Ripple’s XRP Slammed by 1000% Liquidation Gap—Is $2.30 Still in Sight?

0

0

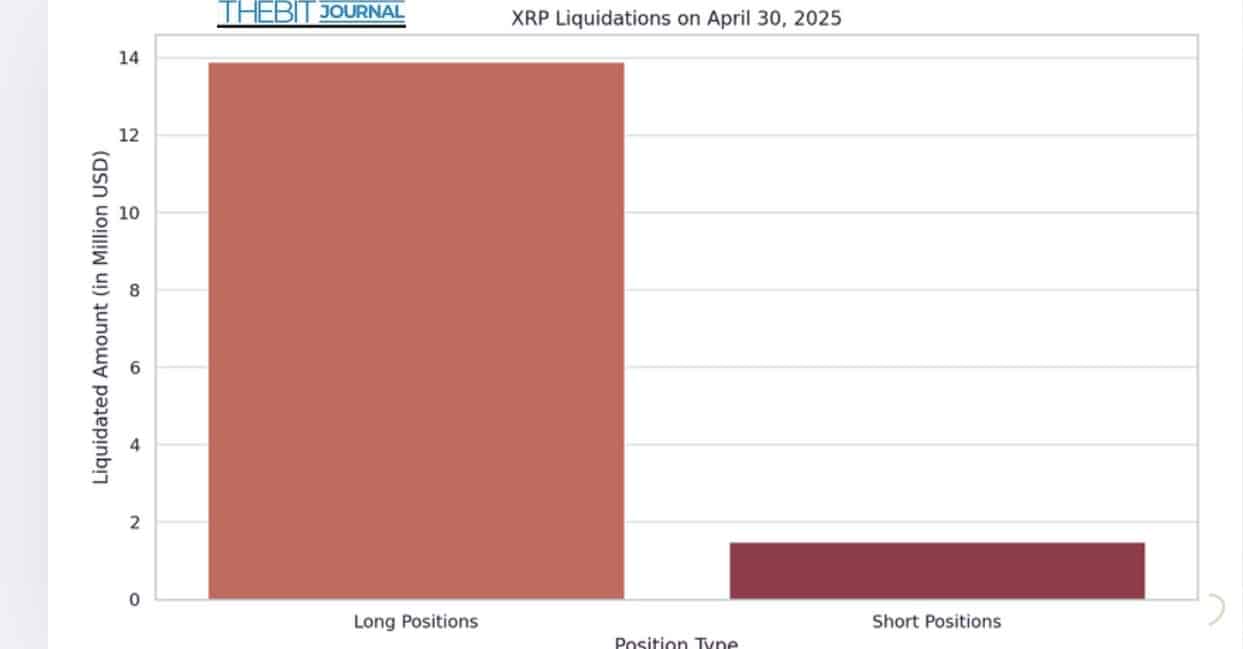

The XRP price falling below $2.20 for XRP has triggered 1000% liquidation imbalances that affect traders in negative ways, as per crypto sources. XRP price drop to $2.15 on April 30 triggered massive long position sell-offs that raised questions about its price path.

XRP Traders Faces a Major Market Wipeout

Within a one-day period, Coinglass tracked $13.9 million in long positions that were cashed out, while the total short positions reached only $1.49 million. The substantial liquidation imbalance reached nearly 1000% because traders had exaggerated expectations for the XRP price’s upward movement.

Analyst Mark Kim from CryptoQuant explains “markets typically reprimand traders who devote excessive leverage positions to single directions.”

Market prices showed strong evidence of an extended upward trend expected by most active traders who hold long positions. Market shifts to the opposite direction lead to fast and significant losses for traders. XRP price value rapidly decreased as it triggered numerous high-risk long position collapses, leading the price to drop to $2.15.

XRP Liquidation Summary

| Metric | Value |

| Price Low | $2.15 |

| Liquidated Long Positions | $13.9 million |

| Liquidated Short Positions | $1.49 million |

| Liquidation Imbalance | ~933% (Long vs. Short) |

| Change in Open Interest | -4% |

XRP Price Finds Temporary Relief at $2.20 Support

TradingView shows XRP price recently achieving $2.20 as its key psychological value before the flash crash occurred. Industry analysts consider this price readjustment to be positive.

“This was a classic flush—weak hands were shaken out ahead of potential upside,” said Elena Choi, senior technical analyst at Kaiko.

The open interest metric tracked active futures contracts of XRP price fell 4% because many traders left the market when liquidation occurred. The market volatility looks likely to stabilize recently yet the system remains exposed to risk because of remaining excessive speculative positions.

