Pi Network Whale Accumulation Sparks Fresh Price Prediction Buzz

0

0

Whale Moves Put Pi Network in the Spotlight

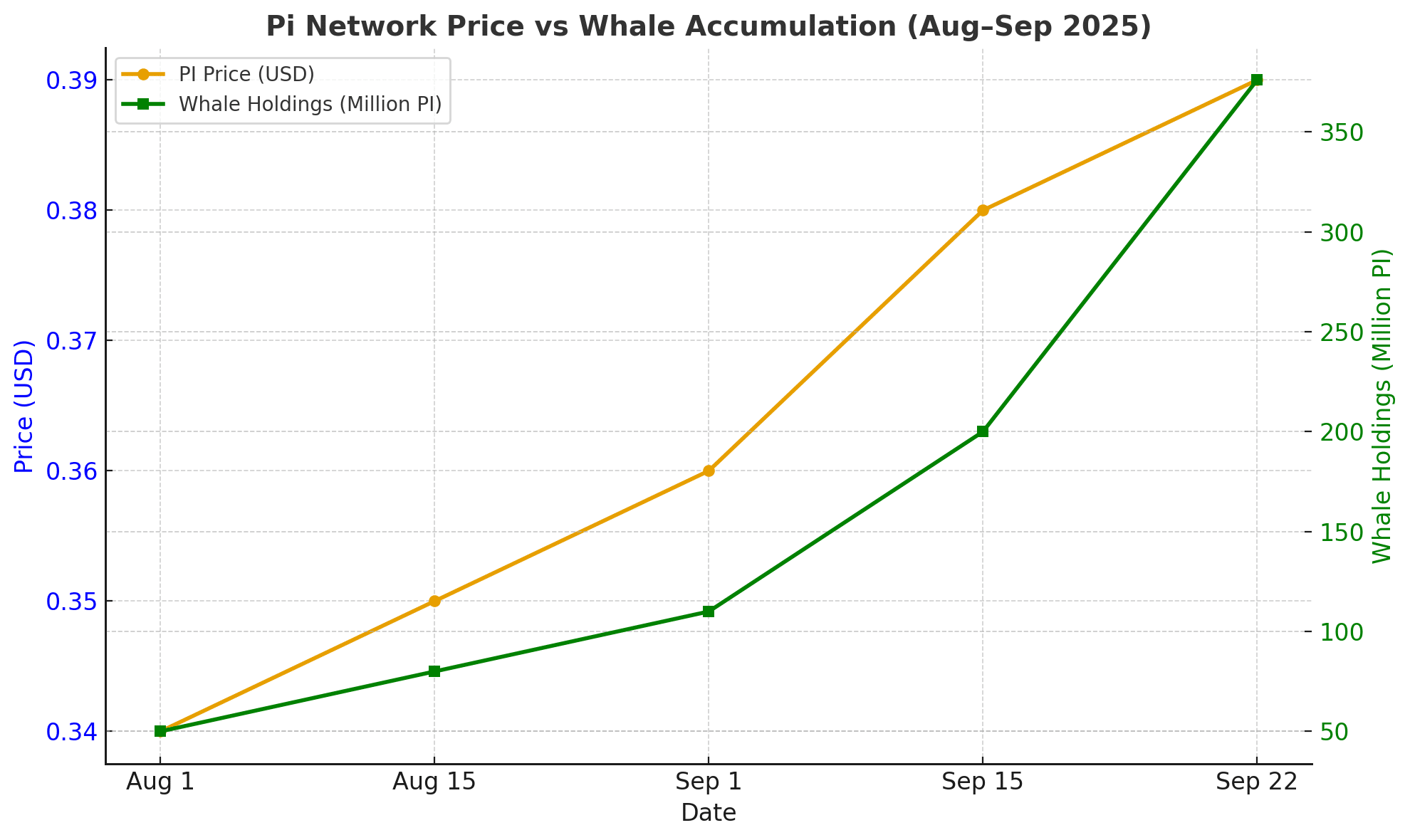

A dramatic surge of whale activity has shifted attention back to Pi Network. A single investor has amassed over $136 million worth of PI tokens, sparking renewed debates around Pi Network price prediction.

The holding, now exceeding 376 million PI, was built through consistent daily purchases since August, according to on-chain reports. Market observers are split: some view this as a signal of long-term confidence, while others warn it could add volatility if the whale decides to unload.

“Large investors often position themselves ahead of major developments,” explained blockchain strategist Daniel Hayes on X. “This kind of steady buying suggests anticipation of catalysts that could move Pi Network price prediction into bullish territory.”

