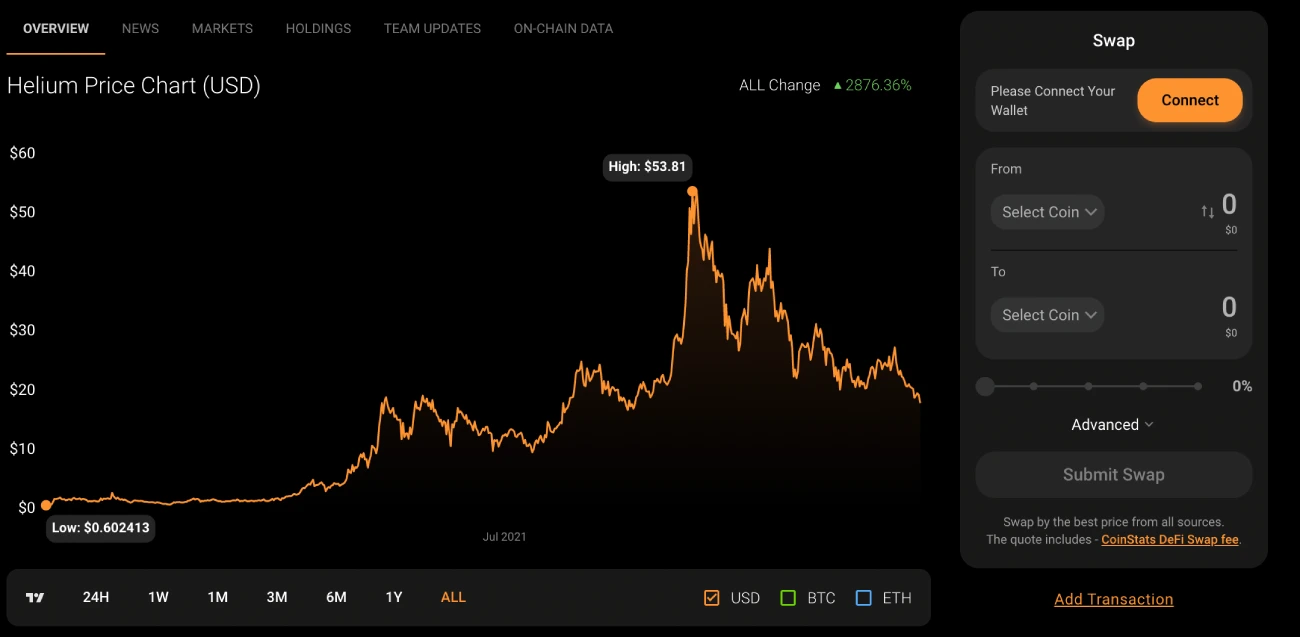

2. Helium (HNT)

Market Cap: $2.0B

Helium is a decentralized wireless network. It enables Internet of Things (IoT) devices to connect to the Internet wirelessly and geolocate themselves without the need for satellite positioning hardware or cellular plans.

HNT is the native token of the network, which is powered by a blockchain. This token encourages a two-way marketplace between service providers and users.

Hotspots combine a wireless gateway with a miner to offer network coverage within a specific radius. HNT is mined by hotspots as well. Helium employs a consensus technique known as proof-of-coverage.

