Tether Posts Record Quarterly Profits of $4.52 Billion

0

0

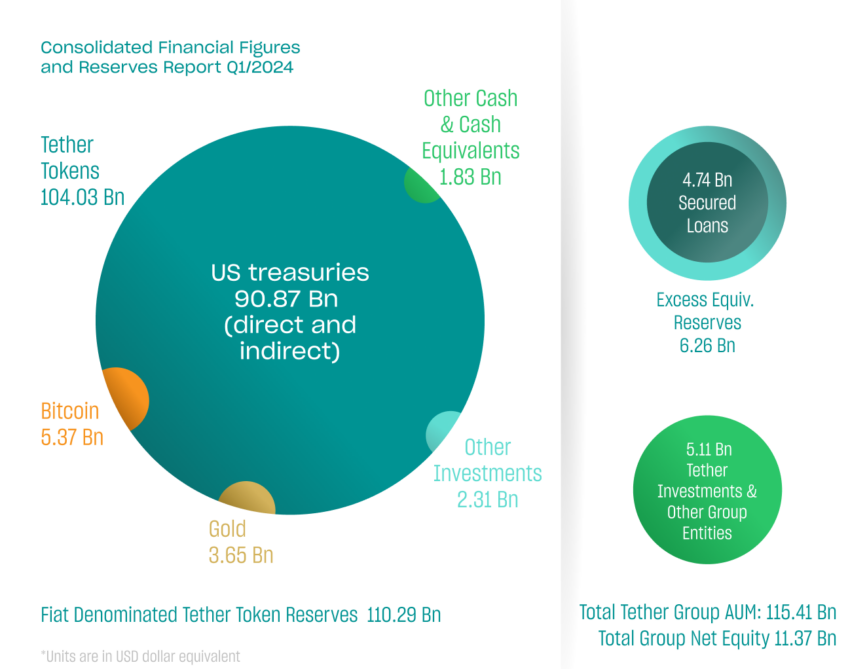

Tether, the entity behind the leading stablecoin USDT, reported a record net profit of $4.52 billion for the first quarter of 2024. It was primarily driven by gains from its substantial US Treasury holdings.

This performance marks a significant financial milestone for the company, showcasing its adept management of a diverse asset portfolio amid volatile market conditions.

US Treasury Bonds Boost Tether Profits

Tether released a detailed financial report disclosing its profits surged by 61% compared to the previous quarter. The firm attributed this remarkable growth to its strategic investments in US Treasury bonds, which currently exceed $90 billion.

Moreover, Tether’s net equity stood at $11.37 billion as of March 31, 2024. This is a sharp increase from the $7.01 billion recorded at the end of 2023.

Such a robust equity base gives Tether a significant buffer to maintain its currency peg and financial stability. Indeed, Tether’s reserves, critical to backing its stablecoin, USDT, are predominantly in cash and cash equivalents, constituting about 90% of its holdings.

“In reporting not just the composition of our reserves, but now the Group’s net equity of $11.37 billion, Tether is again raising the bar in the cryptocurrency industry in the realms of transparency and trust,” Paolo Ardoino, CEO of Tether, said.

This high liquidity ratio is pivotal for Tether, allowing it to meet withdrawal demands swiftly and maintain a stable valuation for its stablecoin. Despite previous controversies regarding reserve transparency, Tether has taken substantial steps to demonstrate its financial health and clear doubts.

Read more: A Guide to the Best Stablecoins in 2024

Tether Reserves. Source: Tether

Tether Reserves. Source: Tether

The company has consistently increased its disclosure practices, with the latest reports providing a detailed breakdown of assets and liabilities. Such transparency distances the company from past accusations of inadequate reserve holdings. Secondly, it reinforces its commitment to regulatory compliance and operational integrity.

0

0