BYDFi Vs. MEXC: Which Platform Do Global Derivatives Traders Prefer?

0

0

In your search for the best crypto exchange for trading, odds are you’ve likely heard of MEXC and BYDFi. And when it comes to the question of which platform to use, it can be challenging to know which one is right for you. This is because both exchanges offer some similar products for trading, storing, and managing crypto assets.

However, they also have unique features and products that make them suitable for different traders. For instance, MEXC offers a comprehensive suite of products, making it an ideal option for advanced traders. On the other hand, BYDFi offers less product support and fewer coin support than MEXC, so it could be a great place to start for beginners.

That said, this BYDFi vs MEXC comparison will give you a full picture of what both exchanges offer, helping you decide which is best for your needs.

BYDFi Vs MEXC: Overview Comparison

| Metrics | BYDFi | MEXC |

| Best for | Beginners and US-based traders | Advanced traders |

| Founded | 2020 | 2018 |

| Supported crypto assets | 1000+ | 3,000+ |

| Best features | BYDFi card, spot and futures trading, bots, MoonX, and copy trading. | DEX+, spot and futures markets, launchpad, MEXC Earn, and automated trading tools. |

| Native token | BYD token | MX token |

| Security | Multi-layer security, two-factor authentication (2FA), segregated accounts, and cold storage. | Cold and multi-sig storage, 2FA, and real-time monitoring. |

| Customer support | Live chat, email, and guides. | 24/7 live chat, email, and comprehensive learning materials. |

| Accessibility | Mobile and desktop | Mobile and desktop |

| Supported payment methods | Crypto, credit/debit card, and bank transfers. | Crypto, credit/debit card, bank transfers, and third-party payment providers. |

What is BYDFi?

BYDFi is a Singapore-based cryptocurrency exchange that offers spot trading, derivatives, copy trading, and perpetual contracts for over 500500 cryptocurrencies. The platform allows investors to trade without KYC and access it without a VPN. Due to this access level, BYDFi is able to serve more than 1,000,000 users across 190 countries.

The exchange originally launched in 2020, and it rebranded to BYDFi in 2023. This name was derived from “BUIDL Your Dream Finance” to reflect its mission of providing high-quality digital asset services and promoting blockchain adoption.

