Bitcoin and Ethereum Price Prediction: Is BTC Losing Steam After “Uptober,” and Can ETH Lead the Next Rally?

0

0

Is Bitcoin price losing steam after Uptober? Jump into the latest Bitcoin and Ethereum price prediction for the first Week of November.

Bitcoin traded near $110,000 on Saturday as sentiment stayed cautious after a slow “Uptober.”

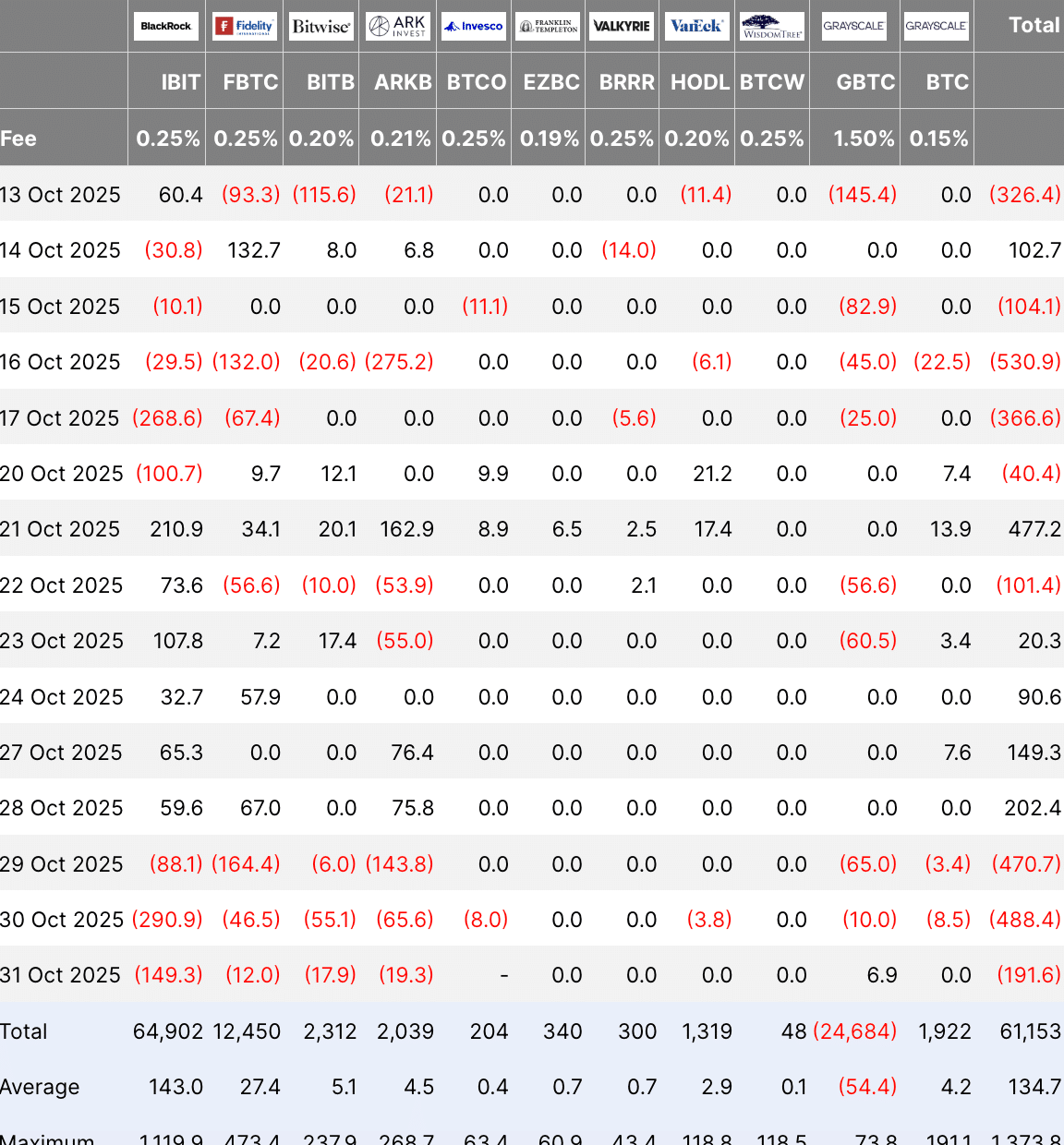

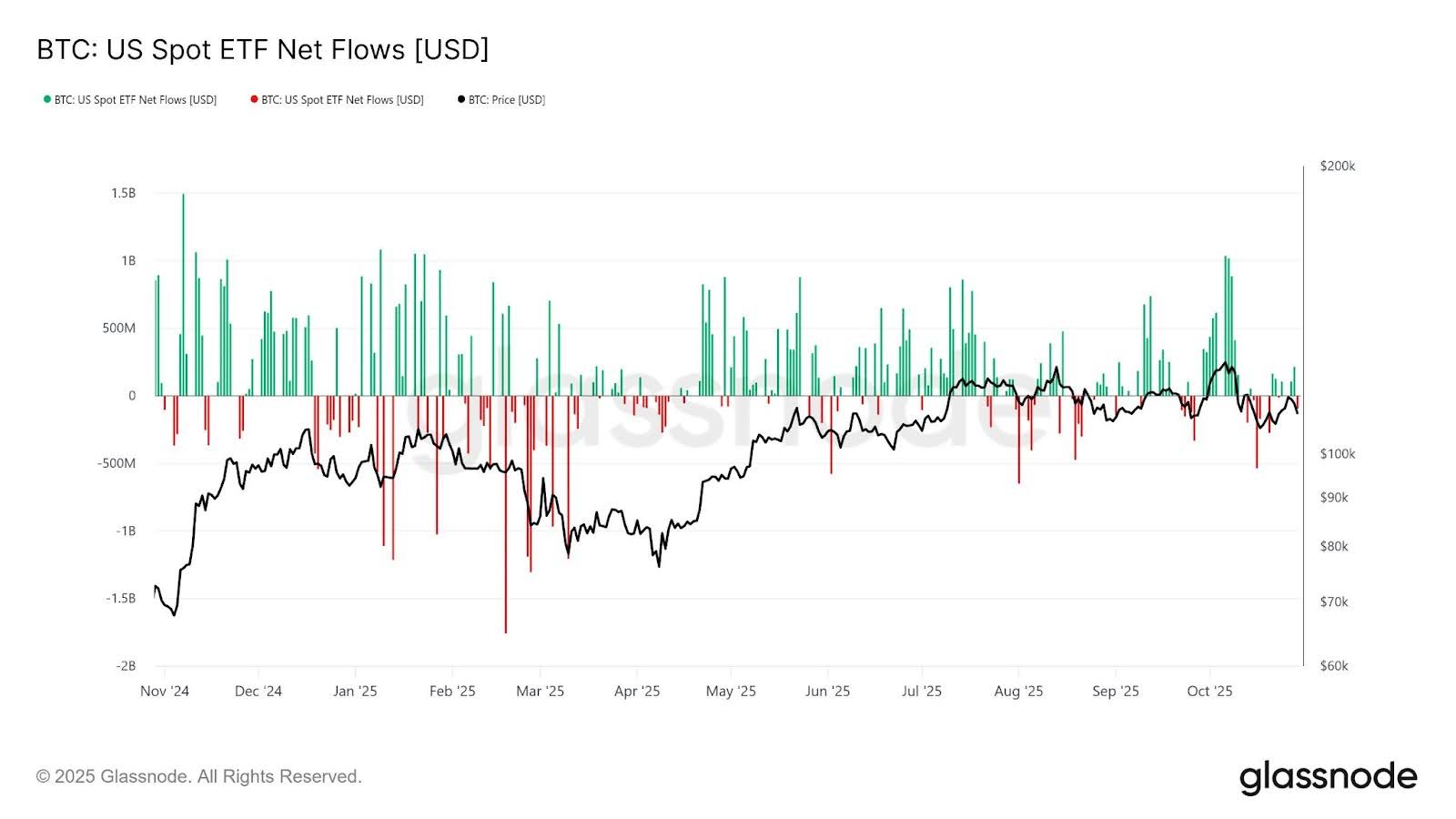

The market attempted to recover from losses incurred during Friday’s Wall Street session, but steady selling persisted throughout the week on US exchanges and in spot Bitcoin exchange-traded funds.

On-chain research firm Glassnode noted that recent ETF outflows point to “rising sell pressure from TradFi investors and renewed weakness in institutional demand.”

Yesterday, U.S. Spot Bitcoin ETFs saw a net outflow of –$93M, highlighting rising sell pressure from TradFi investors and renewed weakness in institutional demand.

https://t.co/BIeP5pVLcm https://t.co/eeLs2p6XvV pic.twitter.com/zNeccTdXNj

— glassnode (@glassnode) October 30, 2025

Data from UK-based manager Farside Investors showed roughly $191M leaving spot Bitcoin ETFs on Friday, following another $488M withdrawn on Thursday.

Glassnode stated that broader markets showed little reaction to the recent interest-rate cut by the US Federal Reserve.

The firm noted on X that the Fed delivered the expected reduction but kept a hawkish tone for December, which has cooled optimism.

DISCOVER: Top 20 Crypto to Buy in 2025

Bitcoin Price Prediction: Is Tight Price Action Under $120K a Sign of Market Caution?

