BlackRock Potential Selloff, TORICO Web3 Partnership: APAC Brief

0

0

Welcome to the Asia Pacific Morning Brief—your essential digest of overnight crypto developments shaping regional markets and global sentiment. Grab a green tea and watch this space.

BlackRock’s $366M crypto transfer signals potential selling pressure as Bitcoin touched 112K before recovering. TORICO surged on Gentosha’s partnership for Web3 expansion. Fed Chair Powell’s Jackson Hole speech tonight adds market uncertainty.

BlackRock Crypto Transfer Signals Potential Selloff

BlackRock moved $366 million worth of Bitcoin and Ethereum to Coinbase Prime yesterday. Transferring 1,885 BTC and 59,606 ETH to the exchange suggests potential selling pressure. Such institutional moves to trading platforms typically indicate preparation for market liquidation.

Bitcoin declined sharply, touching 112K levels before recovering back above 113K. The selloff coincided with broader crypto weakness during Asian daytime hours.

Market participants debate whether this represents portfolio rebalancing or an institutional sentiment shift. Fed Chair Powell’s Jackson Hole speech later today adds uncertainty, with traders expecting signals on September rate cuts amid Trump’s pressure for monetary easing.

TORICO Surges on Web3 Partnership

TORICO shares hit the daily limit yesterday, after the company announced a partnership with major publisher Gentosha for Web3 expansion. Gentosha operates “New Economy,” a leading Japanese crypto media platform, and it brings blockchain expertise to support TORICO’s initiatives. The collaboration targets new business creation in the cryptocurrency and blockchain sectors.

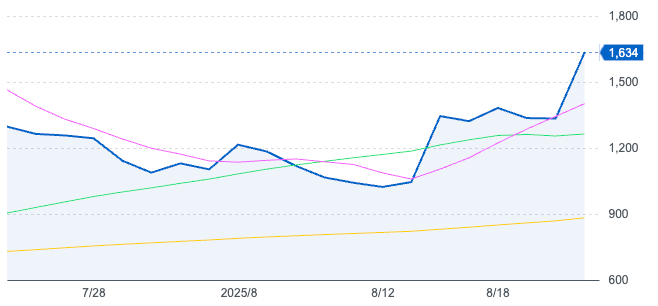

TORICO’s stock price. Source: Yahoo Finance

TORICO’s stock price. Source: Yahoo Finance

TORICO plans to invest 500 million yen in cryptocurrency starting in 2026, focusing on Bitcoin holdings. Following the announcement, the manga retailer’s stock jumped 300 yen to 1,634 yen. Both publishing companies aim to leverage emerging Web3 markets.

BeInCrypto’s Asian Coverage

Asian governments debate national Bitcoin reserve strategies while Hong Kong leads with ETFs and stablecoin licensing frameworks.

Wealthy Asian families boost crypto allocations to 5% of portfolios amid favorable regulations and strong returns.

The Chinese court sentenced a defendant to 3.5 years for knowingly facilitating USDT transactions involving stolen funds.

Hong Kong construction firm acquired 4,250 bitcoins worth $483 million for its corporate treasury strategy.

US policy group warns China fears USD stablecoins could undermine financial sovereignty and capital controls.

Japan’s FSA creates a new bureau in 2026 to oversee crypto, digital finance, and asset management.

More Highlights

Crypto hackers shifted focus to RWA projects, causing $14.6 million losses in first half of 2025.

Ethereum faces potential breakdown below $4,000 after profit-taking erased gains from August peak of $4,793.

Fed rate cut optimism for September continues to fade as prediction markets show diminished hopes despite majority belief.

OKB token burn strategy created 400% rally by reducing supply to 21 million tokens, mirroring Bitcoin’s cap.

Kanye West’s YZY meme coin sparked insider trading suspicions after hitting $3 billion valuation before crashing amid coordinated wallet activity.

0

0

Gestisci cripto, NFT e DeFi in un unico luogo

Gestisci cripto, NFT e DeFi in un unico luogoConnetti in sicurezza il portafoglio che usi per iniziare.