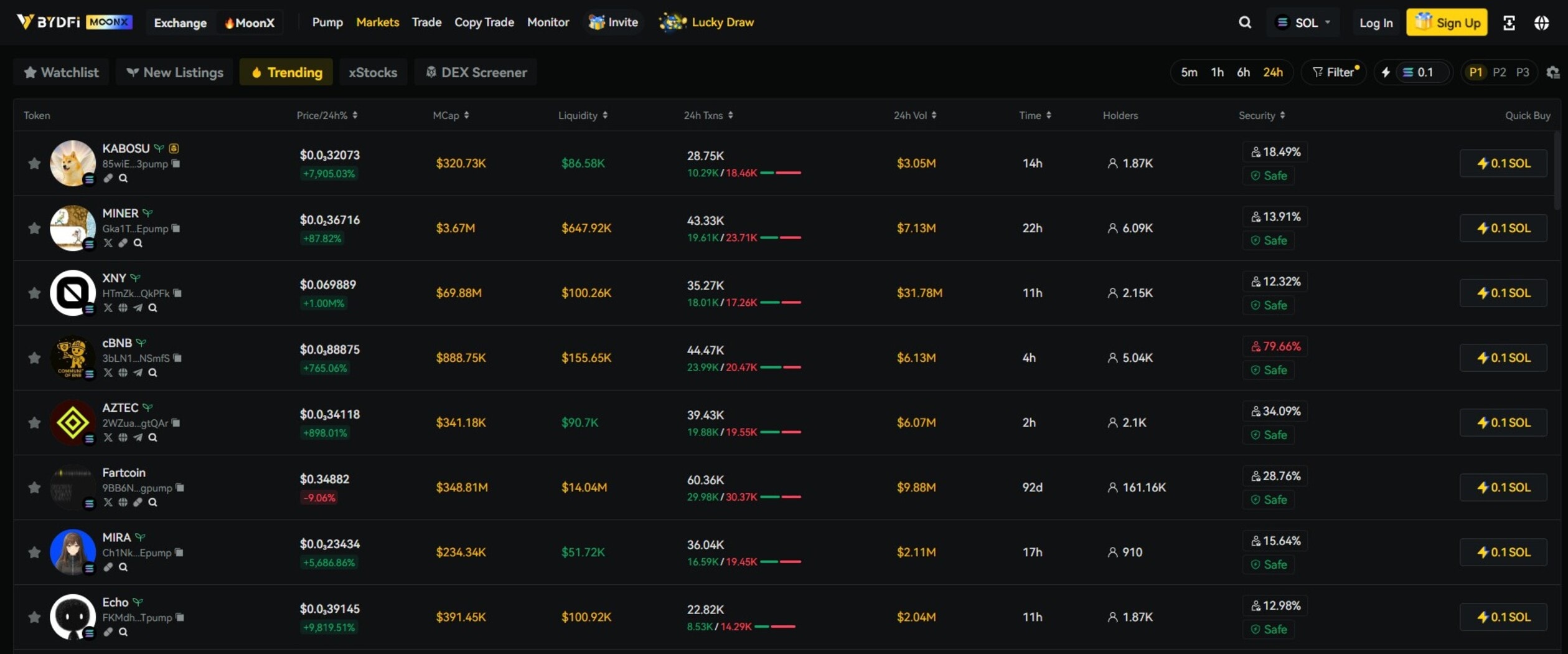

In 2025, BYDFi launched MoonX, an on-chain memecoin trading tool. This move is advancing the platform toward a combined CEX+DEX model.

Additionally, BYDFi’s recent collaboration with Newcastle United further highlights the exchange’s commitment to expanding its international presence and connecting with global communities. The partnership offers fans access to innovative digital finance tools while showcasing BYDFi’s trading platform to a wider audience.

Pros & Cons of BYDFi

| Pros | Cons |

| Competitive trading fees (0.02% maker/0.06% taker fees for perpetual contracts, 0.1% spot). | No staking or lending for passive income. |

| Best for futures trading, offering high leverage up to 200x on futures contracts. | High-risk leverage amplifies losses; overnight funding fees add costs. |

| 1000+ crypto trading pairs. | Lacks advanced order types (e.g., TWAP, iceberg) and native API for algos. |

| Strong security: multi-sig cold storage (95%+ funds), segregated accounts, no hacks. | No-KYC exchange, making it risky to hold large amounts of cryptocurrency. |

| Copy trading, grid bots, demo account with $50K virtual USDT. | No phone support; limited educational resources. |

| No KYC for basic trading; available in 190+ countries including the USA. | Withdrawals limited to USDT only. |

| TradingView charts, fiat gateways (100+ currencies via third-party payment providers). |

BYDFi is best for:

- No-KYC trading: If you prefer to trade cryptocurrencies anonymously, BYDFi allows traders to start trading in minutes without identity verification.

- Beginners and novice traders: BYDFi offers copy trading from top performers, low entry ($10 minimum), demo accounts, and automated bots, which simplify entry and provide learning through real trades.

- Futures and leverage trading: BYDFi is one of the best exchanges for futures trading. It offers up to 200x on perpetuals with isolated/cross margins to high-risk traders. This high leverage allows traders to optimize their potential profits and losses as well.

What is MEXC?

MEXC is a centralized cryptocurrency exchange founded in 2018. The crypto trading platform offers spot, futures, and margin trading, as well as staking, and is one of the best altcoin exchanges, offering access to over 3,000 cryptocurrencies across 170+ countries. The exchange is popular for its high-performance trading engine, which can process up to 1.4 million trades per second.

In addition, MEXC supports early listings of trending tokens, such as memecoins and AI projects, with low fees, daily airdrops, and deep liquidity. It also provides advanced tools such as copy trading, ETFs, launchpads, and a user-friendly interface for both beginners and professional traders.

In terms of security, MEXC implements multi-layer protections, including SSL encryption, two-factor authentication, multi-signature wallets, cold storage for most assets, anti-DDoS measures, address whitelisting, anti-phishing measures, and regular audits, with no reported hacks or major breaches.

Pros & Cons of MEXC

MEXC is best for:

- Wide altcoin selection: MEXC currently supports about 3,000 crypto assets and is known for listing many new and emerging tokens early. This makes the exchange a great option for people looking to get exposure to fresh altcoins before they hit other exchanges.