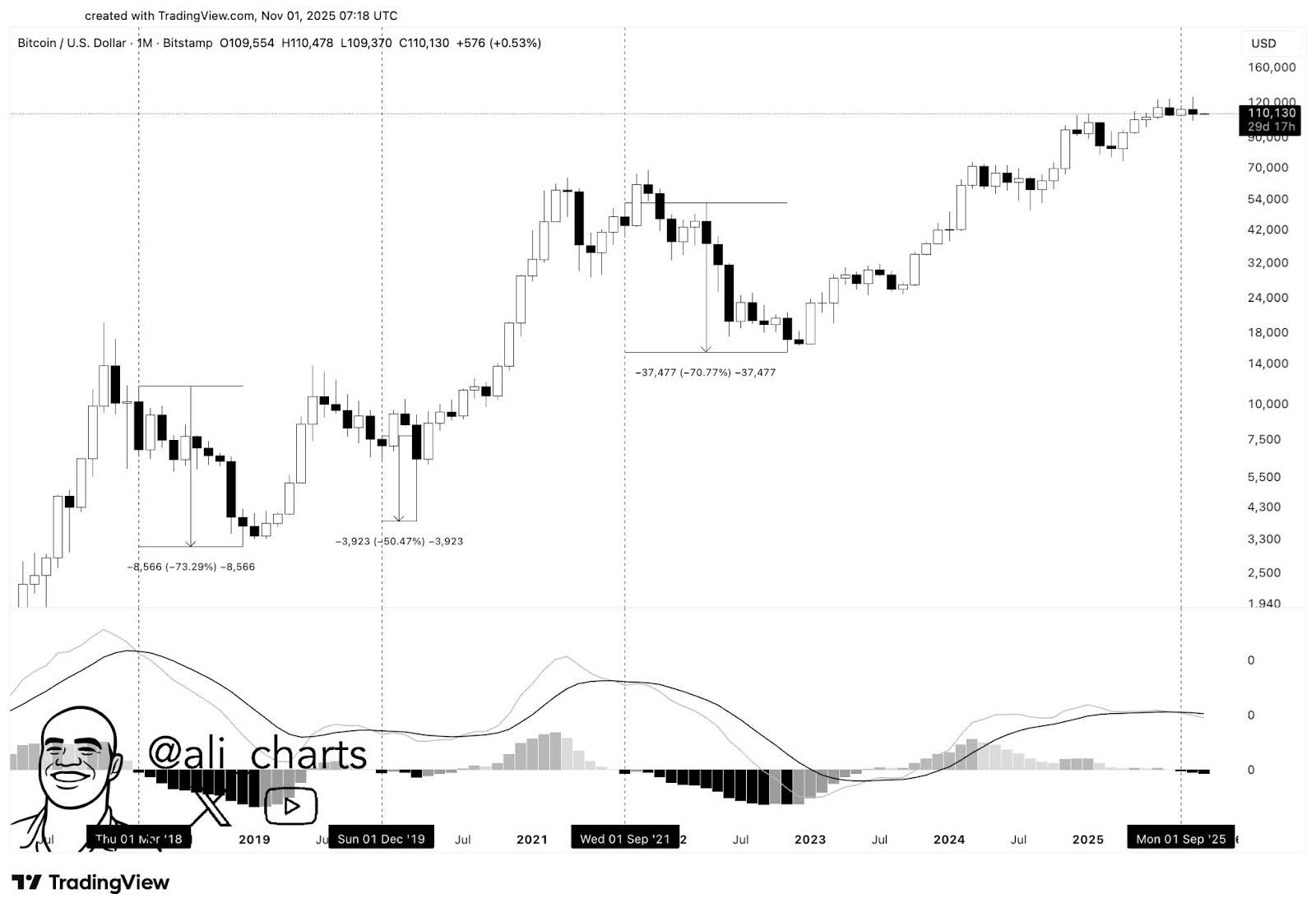

Bitcoin held near $110,000 in November as analyst Ali Martinez questioned whether the current structure could support a move toward $250,000 by December.

The monthly chart he shared shows Bitcoin still tracking an uptrend that began after its 2022 bottom, with two years of higher highs and higher lows.

Martinez pointed to past drawdowns of about 73% in 2018, 50% in 2019, and 71% between 2021 and 2022.

He said those heavy corrections suggest the worst phase may already be behind the market.

Since then, Bitcoin has reclaimed key macro resistance levels and is now consolidating close to its record range.

The monthly MACD remains positive, though it has begun to flatten. That is an indication of dwindling momentum following a protracted recovery. Tighter candle action is also witnessed by the recent candles, as Bitcoin trades laterally under 120,000.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Ethereum Price Prediction: Is ETH Holding Strong Above the Key $3,600–$3,750 Support Zone?

Ether is staying stagnant within a relatively important support level.

The price recently bounced from the $3,600–$3,750 area after briefly slipping under a short descending trendline, showing that buyers are still protecting this zone.

As per Bitbull, a crypto analyst, a possible bull-flag pattern is taking shape below the $4,100–$4,250 resistance band, which has blocked upside moves since mid-2025.

The market structure is still positive, though the chart doesn’t yet show the strong momentum or clean breakout that would suggest a rapid move toward $250,000 in a single month.

A clear push above this barrier could send prices toward the $5,000–$6,000 zone, matching the analyst’s outlook.

The wider blue area on the chart highlights where ETH may expand if the bull flag plays out.

The analyst also pointed to a large Binance order of more than 30,000 ETH, saying these kinds of inflows often appear before stronger moves.

ETH is still holding its broader uptrend after breaking a long-term downtrend earlier this year. Higher lows continue to form, and traders are now looking to November to see whether momentum returns for ETH and the rest of the market.

DISCOVER: 10+ Next Crypto to 100X In 2025

The post Bitcoin and Ethereum Price Prediction: Is BTC Losing Steam After “Uptober,” and Can ETH Lead the Next Rally? appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.