WLFI’s $500M Foreign Stake Triggers Governance Scrutiny

0

0

This article was first published on The Bit Journal.

WLFI has become a flashpoint in the growing intersection of crypto, politics, and foreign capital after U.S. President Donald Trump denied knowing about a reported $500 million investment tied to an Abu Dhabi royal. The controversy highlights how quickly crypto ventures can draw global attention when ownership, timing, and political influence overlap.

According to the source, the investment was finalized just four days before Trump’s inauguration, a detail that transformed an otherwise private funding round into a matter of public interest. The deal’s structure and beneficiaries have since fueled regulatory and media scrutiny.

A Public Denial Amid Mounting Questions

When asked directly about the reported stake, Trump told reporters that he had no knowledge of the transaction. He said his sons handled the business side of the venture and suggested that outside investments were common in family-run projects. While the denial addressed personal involvement, it did not challenge the existence of the deal itself.

For market observers, such statements matter. Studies on financial governance show that unclear leadership boundaries can heighten investor uncertainty, especially in politically exposed companies. This dynamic helps explain why WLFI quickly moved into the spotlight.

Inside The $500 Million WLFI Deal

Reports indicate that Sheikh Tahnoon bin Zayed Al Nahyan agreed to purchase a 49% stake in World Liberty Financial for $500 million. The investment was made through a Tahnoon-backed entity, Aryam Investment 1, which would become the platform’s largest shareholder if fully completed.