Ripple Developments Provide Fundamental Support

Ripple’s recent strategic initiatives provide fundamental support to XRP although its price movements appear inconsistent. The Securities and Exchange Commission under the United States has officially placed a suspension on their ongoing litigation against Ripple based on a Bloomberg report. Favourable outcomes from this development may enable XRP price to achieve acceptance by U.S. financial institutions.

Ripple introduced the stablecoin RLUSD and it achieved a market capitalization of over $300 million. Ripple’s planned acquisition of Circle for $5 billion signifies its desire to enter stablecoin markets despite opposition labeling this price as insufficient.

Multiple financial organizations have applied to regulators about launching XRP-based spot ETFs although the speculation regarding these XRP-based spot ETFs remains ongoing. The analysts at ETF Institute predict a 80% likelihood that regulators will approve the spot ETFs during the third quarter of 2025.

Technical Indicators Point to Uncertainty

The technical data shows XRP price trading between $2.15 and $2.30 where most indicators present a neutral market condition. Based on the Relative Strength Index (RSI) value of 52.47 there is no established market direction.

The Moving Average Convergence Divergence indicator indicates a minimal bullish tendency in the market. Presently all short-term moving averages continue to signal buying signals while longer-term 200-day SMA and EMA operate near the $2.00 price point as a support system.

XRP will restart its growth trajectory if it manages to sustain its support above $2.15 and climbs above $2.30. The XRP price of $2.15 serves as a critical threshold as XRP fails to hold it which could spark another round of long position liquidations unless market sentiment stays positive.

Key Technical Levels for XRP (as of May 1, 2025)

| Indicator | Value/Status |

| RSI | 52.47 (Neutral) |

| MACD | Slight Bullish |

| 10/20/30-Day Averages | Buy Zone |

| 200-Day SMA/EMA | Support at $2.00 |

| Key Support Level | $2.15 – $2.20 |

| Resistance Level | $2.30 |

High Leverage Remains a Concern

High traders’ leverage represents the main issue affecting the XRP market. The market stays at high risk because traders maintain an unstable position equilibrium while currently trading near $2.20.

At present XRP holds the seventh position among cryptocurrencies in terms of its market capitalization as recorded on CoinMarketCap. Several factors including product interest from Ripple and ETF approval potential provide fundamental support to the Ripple ecosystem. Market participants should proceed with careful consideration due to excessive trading leverage that leads to price fluctuations.

Conclusion: XRP’s Future Still Uncertain Amid Mixed Signals

XRP’s recent price movement proves that high-leverage trading comes with significant risks together with the need for maintained market equilibrium. The future price action of XRP is mostly influenced by regulatory developments combined with ETF status decisions and general market sentiment.

FAQs

-

The XRP price declined under $2.20 for what reason?

XRP suffered from massive long position liquidations reaching $13.9 million on one day, while short position liquidations only amounted to $1.49 million, thereby causing a 1000% imbalance effect.

-

Will XRP experience quick price recovery in the near future?

XRP has reached the $2.20 support position in a recovery effort. Ripple’s future recovery potential appears higher when prices rise above $2.30 but strong market risks persist because of excessive leverage.

-

What does the future hold for XRP and Ripple?

The long-term growth potential for Ripple depends on its stablecoin RLUSD development as well as ETF applications, alongside the SEC lawsuit suspension, even though market volatility persists.

Glossary

Liquidation Imbalance: A substantial number of trader positions being liquidated shows investor preference toward either long or short positions through what is known as a liquidation imbalance.

Long Bias: The asset market expects price appreciation according to traders who display a Long Bias.

Open Interest: The total number of outstanding derivative contracts.

RSI: A momentum indicator known as RSI (Relative Strength Index) serves traders in their technical analysis.

MACD (Moving Average Convergence Divergence): A trend-following momentum indicator.

The SMA/EMA: functions as technical trend indicators that use Simple and Exponential Moving Averages.

References

Coinglass: XRP Liquidation Data

Bloomberg: Ripple Legal Updates

TradingView: XRP Technical Charts

CoinMarketCap: XRP Market Overview

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

Read More: Ripple’s XRP Slammed by 1000% Liquidation Gap—Is $2.30 Still in Sight?">Ripple’s XRP Slammed by 1000% Liquidation Gap—Is $2.30 Still in Sight?

0

0

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요시작하는 데 사용하는 포트폴리오를 안전하게 연결하세요.