Coinbase vs. SEC: Clash Over Howey Test Intensifies

0

0

The US Securities and Exchange Commission (SEC), in its opposition to Coinbase’s motion for an interlocutory appeal, criticized Judge Analisa Torres’s decision in its case against Ripple.

In a filing dated May 10, the SEC contended that the court should not entertain Coinbase’s bid to reassess the application of securities law to digital assets.

SEC Says Coinbase Does Not Like Howey Test

Coinbase, in its plea for an Interlocutory review, contends that the SEC’s application of the Howey test to cryptocurrency assets has muddled the definition of securities. The exchange heavily leans on Judge Torres’s ruling in the Ripple case. At the time, the judge deemed the XRP token non-securities and its programmatic sales on exchanges not constituting investment contracts.

However, the SEC rebuffs Coinbase’s motion, stating that no court has followed Judge Torres’s decision. The regulator asserts that Coinbase’s attempt to frame an interlocutory appeal around a “controlling question” is a bid to manipulate the interpretation of the issue.

Read More: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

“Coinbase’s attempts to manipulate the question for an appeal to shoehorn it into a certifiable question under 28 U.S.C. § 1292(b) are self-defeating. Parties cannot manufacture a certifiable issue by jettisoning and then rescuing the questions at issue in the original order,” SEC wrote.

The SEC further argues that an interlocutory review is not justified merely because Coinbase proposes a new legal standard. Furthermore, the Gary Gensler-led agency posits that Coinbase may simply dislike the longstanding answer the courts provide. According to the regulator, Coinbase might have structured its business in ways that could now pose challenges to complying with established securities regulations.

“Despite the Order’s unassailable conclusions that Coinbase’s proposed reading of Howey has not been adopted by anycourt and, critically, that there is no lack of fair notice as to the framework that applies to its conduct, Coinbase continues to insist, as grounds for interlocutory review, that ‘[t]he digital asset industry labors under an intolerable cloud of uncertainty’ or under a ‘cloud of legal uncertainty,'” the SEC stated.

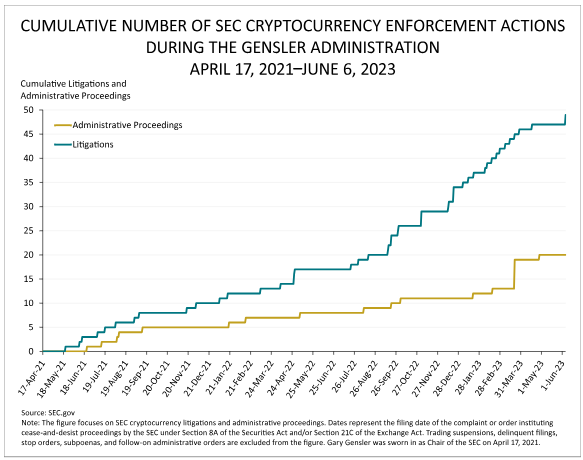

SEC Enforcement Actions Against Crypto Firms. Source: Cornerstone Research

SEC Enforcement Actions Against Crypto Firms. Source: Cornerstone Research

Coinbase’s Chief Legal Officer, Paul Grewal, responded that the SEC’s motion contradicts itself. Grewal shared screenshots showing differing arguments presented by the SEC in a similar appeal against Ripple Labs.

“Let’s at least have an honest conversation. Forget about a split across agencies, circuits and elsewhere. There’s not even a consensus about Howey and digital assets among the district judges in the same courthouse at Foley Square,” he added.

Read more: Who Is Brian Armstrong? A Deep Dive Into the Coinbase Founder

Meanwhile, the ongoing legal dispute between the regulatory agency and the cryptocurrency exchange takes another step forward with this filing. Previously, the agency accused Coinbase of operating as an unregistered exchange and raised concerns about its staking program potentially violating securities laws.

0

0