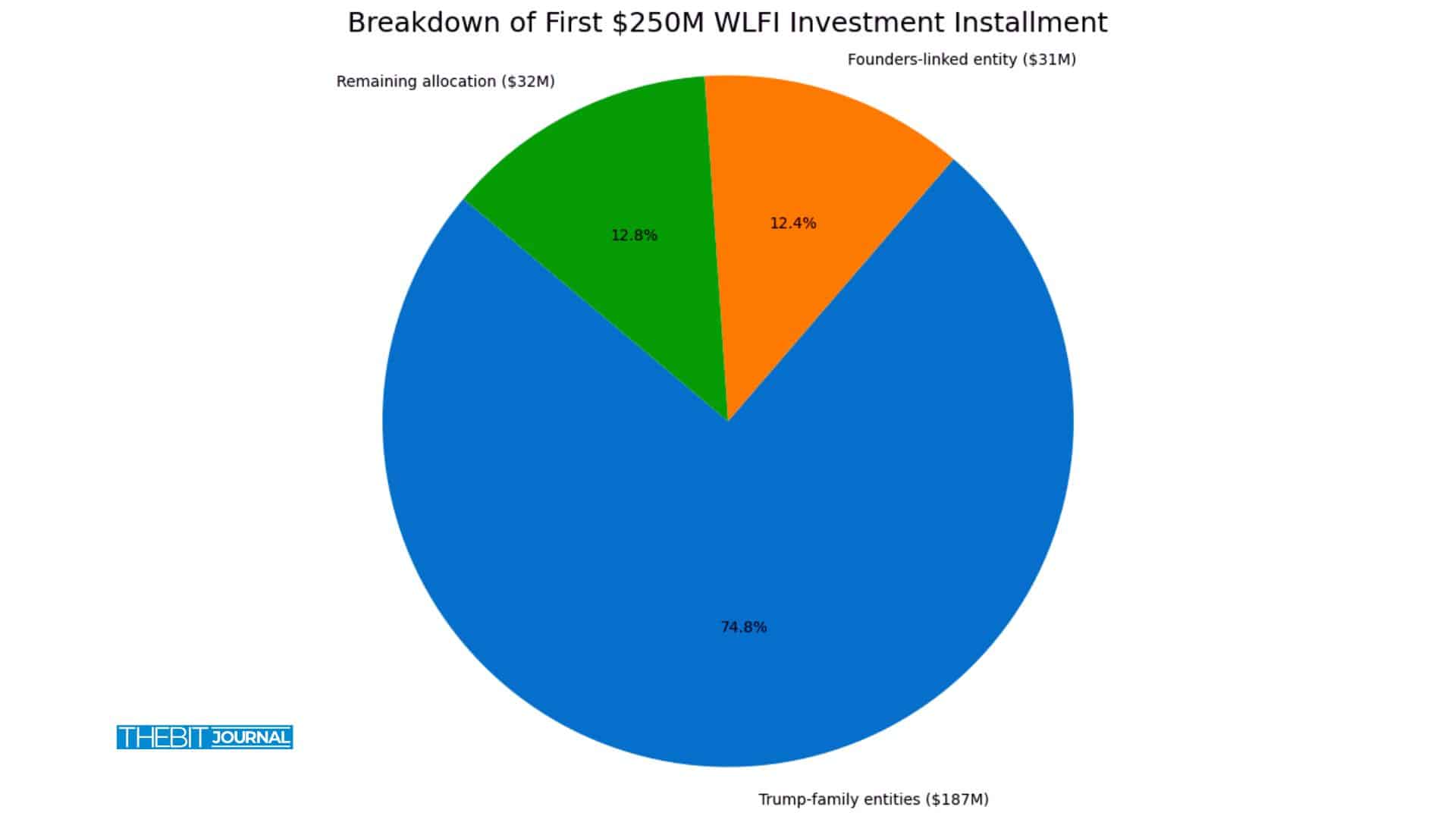

The first installment totaled $250 million. Of that amount, $187 million reportedly flowed to Trump-family entities. Another $31 million was directed to a company linked to two WLFI co-founders, Zak Folkman and Chase Herro. These details sharpened concerns about who benefited directly from the transaction.

Trump is listed as one of nine founders of WLFI, alongside his sons Donald Trump Jr., Eric Trump, and Barron Trump. That structure has intensified debate over governance and influence.

Geopolitics Add Another Layer

Sheikh Tahnoon’s role extends beyond crypto. He chairs Group 42, an artificial intelligence firm with close ties to global technology markets. In December, Group 42 received U.S. approval to purchase advanced chips from Nvidia and Advanced Micro Devices.

This backdrop heightened sensitivity around the WLFI deal. Analysts note that when the same figures operate across AI, geopolitics, and crypto, regulators tend to examine transactions more closely.

Regulators and Political Response

The reported stake prompted renewed criticism from Elizabeth Warren, who urged banking regulators to delay consideration of WLFI’s bank charter application until Trump divested his interest. The Office of the Comptroller of the Currency rejected that request, stating that political or personal ties would not affect its review process.

WLFI spokesman David Wachsman defended the company’s fundraising, arguing that applying unique standards to a privately held American firm was unreasonable and unfair.

Conclusion

The WLFI episode underscores a broader reality for crypto markets. As digital finance attracts larger pools of global capital, transparency and governance matter more than ever. For investors, developers, and students of finance, the lesson is clear. Innovation alone cannot offset perception risk. In today’s crypto landscape, credibility is currency.

Glossary of Key Terms

WLFI: A crypto-focused financial platform tied to high-profile founders.

Foreign stake: Ownership held by investors outside the host country.

Bank charter: Regulatory approval allowing financial services operations.

Governance: Rules that define control, accountability, and decision-making.

FAQs About WLFI

What is WLFI?

WLFI is a crypto platform founded by several individuals, including Trump and his sons.

Who invested $500 million?

The investment is linked to Sheikh Tahnoon bin Zayed Al Nahyan through a UAE-backed entity.

Why is the deal controversial?

Its timing, size, and foreign ownership raised political and regulatory concerns.

Did Trump receive funds directly?

Reports state that Trump-family entities received a portion of the initial payment.

References/Sources

Read More: WLFI’s $500M Foreign Stake Triggers Governance Scrutiny">WLFI’s $500M Foreign Stake Triggers Governance Scrutiny

0

0

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.Connectez de manière sécurisée le portefeuille que vous utilisez pour commencer.