- High-volume futures traders: The exchange offers deep liquidity and up to 500x leverage in futures markets, making it well-suited to active derivatives traders who need fast execution.

- Low-fee trading: MEXC is one of the top zero-fee trading platforms. The exchange consistently offers some of the lowest trading fees in the industry (0% spot maker, 0.02% futures, and zero-fee trading on some pairs), making it attractive for frequent traders.

- AirDrop and launch events: MEXC is popular for hosting regular launchpad events, airdrops, IDOs, and reward campaigns. If you want extra earning/bonus opportunities, MEXC is a suitable option.

BYDFi Vs MEXC: Trading Features

| Trading options | BYDFi | MEXC |

| Spot trading | Yes | Yes |

| Futures trading | Yes | Yes |

| Leverage trading | Up to 200x | Up to 500x |

| Pre-market | No | Yes |

| Convert | Yes | Yes |

| P2P trading | Yes | Yes |

| Demo trading | Yes | Yes |

| Copy trading | Yes | Yes |

| Bot trading | Yes | Yes |

| NFT marketplace | No | Yes |

BYDFi Vs MEXC: Platform Products and Services

What BYDFi Offers:

- Spot and futures trading: BYDFi offers a full suite of trading features designed for both beginners and experienced traders. Spot trading is for anyone who simply wants to buy, sell, hold, or swap assets, while futures and perpetual contracts enable advanced users to speculate on price movements with up to 200x leverage.

- Copy trading: The platform offers copy trading for busy traders and beginners who want to learn from more experienced traders. This lets users automatically mirror the trades of top-performing traders. Once you choose a trader to follow, your account executes the same trades according to your preferred settings.

- Trading bots: BYDFi also supports automated trading through built-in trading bots. These bots can run different strategies depending on market conditions. Grid bots buy low and sell high within a set price range, while Spot DCA helps with long-term accumulation by purchasing at regular intervals. Meanwhile, Spot Martingale can automatically adjust positions to optimize profit during price fluctuations.

- BYDFi card: This is a VISA card that allows users to convert their digital assets into fiat for real-world purchases. It makes it easier to use crypto as a payment tool, whether online or in physical stores.

- MoonX: MoonX is a Web3 on-chain trading platform developed by the crypto exchange BYDFi. It was launched in April 2025 and focuses on memecoin trading across multiple blockchains, including Solana and BNB Chain.

It supports over 500,000 memecoin trading pairs, offers fast listing for new tokens, enables on-chain transactions for transparency, and includes tools like automated copy trading. MoonX also features Alpha, which tracks hot meme assets via smart money patterns.

What MEXC Offers:

- Spot and futures trading: MEXC supports spot trading for buying and selling cryptocurrencies at current market prices. The exchange also supports Futures trading, which allows leveraged positions on derivatives. Traders can apply leverage up to 500x, place trigger orders, and easily transfer assets between spot and futures accounts.

