Millennium Management Drives Bitcoin ETF Boom with $2 Billion Investment

0

0

- Millennium Management emerges as a major player in the Bitcoin ETF market with a $2 billion allocation across key ETFs.

- At the time of writing, BTC was trading at $65,708, marking a 6.12% increase in the last 24 hours.

In a recent disclosure to the United States Securities and Exchange Commission (SEC), Millennium Management, a prominent global investment management firm, unveiled its substantial investment in spot Bitcoin Exchange Traded Funds (ETFs). According to the filing, Millennium’s Bitcoin ETF holdings make up 3% of its $64 billion fund as of the first quarter of this year.

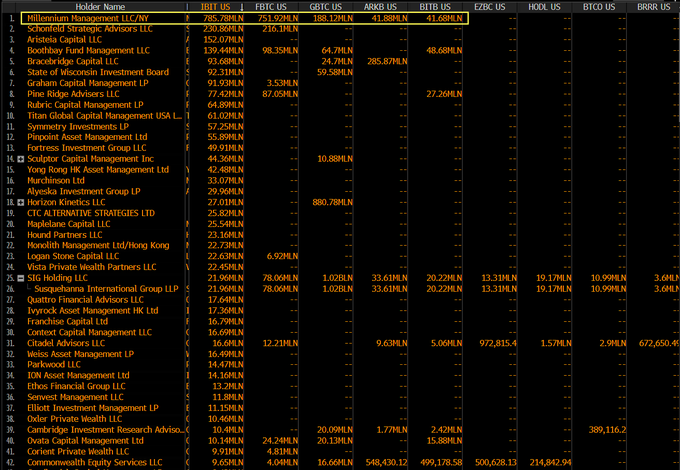

As of March 31, Millennium has allocated approximately $2 billion across five major spot Bitcoin ETFs, as outlined in its 13F filing. These ETFs include offerings from BlackRock, ARK21, Bitwise, Fidelity, and Grayscale.

Millennium Management’s Bitcoin ETF Power Play

Notably, Millennium’s largest holdings are with BlackRock and Fidelity, with investments exceeding $844 million and $800 million, respectively. According to Bloomberg ETF analyst Eric Balchunas, this places Millennium Management at the forefront of Bitcoin ETF investors, earning them the title of “king” of Bitcoin ETF holders. Also, Balchunas highlighted that Millennium’s exposure to the ETF market significantly surpasses that of the average new ETF investor, with a staggering difference of 200 times.

Further, the surge in interest from investment advisory firms and hedge funds has propelled the growth of spot Bitcoin ETFs, with approximately 60% of new buyers coming from investment advisory firms and 25% from hedge funds, Balchunas noted.

This news arrives amidst a bullish trend in Bitcoin’s price, reaching $66,600, marking a 7.6% climb in the past 24 hours. The increasing popularity of Bitcoin among investment firms underscores its emergence as a sought-after asset for client portfolios, with the momentum showing no signs of abating.

Since the approval of spot Bitcoin ETFs in January, they have gained significant traction within the finance sector, solidifying their position as a key investment vehicle. Moreover, the approval marks a pivotal moment in the integration of cryptocurrencies into mainstream finance, opening up new avenues for investors to access the digital asset market.

0

0