Crypto Whales Move $14M Into Tokenized Gold as Bitcoin Stalls

0

0

This article was first published on The Bit Journal. The movement of large cryptocurrency positions to tokenized gold is gaining momentum, and Bitcoin is finding it difficult to recover its momentum, indicating a defensive action instead of a lack of trust in digital assets. The relocation underscores the adoption of the blockchain-based versions of the conventional safe havens by the crypto-native investors to manage the risks in uncertain conditions in the macro environment.

Whales Withdraw Tokenized Gold From Exchanges

On January 27, a blockchain analytics company, Lookonchain, found three large wallets, which collectively sold over 14 million dollars of tokenized gold on centralized exchanges. The assets were pulled out of exchanges such as Bybit, Gate and MEXC, which cited an increasing interest in keeping exposure to gold off-exchange in self-custodied wallets.

Lookonchain reports that one wallet was able to withdraw 1,959 XAUT worth about 9.97 million and another wallet was able to withdraw 559 XAUT worth about 2.83 million. The third address liquidated 194.4 XAUT, which is approximately worth 993,000, and 106.2 PAXG tokens, worth approximately 538,000. XAUT and PAXG are both the dominant tokenized gold products that track the price of physical bullion.

Many whales are accumulating gold!

0xbe4C withdrew 1,959 $XAUT($9.97M) from #Bybit and #Gate.

0x0F67 withdrew 559 $XAUT($2.83M) from #MEXC.

0x1b7D withdrew 194.4 $XAUT($993K) and 106.2 $PAXG($538K) from #MEXC.https://t.co/P1IvyVIBuAhttps://t.co/2BeknSmJ2I… pic.twitter.com/t8uE1xuPIe

— Lookonchain (@lookonchain) January 27, 2026

Gold and Bitcoin Show Market Divergence

Although these assets are claims to gold in digital form and not actual physical delivery of the same at that time, according to the analysts, the withdrawals are more indicative of longer-term positioning. Historically, such large off-exchange movements of tokenized gold are linked to custody, as opposed to short-term trading.

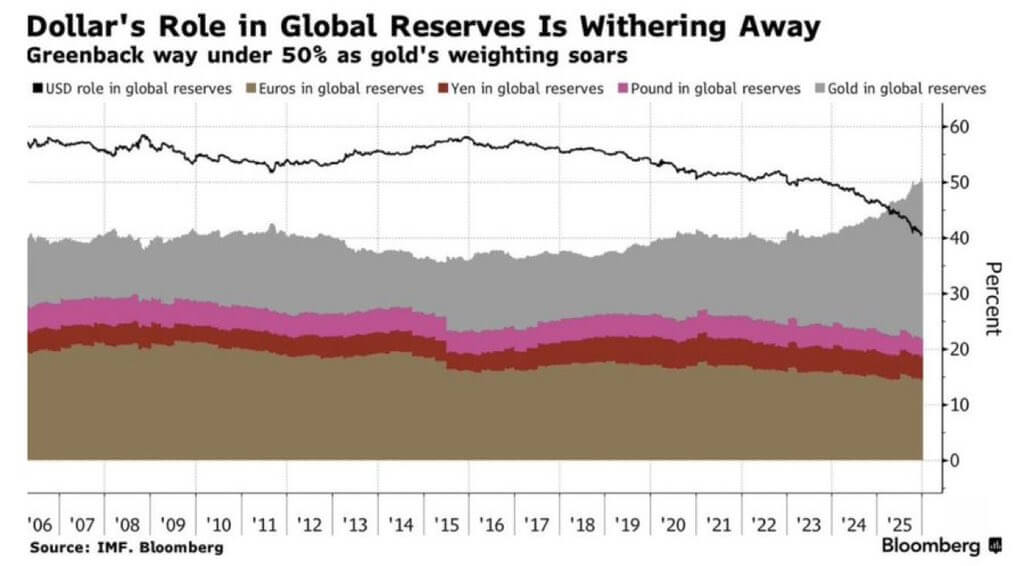

The purchases were made at a time when the hard assets and cryptocurrencies were divergent. Spot gold has been trading at above 5,000 per ounce on a high level after a significant increase, which was driven by geopolitical tensions, central bank demand and investor caution. Bitcoin, in its turn, has entered a phase of consolidation even though there are bigger macro queries.

