Tumbling Crypto Markets Wait on Powell Fed Speech: Is Bottom in For XRP?

0

0

XRP has one primary advantage over all other cryptocurrencies, and that lies in its management and business relationships. Who would you rather have a beer with?

- President of Ripple, Monica Long

- CEO of Ripple, Brad Garlinghouse

- Sergey Nazarov of Chainlink

- Vitalik Buterin of Ethereum

- CZ of Binance

On second thought… I’d take a beer with Vitalik any day. Regardless, Federal Reserve Chair Jerome Powell enters the final months of his tenure with one of the most closely watched speeches of the year, and XRP is set to gain from it.

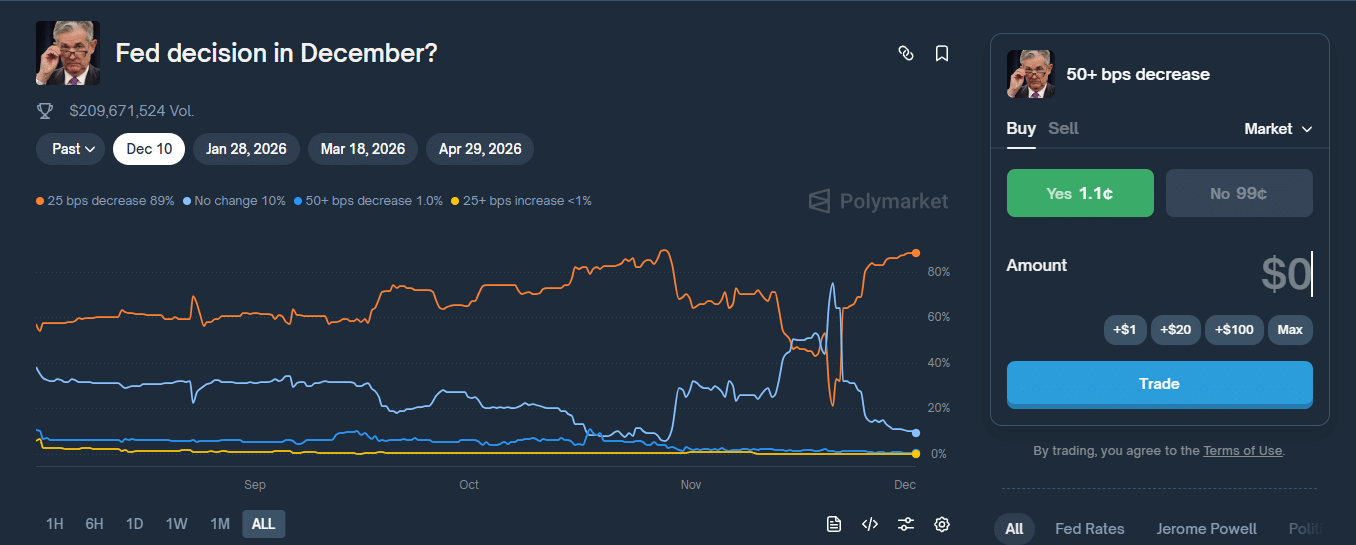

Powell spoke Monday night at Stanford’s Hoover Institution, giving investors a last read on his thinking before the December 9-10 FOMC meeting, where markets widely expect a 25 bps rate cut.

Bloomberg analysts say a cut is “extremely likely” if the Fed concludes inflation is cooling while employment weakens.

DISCOVER: 20+ Next Crypto to Explode in 2025

Will Jerome Powell Rate Cuts Save Crypto? Markets Brace for Fed Decision

FRED data shows US core inflation slowing through Q3, while labor indicators remain contradictory. Despite high-profile layoffs across the tech sector, initial unemployment claims have fallen to a seven-month low, suggesting resilience beneath an otherwise sluggish hiring backdrop.

