Ripple’s RLUSD Becomes Redemption Rail for BlackRock BUIDL as XRP Ledger Integration Nears

0

0

According to new partner updates, BlackRock BUIDL now supports around-the-clock redemptions into RLUSD via Securitize, with an integration path toward the XRP Ledger that could widen liquidity and speed settlement across venues.

The push builds on rising assets, live redemption rails, and fresh bank listings that point to real-world usage, not hype.

Why this step matters

A live smart-contract flow lets qualified holders swap tokenized shares for RLUSD 24/7, starting with BlackRock BUIDL and expanding to VBILL. An update noted this will “enable instant exchange for fund shares,” removing banking-hour friction and aligning with institutional workflows.

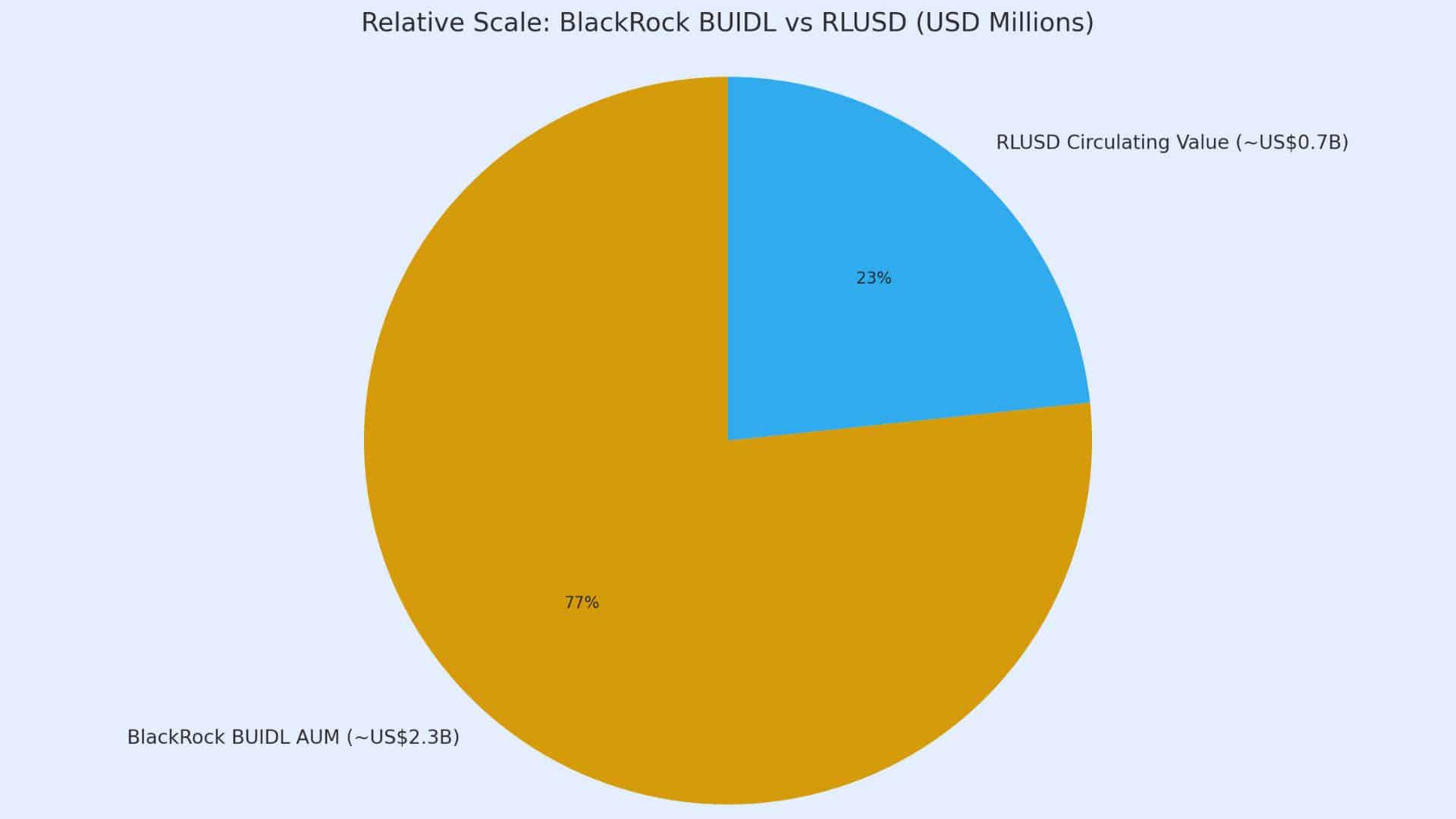

Public trackers and press show BlackRock BUIDL above $2.3 billion after crossing $1 billion in March 2025, signaling durable demand for tokenized treasuries.