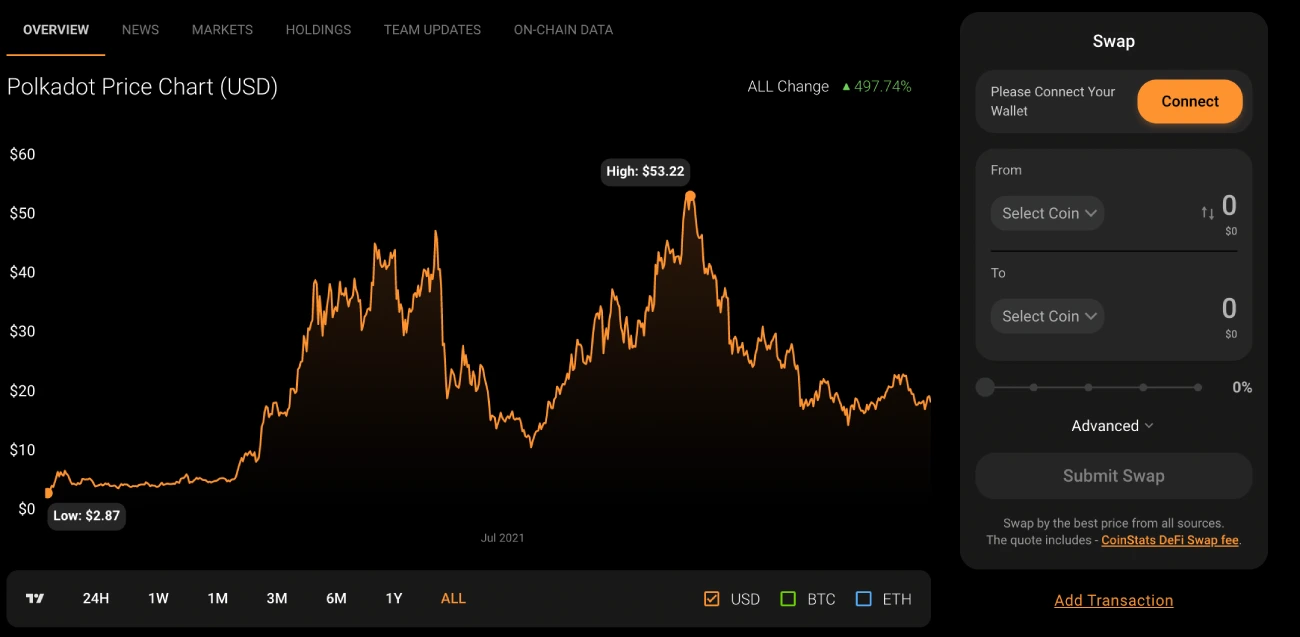

3. Polkadot (DOT)

Market Cap: $21.3B

Polkadot is a decentralized project that provides a Layer 0 solution known as "Relay Chain," which is known to boost scalability, as well as a Layer 1 solution known as "Parachain," which functions as a bridge between chains.

Gavin Wood, the Co-founder of Ethereum, launched Polkadot. Its native coin, DOT, is used for governance and in parachain slot auctions. There are just a few parachain spaces available in Polkadot. Developers compete in auctions to acquire the privilege to build on Polkadot by locking up DOT tokens.

4. Filecoin (FIL)

Market Cap: $4.0B

Filecoin (FIL) is a decentralized marketplace for cloud storage. A wide number of storage providers and developers power the network, which assists organizations and projects in finding cost-effective, decentralized, and secure data storage solutions. Filecoin is commonly used for the storing of big archives, NFTs, and frequently accessed data.

The majority of storage providers on the Filecoin network have "committed" to providing data center resources by investing in hardware and depositing collateral to ensure service quality, data availability, and long-term data reliability. Its native token, FIL, is used to pay storage providers for data storage and retrieval.