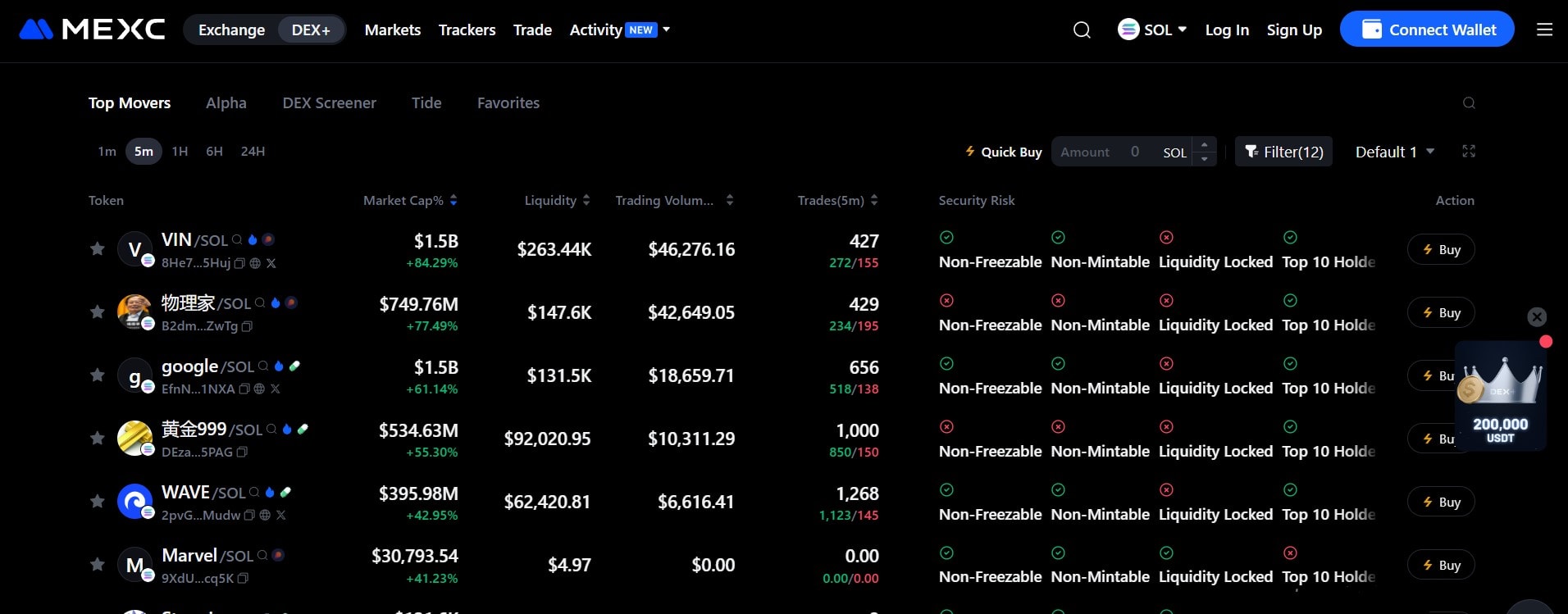

- MEXC DEX+: MEXC DEX+ is a decentralized exchange aggregator, integrating multiple DEXs to find optimal trading routes and minimize slippage or high fees. DEX+ enables direct on-chain swaps without centralized custody, supporting a wide range of tokens across networks.

- Copy trade and demo trade: The copy trade feature lets users follow professional traders by setting parameters such as margin, copy mode, and risk controls, automatically mirroring their open/close positions in real time. Meanwhile, demo trade provides a risk-free futures simulation environment for users to test strategies without using real funds.

