Hedera’s (HBAR) Market Outlook Brightens as Demand for Longs Strengthens

0

0

Hedera Foundation’s recent move to partner with Zoopto for a late-stage bid to acquire TikTok has sparked renewed investor interest in HBAR, driving a fresh wave of demand for the altcoin.

Market participants have grown increasingly bullish, with a notable uptick in long positions signaling growing confidence in HBAR’s future price performance.

HBAR’s Futures Market Sees Bullish Spike

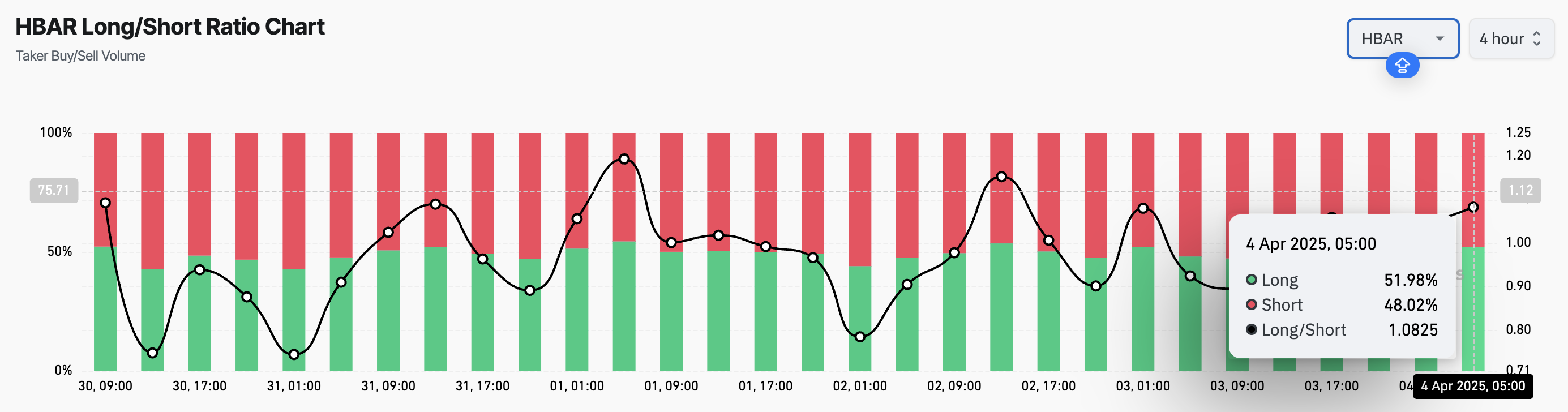

HBAR’s long/short ratio currently sits at a monthly high of 1.08. Over the past 24 hours, its value has climbed by 17%, reflecting the surge in demand for long positions among derivatives traders.

HBAR Long/Short Ratio. Source: Coinglass

HBAR Long/Short Ratio. Source: Coinglass

An asset’s long/short ratio compares the proportion of its long positions (bets on price increases) to short ones (bets on price declines) in the market.

When the long/short ratio is above one like this, more traders are holding long positions than short ones, indicating bullish market sentiment. This suggests that HBAR investors expect the asset’s price to rise, a trend that could drive buying activity and cause HBAR’s price to extend its rally.

