Why Is The Crypto Market Down Today?

0

0

The total crypto market cap (TOTAL) and Bitcoin (BTC) took a hit over the past day as the market remained slightly bearish. Although BTC is still holding above $95,000, altcoins led by Monero (XMR) witnessed a sharper decline in the last 24 hours.

In the news today:-

- The US Department of Justice charged Venezuelan national Jorge Figueira for allegedly laundering $1 billion through crypto exchanges and shell companies. Prosecutors claim the scheme moved funds in and out of the US, targeting high-risk jurisdictions including Colombia, China, Panama, and Mexico.

- The White House is considering withdrawing support for a digital asset market structure bill after Coinbase abruptly pulled its backing. Officials say the move, described as a “rug pull,” angered the administration and destabilized broader crypto policy efforts.

The Crypto Market Dips

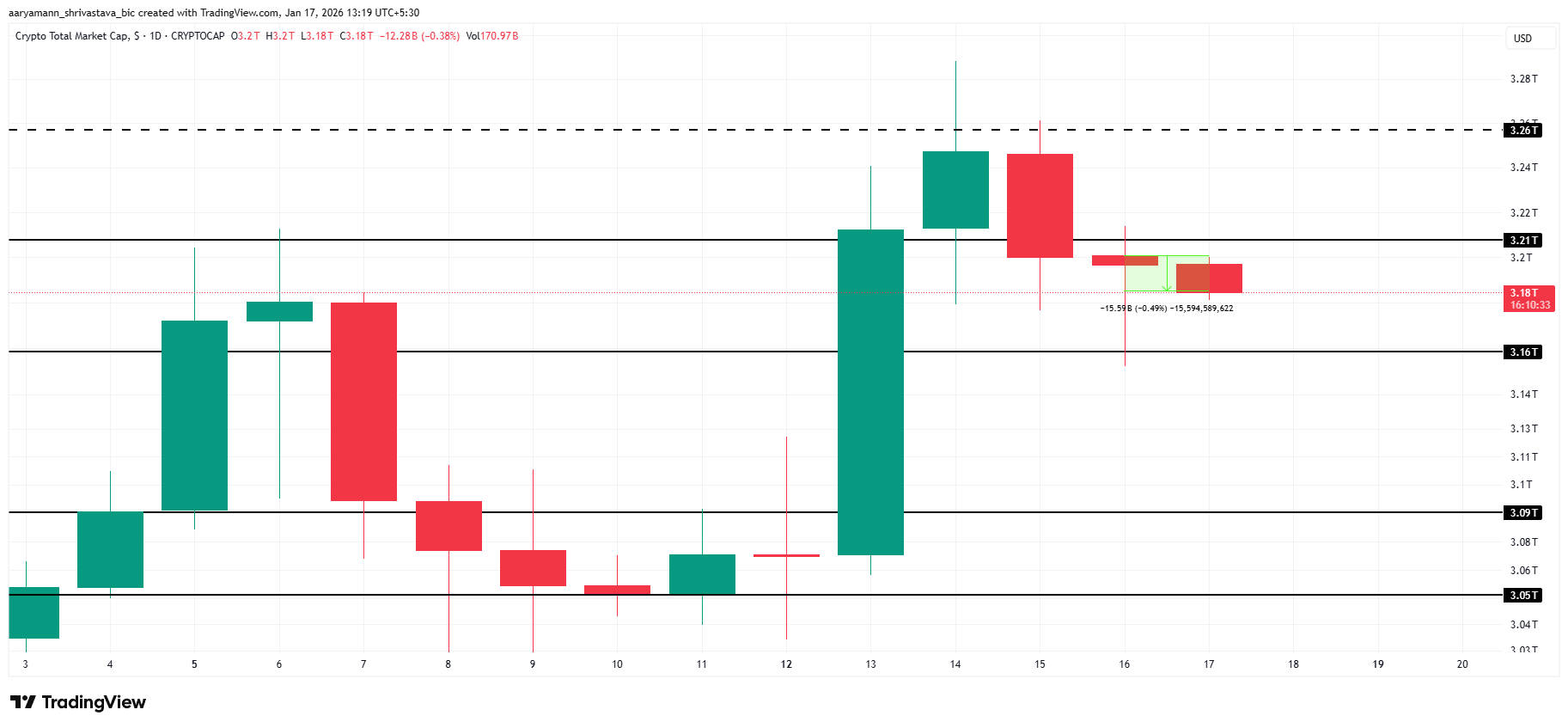

The total crypto market cap declined by $15.5 billion in the past 24 hours, reaching $3.18 trillion, according to market data. This places TOTAL just below the $3.21 trillion resistance level. The drop reflects cautious sentiment as investors react to macro uncertainty and reduced short-term risk appetite.

If current market conditions persist, TOTAL is likely to retest support near $3.16 trillion. A breakdown below this level would signal stronger selling pressure across major assets. Such a move could increase volatility, as traders reduce exposure amid weakening momentum and limited near-term catalysts.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

TOTAL Price Analysis. Source: TradingView

TOTAL Price Analysis. Source: TradingView

A recovery remains possible if broader market sentiment improves over the coming week. Should buying activity return, TOTAL could reclaim $3.21 trillion as support. Holding that level may allow the market cap to rebound toward $3.26 trillion, signaling renewed confidence and stabilizing capital inflows.

