ChainLink price analysis: LINK shows bullish characteristics at $7.2

3

0

ChainLink price analysis for March 29, 2023, reveals the market following an upward movement, showing increasing momentum, signifying positivity for the LINK market. The price of ChainLink has remained bullish over the past few hours. On March 28, 2023, the price reached $7 from $6.7. However, the market increased in value soon after and gained some value. Moreover, ChainLink reached an all-day high price of $7.26 and is currently valued at $7.25.

As of March 29, 2023, the price of Chainlink is $7.25 with a trading volume of $664.08 million and a market cap of $3.74 billion. Its market dominance is 0.31%, and the price has increased by 5.51% in the last 24 hours.

Chainlink’s highest price was reached on May 10, 2021, when it traded at an all-time high of $52.89, while its lowest price was recorded on September 23, 2017, at an all-time low of $0.126297. Since its ATH, the lowest price was $5.36 (cycle low), and the highest LINK price since the last cycle low was $9.45 (cycle high). Currently, the sentiment for Chainlink price prediction is bearish, and the Fear & Greed Index is showing 57 (Greed).

The current circulating supply of Chainlink is 517.10 million LINK out of a maximum supply of 1.00 billion LINK. The yearly supply inflation rate is 10.73%, meaning 50.09 million LINK were created in the last year. Chainlink is currently ranked #4 in the DeFi Coins sector and #7 in the Ethereum (ERC20) Tokens sector in terms of market cap.

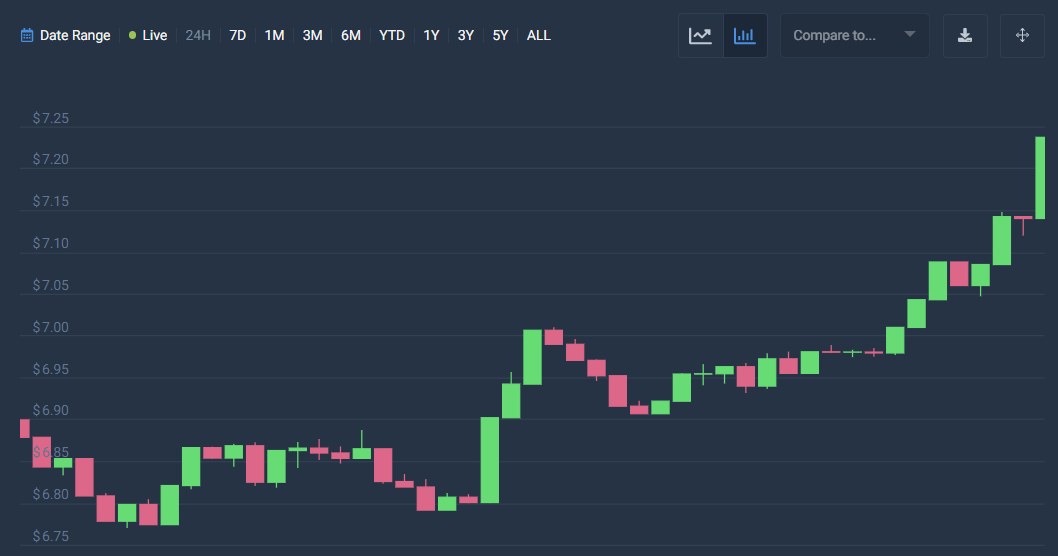

LINK/USD 1-day price analysis: Latest developments

ChainLink price analysis reveals the market’s volatility following a decreasing movement. This means that the price of ChainLink is becoming less prone to the movement toward either extreme, showing dormant dynamics. The opening price is $7.14, while the high price appears to be $7.26. Conversely, the low price is present at $7.14, with a close price remaining at $7.23. ChainLink market is undergoing a change of 1.33%.

The LINK/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. The market’s trend seems to be dominated by bears, but not for long. Moreover, the LINK/USD price appears to be moving upward, illustrating an increasing market. The market appears to be showing bullish potential. The price has almost crossed the moving average band; a reversal is imminent in the coming days.

ChainLink price analysis reveals that the Relative Strength Index (RSI) is 53 showing an increasing cryptocurrency market. This means that cryptocurrency is in the central neutral region. Furthermore, the RSI appears to move upward, indicating an increasing market. The dominance of buying activities causes the RSI score to increase.

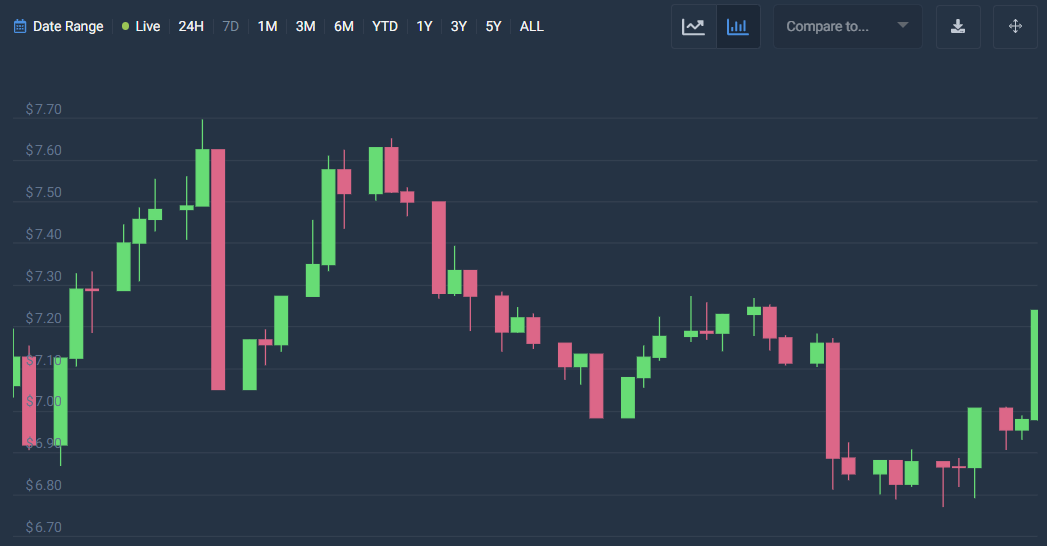

ChainLink price analysis for 7-days

ChainLink price analysis reveals the market’s volatility following an increasing movement, which means that the price of ChainLink is becoming more prone to experience variable change on either extreme. The Opening price appears to be $6.98, while the high price is present at $7.26. Conversely, the low price is at $6.98, with a close price of $7.24, which is at a change of 3.78%.

The LINK/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. However, the market’s trend seems to have shown bullish tendencies in the last few hours. Moreover, the market has decided on a positive approach. As a result, the movement path has shifted today, the price started moving upwards, and the market started opening its volatility.

Chainlink price analysis shows the Relative Strength Index (RSI) to be 49, signifying a stable cryptocurrency. This means that the LINK cryptocurrency falls in the central-neutral region. Furthermore, the RSI path seems to have shown an upward movement. An increasing RSI score also means dominant buying activities.

ChainLink Price Analysis Conclusion

Chainlink price analysis reveals that the cryptocurrency follows an increasing trend with much room for activity on the positive extreme. Moreover, the market’s current condition appears to be following a neutral approach, as it shows the potential to move to either bullish extreme. The market shows much potential for development towards the increasing end of the market.

3

0