Friend.tech users lock 3m tokens in influencer ‘clubs’

0

0

Friend.tech made headlines earlier this month by distributing 100% of its native token to users in a move that contrasts with the recent trend of projects allocating smaller sums, typically between 5%-15%.

Many expected that users who amassed large quantities of the FRIEND token during the platform’s V1 phase — where points earned converted to FRIEND — would sell their holdings and cause the price to plummet.

Although the token was extremely volatile on May 3, the day that it launched, it has since remained range bound between $1 and $2, recently trading at $1.98.

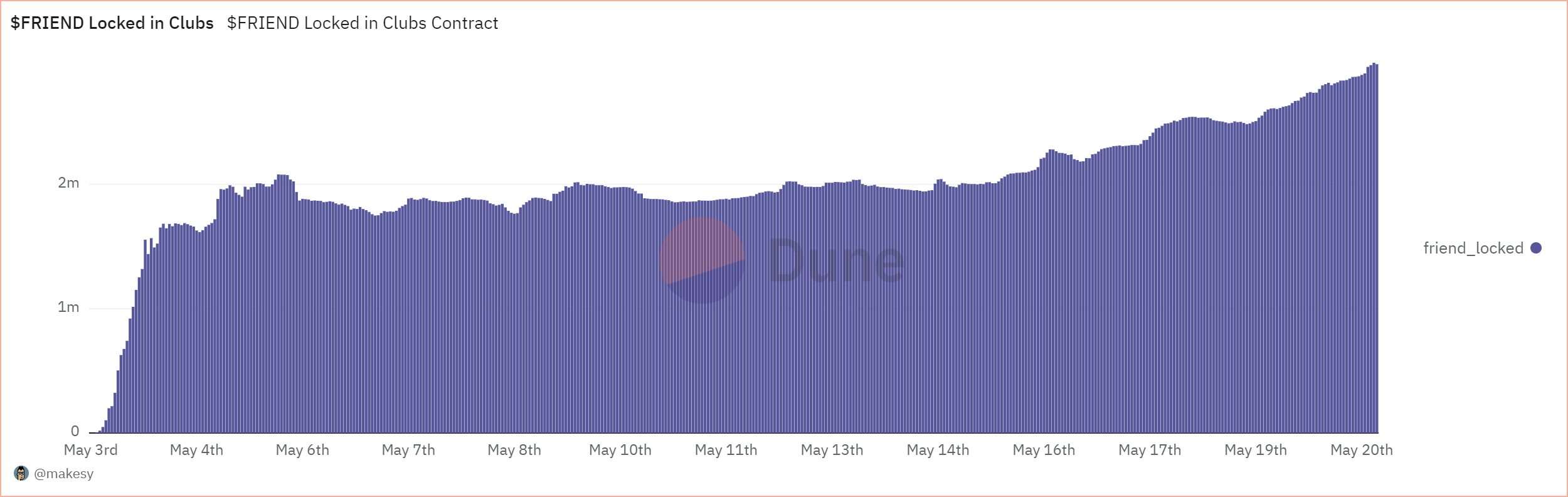

That may be because 2.96 million FRIEND tokens are locked in “clubs,” which function as group chat rooms, requiring users to pay for entry with FRIEND tokens. The tokens are then paired with Ether in Friend.tech’s native decentralised exchange.

Now the question is whether clubs can continue to grow, removing FRIEND from the open market.

Each club can choose from three different bonding curves for pricing, letting club creators determine how quickly the price of entry into a club increases. Users generally join the clubs to speak with their favourite influencers or share “alpha,” information that can help traders to realise a profit.

The largest club, named “Hog McCrankerson,” costs users 892 FRIEND, or $1,780. The club has 647 holders, resulting in nearly 1% of the total supply locked in the “memeclub.”

The second-largest club, “Ansem’s Army,” the chat room for the popular influencer blknoiz06, has 0.35% of the total supply locked, around 326,000 FRIEND.

Fewer clubs coming onboard

Still, the question of how sustainable club activity has come into play. The day of Friend.tech’s V2 launch saw 62,118 clubs created by 26,128 creators, but Sunday saw only 1,170 clubs from 339 creators.

Total traders saw a similar decline, falling 96% to 1,449 on Sunday from 33,597 on May 3.

Another significant sink for FRIEND has been providing liquidity for the FRIEND/WETH pair on Friend.tech’s decentralised exchange. This pool has over $37 million in liquidity provided, with just under 9.1 million FRIEND.

Users who provide liquidity to this pool are earning about a 138% annual percentage rate, thanks to swap fees, club fees, and LP incentives.

Liquidity providers earn a 1.5% fee from every FRIEND, and Friend.tech club trade, in addition to a share of the 12 million FRIEND distributed over 12 months.

Most of the yield earned here comes from FRIEND incentives, around 66%, while LP swap fees account for 58% and club fees only 13%.

Ryan Celaj is a data correspondent at DL News. Got a tip? Email him at ryan@dlnews.com.

0

0