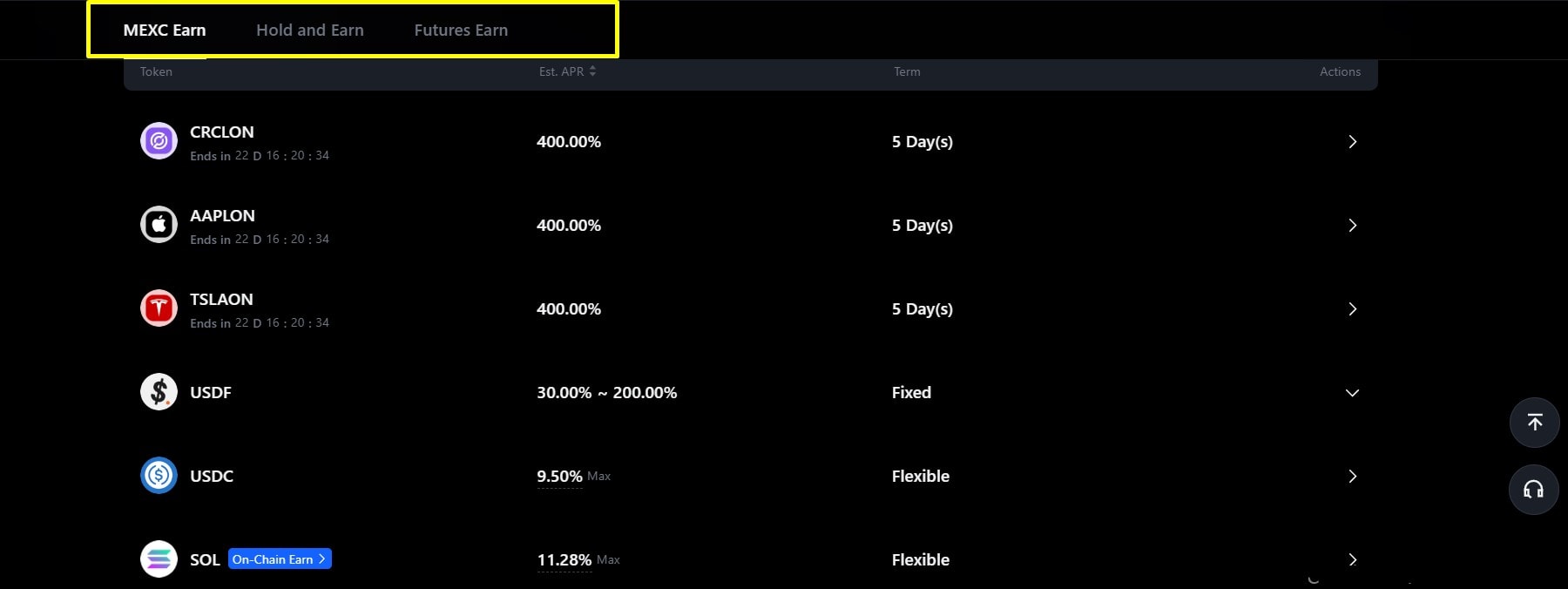

- MEXC Earn: MEXC provides a comprehensive platform for users to generate yields on crypto holdings through staking and savings products. It offers potential rewards up to 777% APR, varying by token and network conditions, with options for both flexible and fixed terms.

- MEXC AI: MEXC offers an AI Select List to rank high-potential tokens, an AI News Radar for real-time insights from social media, news, and on-chain data, and one-click trading. In addition, it offers an AI Bot Assistant for conversational strategy advice and Ask AI for token movement analysis. These tools process vast amounts of data 24/7 to generate signals, helping users spot trends such as whale activity or meme coin surges ahead of the market.

BYDFi Vs MEXC: Fee Structures

| Fee | BYDFi | MEXC |

| Spot trading | 0.1% maker and taker fees | 0% maker and 0.05% taker |

| Futures trading | 0.02% maker and 0.055% taker | 0% maker and 0.02% taker |

| Deposit fees | Free for crypto deposits | Free for crypto deposits |

| Withdrawal fees | Varies based on asset and network conditions | Varies based on asset and network conditions |

| Fee discounts | Tiered | 20% discount for MX holders |

BYDFi Vs MEXC: Supported Cryptocurrencies, Liquidity & Trading Volume

| Metrics | BYDFi | MEXC |

| Supported coins | 600+ | 3,000+ |

| Trading pairs | 1,000+ | 2,000+ |

| Market liquidity | Medium | Deep |

| Trading volume | Lower | High |

BYDFi Vs MEXC: Security Features

BYDFi Security Measures

- Cold-wallet asset storage: Most user funds are stored in offline cold wallets not connected to the internet. Since they’re offline, they’re far less vulnerable to online attacks or hacks.

- Two-factor authentication (2FA): Users are encouraged to enable 2FA to add an extra step when logging in or withdrawing funds. Even if someone gets your password, they would still need your code to access your account.

- Proof of Reserves (PoR): Maintains over 1:1 reserves with periodic public reports to ensure transparency.

- Protection Fund: 800 BTC Protection Fund (as of September 2025) to provide extra safeguards for user assets.

- Multi-Party approvals: Significant transactions require authorization from multiple approvers.

- Segregated accounts: Client assets are separated from company funds and held in dedicated cold storage wallets.

- Security partnership: Partnered with Ledger in February 2025 to launch a co-branded hardware wallet for offline asset protection.

MEXC Security Measures

- Cold and multi-sig storage: The majority of assets are held offline in cold wallets, with multi-signature tech requiring multiple keys for transactions, balancing security and usability.

- Account protection: 2FA via Google Authenticator or email, KYC for high-risk actions, and DDoS protection ensure secure logins and safeguard user funds.

- Monitoring systems: 24/7 AI-driven real-time anomaly detection flags suspicious trades, with automated transaction halts and AML compliance checks.

- Audits and compliance: Regular penetration testing by firms like Hacken, bug bounty programs, and Proof of Reserves verify platform integrity and reserve holdings.