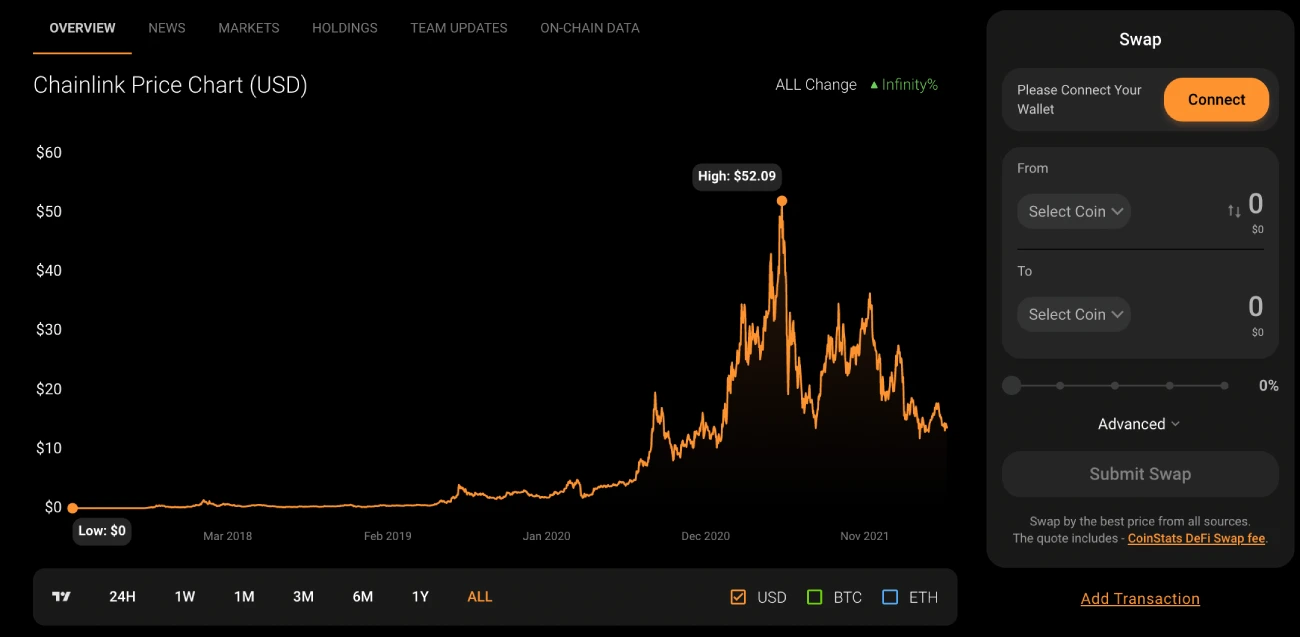

5. Chainlink (LINK):

Market Cap: $6.7B

Chainlink is a decentralized oracle network that relays data to smart contracts, allowing contracts to be executed using real-world inputs and outputs. Sergey Nazarov and Steve Ellis launched the network in 2017. It swiftly became the market leader in the blockchain oracle area.

Web3, which is structured and maintained by pre-written programs and smart contracts, relies on Oracle networks like Chainlink to function. Users can create decentralized oracle networks (DONs) on Chainlink to distribute data to and from current blockchains while also ensuring data accuracy.

Its native token, LINK, is used to reward Chainlink node operators for fetching data from off-chain data feeds for smart contracts, converting data into blockchain-readable forms, off-chain computing, and uptime guarantees provided by operators. Chainlink is also developing a robust staking mechanism for its network.

