How much will $1 Bitcoin be worth in 2030? A practical scenario guide

0

0

FinancePolice aims to reduce confusion and help everyday readers test assumptions without promising outcomes. Use the examples and the simple calculator approach here as a starting point, and verify inputs with primary sources before you draw conclusions.

What forecasting the value of one dollar in Bitcoin means

Why people ask “what will $1 be worth” and what the question actually measures

When people ask “what will $1 be worth in 2030” they usually mean: if you hold the BTC fraction that $1 buys today, what will that fraction be worth in 2030 if BTC trades at a chosen spot price then. This is a conversion question, not a prediction of returns per se, and the simplest way to answer it is to pick a plausible 2030 BTC price and apply a fixed multiplication to the BTC fraction represented by $1 today.

Because the method is arithmetic, it keeps assumptions explicit. You state a 2030 BTC price, you compute how much BTC $1 buys now, and you multiply. That transparency helps readers compare scenarios without hiding assumptions. See our crypto coverage.

How Bitcoin supply mechanics shape the question, crypto market live

Bitcoin supply mechanics reduce one source of long-term uncertainty: new issuance follows a known schedule and the protocol caps supply at 21 million coins, so supply-side assumptions are treated as high confidence inputs in many long-range scenarios, rather than a major unknown, as on-chain analytics routinely note Glassnode on-chain analytics.

That deterministic issuance makes the remaining uncertainty concentrate on price drivers, such as demand, macro factors, and regulatory outcomes. Historical price swings show why forecasts must be ranges instead of single-point pronouncements, and a conversion method helps keep the math clear while the scenario inputs are debated.

compute the future dollar value of the BTC fraction $1 buys today

–

USD

copy the formula and plug your prices

The simple math: convert a 2030 BTC price into the value of $1 today

Step-by-step calculation with an example using current BTC price data

The calculation has three steps: choose a 2030 BTC price, compute the BTC fraction that $1 buys today, and multiply that fraction by the 2030 price. The arithmetic is straightforward and reproducible, which is why many practical guides prefer scenario ranges over single-number forecasts.

Step 1, pick a 2030 BTC price. Step 2, compute the BTC fraction for $1 by dividing 1 by the current BTC price. Step 3, multiply that fraction by your 2030 price to get the dollar value of $1 in 2030. If you prefer whole units, convert the result to satoshis or round to sensible cents for display.

For a worked example, use a recent historical price as the current price and a clear 2030 assumption. Using published historical data to ground the current price helps keep the example reproducible CoinMarketCap historical data.

How to express results in dollars and in fractional BTC (satoshis)

Suppose the current BTC price is 30,000 USD and you choose 100,000 USD as a 2030 scenario. The BTC fraction for $1 today is 1 / 30,000 = 0.00003333 BTC. Multiply that by 100,000 and you get about 3.33 USD. If you prefer satoshis, note that one satoshi is 0.00000001 BTC, so you can show both the future dollar value and the equivalent satoshi count to make results easier to compare.

When you display results, clarify rounding choices and mention practical costs. Realized outcomes differ from the math because exchange spreads, transaction fees, and taxes reduce proceeds when converting between fiat and BTC; treat these as verification steps after you do the basic conversion.

Key inputs that drive BTC price scenarios

Supply-side certainty and scheduled issuance changes

Supply-side inputs are unusually stable for a long-term asset because Bitcoin’s issuance follows scheduled halvings and the total cap is set by protocol rules. Scenario builders often treat these features as fixed parameters when exploring multi-year price paths, using on-chain supply analytics as reference Glassnode on-chain analytics. See VanEck’s long-term assumptions here.

That does not mean supply never matters when you refine scenarios. It means the dominant uncertainty for a 2030 projection tends to be demand-side and macro factors, which should receive more scenario attention than supply variables.