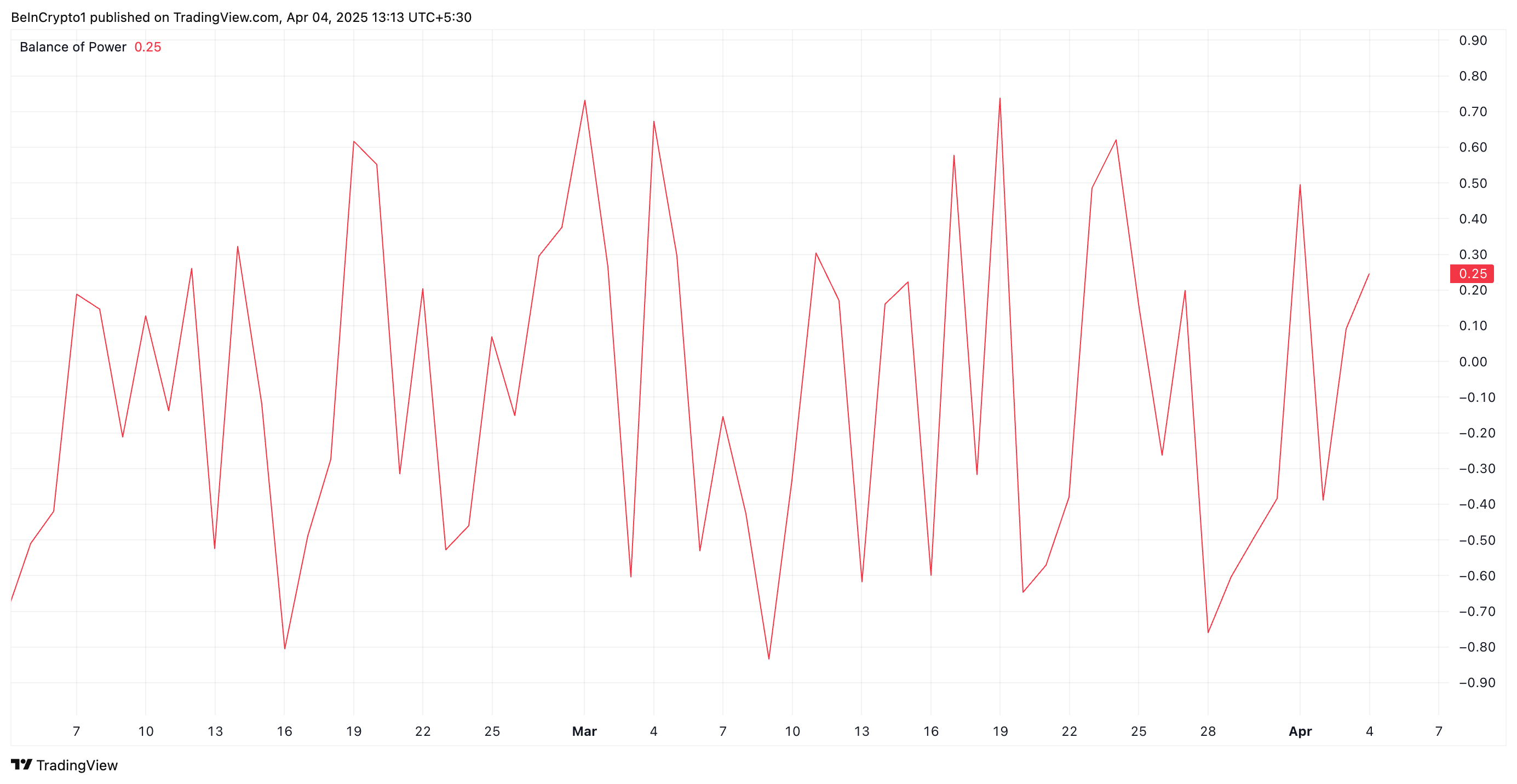

Further, the token’s Balance of Power (BoP) confirms this bullish outlook. At press time, this bullish indicator, which measures buying and selling pressure, is above zero at 0.25.

HBAR BoP. Source: TradingView

HBAR BoP. Source: TradingView

When an asset’s BoP is above zero, buying pressure is stronger than selling pressure, suggesting bullish momentum. This means HBAR buyers dominate price action, and are pushing its value higher.

HBAR Buyers Push Back After Hitting Multi-Month Low

During Thursday’s trading session, HBAR traded briefly at a four-month low of $0.153. However, with strengthening buying pressure, the altcoin appears to be correcting this downward trend.

If HBAR buyers consolidate their control, the token could flip the resistance at $0.169 into a support floor and climb toward $0.247.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingView

However, a resurgence in profit-taking activity will invalidate this bullish projection. HBAR could resume its decline and fall to $0.129 in that scenario.

0

0

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요시작하는 데 사용하는 포트폴리오를 안전하게 연결하세요.