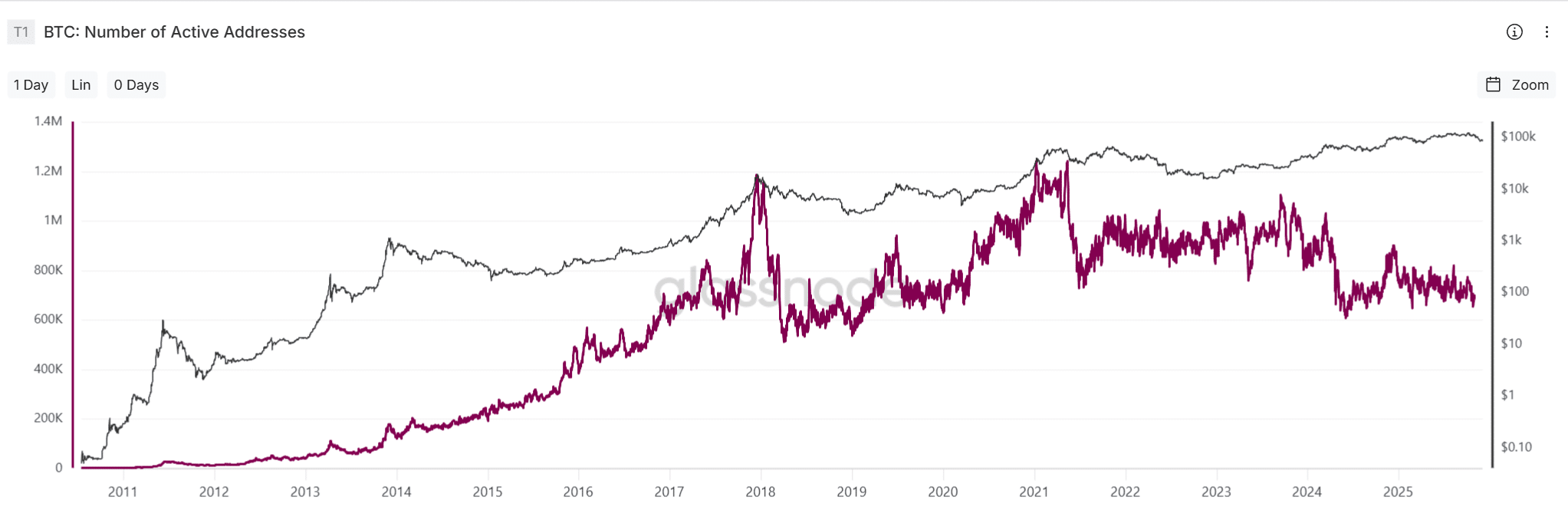

Historically, outperforms in the months following rate cuts, but the correlation has weakened in 2025.

Glassnode data shows that long-term BTC holders are distributing their holdings into strength, while CoinGecko’s global market cap index indicates that the crypto market is down roughly 20% over the past 30 days.

Risk assets remain hypersensitive to Powell’s tone. If Powell has anything resembling hawkish caution going forward, we’ll see risks accelerating the liquidity pullback already pressuring crypto and growth stocks.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What’s Next For XRP? Singapore Expands Ripple’s Licensing Footprint

Amid the macro uncertainty, Ripple secured one of its most consequential regulatory wins of the year. The Monetary Authority of Singapore approved an expanded scope for Ripple’s Major Payment Institution (MPI) license, allowing broader digital payment token services.

Ripple says the approval enables a unified integration for corporate clients, letting firms collect, hold, convert, and settle payments using XRP and RLUSD without additional banking rails.

“Asia Pacific leads the world in actual digital asset use,” said Ripple APAC MD Fiona Murray

TRUMP ALREADY PICKED JEROME POWELL'S REPLACEMENT, AND HE'S GRINNING EAR-TO-EAR WHEN REPORTERS GUESS KEVIN HASSETT

Caught walking through the halls today, reporters swarmed him:

"Mr. President, have you decided on Powell's replacement?"

Trump, with the biggest shit-eating… pic.twitter.com/TMzvURdHSC

— Mario Nawfal (@MarioNawfal) November 30, 2025

Monday’s Powell speech is a Fed pivot that could loosen global liquidity into 2026. Although the crypto market is still recovering from leverage washouts and macro shocks, it’s the first beacon of good news heading into 2026.

If Powell confirms a December rate cut, markets may see the first coordinated upswing across US equities, Asian risk assets, and major cryptos in weeks. If he doesn’t, the year’s final trading window could turn defensive fast.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Federal Reserve Chair Jerome Powell enters the final months of his tenure with one of the most closely watched speeches of the year and XRP is set to gain from it.

- Monday’s Powell speech is a Fed pivot that could loosen global liquidity into 2026.

The post Tumbling Crypto Markets Wait on Powell Fed Speech: Is Bottom in For XRP? appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.