Also Read: BlackRock’s BUIDL Token Hits $1B—Crypto’s Next Big Thing?

BlackRock BUIDL and the XRP Ledger

Securitize is integrating the XRP Ledger, a move that positions RLUSD and tokenized fund flows to reach XRPL venues. A major bank confirmed it will list a tokenized money market fund and RLUSD, with the issuer planning to mint on the XRP Ledger for accredited users.

Ondo’s OUSG, backed by assets held by BlackRock BUIDL, already supports subscription and redemption on XRPL using RLUSD, which demonstrates the bridge in action.

Fast facts (updated)

| Item | Latest figure |

|---|---|

| BlackRock BUIDL AUM | ~$2.3B+ (Apr–Jun 2025 reporting) |

| RLUSD circulating value | $700M+ and rising |

| XRPL access today | OUSG mint/redeem in RLUSD live on XRP Ledger |

What people are saying

A partner release stated that the new RLUSD rail will “unlock efficient redemptions for tokenized funds,” integrating custody, transfer agency, and settlement into a single flow.

A separate banking update said accredited clients will trade and lend tokenized MMFs against RLUSD on an exchange, with sgBENJI issuance on the XRP Ledger. Another technical brief confirmed new cross-chain plumbing to help institutions move stablecoins and RWAs across networks.

Market context investors can use

This is not a siloed upgrade. BlackRock BUIDL now appears as collateral on leading trading venues, while the expansion of RLUSD creates a common settlement asset across Ethereum and the XRP Ledger.

As more venues accept these instruments, spreads can tighten and funding can clear faster, which supports real positions rather than paper claims.

Conclusion

Based on the latest research, BlackRock BUIDL sits at the center of the next wave: live RLUSD redemptions, tangible bank listings, and a clear route onto the XRP Ledger. If flows deepen, expect quicker settlement, broader collateral use, and steadier liquidity across connected exchanges and custodians.

Also Read: BlackRock Eyes ETF Tokenization to Tap $2 Trillion RWA Market

Summary:

BlackRock BUIDL now supports 24/7 RLUSD redemptions via Securitize, while integration work opens a path to the XRP Ledger. Verified updates indicate that BUIDL exceeds $2.3 billion and RLUSD surpasses $ 700 million.

A major bank will list tokenized MMFs and RLUSD, with issuance planned on XRPL. With OUSG already minting and redeeming on XRPL in RLUSD, the rails are live and useful for institutions today.

Glossary of key terms

BlackRock BUIDL: A tokenized U.S. Treasury fund issued with Securitize.

XRP Ledger: A public blockchain used for fast, low-cost transfers.

RLUSD: Ripple’s regulated dollar stablecoin used for settlement and collateral.

VBILL: A tokenized U.S. Treasury bill fund from VanEck. It supports fast settlement and may use RLUSD for on-chain swaps.

FAQs about BlackRock BUIDL

Is BlackRock BUIDL already issued on the XRP Ledger?

Issuance remains on existing chains. The live piece today is RLUSD redemptions via Securitize, along with integration work that enables XRPL-based flows.

Why mention the XRP Ledger so often?

A bank and an asset manager plan to issue and list assets tied to XRPL, and OUSG already runs minting and redemption services there with RLUSD. That is practical access, not theory.

How large is BlackRock BUIDL now?

Recent coverage indicates that the fund has surpassed $2.3 billion, having reached $1 billion in March 2025.

Who can access BlackRock BUIDL?

Access is generally targeted at qualified or accredited investors through approved platforms. Availability depends on local rules and venue onboarding.

Read More: Ripple’s RLUSD Becomes Redemption Rail for BlackRock BUIDL as XRP Ledger Integration Nears">Ripple’s RLUSD Becomes Redemption Rail for BlackRock BUIDL as XRP Ledger Integration Nears

0

0

Gerencie todo seu criptograma, NFT e DeFi de um só lugar

Gerencie todo seu criptograma, NFT e DeFi de um só lugarConecte com segurança o portfólio que você está usando para começar.