Technical Indicators Signal a Potential Breakout

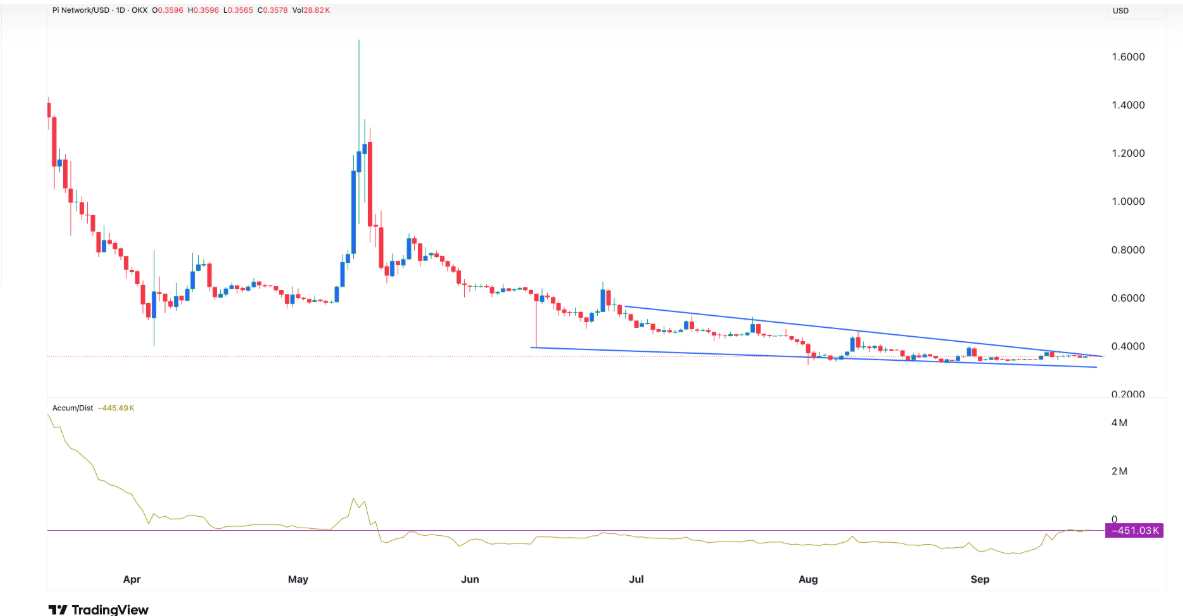

Charts reveal that Pi Network has been consolidating between $0.33 and $0.40. The resistance at $0.40 has proven stubborn, yet technical patterns hint at pressure building. Analysts highlight a falling wedge structure, historically seen as a bullish reversal pattern. At the same time, narrowing Bollinger Bands shows reduced volatility, which often precedes a strong price move.

Traders are also watching accumulation/distribution metrics, which remain elevated, confirming steady demand even as price momentum stalls. If Pi breaks above $0.40 with strong volume, it could pave the way toward the next psychological target of $1. This has intensified market focus on Pi Network price prediction for the final quarter of the year.

Whale Concentration and Market Risks

Data from recent reports show that more than 22 wallets hold over 10 million PI each. Such concentration amplifies both upside potential and downside risk. Should whales continue accumulating, scarcity could drive a sharp upward movement. However, if large holders liquidate positions, liquidity challenges may trigger steep corrections.

Economist Karen Liu noted, “The same forces that make Pi Network price prediction optimistic also highlight its fragility. Heavy concentration means investors must prepare for swings in either direction.”

Adding to the mix, upcoming token unlocks remain a wildcard. Increased supply could weigh on prices if not matched by demand growth, keeping the outlook highly sensitive to whale behavior and ecosystem updates.

Developments Driving Speculation

Pi Network’s development roadmap has also fueled speculation. The community anticipates smart contract upgrades and greater compatibility with decentralized applications. These advances could add utility and increase user adoption, providing fundamental support behind bullish forecasts.

If combined with exchange listings on larger platforms, Pi could see stronger liquidity, potentially validating current optimism. Such scenarios are shaping conversations around Pi Network price prediction, as traders weigh both technical setups and long-term fundamentals.

Conclusion

The recent $136 million whale accumulation has reignited interest in Pi Network and reshaped the debate around its trajectory. With resistance levels being tested, technical indicators tightening, and ecosystem upgrades in focus, the stage appears set for a decisive move.

Whether Pi breaks higher or faces another round of consolidation will depend heavily on whale actions and market sentiment. For now, Pi Network price prediction remains one of the most closely watched narratives in the crypto market.

FAQs about Pi Network whale accumulation

What is driving Pi Network’s current price speculation?

A whale accumulation of over $136 million worth of PI tokens, along with bullish technical indicators, has sparked renewed speculation.

What is the key resistance level for Pi Network right now?

The token has struggled to break above $0.40, which is seen as the critical resistance zone.

Could Pi Network reach $1 soon?

If resistance breaks with strong trading volume and ecosystem upgrades roll out, analysts see $1 as a possible target.

What risks should investors consider?

High whale concentration, potential token unlocks, and market volatility remain key risks that could impact Pi’s price trajectory.

Glossary

Whale: A large investor holding a significant amount of a cryptocurrency.

Resistance Level: A price point where selling pressure typically prevents further upward movement.

Bollinger Bands: A technical indicator that measures volatility and potential breakout points.

Token Unlocks: Scheduled releases of tokens into circulation, which can affect supply and price.

Accumulation/Distribution: An indicator tracking whether traders are buying (accumulating) or selling (distributing) an asset.

Falling Wedge: A chart pattern that often signals a bullish breakout when price consolidates downward in narrowing ranges.

Read More: Pi Network Whale Accumulation Sparks Fresh Price Prediction Buzz">Pi Network Whale Accumulation Sparks Fresh Price Prediction Buzz

0

0

Administra todas tus criptomonedas, NFT y DeFi desde un solo lugar

Administra todas tus criptomonedas, NFT y DeFi desde un solo lugarPara comenzar, conecta de forma segura el portafolio que estés utilizando.