Ethereum price analysis: ETH rallies above $1,800 as the bull market continues

3

0

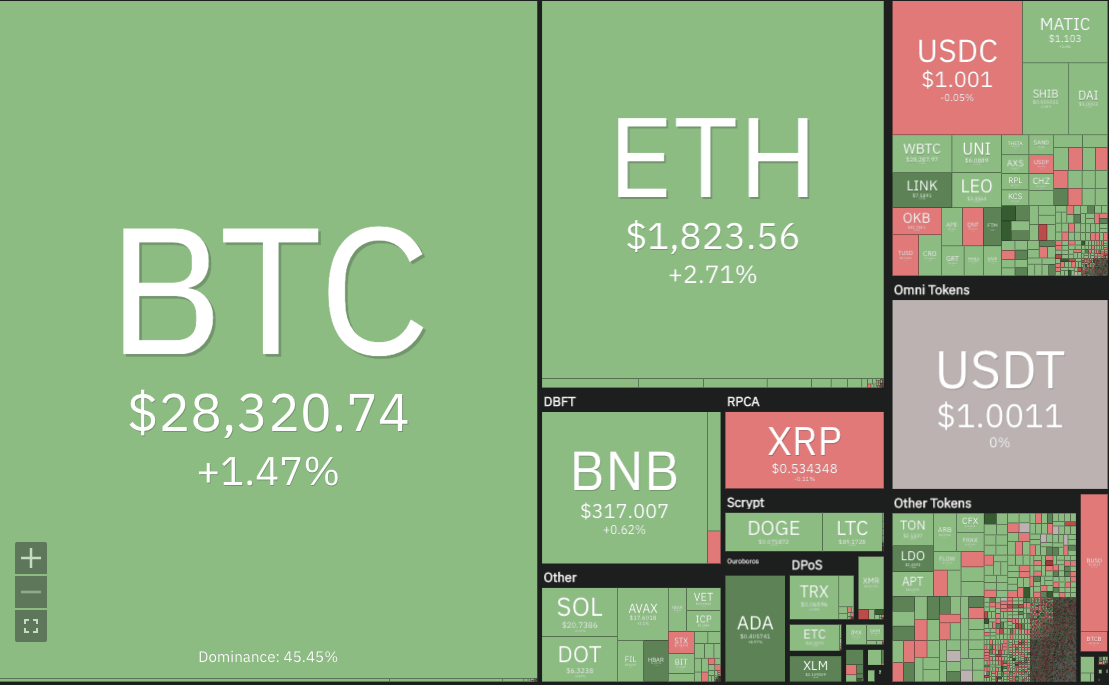

Ethereum price analysis shows an uptrend, as investors flock to the cryptocurrency, with the ETH/USD pair breaching the $1,766 support level and aiming for higher gains. The buying pressure has been strong, with the pair currently trading at $1,823 gaining more than +2.71 percent in the last 24 hours.

The ETH/USD pair has been ranging between $1,766 and $1,844, indicating an overall bullish trend in the crypto market. The ETH token has seen a significant increase in demand recently, as investors flock to the cryptocurrency for its impressive returns and strong project fundamentals.

Looking ahead, the Ethereum price analysis shows a bullish outlook as the ETH/USD pair continues to trade above the $1,766 support level. And if the bullish sentiment persists, then the pair could potentially rally above $1,844, paving the way for further gains in the long run.

Ethereum price analysis 24-hour chart: ETH regains balance at $1,823 after receiving a bullish push

