AAVE eyes $188 as whale accumulation and DeFi resilience fuel price recovery

0

0

Aave’s native token has seen a measured rebound as market participants weigh the influence of large whale activity alongside broader DeFi sector resilience.

The cryptocurrency is now testing resistance near the upper end of its daily trading range, reflecting both short-term technical momentum and structural support from long-term holders.

At press time, AAVE’s price was at $182.56, after a 3.7% increase over the past 24 hours and extending gains from recent mid-$170 levels.

Whale activity bolsters confidence

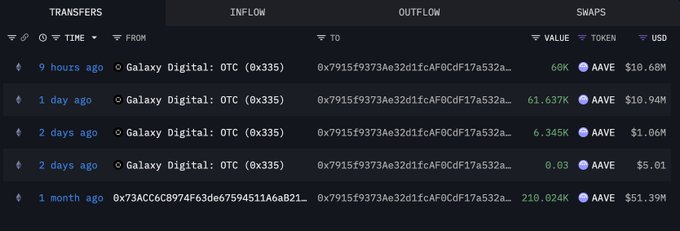

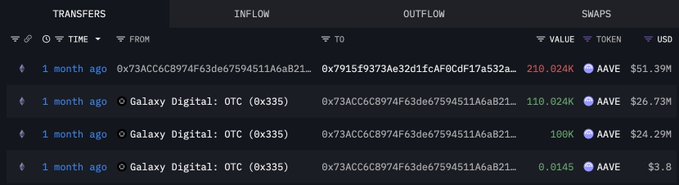

A significant factor supporting AAVE’s recovery has been concentrated whale accumulation.

On November 26, a single whale executed an over-the-counter purchase of 60,000 AAVE, valued at approximately $10.68 million via Galaxy Digital.

This brings the whale’s total holdings to 338,000 AAVE, representing nearly $60 million in market exposure since mid-October.

Despite an unrealized loss of around $13.8 million compared to the average purchase price, the move signals long-term conviction and reduces immediate sell-side pressure.

Historically, similar whale activity has preceded short-term rallies, creating psychological support zones that can influence trader sentiment.

Market participation has also improved alongside this whale accumulation, with 24-hour trading volume climbing to over $280 million and net inflows signalling a tentative return of capital to the protocol.

Eye are now on whether additional accumulation occurs or if profit-taking emerges around key resistance levels near $195.

DeFi fundamentals reinforce recovery

Beyond individual trader activity, broader DeFi sector health has played a supportive role.

Aave’s total value locked remains steady at approximately $32 billion, a twofold increase from the previous year, and decentralized exchange volumes have risen, signaling sustained sector engagement.

Core protocols have retained more than 80% of user deposits, even amid YTD token declines.

This stability highlights a growing divergence between on-chain fundamentals and short-term market fluctuations, suggesting that investors are increasingly discerning in their rotation into leading DeFi assets.

Technical rebound shapes AAVE price

Overall, the combination of strategic whale accumulation and solid DeFi sector fundamentals lays the ground for further gains in the AAVE price.

The AAVE price has reclaimed multiple short-term exponential moving averages, including the 20, 50, 100, and 200 EMAs on hourly charts, indicating strengthening intraday structure.

In addition, the daily RSI sits around 46, reflecting moderated yet firm momentum.

While the token remains below longer-term SMA levels, a clean close above $188 is considered critical to confirm a sustained upward trajectory.

Conversely, a drop below $180 could prompt a return to the mid-$170 support zone, underscoring the importance of maintaining short-term stability.

The post AAVE eyes $188 as whale accumulation and DeFi resilience fuel price recovery appeared first on Invezz

0

0

Verwalten Sie alle Ihre Kryptowährungen, NFTs und DeFi an einem Ort

Verwalten Sie alle Ihre Kryptowährungen, NFTs und DeFi an einem OrtVerbinden Sie sicher das Portfolio, das Sie zu Beginn verwenden möchten.