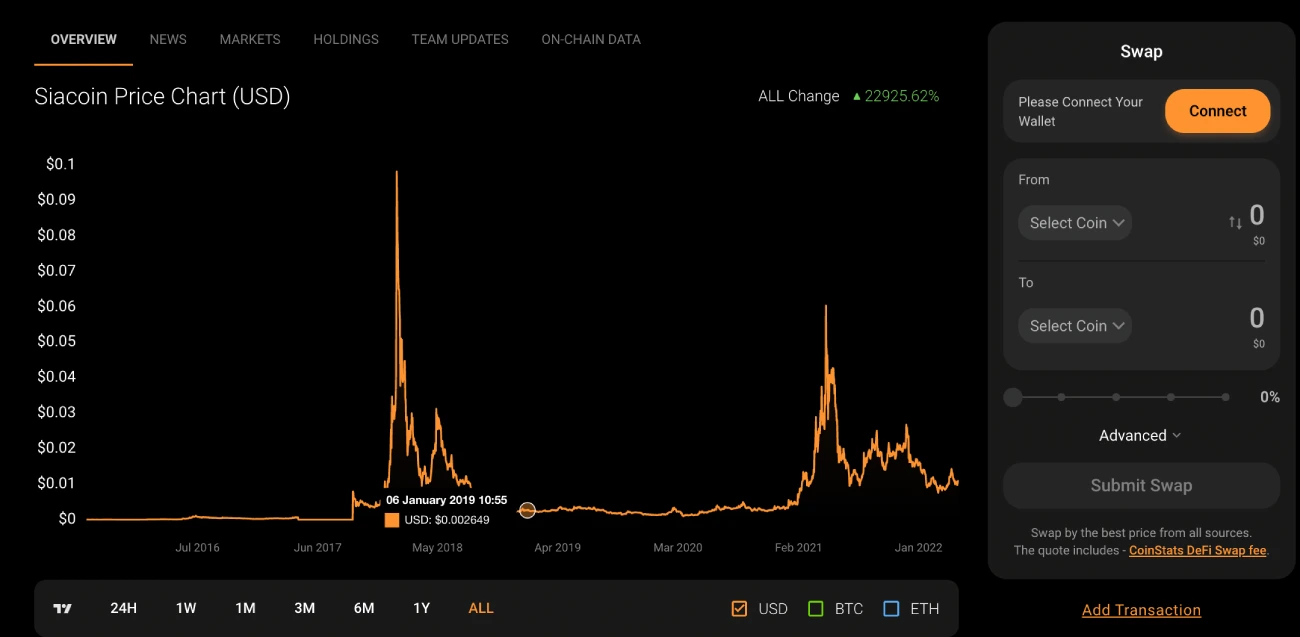

6. Siacoin (SC)

Market Cap: $542.7M

Sia is a blockchain-based decentralized cloud storage platform that allows users to lease excess storage space on the network. Smart contracts are used to facilitate network transactions. The native token of the blockchain SC (Siacoin) is the currency used to pay for data storage on the network.

Sia's initial whitepaper said that the network's purpose was to compete with established storage solutions such as Amazon, Google, and Microsoft. Because of its decentralized nature, Sia has an advantage over its competitors in terms of storage rates.

7. Audius (AUDIO)

Market Cap: $808.4M

Audius is a music streaming platform that aims to provide everyone with the freedom to distribute, monetize, and stream any audio content.

The native token, AUDIO, enables network security, unique feature access, and community-owned governance.

Musicians can use Audius to publish their songs and establish a fan following. When artists stake AUDIO, they gain access to badges and artist tokens, as well as voting power from their followers. Audius is supported by artists such as 3LAU,deadmau5, Rezz, and the Stafford Brothers. This platform provides 320 kbps high-quality audio streaming.

The Audius project has announced a partnership with TikTok, a streaming platform, with plans to integrate stablecoin on the network in the future to enable sponsored content.

8. The Graph (GRT)

Market Cap: $2.5B

The graph is an important decentralized protocol. In the DeFi world, the goal is to introduce a trustworthy decentralized public infrastructure to the mainstream market. It enables network users to create and publish an application programming interface (API), which is a workflow process that conceals complex code behind a simple API.

APIs are subgraphs in graph protocols, and they employ a specific query to retrieve data from a blockchain. The graph token (GRT) is used by graph network participants to secure the network's economic security. GRT is a work token that enables a community of stakeholders to deliver network indexing and curation services.

