Tom Lee Says Bitmine’s $6.6B Unrealized ETH Loss Is a Feature of Its Treasury Strategy

0

0

Highlights:

- Tom Lee has described the unrealized loss from BitMine’s Ethereum holdings as an expected feature of the company’s strategy.

- The chairman also confirmed that BitMine will not sell any of its ETH holdings.

- Ethereum’s price nears $2,000 amid the crypto market’s persistent declines.

Tom Lee, the Chairman of one BitMine Immersion Technologies, has reacted to an X post claiming that the company is currently sitting on a $6.6 billion unrealized loss on its ETH holdings. The tweet also claimed that BitMine will eventually be forced to sell its ETH holdings. This contradicts the company’s long-term holding strategy, eliciting fear among Ethereum holders.

The critic added:

“Tom Lee was the final exit liquidity for OG ETH whales to get out of their worthless token.”

https://twitter.com/WuBlockchain/status/2018906449481761039?ref_src=twsrc%5Etfw

Tom Lee Reiterates BitMine’s Ethereum Treasury Strategy

In response, the BitMine Chairman has once again defended the company’s investment strategy. He did not deny the paper loss. Instead, he explained what BitMine’s strategy entails. Tom Lee reiterated that BitMine is designed to hold and track Ethereum’s price, similar to how index exchange-traded funds (ETFs) track stock indexes. If ETH’s price declines following a crypto market downturn, the value of BitMine’s ETH holdings will also drop accordingly.

Going further, Tom Lee explained that the $6.6 billion loss is unrealized, meaning that the company has not sold any of its ETH holdings. He noted that losses during the broader market declines are normal for long-term asset holders. He also compared critics to people mocking index ETFs during bear markets.

Renowned for his cycle investing approach. Tom Lee strongly believes that Ethereum tends to always underperform in down cycles but overperforms in up cycles. BitMine’s goal is to outperform over a full market cycle, not to look good in market declines. He concluded by reiterating that Ethereum remains the future of finance.

https://twitter.com/fundstrat/status/2018705853101072853?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E2018705853101072853%7Ctwgr%5E5bcdb2eab7ec63537d35704296b1773a5a03955f%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fpublish.twitter.com%2F

ETH’s Price Continues to Dip

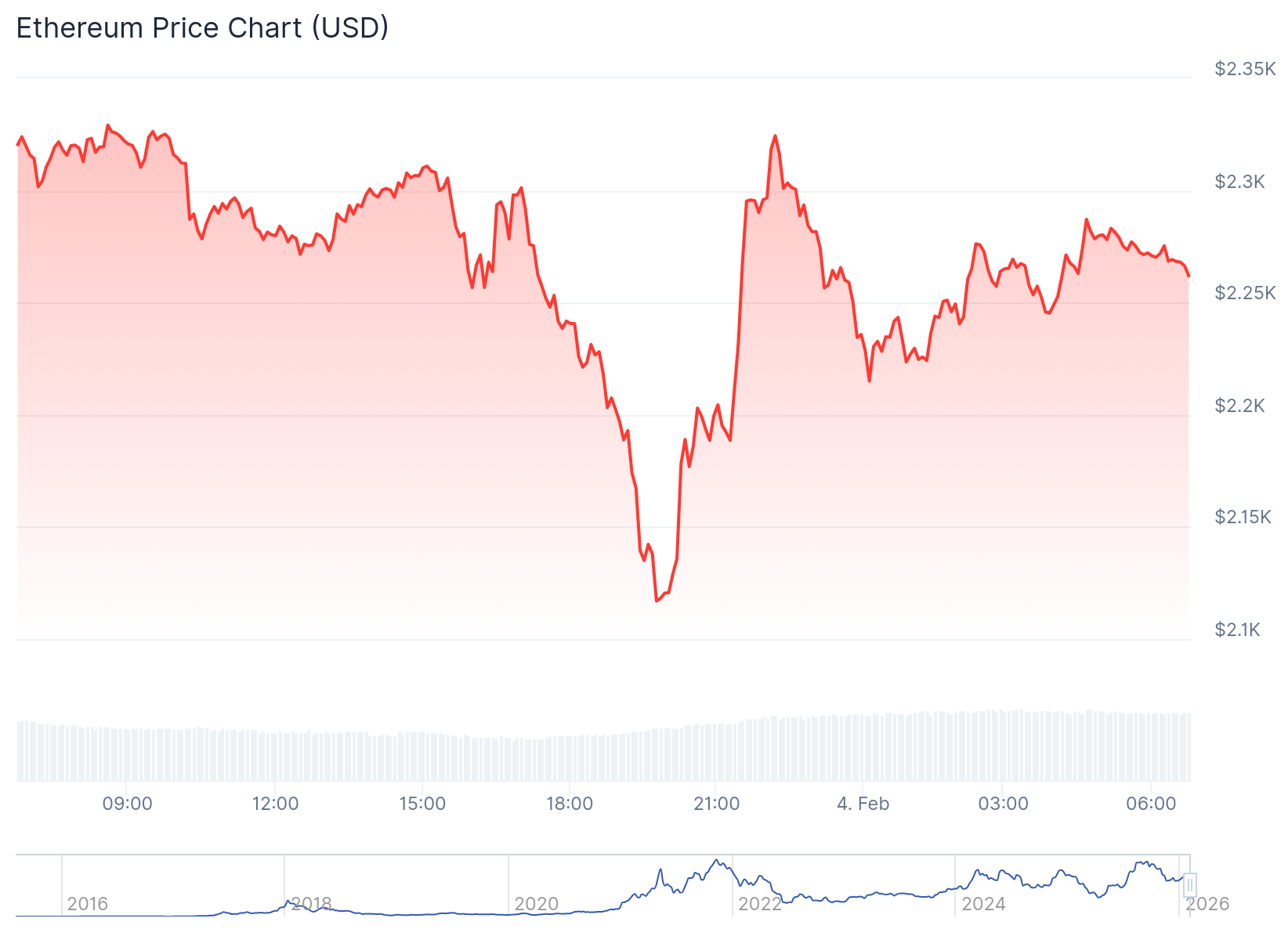

At the time of press, the crypto market is 2.1% down in the past 24 hours, with a trading volume of $185.732 billion and a market cap of $2.655 trillion. Bitcoin’s dominance sits at 57.3%, while ETH’s dominance has dropped to 10.3%. Within the same timeframe, ETH is trading at $2,263, following a 2.5% decline. It has a market cap of $273.12 billion and a trading volume of $48.38 billion. In its week-to-date, month-to-date, and year-to-date price change variables, Ethereum has dropped by 24.6%, 28.9%, and 19.5%, respectively.

On Coincodex, Ethereum’s supply inflation is low at 0.16%, and volatility is high at 8.4%. “Fear & Greed Index” reflects extreme fear at 14, with a bearish sentiment. Risk assessment shows that ETH is oversold and may soon rise. The asset is also trading near its cycle high, has high liquidity based on its market cap, and a yearly inflation rate of 0.16%. On the other hand, 93% of the top 100 most valuable cryptocurrencies are outperforming Ethereum.

Despite the price dip, BitMine has continued to accumulate Ethereum. On February 2, Crypto2Community reported that the company grew its ETH holdings after buying 41,788 ETH over the past week. Aside from the purchase, the company disclosed that it carries no debt and will continue to generate rising staking income to support its long-term strategy. Per a February 2 report, the company’s total holdings across crypto investments and cash were roughly $10.7 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.Connectez de manière sécurisée le portefeuille que vous utilisez pour commencer.