Is a gold-backed token a good exchange currency?

0

0

Consider how Aristotle saw money. According to him, it is defined by three functions: it is a unit of account, a store of value and a medium of exchange.

Money as a unit of account

Central banks tell us that few prices in the world are expressed in gold, Bitcoin or cryptocurrency in the broadest sense of the term. A champion of cryptocurrency might respond that more Bitcoin is issued in value and used each day than there are Gibraltar pounds in circulation, even though they are recognized as an official currency in their country. A champion of gold might argue the same thing even more easily, as the 171,000 tonnes of the precious metal at humanity’s disposal are worth more than 7 trillion US dollars, and gold trading represents nearly $100 billion changing hands every day on the London and New York Stock Exchanges.

Money as a medium of exchange

Detractors would then say that current cryptocurrencies are too volatile, that it is hard to use to pay and, worse still, that their transaction fees are high compared to traditional currencies. This excludes them from aspiring to be the media of any exchanges. At the end of the day, this is laughable, if you consider what drove the creation of Bitcoin for example. Here again, champions of cryptocurrencies might retort that Bitcoin is not as volatile as the Argentinian Peso and clearly less so than the Venezuelan bolívar, even though those are currencies of sovereign States. In passing, it should be noted that, just 10 years ago, Venezuela was still one of the richest countries in the world. It even created a State cryptocurrency, the Petro, in an attempt to restore trust in the national monetary system and boost the economy. Imagine that cryptocurrency volatility was really a problem. In that case, who could argue against the age-old stability of gold, including in the form of a stablecoin which follows its international price? In general, gold can still purchase the same quantity of things today as in the 1970s, although the US dollar lost 97% of its value over that same period. And as for fees, are our fiat currencies really free? Clearly not. There is no financial transaction which comes with no direct or indirect fees, due to the fact that the issuing of currency is linked to the award of credit.

Money as a store of value

On this subject, private banks and central banks will argue that crypto-assets come from “computing power” and that they have “no real underlying assets”. That argument is understandable. And yet, its tenability is enormously problematic. What are the banks (whether private or central) talking about when they mention an absence of real underlying assets? Are they trying to suggest that our euros and dollars are still backed by gold? Because unless we are mistaken, they are not. Our banknotes and coins have no intrinsic value and, at any rate, only represent a minority of the money supply today. So, what exactly are the euro and the dollar? For the most part, deposits are made up of credit. In short, our national currencies have all followed the same rule since 1971: they are backed by our future work. So, one might say that, in respect of “real underlying assets”, gold easily comes out first, as the customary practice today is that its price is set by the world of industry and jewellery, Bitcoin is not so bad off since it is backed by work which has already been done (the famous “mining”), and our debt-based money loses by comparison, because it is only backed by future work. And we do all certainly hope that that future work will come to pass.

Accountants the world over tell us that the accounting concept of prudence requires the recording of unrealized capital losses and prohibits the same for unrealized capital gains. In assigning value to our national currencies based on future work, we have had a monetary system for the past 50 years which does not apply to itself the accounting rules which are self-imposed by any serious company. Yet the central banks want to give cryptocurrencies a lecture? Worse still, a lecture on gold, which they buy up in massive quantities at the same time? To us then, the central banks’ remarks about the store of value is like listening to a pyromaniac firefighter.

But also…

Detractors claim that real currency is necessarily issued by a State. This is false. Real currency is currency which is recognized as such for everyday uses, as a result of the trust that it inspires. The past has shown us that industrialists and small private banks are able to issue currencies which surpass all the rest, particularly in cases of defaulting public authorities. Our monetary memory seems to be limited to the last 70 years, despite the fact that many inventions were successfully tested before our current monetary system began to slide out of control.