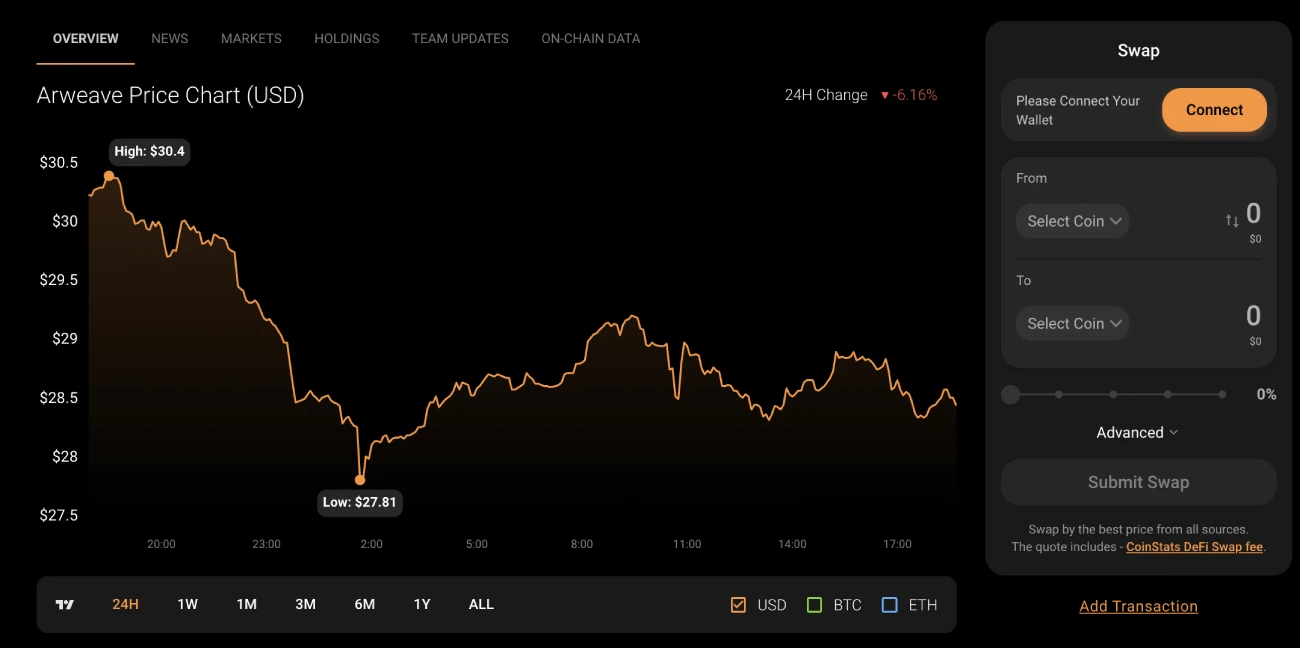

9. Arweave (AR):

Market Cap: $1.5B

Arweave describes itself as a jointly owned hard drive that never forgets. It allows for permanent data storage for a one-time fee.

Arweave (AR) is a decentralized storage network that allows for indefinite data storage. At its core is the ‘permaweb’ — a permanent, decentralized web with applications and platforms such as UI hosting, database writes and queries, and smart contracts.

The network employs blockweave technology, a blockchain variant that connects a new block not just to the previous one but also to a random preceding block. Coinbase Ventures, Andreessen Horowitz, and Union Square Ventures have all invested in the network.