BYDFi Vs MEXC: Affiliate & Referral Programs

| Metric | BYDFi | MEXC |

| Referral bonus | 8,100 USDT | 10,000 USDT |

| Affiliate commission | 70% | 70% |

| Fee rebate | 10% | 50% |

| Additional benefits | The Global Partner Program offers monthly salaries (up to 2500 USDT + 2500 BYD tokens), exclusive gifts, and priority access to products for qualified partners with large communities. | Sub-affiliates receive an additional 10% commission. |

| KYC requirements | Not mandatory | Mandatory |

BYDFi Vs MEXC: User Experience

BYDFi has a beginner-friendly interface and offers seamless onboarding, while MEXC offers a feature-rich platform appealing to experienced traders. Both platforms provide mobile apps, making the platform more accessible, though MEXC handles higher volumes better.

BYDFi has a clean, intuitive design that simplifies trading for novices, with quick registration and an organized interface for spot, futures, and copy trading tools. Meanwhile, after using MEXC, we found its comprehensive dashboard suitable for professional traders, as it provides advanced tools such as detailed charts, more trading pairs, trading bots, and copy trading.

BYDFi Vs MEXC: Customer Support

Both MEXC and BYDFi provide support via live chat, email, ticket systems, and help centers with FAQs and guides. Users can access support directly from the app and web interfaces. If you have a query, you can start with the automated live chat for quick resolutions, especially for frequently asked questions.

For BYDFi, online reviews reveal that the cryptocurrency exchange provides fast deposits, and users appreciate the optional KYC flexibility. Even with these, other users mention slow customer service on complex queries, app glitches during volatility, and limited fiat options outside select regions.

For MEXC customer support, reviewers are mostly inclined to the exchange’s wide coin selection, zero spot trading fees for makers, and quick listings of new projects. Common complaints include account freezes without clear reasons, slower UK/EU support, and verification delays amid high traffic.

Conclusion

MEXC and BYDFi are both reliable crypto exchanges for trading Bitcoin and other cryptocurrencies. MEXC is ideal for both beginners and advanced traders, but seasoned investors may benefit more from the platform’s extensive product offerings and trading options than newbies.

If you’re leaning toward BYDFi after reading this comparison, you can explore the platform yourself and see how its interface, fees, and trading tools match your style. BYDFi is particularly useful if you want a simpler setup, quick onboarding, and access to both spot and futures markets without the heavy complexity of larger exchanges.

You can sign up in a few minutes, try a demo account, or experiment with copy trading before committing any real funds. Also, ensure you do your own research and compare with crypto exchanges to get a balanced view of what to expect from a crypto trading platform.

FAQs

Yes, BYDFi is legal in the US. BYDFi offers limited services in the US due to strict US crypto regulations, particularly regarding derivatives (perpetuals). However, it provides spot trading, copy trading, and fiat on/off ramps by relying on third parties for US fiat.

Yes, MEXC is prohibited in the USA, as the exchange explicitly bans registration and trading for US traders due to strict US crypto regulations. Although US traders can visit the website, MEXC blocks US IP addresses and lists it as a restricted country in its terms, meaning that operating there without a license is illegal for them.

MEXC has lower fees than BYDFi across spot and futures markets. Although both exchanges offer competitive structures with tiered trading volume-based reductions, MEXC’s zero maker fees give it an edge for frequent traders.

BYDFi is more beginner-friendly than MEXC due to its simpler, less congested interface and features like demo trading. MEXC’s advanced tools and vast altcoin selection can overwhelm new users despite its intuitive design.

Both BYDFi and MEXC support free cryptocurrency deposits via multiple networks. BYDFi additionally offers fiat deposits through third-party providers, credit/debit cards, and bank transfers. MEXC focuses primarily on crypto deposits with P2P options for fiat entry in select regions.

For withdrawals, both exchanges offer crypto withdrawals, but BYDFi does not support fiat withdrawals. BYDFi users have to convert to stablecoins like USDT, transfer them to external fiat exchanges, sell for fiat, and then bank transfer the proceeds.

The post BYDFi Vs. MEXC: Which Platform Do Global Derivatives Traders Prefer? appeared first on NFT Plazas.

0

0

Управляйте всей своей криптовалютой, NFT и DeFi из одного места

Управляйте всей своей криптовалютой, NFT и DeFi из одного местаБезопасно подключите используемый вами портфель для начала.