Bitcoin Is Holding Above $95,000

Bitcoin is trading at $95,100, holding above the $95,000 support at the time of writing, while trading inside an ascending broadening wedge pattern. This formation can favor upward continuation if the price pushes higher with conviction. For a valid breakout, BTC must move above $98,000 and confirm that level as a new support zone.

Current price behavior suggests a potential base is forming. Maintaining strength above the $95,000 psychological threshold is essential. If buyers continue defending this area, another attempt at $98,000 becomes likely. A successful reclaim would position Bitcoin for a move toward the $100,000 psychological target.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, downside risk has not been eliminated. If momentum weakens and short-term participants take profits, BTC could slip below $95,000. A decline toward $93,471 would come into focus. Losing that level would negate the bullish setup and postpone any near-term upside breakout.

Monero Falls 8%

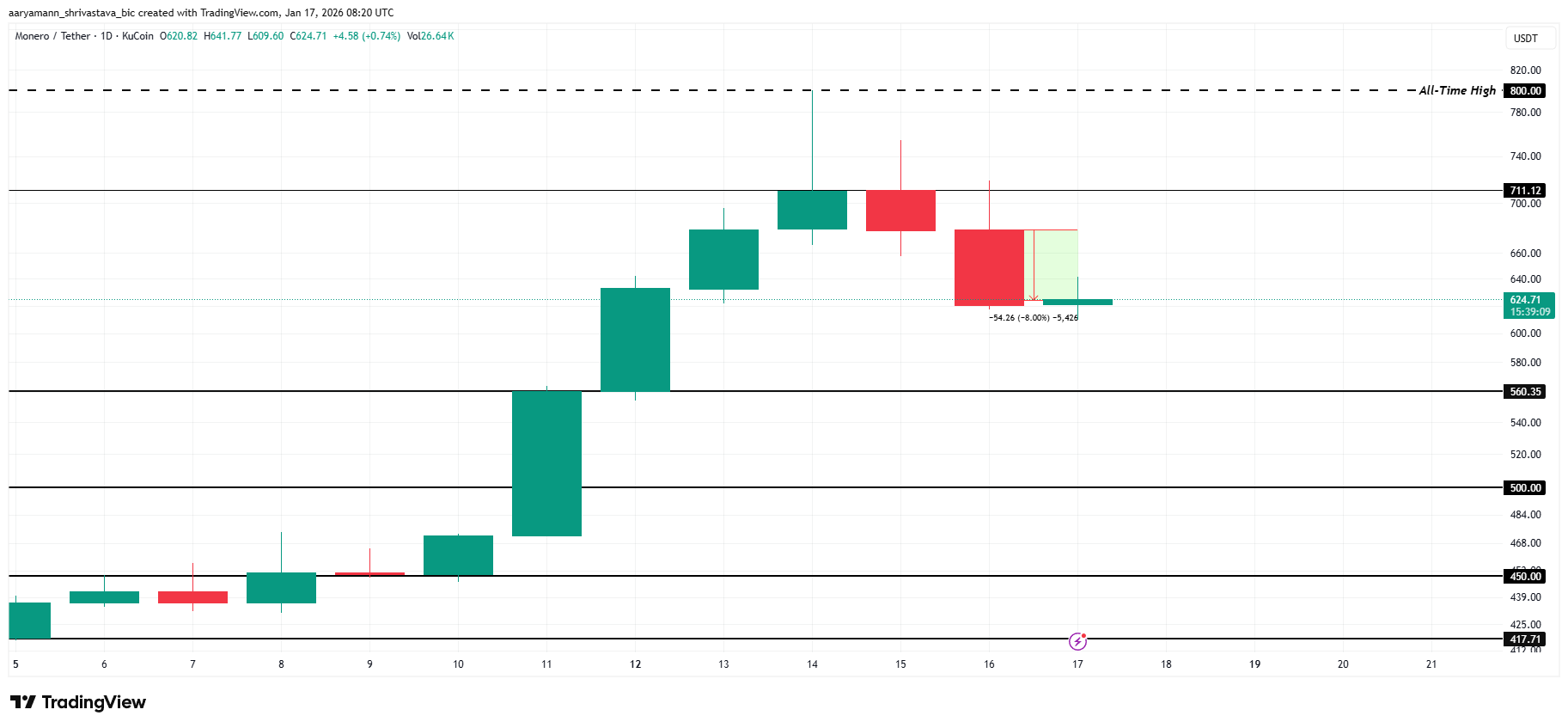

Monero price fell 8% in the last 24 hours, trading near $624 at the time of writing. The privacy-focused cryptocurrency recently surged to a new all-time high of $800. The pullback follows rapid gains, suggesting cooling momentum after an aggressive rally driven by heightened demand.

Profit-taking by long-term holders, combined with broader bearish crypto market conditions, continues to pressure XMR price action. Weak sentiment across altcoins is increasing downside risk. If selling persists, Monero could decline toward the $560 level, where buyers may attempt to slow further losses.

XMR Price Analysis. Source: TradingView

XMR Price Analysis. Source: TradingView

For a bullish reversal, XMR must rebound and reclaim $711 as a key support level. A successful hold above this threshold would signal renewed strength. Such a move could open the path for Monero to retest $800 and potentially establish a fresh all-time high.

0

0

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요시작하는 데 사용하는 포트폴리오를 안전하게 연결하세요.