Advertise with FinancePolice to reach practical personal finance readers

If you want to see the worked examples that follow, use the simple calculator steps in this guide to test your own 2030 price assumptions and compare bull, base, and bear ranges.

Demand and adoption indicators: on-chain and user adoption

Modelers commonly include growing on-chain and off-chain usage as a positive demand input for multi-year BTC price scenarios, reflecting ongoing global adoption trends reported through 2024 Chainalysis global adoption index. The CoinGecko 2025 report also provides adoption context CoinGecko Bitcoin Report 2025.

On-chain metrics such as transactions and active addresses are useful signals but their predictive power varies across periods, so many analysts use them alongside macro indicators rather than as sole predictors Coin Metrics research. Recent on-chain prediction research is discussed in academic work here.

Macro and regulatory risk factors that shift scenario probabilities

Large macro factors and regulatory outcomes can change 2030 paths materially. Shifts in real interest rates, dollar strength, or the arrival of restrictive policy in major markets are plausible tail risks that justify explicit downside scenarios rather than being ignored IMF analysis.

Because these factors interact with demand and liquidity, include them as separate scenario levers when you construct bull, base, and bear cases. That approach helps you quantify how sensitive your $1 outcome is to broad economic or policy shocks.

How to build three plausible 2030 scenarios and what each implies for $1

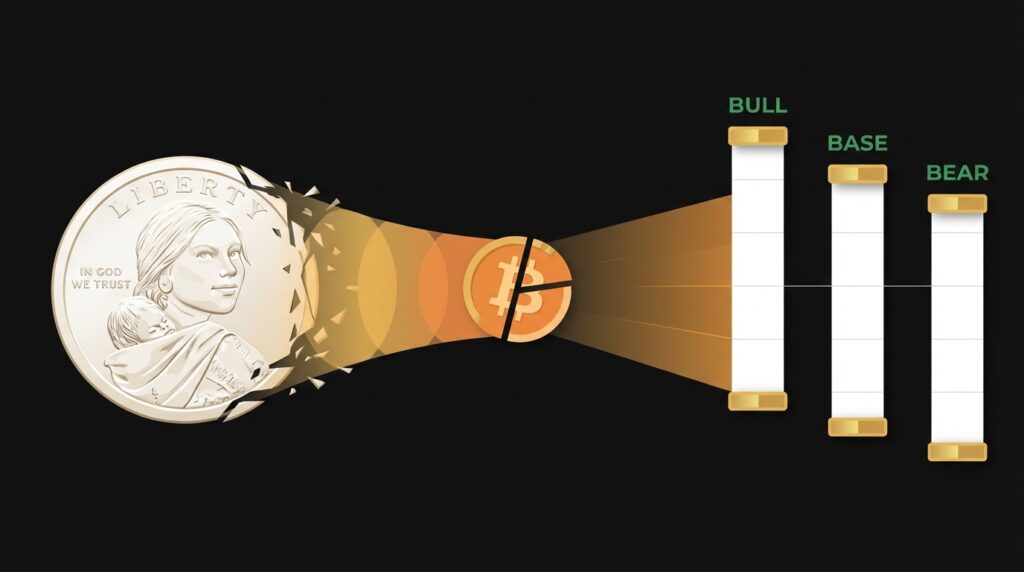

Bull, base, and bear scenario definitions and common assumption ranges

A compact scenario framework uses three cases. The bull scenario assumes stronger adoption and a supportive macro backdrop. The base case assumes gradual adoption with mixed macro conditions. The bear scenario assumes slow adoption or adverse macro and regulatory shocks. These labels keep the structure simple and transparent.

Choose numeric 2030 BTC price assumptions for each case. Keep the drivers explicit: adoption pace, institutional participation, macro conditions, and regulatory outcomes. Historical price volatility makes it important to use ranges rather than precise point forecasts when you translate these assumptions into a $1 outcome CoinMarketCap historical data.