Bitcoin Stalls Amid Heavy ETF Outflows

Bitcoin was trading around the $89,125 mark at press time, which was a gain of only 0.28 percent compared to the beginning of the year. Capital flows are credited by market analysts with the stagnation. Bitwise Europe said weekly net outflows of global crypto exchange-traded products were of 1.811 billion dollars, including over 1.1 billion dollars in Bitcoin-related funds. The Bitcoin ETFs in the US alone incurred the net redemptions of $1.32 billion.

The derivatives data indicate the same risk-off tone. The observation of low futures premiums and increasing demand of downside protection in the options markets suggested that this is in line with hedging behavior and not aggressive bull positioning.

Tokenized Gold Offers On-Chain Safe Haven

As a crypto-native, tokenized gold is a distinctive benefit to crypto-native investors; it provides them an opportunity to invest in a classic safe haven without exiting the blockchain world. Rather than sending money out of exchanges, investors can swap into tokens backed by gold which trade 24/7 and settle as any other digital asset.

This trend is being supported by institutional behavior. Stablecoin issuer Tether announced the acquisition of about 27 metric tons of physical gold to cover its reserves in late 2025, which further justifies tokenized gold as an internal hedge in times of increased volatility.

Although the trend has shifted to tokens backed by gold, analysts warn against taking the trend as a long-term negative indicator of Bitcoin. Some view it as a sequencing strategy that gold rushes in times of stress, and Bitcoin does in times of increased liquidity and the revival of inflation-themed narratives.

Tether Gold Accounts for More Than Half the Entire Gold-Backed Stablecoin Market as XAU₮ Surpasses $4 Billion in Value

Read more: https://t.co/BXrxBWsgHX

— Tether (@tether) January 26, 2026

BTC-to-Gold Ratio Signals Potential Recovery

Bitwise Europe has emphasized that the ratio of the Bitcoin to gold is already in historical extremes, which in the past has been a set up that has led to Bitcoin recoveries. Although the short-term pressures still exist, a long-term inflow rebound of ETFs may open the door to demand-based price increase.

To date, the emergence of tokenized gold highlights the process of traditional risk management tools being applied to on-chain infrastructure by the crypto markets so that investors can trade uncertainty without leaving the digital asset space.

Conclusion

Overall, the surge in tokenized gold purchases by crypto whales reflects strategic hedging rather than abandonment of Bitcoin. Safe-haven positioning also seems to be a priority of investors in the face of macro uncertainty, and Bitcoin has an opportunity to recover its momentum when ETF flows are normalized and liquidity is restored, which is a gradual rotation between gold and digital assets.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- Crypto whales withdraw $14M tokenized gold, indicating safe haven hedging.

- Gold remains over $5,000, and Bitcoin remains at around 89K amid outflows.

- On-chain hedging can be done without crypto infrastructure by tokenizing gold.

- Gold-first, Bitcoin-later rotation is visible to the analysts, and BTC can rebound.

Glossary of Key Terms

Crypto Whales: Large crypto holders influencing market moves.

Tokenized Gold: Digital tokens representing physical gold on blockchain.

Safe-Haven Assets: Low-risk investments during market uncertainty, like gold.

Spot Gold: Current price of physical gold.

Bitcoin (BTC): Largest cryptocurrency, often compared to gold.

ETF Outflows: Withdrawals from funds affecting underlying asset prices.

Derivatives: Contracts based on another asset’s value, used for hedging.

Frequently Asked Questions about Tokenized Gold

1. Why are whales buying tokenized gold?

As a safe-haven hedge during Bitcoin stagnation and macro uncertainty.

2. What are XAUT and PAXG?

Tokenized gold products tracking the price of physical gold.

3. Does this mean whales abandon Bitcoin?

No, it’s hedging; rotation back to Bitcoin may follow.

4. How does tokenized gold help investors?

Provides on-chain gold exposure and internal hedging without leaving crypto.

References

Read More: Crypto Whales Move $14M Into Tokenized Gold as Bitcoin Stalls">Crypto Whales Move $14M Into Tokenized Gold as Bitcoin Stalls

0

0

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요시작하는 데 사용하는 포트폴리오를 안전하게 연결하세요.