What Happens to the Old Ethereum After September?

1

0

What Happens to the Old Ethereum Blockchain After September?

When Ethereum (ETH-USD) merges with the Beacon Chain on (or after) September 19: "This will mark the end of proof-of-work for Ethereum, and the full transition to proof-of-stake [and] sets the stage for future scaling upgrades." That's the official word from the Ethereum Foundation.

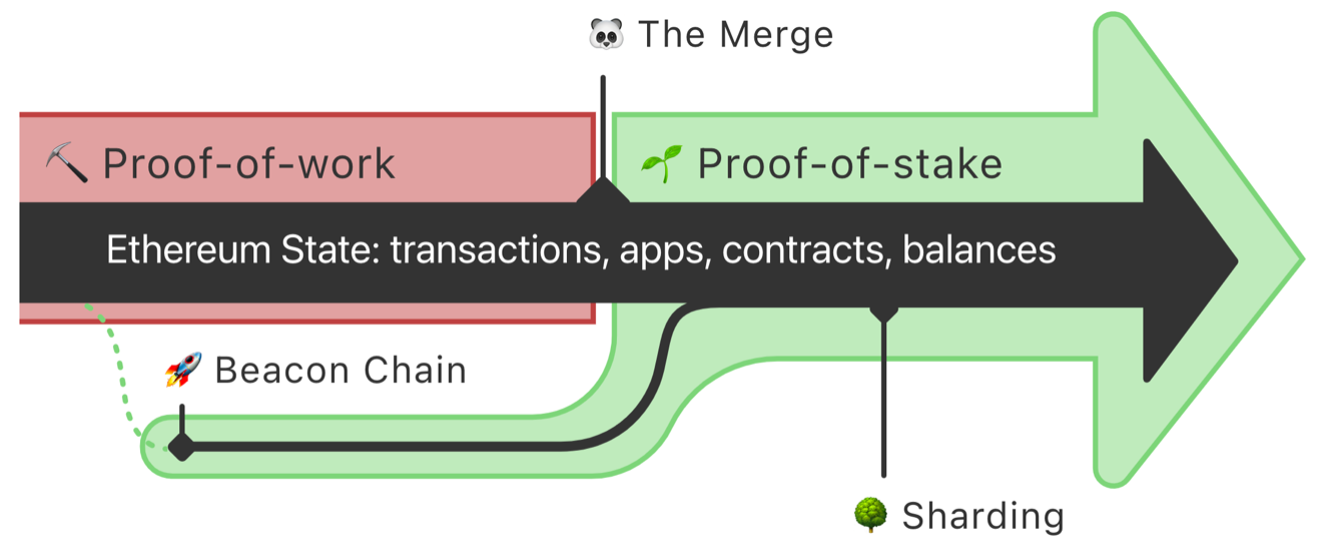

"Any funds held in your wallet before The Merge will still be accessible," we further hear. "No action is required to upgrade on your part." There's a flowchart to help us grasp what is happening:

Right now, we're at the fork in the road, on the left. Beacon Chain is almost done, but we're still under the "old regime" of proof-of-work. With The Merge, all data and applications move onto Beacon Chain, which becomes "Ethereum"…

But then there's that red box, "Proof of Work." Does it vanish, like a "cut and paste" of Ethereum... Or is it more of a "copy/paste," where Old Ethereum gets left behind?

That's the question now - particularly for people mining ETH (until September), or who just like the proof-of-work status quo. These are the type of people who've flocked to Ethereum Classic (ETC-USD). So, bottom line: Is this Merge really a "hard fork" like what created Ethereum Classic in 2016?

Marc Zeller - Head of Integrations for DeFi platform Aave (AAVE-USD) - did a "short thread about EthPoW and what is quite likely to happen." It's not all that short, but it is helpful, so I'll summarize:

Yes, you can still do stuff on the old proof-of-work network… But:

- Every DeFi provider will have left, because all the Lido Staked ETH (stETH-USD) they've accumulated on Beacon Chain will be worthless on the Old Ethereum.

- Stablecoins will move over with the DeFis.

- As people leave, the Old Ethereum gets less secure, so:

- NFTs will probably move over, too.

- Automated market-maker (AMM) protocols will still work… But trading on Old Ethereum will leave you extra-vulnerable to bots and ruthless humans looking to exploit you for a quick buck.

