Analyzing the US Government’s Bitcoin holdings: What you need to know

0

0

The following is a guest post from Vincent Maliepaard, Marketing Director at IntoTheBlock.

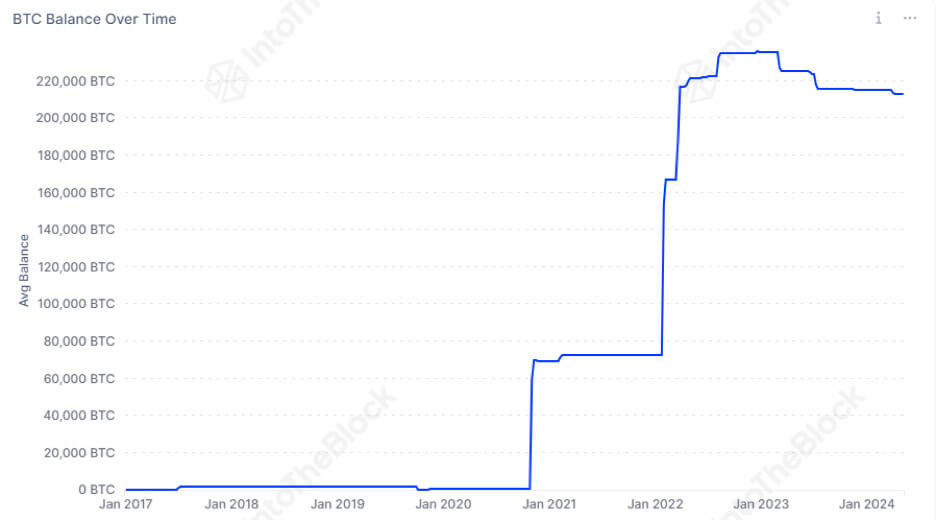

According to the latest data from IntoTheBlock, the U.S. government holds over 1% of the Bitcoin supply, valued at an impressive $13.16 billion. These holdings have tripled since 2021, demonstrating a consistent increase over the years.

Why the US government holds Bitcoin

It’s important to clarify that the U.S. government’s Bitcoin holdings are not the result of purchases but enforcement actions. These seizures typically occur in response to illegal activities.

Spikes in the amount of Bitcoin held by the US government are associated with the biggest BTC-related enforcement actions. Notable instances include the Silk Road vase and the Bitfinex hack.

Silk Road (2013):

One of the most notable cases involved the seizure of approximately 174,000 bitcoins from Silk Road, a dark web marketplace. The FBI shut down Silk Road and arrested its founder, Ross Ulbricht. In a dramatic twist, the US government later seized over $1 billion worth of Bitcoin linked to Silk Road, found in a previously undiscovered wallet holding approximately 69,370 bitcoins.

Bitfinex Hack (2016):

In August 2016, hackers breached Bitfinex, a prominent cryptocurrency exchange, stealing approximately 120,000 BTC, valued at around $72 million.

Years later, in February 2022, the Department of Justice announced the recovery of a significant portion of the stolen Bitcoin, valued at over $3.6 billion. This marked the largest recoveries of stolen crypto in history.

Other notable seizures

While Silk Road and Bitfinex are among the most prominent cases, several other significant seizures have occurred. In 2017, the US seized bitcoins worth $4 million (currently valued at over $60 million) from the BTC-e exchange during a multi-agency investigation into alleged money laundering activities. Alexander Vinnik, the alleged operator of BTC-e, was arrested.

Another notable case involves the 2020 seizure of assets from the founders of the BitMEX exchange for violations of the Bank Secrecy Act. Although specific amounts of Bitcoin weren’t disclosed, BitMEX handled large volumes of Bitcoin transactions.

Implications of Government Holdings

Monitoring the holdings of large Bitcoin stashes, such as those held by the U.S. government, is crucial for several reasons.

Firstly, the decisions surrounding whether and when the government moves these Bitcoins could significantly influence market dynamics. The method of their release—be it via direct sale, auction, or another approach—can either mitigate or exacerbate market impact.

For example, auctioning off the coins could attract institutional investors who value the transparency and legitimacy of “government-sanctioned” Bitcoin. This reassurance is particularly important for those concerned about the origins of their crypto holdings, as purchasing from reputable sources avoids the risks associated with funds tied to illegal activities.

Similarly, the US government holds enough Bitcoin to affect market prices significantly upon releasing their holdings, which could lead to speculative behavior among smaller investors trying to anticipate or react to these moves.

But there is more to the story. A significant portion of the Bitcoin supply is controlled by government and ETF entities, posing a potential threat. According to Juan Pellicer, Senior Researcher at IntoTheBlock:

The current ownership levels of Bitcoin among U.S. government and ETF entities pose a potential risk to the perception of Bitcoin as an asset beyond the control of government forces or major financial institutions. The US government holds over 1% of the Bitcoin supply, valued at over $13.16 billion, while Bitcoin ETF issuers control $50.6 billion, accounting for over 4% of the BTC supply. This high concentration of holdings challenges the narrative of Bitcoin’s decentralization and could influence market dynamics and investor behavior in the future.’

Thus, monitoring these significant holdings is about understanding current market values and foreseeing potential market shifts.

The post Analyzing the US Government’s Bitcoin holdings: What you need to know appeared first on CryptoSlate.

0

0