BlackRock Ethereum Staking ETF Offers 82% Yield Share

0

0

This article was first published on The Bit Journal.

BlackRock Ethereum staking ETF moved a step closer to launch after a new filing detailed its reward structure. The asset manager confirmed it plans to take an 18% share of staking rewards with Coinbase. Investors would receive the remaining 82% of gross yield.

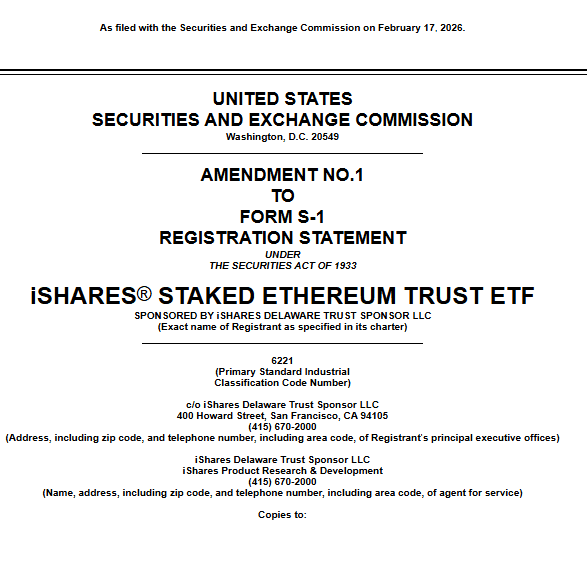

The disclosure was made in an amended S-1 filed with the U.S. Securities and Exchange Commission on Feb. 17. The document outlines fees, staking allocation, and operational roles. The structure has sparked debate across crypto and traditional finance circles.

BlackRock Ethereum Staking ETF Stakes Up to 95%

BlackRock Ethereum staking ETF will allocate most of its Ethereum holdings to staking. The filing states that between 70% and 95% of assets may be staked under normal conditions. The rest will remain liquid to meet redemptions and operational needs.

Investors will receive 82% of gross staking rewards. BlackRock and Coinbase will share the remaining 18%. Shareholders will also pay a sponsor fee ranging from 0.12% to 0.25% each year.

The trust has already been seeded with $100,000. That equals 4,000 shares priced at $25 each. Nasdaq has applied to list the fund.

Institutional Push Into Regulated Staking Products

BlackRock Ethereum staking ETF is designed as a yield-generating version of its existing spot Ethereum product. The structure allows investors to earn blockchain rewards without running validators. It also removes the need to manage private keys or wallets.

The ETF enters a growing field of regulated crypto yield products. Institutional demand for structured exposure to staking has increased over the past year. The proposal reflects that shift.

Reward Structure and Investor Impact

Ethereum staking yields have averaged close to 3% annually based on early 2026 data. The actual return for investors will be lower after the 18% allocation and sponsor fees.

If staking yields reach 4%, investors would receive about 3.28% before sponsor costs. BlackRock and Coinbase would retain 0.72% of the gross yield. Final returns will depend on network participation and market conditions.

Operational Role of Coinbase

Coinbase will serve as prime execution agent and custodian. The firm will handle staking operations through its institutional division. It may pass part of its share to third-party validators and infrastructure providers.

This setup centralizes staking management under a regulated entity. It offers operational simplicity. However, it also reduces direct investor control.

Institutional Expansion Strategy

BlackRock has expanded rapidly in digital asset ETFs. Its Bitcoin and Ethereum spot funds attracted large inflows after launch. The firm has positioned itself as a major player in regulated crypto investment products.

BlackRock’s Ethereum staking ETF builds on that strategy. It targets investors seeking predictable yield in a familiar exchange-traded format.

Centralization Concerns Surface

Vitalik Buterin raised concerns during the same week as the filing. He warned that growing Wall Street participation in staking could increase centralization risks. Large asset managers could accumulate significant validator influence.

Critics argue that institutional products may shift control away from independent validators. Supporters respond that regulated funds add transparency and liquidity.

Competitive Landscape

Grayscale Investments already operates Ethereum-related ETFs that earn yield through staking. VanEck has also submitted filings for a staked Ethereum ETF.

Competition may pressure fees lower over time. Investors will compare yield efficiency and cost structures. The 18% allocation could face scrutiny as alternatives expand.

Regulatory Path and Market Outlook

The amended S-1 provides detailed disclosures on risk and operations. Nasdaq’s listing application signals regulatory engagement. Approval would further integrate staking into traditional financial markets.

BlackRock’s Ethereum staking ETF represents a new stage in crypto ETF evolution. It blends blockchain yield with established fund structures. Its reception may influence how future staking products are priced and managed.

Conclusion

BlackRock’s Ethereum staking ETF outlines a clear 82/18 reward split and layered sponsor fees. The structure offers convenience and regulatory oversight. It also reduces net yield compared to direct staking.

The proposal highlights growing institutional interest in Ethereum rewards. At the same time, it revives debate about fees and network concentration. The final outcome will depend on regulatory approval and investor demand.

Appendix: Glossary of Key Terms

Staking: The process of locking up cryptocurrency to help validate blockchain transactions and in return, receiving rewards.

Exchange-traded fund (ETF): An investment fund that trades on exchanges, similar to a stock.

Gross Staking Yield: The complete staking rewards made prior to fees or charges.

Sponsor Fee: The annual fee for managing the fund is paid to the fund provider.

Custodian: An institution that holds digital assets in a secure manner for investors.

Validator: A user of the network that is responsible for validating transactions and securing the network.

Frequently Asked Questions About BlackRock Ethereum staking ETF

1- What is BlackRock Ethereum staking ETF?

It is a proposed exchange-traded fund that stakes Ethereum to generate yield for investors.

2- How are rewards divided?

Investors receive 82% of gross staking rewards. BlackRock and Coinbase share 18%.

3- Are there additional fees?

Yes. Shareholders pay a sponsor fee between 0.12% and 0.25% annually.

4- How much ETH will be staked?

Between 70% and 95% of holdings may be staked under normal conditions.

References

Read More: BlackRock Ethereum Staking ETF Offers 82% Yield Share">BlackRock Ethereum Staking ETF Offers 82% Yield Share

0

0

Gestisci cripto, NFT e DeFi in un unico luogo

Gestisci cripto, NFT e DeFi in un unico luogoConnetti in sicurezza il portafoglio che usi per iniziare.