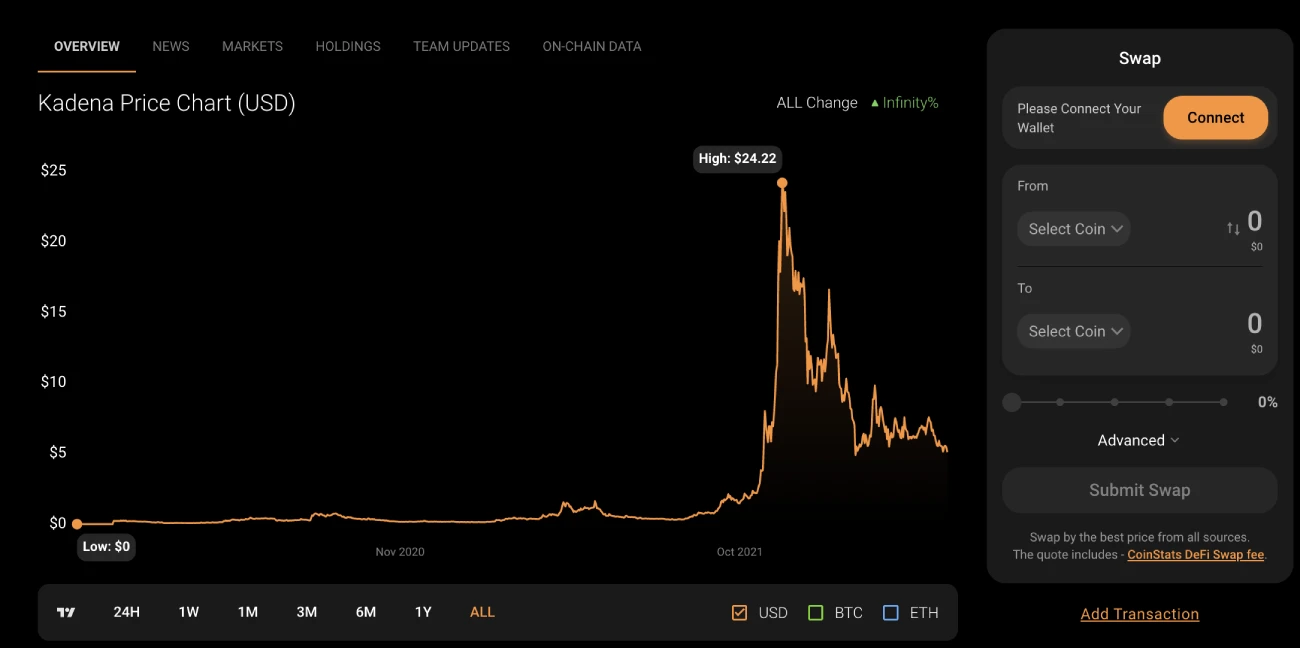

10. Kadena (KDA)

Market Cap: $950.5M

The purpose of this platform is to power global financial systems. Kadena offers more secure smart contracts, as well as unique energy efficiency and PoS security. Unlike many other platforms, Kadena continues to utilize the same amount of energy as network demand grows. It can handle up to 480,000 transactions per second (TPS) due to the usage of braided chains. The protocol scales to larger processing powers as additional chains are added.

The KDA token is used to process transactions on the Kadena blockchain. There are 1 billion KDA in total, which will be mined during a 120-year period.

How to Buy Web 3.0 Coins on CoinStats

Sign up for a free CoinStats trading account to invest in web 3.0 coins with a credit or debit card. To buy any web 3.0 coins listed above with the CoinStats app, follow the steps listed below:

- Sign up for an account with CoinStats using your email address or by checking in with Coinbase; you can also use SSO.

- Verify your account. You must supply a national ID to authenticate your identity in order to comply with KYC requirements (and also aid in improving account security).

- Sign in using your credentials, then search for the token you wish to buy in the search box and tap on that token.

- You will see the current market price of your selected web 3.0 coin. After doing your research proceed to buy that coin. CoinStats will provide you with two options: Buy or Sell. Choose “Buy” from the menu and input the desired quantity you wish to purchase of that coins and in a matter of few seconds the coins will arrive in your wallet.

- If you plan to store your freshly acquired coins for more than a month, make sure to move them as quickly as possible to a secure hardware wallet.

Closing Thoughts

Web 3.0 coins, metaverse coins, and NFTs are some of the biggest opportunities in the crypto market for 2022 and the years ahead. The internet is becoming increasingly decentralized, with artificial intelligence and virtual reality being integrated into the experience. More people are also adopting blockchain technology.

We feel the 10 tokens listed above are the best tokens you can invest in right now if you want to promote Web 3.0 and the crypto market while also giving yourself a chance to make a lucrative profit.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market and sensitive to secondary activity, do your independent research, obtain your own advice, and only invest what you can afford to lose. There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-and 89% of retail investor accounts lose money when trading CFDs. You should consider your circumstances and obtain your advice before making any investment. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites

In 2021, the worldwide crypto market capitalization surpassed $3 trillion, with lots of space for further expansion. Web 3.0 emerged as one of the new buzzwords in the crypto industry after the metaverse grabbed the internet by storm. While web 1.0 and web 2.0 aided in the growth of the internet, web 3.0 is more adventurous and focused on decentralization by giving users the ability to control their data. But, exactly, What is Web 3.0, and which are the best web 3.0 crypto coins to buy in 2022

Let’s jump right in!

What is Web 3.0

Web 3.0 is one of the newest buzzwords for the internet's next major evolution. Web 1.0 took place between 1990 - 2004, when the majority of websites were static and created by corporations. During this period, many who recognized an opportunity purchased domain names with the intention of selling them later at a higher price to enterprises in need of these domains.

Web 2.0 was the period of social media and user-generated content. Users are encouraged to communicate and connect using social media platforms such as blogs, vlogs, and social media, which have since become popular. The transition results in a greater amount of content creation with the majority of data controlled by a smaller set of tech behemoths such as Google, Microsoft, and Facebook. This also led to the topic of whether or not the user's privacy is secure?

Web 3.0 focuses on decentralization, which is driven by the concept of peer-to-peer internet solutions, in which users have a choice over how their data is utilized. Web 3.0 is expected to improve data openness and content accessibility by depending on blockchain technology, as various applications and services begin to use blockchain technology, metaverse, and artificial intelligence (AI). The adoption of this technology helps to eliminate the need for a centralized authority to store data and helps to maintain security through widespread consensus. Essentially, Web 3.0 seeks to re-establish control in the hands of individuals – its users — rather than large corporations.