To sum up:

Our central banks, which were largely to blame for the crises of 2008 and 2011, are now being criticized from every side. As a result, the currencies they guarantee are likewise called into question. Those same currencies are issued in part by the credit facilities granted by private banks, behind which is a system of fractional reserves meaning that our currencies today are based solely on the trust we have in our governments, our private banks and our future capacity to work to repay our debt. That is a lot to believe in. And yet, this model forms the bedrock of our modern-day economies.

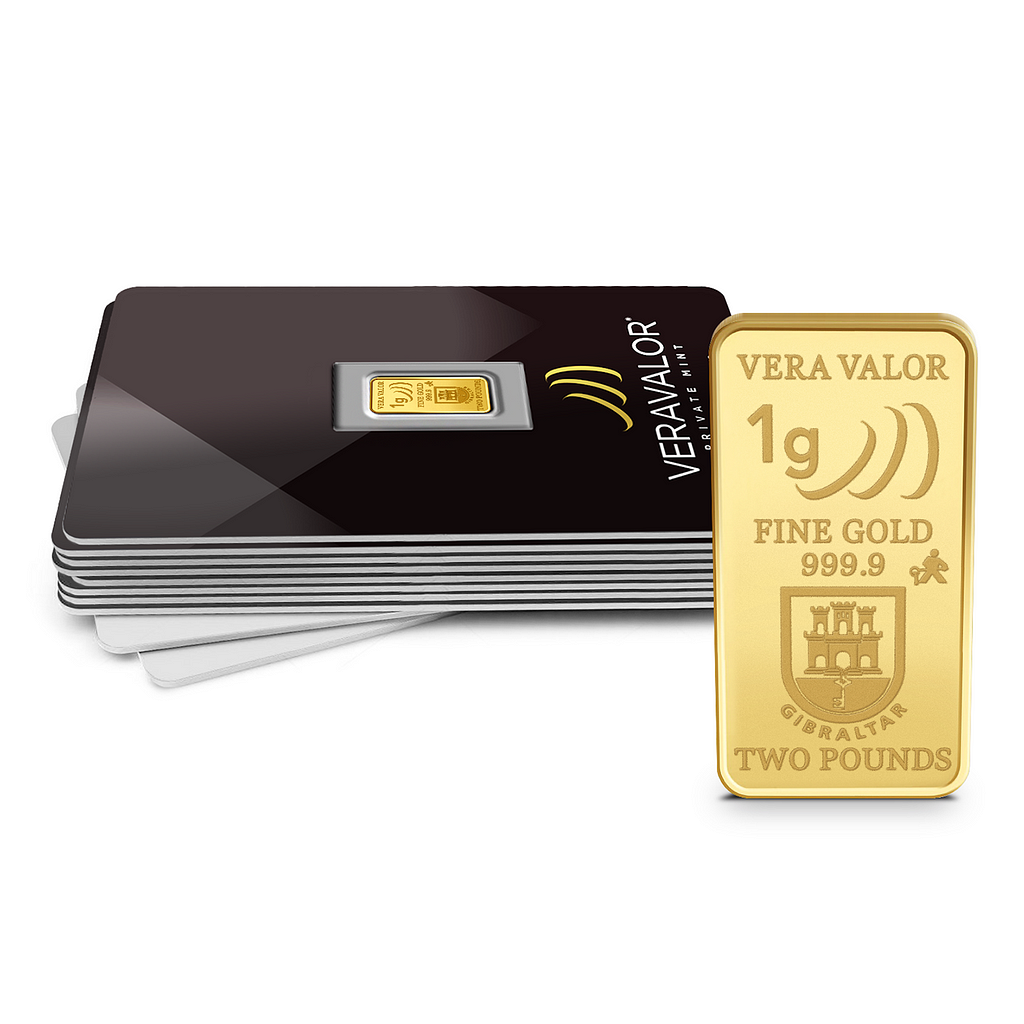

But a system like VeraOne, that decides to be backed by a full counterpart in order to cover its users’ deposits, in the form of a tangible, physical and age-old asset like gold? Now that is a project which thoroughly satisfies the expectations we have of a valid, sustainable exchange currency.

0

0