Worked examples: multiply chosen 2030 BTC prices by the $1 BTC fraction

Use the conversion formula for each scenario. For illustration, imagine the current BTC price is 30,000 USD and the BTC fraction for $1 is 1 / 30,000 = 0.00003333 BTC. If the bull case sets 2030 BTC at 250,000 USD, the base case at 100,000 USD, and the bear case at 20,000 USD, multiply the BTC fraction by each 2030 price to get the $1 outcomes.

With those numbers the illustrative outcomes are: bull, 0.00003333 * 250,000 = 8.33 USD; base, 0.00003333 * 100,000 = 3.33 USD; bear, 0.00003333 * 20,000 = 0.67 USD. These are example calculations to show how scenario choices map directly into dollar outcomes; they are not predictions and do not imply probabilities.

How to interpret the resulting range and communicate uncertainty

Present results as a range and state your scenario drivers clearly. Use conditional language and avoid implying a single expected outcome. Historical multi-year swings in BTC emphasize that even plausible scenarios can diverge widely, so communicating the uncertainty and the assumptions behind each case is essential CoinMarketCap historical data.

When you report a range, include a short note on practical costs again: trading spreads, fees, and taxes reduce net proceeds and should be shown separately so readers understand the math versus real-world outcomes.

Common mistakes and pitfalls in $1 to 2030 Bitcoin forecasts

Overreliance on a single point estimate or recent trend

One frequent error is treating a single recent trend as decisive and publishing a single point estimate without showing alternatives. Given Bitcoin’s history of large swings, single-number forecasts can be misleading and overconfident CoinMarketCap historical data.

Instead, publish a few defensible scenarios and explain the drivers behind each. That makes it easier for readers to judge which scenario fits their time horizon and risk tolerance.

Choose plausible 2030 BTC price scenarios, calculate the BTC fraction $1 buys today, multiply that fraction by each 2030 price, and present the resulting range while noting fees, taxes, and macro or regulatory risks.

Treating on-chain metrics as perfect predictors

Another pitfall is using on-chain indicators as perfect predictors. On-chain metrics and network fundamentals are helpful inputs, but their correlation with price varies by period and they can give false signals at times, so rely on them alongside macro context and adoption data Coin Metrics research.

Balance on-chain signals with external evidence such as adoption reports and macro indicators to avoid overfitting your scenarios to one data source.

Ignoring macro and regulatory tail risks

Ignoring macro or regulatory tail risks produces overconfident projections. Major policy changes or adverse macro shifts can drive large deviations from expected paths, so include explicit downside scenarios and describe the triggers that would move a base case toward a bear case IMF analysis.

When you prepare a forecast, list the regulatory and macro events that would prompt you to update your scenario, so readers see the contingency logic behind your numbers.

Decision criteria: how to choose assumptions that match your goals

Checklist to select assumptions based on time horizon and risk tolerance

Choose assumptions that reflect your time horizon and risk tolerance. Shorter horizons typically require more conservative scenarios and explicit liquidity plans, while longer horizons can afford wider scenario ranges and more weight on adoption trends. Use primary sources for data inputs when possible Cambridge Centre for Alternative Finance review.

Use a simple checklist: define your horizon, state your tolerance for downside outcomes, decide how much weight to give adoption indicators, and document any macro or regulatory views you are making. Writing these down makes your scenario choices auditable and easier to update.

How to weigh evidence: primary sources, on-chain signals, and macro context

Weight evidence by source reliability and relevance. Price history and exchange feeds provide the current price; on-chain analytics help interpret network activity; adoption reports and macro briefings contextualize demand drivers. Combine these inputs rather than treating any single source as decisive, and prefer primary sources when you can verify data directly Chainalysis global adoption index.

Because evidence quality can change, plan a cadence for updates and keep a short list of trusted data providers so you can re-run scenarios efficiently when new information arrives.