How Web 3.0 and the Metaverse Interoperability Works

According to Web 3.0, user interactivity and scalability are critical to facilitating user operations. To be really useful, Web 3.0 must satisfy three key features: decentralization, scalability, and security. The development of NFTs, in which users engage with one another through virtual reality technology, demonstrates the interoperability of Web 3.0 and Metaverse, while Web 3.0 facilitates trade and communication.

Because Web 3.0 is a collection of apps on a decentralized platform, interoperability can be achieved by connecting apps with the metaverse concept. Decentraland MANA, for example, provides an open link enabling a global network of users to administer a shared virtual environment by purchasing and selling digital real estate. To begin, users must buy LAND to identify ownership of their land, which represents their digital real estate. The MANA, on the other hand, is used to facilitate the purchase of LAND and products in Decentraland. The marketplace allows users to swap LAND tokens and simplifies user interactions to transact in-game items.

Top 10 Web 3.0 Coins

1. THETA (THETA)

Market Cap: $3.2B

Theta is similar to Airbnb for video streaming. On this Platform, viewers earn rewards for sharing extra bandwidth and computing resources. According to Steve Chen, co-founder of YouTube, Theta will disrupt the online video industry in the same manner that YouTube did in 2005, but in a different way. Theta solves the problem of delivering video to specific portions of the world by lowering costs while maintaining quality. As Theta feels it is critical to delivering high-quality streaming to all users.

When users share their bandwidth and computational resources, they are rewarded with the Theta Fuel token (TFUEL). The normal Theta token (THETA) is tied to the platform's governance. Another advantage of Theta is that it is an open-source platform, which allows for community innovation. Proof of stake (PoS) and multi-level Byzantine fault tolerance (BFT) consensus mechanisms are used to protect the network.

2. Helium (HNT)

Market Cap: $2.0B

Helium is a decentralized wireless network. It enables Internet of Things (IoT) devices to connect to the Internet wirelessly and geolocate themselves without the need for satellite positioning hardware or cellular plans.

HNT is the native token of the network, which is powered by a blockchain. This token encourages a two-way marketplace between service providers and users.

Hotspots combine a wireless gateway with a miner to offer network coverage within a specific radius. HNT is mined by hotspots as well. Helium employs a consensus technique known as proof-of-coverage.

3. Polkadot (DOT)

Market Cap: $21.3B

Polkadot is a decentralized project that provides a Layer 0 solution known as "Relay Chain," which is known to boost scalability, as well as a Layer 1 solution known as "Parachain," which functions as a bridge between chains.

Gavin Wood, the Co-founder of Ethereum, launched Polkadot. Its native coin, DOT, is used for governance and in parachain slot auctions. There are just a few parachain spaces available in Polkadot. Developers compete in auctions to acquire the privilege to build on Polkadot by locking up DOT tokens.

4. Filecoin (FIL)

Market Cap: $4.0B

Filecoin (FIL) is a decentralized marketplace for cloud storage. A wide number of storage providers and developers power the network, which assists organizations and projects in finding cost-effective, decentralized, and secure data storage solutions. Filecoin is commonly used for the storing of big archives, NFTs, and frequently accessed data.

The majority of storage providers on the Filecoin network have "committed" to providing data center resources by investing in hardware and depositing collateral to ensure service quality, data availability, and long-term data reliability. Its native token, FIL, is used to pay storage providers for data storage and retrieval.

5. Chainlink (LINK)

Market Cap: $6.7B

Chainlink is a decentralized oracle network that relays data to smart contracts, allowing contracts to be executed using real-world inputs and outputs. Sergey Nazarov and Steve Ellis launched the network in 2017. It swiftly became the market leader in the blockchain oracle area.

Web3, which is structured and maintained by pre-written programs and smart contracts, relies on Oracle networks like Chainlink to function. Users can create decentralized oracle networks (DONs) on Chainlink to distribute data to and from current blockchains while also ensuring data accuracy.

Its native token, LINK, is used to reward Chainlink node operators for fetching data from off-chain data feeds for smart contracts, converting data into blockchain-readable forms, off-chain computing, and uptime guarantees provided by operators. Chainlink is also developing a robust staking mechanism for its network.

6. Siacoin (SC)

Market Cap: $542.7M

Sia is a blockchain-based decentralized cloud storage platform that allows users to lease excess storage space on the network. Smart contracts are used to facilitate network transactions. The native token of the blockchain SC (Siacoin) is the currency used to pay for data storage on the network.

