XRP Perpetual Futures Open Interest skyrockets to $610 million

6

2

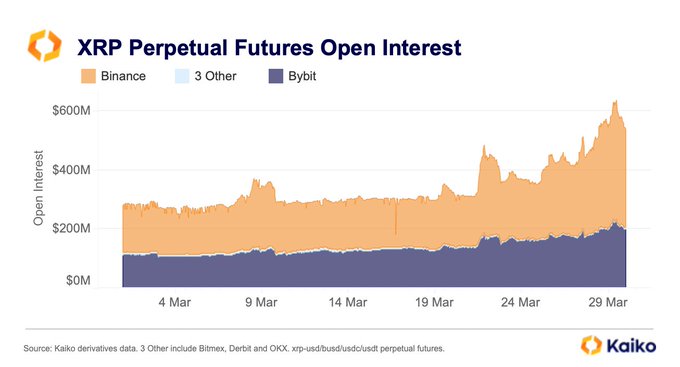

XRP Perpetual Futures Open Interest (PFOI) has shot up significantly since March 24 to around $610 million at its peak.

Open interest refers to the number of open futures contracts traders hold at the end of a trading day. It is commonly used to gauge market sentiment and the strength underlying price moves.

Whereas perpetual futures are a form of derivative contract, with no expiration date, that is cash settled – as opposed to settled in the underlying asset.

XRP perps skyrocket

Analysis from the data platform Kaiko showed a spike in XRP PFOI.

Since the start of March, XRP PFOI had been holding relatively steady, at around $300 million. However, on March 22, a significant jump in PFOI occurred – spiking as high as $500 million.

Through to March 26, a downtrend followed. But as we entered this week, futures traders began piling in to lift XRP PFOI much higher – peaking at $610 million on Wednesday.

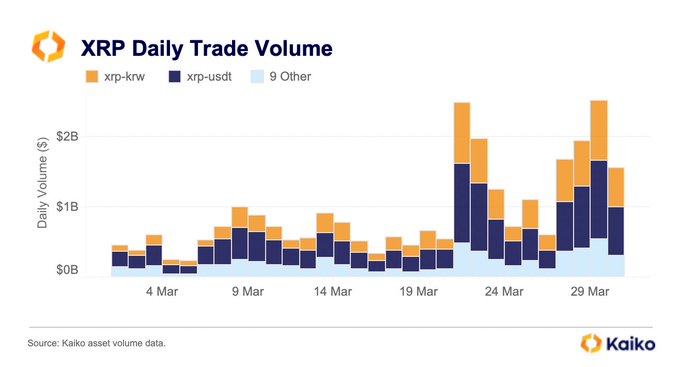

Further analysis from Kaiko showed spot XRP daily trading volume rising and falling in tandem with PFOI – with a monthly peak at around $2.5 billion on two occasions.

The chart below shows spot volumes being primarily driven by the Korean market.

SEC lawsuit drawing to a close?

In December 2020, the SEC filed charges against Ripple over allegations it had raised over $1.3 billion through the unregistered XRP token.

“the defendants failed to register their offers and sales of XRP or satisfy any exemption from registration, in violation of the registration provisions of the federal securities laws.”

Since then, both sides have stated their case, with many observers noting the fragility of the regulator’s arguments.

While many XRP advocates expect a favorable decision, Judge Torres has yet to give her final verdict.

Some in the XRP community expect the outcome to be delivered before March 31. However, there has been no official confirmation of this deadline.

It should be noted that this date was a predictive estimate from James Filan – a lawyer who has been monitoring this case.

The daily chart below shows anticipation of the case conclusion filtering into the spot price around March 22. Since then, XRP recorded 57% gains at its peak – to post a 46-week high.

The post XRP Perpetual Futures Open Interest skyrockets to $610 million appeared first on CryptoSlate.

6

2