Bitcoin Skyrockets to $66,000 as Easing US Inflation Fuels Crypto Market Surge

0

0

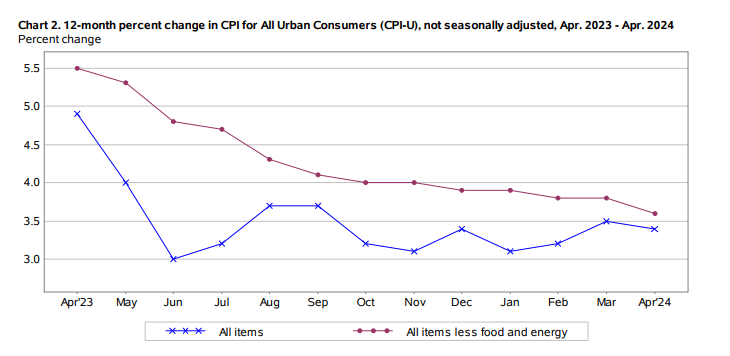

US consumer price data came out on Monday, May 15. The core consumer price index (CPI), which measures underlying US inflation, increased less than expected in April. It climbed 0.3% from March, marking the first time in six months.

This figure suggests a possible downtrend in inflation, raising hopes for a future Federal Reserve interest rate cut.

Crypto Market Rebounds as US Inflation Slows, but Will It Last?

Yet, Fed officials need more data before considering rate cuts. On Tuesday, Fed Chair Jerome Powell said the central bank will “need to be patient and let restrictive policy do its work.” Moreover, some policymakers do not see rate cuts happening this year.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

US CPI Percent Change (April 2023 – April 2024). Source: US Bureau of Labor Statistics

US CPI Percent Change (April 2023 – April 2024). Source: US Bureau of Labor Statistics

Despite this, the inflation news boosted optimism in financial markets, including crypto. Bitcoin’s (BTC) price jumped from $62,000 to $66,000, a roughly 7% increase in 24 hours.

Major altcoins also experienced significant gains, with Ethereum (ETH) and Solana (SOL) rising by 4.4% and 12.3%, respectively. Consequently, the total cryptocurrency market capitalization expanded by 6.7%, reaching $2.5 trillion, according to CoinGecko data.

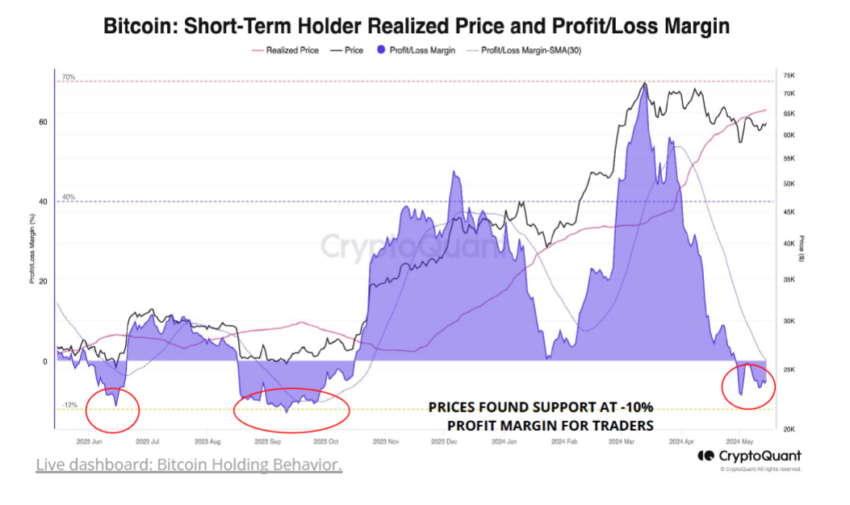

Analysts believe factors besides easing US inflation also influenced Bitcoin’s recent rally. CryptoQuant analysts see that “lower selling pressure” contributed to the situation.

Bitcoin Short-Term Holder Realized Price and Profit/Loss Margin. Source: CryptoQuant

Bitcoin Short-Term Holder Realized Price and Profit/Loss Margin. Source: CryptoQuant

“Lower selling pressure [is] evident in short-term Bitcoin holders selling at basically zero profit and traders depleting their unrealized profits in the last few months. [Furthermore], Bitcoin balances at [over-the-counter] OTC desks stabilizing, which suggests there is less Bitcoin supply coming into the market to sell via these entities,” they told BeInCrypto.

However, demand growth needs to accelerate for the rally to be sustainable. While there are signs of increased demand from long-term holders and large investors, it needs to pick up pace. Additionally, CryptoQuant analysts noted that spot Bitcoin exchange-traded fund (ETF) purchases remained minimal, and stablecoin liquidity growth had yet to improve.

Moreover, Bitcoin’s price remains undervalued from a miner’s profitability perspective. Following the Bitcoin halving event in late April 2024, miners’ rewards were halved, putting financial pressure on them. Historically, extremely low miner profitability is often associated with price bottoms, suggesting potential for future growth.

Read more: Bitcoin Price Prediction 2024/2025/2030

Overall, analysts and industry experts remain bullish on Bitcoin’s long-term trajectory. As the crypto market continues to evolve, macroeconomic conditions, regulatory developments, and political factors will play crucial roles in shaping its future.

0

0