Riot Platforms Delivers Strong Q1 Despite Stock Price Slide

0

0

Riot Platforms, a leading Bitcoin mining firm based in the U.S., has disclosed a stellar financial outcome for the first quarter of 2024. The company achieved a total revenue of $79.3 million, marking a rise from the previous year’s $73.2 million during the same period.

Riot not only improved its revenue but also reported an impressive net income of $211.8 million, with earnings per share standing at $0.82 and adjusted EBITDA reaching $245.7 million, setting new records for its quarterly financial metrics.

This Surge Is Attributed Significantly To A 131% Increase In Bitcoin Prices

The company also enhanced its operational efficiencies, securing $5.1 million in power curtailment credits, up from $3.1 million the previous year. Revenue from Riot’s Bitcoin Mining segment alone totaled $74.6 million, a substantial increase from $48.0 million last year, buoyed by the favorable Bitcoin market conditions.

However, the Engineering segment experienced a decline, generating only $4.7 million compared to $16.1 million in the prior year. Riot maintains a strong financial foundation with $692.5 million in working capital and $688.5 million in cash. As of March 31, 2024, the company also held 8,490 unencumbered Bitcoins, valued at approximately $605.6 million.

A Key Development This Quarter Was The Energization Of The Substation At The Corsicana Facility

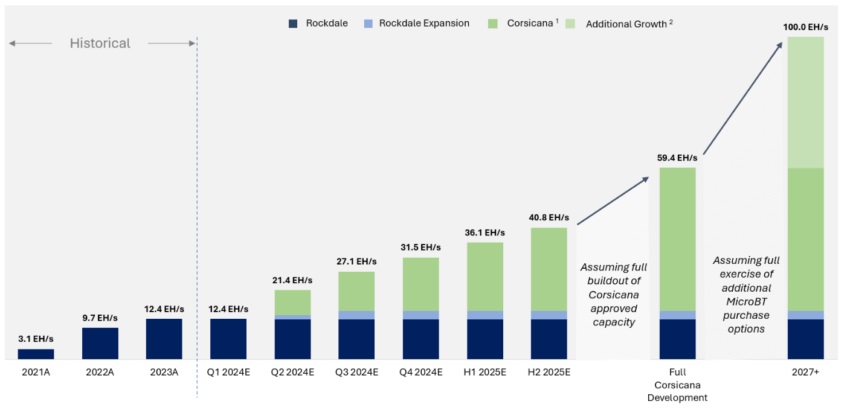

This facility is poised to become the world’s largest Bitcoin mining facility upon completion. This expansion is expected to significantly boost Riot’s operations, coupled with the anticipated benefits from its June 2023 purchase from MicroBT, aimed at enhancing self-mining hash rate capacity. The deployment of these miners has started and is expected to finish by the second half of 2025.

Jason Les, CEO of Riot Platforms, expressed confidence in the company’s strategic direction, stating that they are on track to nearly triple their existing hash rate capacity to 31 EH/s by the end of the year, with the Corsicana Facility providing up to 1 GW of total capacity when fully developed.

Despite These Positive Developments, Riot Platforms Faced A Decline In Bitcoin Production

The Bitcoin production resulted in the company mining only 1,364 Bitcoins in the first quarter, a 36% decrease from the 2,115 Bitcoins produced in Q1 2023. This downturn is primarily due to the significant rise in Bitcoin network difficulty, which has more than doubled since January 2023, posing a considerable challenge to miners.

The cost to mine a single Bitcoin also surged dramatically to $23,034 from $9,438 the previous year, reflecting an 89% increase in the global network hash rate over the same period. Charles Edwards, founder of Capriole Fund, commented on the increasing Bitcoin production costs and the challenges it poses, suggesting that the situation could lead to higher prices, shutdown of some miners, or sustained high transaction fees.

In light of these challenges, analysts predict that some miners might diversify into emerging technologies such as artificial intelligence to mitigate the risks associated with the volatile cryptocurrency market. A January 2024 study by CoinShares indicated that miners with substantial Bitcoin reserves and strong capitalization are better positioned in bullish markets, while those with limited cash reserves and high operational costs per Bitcoin are at increased risk.

The post Riot Platforms Delivers Strong Q1 Despite Stock Price Slide appeared first on Coinfomania.

0

0