Can $4 Billion Ethereum Buying Undo First Death Cross In 9 Months?

0

0

Ethereum is facing renewed downward pressure as its price slipped below the critical $3,000 level, leaving the altcoin stuck beneath a major psychological barrier.

However, this drop has failed to trigger fear across the market, leading to major buying from ETH holders who appear increasingly bullish about short-term price stability.

Ethereum Holders Buy Heavily

The balance of Ethereum held on exchanges has witnessed a dramatic decline this week. ETH supply on trading platforms fell from 2.77 million ETH to 1.41 million ETH — a staggering 136 million ETH drop. At current prices, this represents nearly $4 billion in buying.

Such a massive outflow reflects confidence from investors who chose to accumulate as Ethereum fell below $3,000, awaiting recovery While exchange outflows sometimes panic selling, the pace and timing of this drop suggest accumulation rather than pessimistic repositioning.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Exchange Balance. Source: Santiment

Ethereum Exchange Balance. Source: Santiment

Macroeconomic momentum has weakened further with a major technical indicator flashing red. Ethereum’s exponential moving averages formed a Death Cross this week — its first in more than nine months. This crossover ends the Golden Cross structure that began in July, which had supported Ethereum’s strength during the summer rally.

Historically, a Death Cross on Ethereum has paved the way for short-term consolidation or minor relief rallies, followed by renewed declines. This pattern increases the probability that ETH may trade sideways before encountering additional downward pressure.

ETH Death Cross. Source: TradingView

ETH Death Cross. Source: TradingView

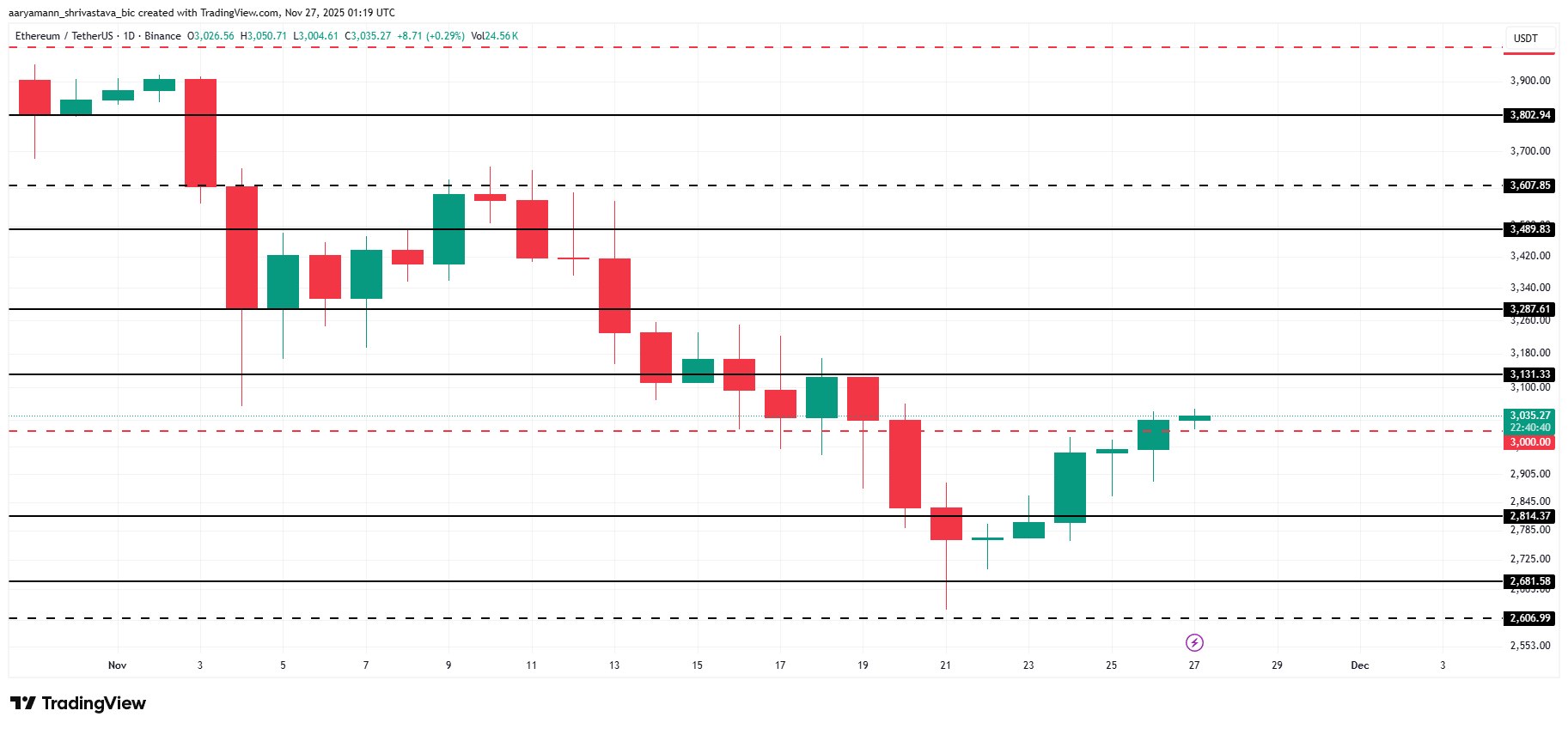

ETH Price May See Volatility

Ethereum is currently priced at $3,035, attempting to flip the crucial $3,000 resistance level. Losing this psychological threshold triggered the wave of $4 billion in buying as investors consider this to be a bottom for ETH and are accumulating to capitalize on the eventual gains.

If broader conditions stabilize, ETH could regain bullish momentum. A decisive reclaim of $3,000 would open the path toward $3,131 and potentially $3,287. This would help Ethereum continue its recovery and rebuild confidence among holders.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

On the other hand, if the market conditions worsen, ETH will likely consolidate under $3,000 and attempt to hold above support at $2,814 or $2,681. If market conditions worsen or investors continue to sell, Ethereum could break below $2,681 and slide toward $2,606 or lower, invalidating the bullish thesis.

0

0

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요시작하는 데 사용하는 포트폴리오를 안전하게 연결하세요.