Zeller is a DeFi guy; Circle and Tether (USDT-USD) operate differently… But the latter stablecoin provider has weighed in, and says: "We plan to support ETH2." Support will be "seamless" and "stablecoins should act responsibly and avoid disruption for users."

Maybe this is "disruptive" for miners - but for the community as a whole, the only reason to keep Old Ethereum is if the Merge fails, says Michael Bentley of Euler (EUL-USD) in Blockworks. But "I don't think things will go wrong" since the testing process has gone smoothly (if slowly).

Bottom line: Maybe the proof-of-work fans will be best served by Ethereum Classic if they really want to keep mining (some form of) ETH. The rest of us will want to benefit from the new, improved Ethereum - with all the apps and assets that'll wind up there.

Crypto Fund Flows Just Had Their Best Month All Year

July wasn't just a solid month for crypto prices: We also saw $474 million inflows into crypto funds, which was the best monthly haul in 2022 to date, according to CoinShares' Digital Assets Fund Flows Report.

A good $306 million of that went to Bitcoin (BTC-USD) funds, or 64%! ETH was a distant second, at $138 million… But funds for other major cryptos got next to nothing. Multi-crypto funds actually were slightly net-negative.

A lot of this was happening in Switzerland ($357 million worth): whether for tax reasons or geographic ones, I can't say.

As for performance: Cathie Wood's ARK Innovation ETF (NASDAQ:ARKK) - which includes some indirect plays on bitcoin, like Block (NYSE:SQ) and Coinbase (NASDAQ:COIN) - gained +14% in July.

This "snapped its eight-month losing streak," notes Seeking Alpha, and coincided with $394 million of inflows. With ARKK having gained +154% in 2020...but lost -22% in 2021 and -48% in 2020 to date... ARKK is +62% in the past five years. Which is the timeframe Cathie Wood always tells us to invest for.

Side note: You don't have to buy fund shares on the NYSE or Nasdaq to invest in a basket of cryptos (or "crypto stocks"). You can actually buy a crypto token that's designed as a compilation of different investments.

Index Coop (INDEX-USD) is a provider that's respected by the crypto voices I follow... And for a more cautious approach in your crypto account, their new Market-Neutral Yield offering looks interesting.

NFTs for Pearson Textbooks - and Starbucks Rewards

Starbucks (NASDAQ:SBUX) is looking to add some extra flavor to its next Investor Day (on September 13) by announcing a Web3/NFT strategy.

What could these things have to do with lattes and Frappuccinos, you might ask? Well, like many other brands:

Starbucks "NFTs wouldn't just serve as digital collectibles, but would provide their owners with access to exclusive content and other perks," reports TechCrunch.

Yes, these NFTs would be "an extension of customer loyalty" in the Starbucks Rewards program. They're even bringing back the guy who built Mobile Order & Pay and the Starbucks app to advise the Web3 initiative.

In the earnings call Tuesday evening, CEO Howard Schultz mentioned unionization zero times - but did highlight "this new digital Web3-enabled initiative":

"Integrating our digital Starbucks Rewards ecosystem with Starbucks branded digital collectibles as both a reward and a community building element, this will create an entirely new set of digital network effects that will attract new customers and be accretive to existing customers in our core retail stores," as Schultz concluded his remarks to SBUX shareholders and analysts.

On the other hand: NFTs don't have to be collectibles, in themselves. They can be useful just for the smart contracts behind them.

Textbook publisher Pearson (NYSE:PSO) sees the appeal. In Monday's earnings call, CEO Andy Bird said he views digital textbooks - way more of a thing than physical copies, these days - as a chance to "take a cut from secondhand sales of its materials," by programming this into an NFT.

What I find most interesting about this is not Pearson's cut of the proceeds; PSO is not the most exciting stock. But the idea makes sense for this whole type of business.

If more of them start selling their wares through NFT marketplaces… Eventually, Amazon (NASDAQ:AMZN) can say bye-bye to its online store and become "Amazon Web Services," full stop - or get in the game itself. It's an exciting New Digital World out there, and I can't wait to see where it's at a year, five years from now.

On the date of publication, Ashley Cassell did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines. To have more news from The New Digital World sent to your inbox, click here to sign up for the newsletter.

1

0