Grayscale Launches GSUI ETF on NYSE Arca

0

0

Highlights:

- Grayscale launches GSUI ETF, which gives regulated access to SUI and staking rewards.

- GSUI starts with a fee waiver, backed by BNY Mellon and Coinbase custody.

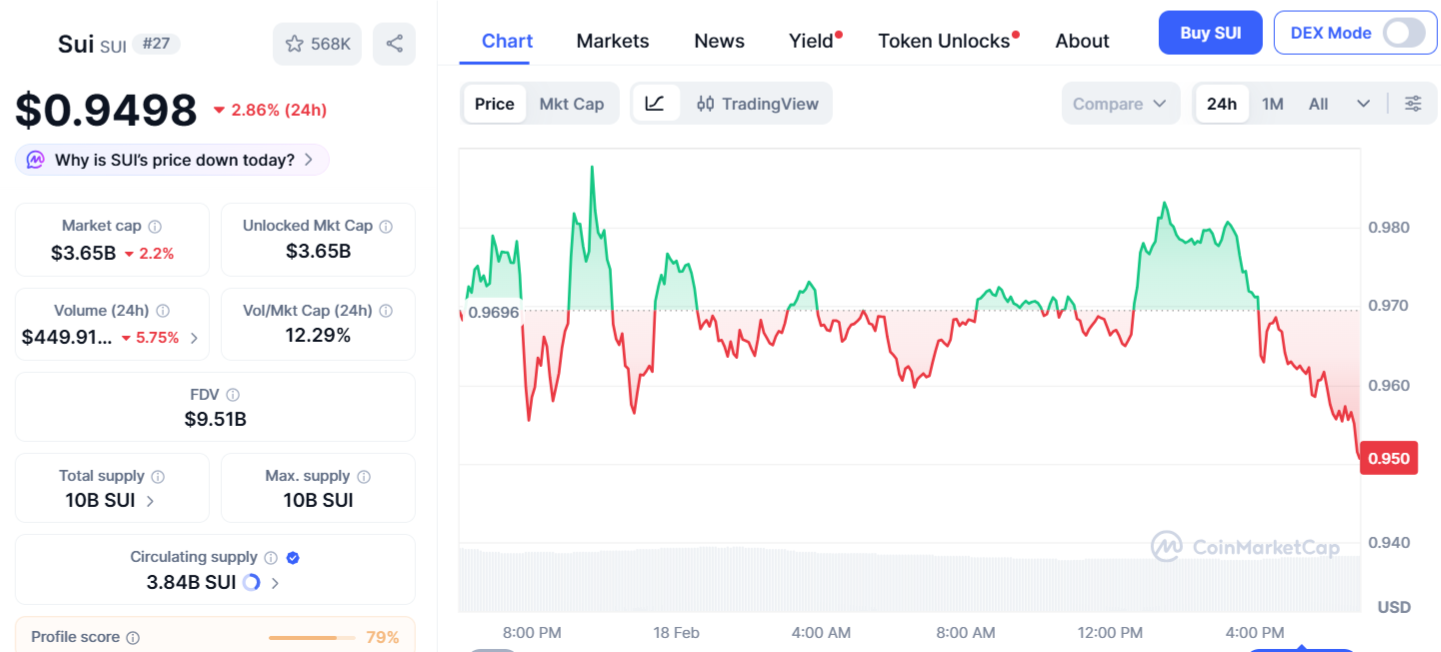

- SUI hovers near $0.97, breakout above $1.05 could ignite a powerful rally.

Grayscale Investments has started a new SUI Staking ETF. It is now trading on NYSE Arca with the ticker GSUI. This fund lets investors get exposure to the SUI token in a regulated way, just like buying a normal stock. The ETF buys SUI tokens and then stakes them on the Sui blockchain. In a proof-of-stake system, staked tokens help run and protect the network. In return, the network pays rewards. So investors can earn in two ways. They can benefit if the SUI price goes up, and they can also receive staking rewards. This makes the ETF more than just a simple price tracking product.

Grayscale Sui Staking ETF ("GSUI" or the "Fund"), an exchange traded product, is not registered under the Investment Company Act of 1940 ("40 Act") and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. Investing involves…

— Grayscale (@Grayscale) February 18, 2026

GSUI Launches with Fee Waiver and Strong Institutional Support

Grayscale has set the management fee at 0.35%. However, investors will not pay this fee for the first three months, or until the ETF reaches $1 billion in assets under management, whichever comes first. This move is meant to attract early investors, both retail and institutional.

The fund also has strong institutional support. Bank of New York Mellon takes care of the administrative services, and Coinbase is the custodian and prime broker. This arrangement brings a sense of trust and organization to the investors who want to deal with well-established financial institutions. The launch indicates that there is a growing interest in staking-based products. The asset managers are not just offering simple spot crypto funds anymore. They are now offering staking-based products that combine regulated access with staking rewards.

Grayscale’s SVP of ETF Capital Markets, Krista Lynch, said,

“GSUI is structured to provide investors with exposure to SUI and its staking activity through an ETP, offering a convenient way to gain exposure to a network designed for scalable, real-world applications.”

SUI Price Movement After GSUI ETF Debut

SUI’s price has reacted with mixed signals around the ETF launch. On the daily chart, the token is trading near $0.95. This is much lower than its early January high of around $1.90. The overall trend still looks weak. The chart shows lower highs and lower lows in recent weeks. That usually means sellers are still in control, and traders remain cautious. Now, key levels are in focus. The $1.00 to $1.05 area is seen as resistance. If the price moves above that zone, momentum could improve. On the downside, $0.90 and $0.85 are important support levels.

Broader Market Factors and Investor Considerations

The release of GSUI occurs at a critical time for the market. On March 1, 43.35 million SUI tokens will be unlocked. The total supply will increase as a result. The total supply can lead to selling pressures, as the holders of the tokens may choose to sell them. Unlocking can result in higher volatility, especially when the demand for the tokens is low.

SUI’s market capitalization is around $4 billion. However, SUI’s performance has declined significantly over the last year, like other altcoins. At the same time, Bitcoin dominance is around 58%. This implies that investors are favoring larger and more established assets.

Staking yield is another factor. SUI staking rewards have averaged roughly 1.7% to 3.3% per year. This yield component could make the GSUI ETF more attractive compared to standard spot crypto ETFs that only track price.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.Connectez de manière sécurisée le portefeuille que vous utilisez pour commencer.