Nasdaq 100 covered call ETF (QYLD) yields 11.8% but is it a buy?

0

0

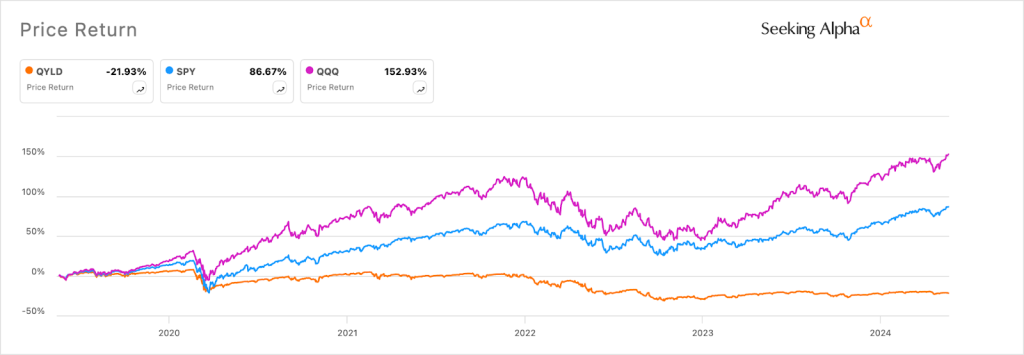

The Global X NASDAQ 100 Covered Call (QYLD) ETF total return has continued to lag behind the Nasdaq 100 index this year. It has returned just 0.98% while the Invesco QQQ and the SPDR S&P 500 ETF (SPY) have risen by over 11%.

QYLD ETF continues to trail Nasdaq 100

Its underperformance goes from its early days. Data by Yahoo Finance shows that its best annual return was in 2019 when it gained by 22.685 followed by 2017 when it added 18.7%. Its worst year was in 2022 when the fund lost 19%.

In contrast, Invesco QQQ’s best annual performance recently was in 2023 when it jumped by 54% followed by 2020, 2019, and 2017 when it added over 32%.

This performance has happened even though the QYLD is an expensive ETF to hold. It has an expense ratio of 0.61% while the QQQ fund charges just 0.20%. The higher fee is understandable since QYLD is an actively managed ETF.

For beginners, the QYLD ETF aims to provide investors with price appreciation and regular dividends. Data shows that it has a dividend yield of about 11.79%, higher than most passive ETFs. QQQ and SPY yield less than 1%.

QYLD ETF vs QQQ vs SPY ETF five-year performance

QYLD aims to achieve growth and income

QYLD achieves growth and income by investing in the Nasdaq 100 index, which tracks the tech-heavy Nasdaq 100 index. It also does that by leveraging the concept of covered calls, which gives it monthly premiums.

QYLD does well when the Nasdaq 100 index is either rising or when it is moving sideways. However, using options can cap its upside if the index continues rising. I suspect that the Nasdaq 100 index will continue rising this year.

QYLD is not the only covered call ETF that is lagging behind its benchmark. As I wrote earlier on, the popular TSLY ETF has constantly trailed Tesla shares while NVDY has trailed Nvidia. JEPI and JEPQ have lagged behind S&P 500 and Nasdaq 100 indices.

Technically, the index has recently crossed the crucial resistance point at $18,465, invalidating the double-top pattern that has been forming. It has also remained above all moving averages, meaning that bulls are still in control.

Nasdaq 100 chart

Fundamentally, there are chances that the Fed will start cutting interest rates in the coming months. Fed rate cuts will likely lead to a rotation from short-term government bonds to stocks. Also, US equities continued publishing strong earnings, with the average revenue growth in Q1 being 5.4%.

Therefore, I believe that the QYLD, despite its strong dividend yield, is not a better investment than the generic QQQ.

The post Nasdaq 100 covered call ETF (QYLD) yields 11.8% but is it a buy? appeared first on Invezz

0

0