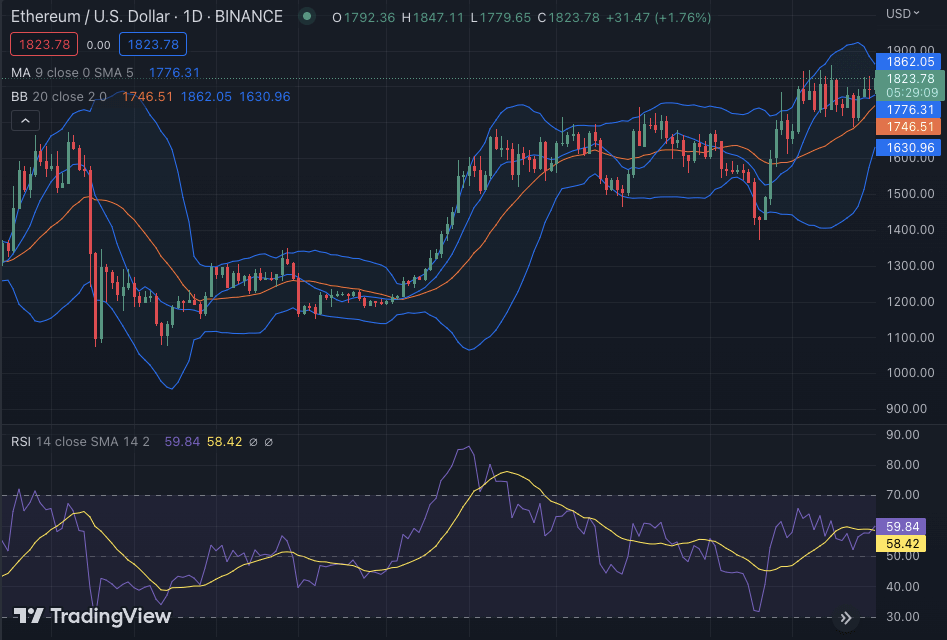

The 24-hour chart Ethereum price analysis shows the ETH/USD is trading in a positive zone above the $1,766 support level. The pair has seen multiple attempts by buyers to break out of the range, but all have failed so far. The chart shows that the bears were present earlier today, but have since been pushed back by the bulls. The 24-trading volume for the ETH/USD pair is currently at $219 billion, indicating healthy demand for the token, while the market capitalization stands at $9.13 billion.

Looking at the technical indicators for ETH/USD, the RSI is currently close to the overbought zone at 59.84, indicating that the pair could be nearing a reversal. The relative strength index is also pointing towards a bullish trend, as the 50-day moving average (MA) is trending above the 200-day MA. The Bollinger bands on the daily chart show that the volatility is high, and buyers have pushed the price above the middle band. The upper Bollinger band is at $1,862 and if the bulls continue to rally, then a breakout could potentially take place, while the lower Bollinger band is at $1,630

Ethereum price analysis: Recent developments and further technical indications

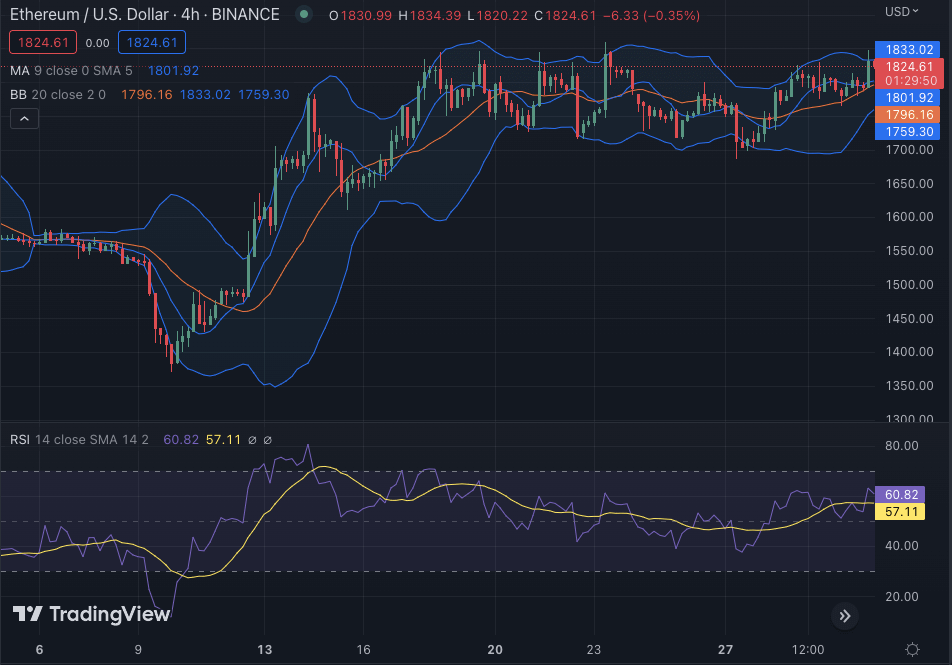

The 4-hour Ethereum price analysis indicates a rise in price as the bullish momentum has been mostly lean. The past few hours have been highly favorable for the bulls, as the short-term trending line is showing more green candlesticks. The bullish pattern is strong as more buying pressure is present in the market, as buyers are trying to push ETH above the $1,844 resistance level.

The Bolinger bands are widening on the hourly chart, indicating increasing volatility. The upper Bollinger is currently at $1,833, while the lower Bollinger is at $1,759. The moving average indicator is at $1,801 and is trending above the 200-day MA, signaling further gains in the long run. The relative strength index is currently at 60.82, close to the overbought zone, which could indicate a reversal in the near future.

Ethereum price analysis conclusion

From the above Ethereum price analysis, it can be concluded that the ETH/USD pair is trading in a bullish zone at $1,823. The buying pressure is strong, as the pair breached the $1,766 support level and is now aiming for higher gains. The technical indicators on the 4-hour chart are also pointing towards a bullish trend in the near term. If this momentum continues, then Ethereum could potentially break above the $1,844 resistance level in the coming days.

3

0