Solana price analysis: Bullish momentum helps elevate SOL to $33.65

0

0

Solana price analysis shows signs of an uptrend, as the price underwent a further increase in the last 24 hours. The price is on its way towards revival and has recovered up to the $33.65 mark during the day as the bullish trend has gained stability. The past week has proved to be highly supportive for the buyers. A constant uptrend has been on the rise, and a similar trend is observed even today. Further recovery is possible if the buyers remain persistent with their efforts.

The altcoin has seen some strong buying pressure as of late and looks poised to continue its upward momentum in the medium term. Solana prices have been hovering around the $32-33 level for the past few days and a breakout above this could see prices move towards the $34.00 region in the near term. The 24-hour trading volume is currently around $702 billion and the total market capitalization is at $11 billion.

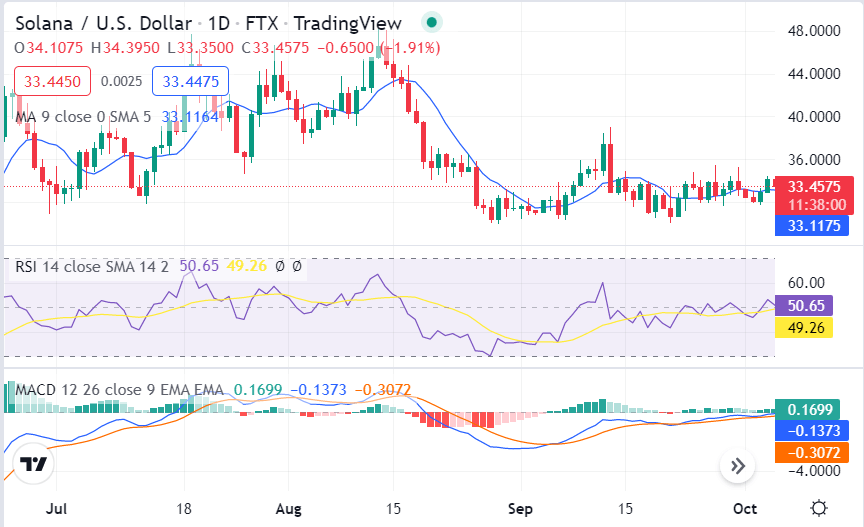

SOL/USD 1-day price chart: uptrend causes price rise up to $33.65

The one-day Solana price analysis confirms a bullish trend for cryptocurrency, as the SOL/USD value has increased significantly. A considerable degree of increase in coin value is being detected due to emerging bullish efforts. If the buyers remain persistent, it can be predicted that the price will increase further in the next coming hours. The price is now standing at $33.65, as the coin gained 1 percent value during the last 24 hours, and the weekly trend line is also going upwards.

The price has been trending higher in recent days and the RSI indicator is currently at 49.26 which is in the overbought region, meaning that a pullback could occur in the near term. The MACD indicator is also in bullish territory and is currently above the signal line, suggesting that prices could continue to move higher. The coin is trading above the 20-day moving average (MA) and the 50-day MA, which is a bullish sign.

Solana price analysis: Recent developments and further technical indications

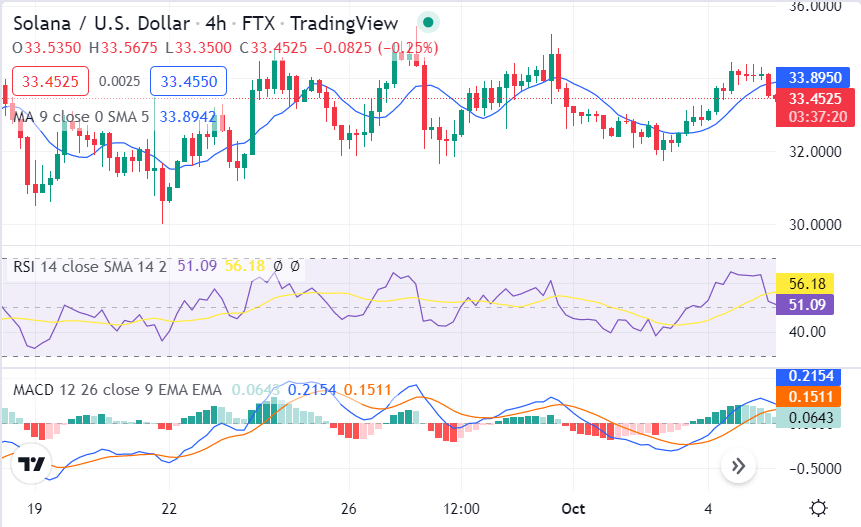

The 4-hour chart for Solana price analysis shows that the bulls have managed to push prices higher after a period of consolidation. Prices are currently trading above the $33.00 level as the market has formed higher highs and higher lows. SOL/USD is trading between the $33.54 and $34.34 levels, with a breakout above the latter needed for further upside.

The RSI indicator is currently at 56.18, which is in neutral territory, suggesting that prices could move in either direction in the near term. The MACD indicator is also in bullish territory but is close to the signal line, offering that prices could consolidate in the near term. The 20-day moving average (MA) is currently at $34.34 and the 50-day MA is at $33.54, both of which are bullish signs.

Solana price analysis conclusion

The price is headed up once again, as it has been confirmed from the one-day and four hours Solana price analysis. The price has followed an upward movement today because of the bullish trend dominating the market. As bulls have been in the driving seat for the past 24 hours, a correction may appear in the coming hours if bears show any activity. But if the buying momentum continues, then SOL may continue upside above the $32.00 mark.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

0

0