When to update assumptions and how often to re-run scenarios

Re-run scenarios when a major trigger occurs: a significant change in on-chain activity, a large sustained price move, new large-scale regulation, or major macro shifts. For routine maintenance, review your scenarios quarterly or whenever new primary reports appear, depending on how actively you monitor the market IMF analysis.

Updating often helps you avoid stale assumptions, but avoid overreacting to short-term noise. Reassess only when new evidence changes one of your scenario drivers materially.

Practical next steps, a reader checklist, and worked calculator examples

Short reader checklist to verify assumptions and sources

Before you publish or rely on your $1 to 2030 numbers, verify the current BTC price from a reputable price feed, document your scenario assumptions, include macro and regulatory risk lines, and note trading costs and taxes. Recommended primary source types include exchange price history, on-chain analytics providers, adoption studies, and macro briefings Coin Metrics research. Also consult our homepage for related coverage Finance Police.

Keep a short log of the data sources and timestamps you used. That record makes future updates easier and helps others evaluate how current your assumptions were at the time of writing.

Three worked calculator examples at different current BTC prices

Example A, current BTC = 20,000 USD. BTC fraction for $1 = 1 / 20,000 = 0.00005 BTC. If 2030 BTC is 100,000 USD then $1 becomes 0.00005 * 100,000 = 5 USD.

Example B, current BTC = 40,000 USD. BTC fraction for $1 = 0.000025 BTC. If 2030 BTC is 100,000 USD then $1 becomes 2.5 USD. Example C, current BTC = 60,000 USD. BTC fraction for $1 = 0.00001667 BTC. If 2030 BTC is 100,000 USD then $1 becomes 1.67 USD.

Where to go for reliable primary sources and further reading

Check exchange price history for current and historical prices, on-chain analytics sites for supply and network signals, adoption reports for demand context, and macro policy briefings for regulatory and economic risk. These categories cover the primary evidence you will need to update scenarios responsibly CoinMarketCap historical data. See recent market posts on Finance Police here.

As you follow primary sources, keep in mind that data interpretation matters: similar numbers can support different narratives depending on the macro context and on whether you believe on-chain metrics remain predictive.

Compute the BTC fraction $1 buys today by dividing 1 by the current BTC price, then multiply that fraction by your assumed 2030 BTC price. Adjust for fees and taxes to estimate net proceeds.

Bitcoin has shown large multi-year swings, so scenarios capture a range of plausible outcomes and make assumptions explicit rather than implying false precision.

Use exchange price history for current prices, on-chain analytics for supply and network signals, adoption reports for demand context, and macro briefings for regulatory risks.

If you follow the checklist, re-run scenarios when major triggers occur, and keep track of costs and taxes, you will have a practical, auditable way to understand how different 2030 BTC prices map into dollar outcomes for $1 today.

References

- https://glassnode.com/

- https://coinmarketcap.com/currencies/bitcoin/historical-data/

- https://blog.chainalysis.com/reports/2024-global-crypto-adoption-index/

- https://coinmetrics.io/resources/

- https://www.imf.org/en/Topics/financial-stability/publications

- https://financepolice.com/category/crypto/

- https://www.vaneck.com/us/en/blogs/digital-assets/matthew-sigel-vaneck-bitcoin-long-term-capital-market-assumptions/

- https://www.coingecko.com/research/publications/bitcoin-report-2025

- https://www.sciencedirect.com/science/article/pii/S266682702500057X

- https://www.jbs.cam.ac.uk/insight/2024/global-cryptoasset/

- https://financepolice.com/

- https://financepolice.com/advertise/

- https://financepolice.com/bitcoin-price-analysis-btc-reclaims-92000-as-market-awaits-fed-decision/

0

0

Verwalten Sie alle Ihre Kryptowährungen, NFTs und DeFi an einem Ort

Verwalten Sie alle Ihre Kryptowährungen, NFTs und DeFi an einem OrtVerbinden Sie sicher das Portfolio, das Sie zu Beginn verwenden möchten.