Sia's initial whitepaper said that the network's purpose was to compete with established storage solutions such as Amazon, Google, and Microsoft. Because of its decentralized nature, Sia has an advantage over its competitors in terms of storage rates.

7. Audius (AUDIO)

Market Cap: $808.4M

Audius is a music streaming platform that aims to provide everyone with the freedom to distribute, monetize, and stream any audio content.

The native token, AUDIO, enables network security, unique feature access, and community-owned governance.

Musicians can use Audius to publish their songs and establish a fan following. When artists stake AUDIO, they gain access to badges and artist tokens, as well as voting power from their followers. Audius is supported by artists such as 3LAU,deadmau5, Rezz, and the Stafford Brothers. This platform provides 320 kbps high-quality audio streaming.

The Audius project has announced a partnership with TikTok, a streaming platform, with plans to integrate stablecoin on the network in the future to enable sponsored content.

8. The Graph (GRT)

Market Cap: $2.5B

The graph is an important decentralized protocol. In the DeFi world, the goal is to introduce a trustworthy decentralized public infrastructure to the mainstream market. It enables network users to create and publish an application programming interface (API), which is a workflow process that conceals complex code behind a simple API.

APIs are subgraphs in graph protocols, and they employ a specific query to retrieve data from a blockchain. The graph token (GRT) is used by graph network participants to secure the network's economic security. GRT is a work token that enables a community of stakeholders to deliver network indexing and curation services.

9. Arweave (AR)

Market Cap: $1.5B

Arweave describes itself as a jointly owned hard drive that never forgets. It allows for permanent data storage for a one-time fee.

Arweave (AR) is a decentralized storage network that allows for indefinite data storage. At its core is the ‘permaweb’ — a permanent, decentralized web with applications and platforms such as UI hosting, database writes and queries, and smart contracts.

The network employs blockweave technology, a blockchain variant that connects a new block not just to the previous one but also to a random preceding block. Coinbase Ventures, Andreessen Horowitz, and Union Square Ventures have all invested in the network.

10. Kadena (KDA)

Market Cap: $950.5M

The purpose of this platform is to power global financial systems. Kadena offers more secure smart contracts, as well as unique energy efficiency and PoS security. Unlike many other platforms, Kadena continues to utilize the same amount of energy as network demand grows. It can handle up to 480,000 transactions per second (TPS) due to the usage of braided chains. The protocol scales to larger processing powers as additional chains are added.

The KDA token is used to process transactions on the Kadena blockchain. There are 1 billion KDA in total, which will be mined during a 120-year period.

How to Buy Web 3.0 Coins on CoinStats

Sign up for a free CoinStats trading account to invest in web 3.0 coins with a credit or debit card. To buy any web 3.0 coins listed above with the CoinStats app, follow the steps listed below:

- Sign up for an account with CoinStats using your email address or by checking in with Coinbase; you can also use SSO.

- Verify your account. You must supply a national ID to authenticate your identity in order to comply with KYC requirements (and also aid in improving account security).

- Sign in using your credentials, then search for the token you wish to buy in the search box and tap on that token.

- You will see the current market price of your selected web 3.0 coin. After doing your research proceed to buy that coin. CoinStats will provide you with two options: Buy or Sell. Choose “Buy” from the menu and input the desired quantity you wish to purchase of that coins and in a matter of few seconds the coins will arrive in your wallet.

- If you plan to store your freshly acquired coins for more than a month, make sure to move them as quickly as possible to a secure hardware wallet.

Closing Thoughts

Web 3.0 coins, metaverse coins, and NFTs are some of the biggest opportunities in the crypto market for 2022 and the years ahead. The internet is becoming increasingly decentralized, with artificial intelligence and virtual reality being integrated into the experience. More people are also adopting blockchain technology.

We feel the 10 tokens listed above are the best tokens you can invest in right now if you want to promote Web 3.0 and the crypto market while also giving yourself a chance to make a lucrative profit.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market and sensitive to secondary activity, do your independent research, obtain your own advice, and only invest what you can afford to lose. There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-and 89% of retail investor accounts lose money when trading CFDs. You should consider your circumstances and obtain your advice before making any investment. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.

48

14