Crypto Market News Today, February 5: I Am Free, Freefalling! 8% Drop in Bitcoin and Ethereum Price

0

0

Bitcoin price has stepped off a cliff, and we are free-falling. So, congrats bears!

Just in a single session, Bitcoin tumbled by 8% to $70,000 level, dragging the Ethereum price down to under $2,100. As cruel as it is to us, this likely happens because of the wobbling global tech stocks. Liquidity is thinning out, and the Nasdaq had just wrapped up a bruising two-day rout. Crypto has not decouple itself from equity yet this cycle.

Bitcoin price is now flirting with levels last seen in November 2024, while Ethereum looks even shakier thanks to underwhelming ETF inflows and crowded leverage.

Now, is the next pump just a dead cat bounce if it comes, or is this really the crypto bottom? But knock knock rock lovers, precious metals aren’t doing any better.

Bitcoin Price Under Pressure and Puts People on The Street

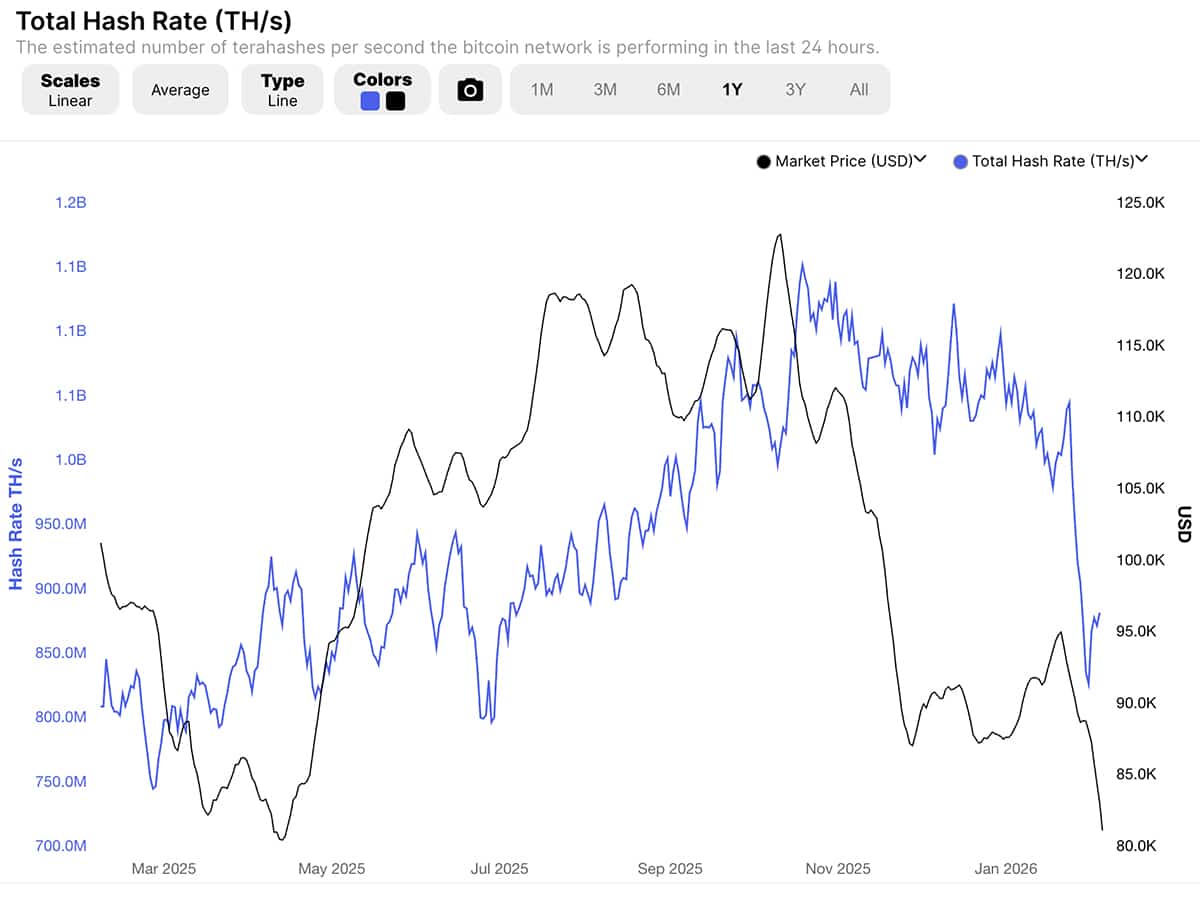

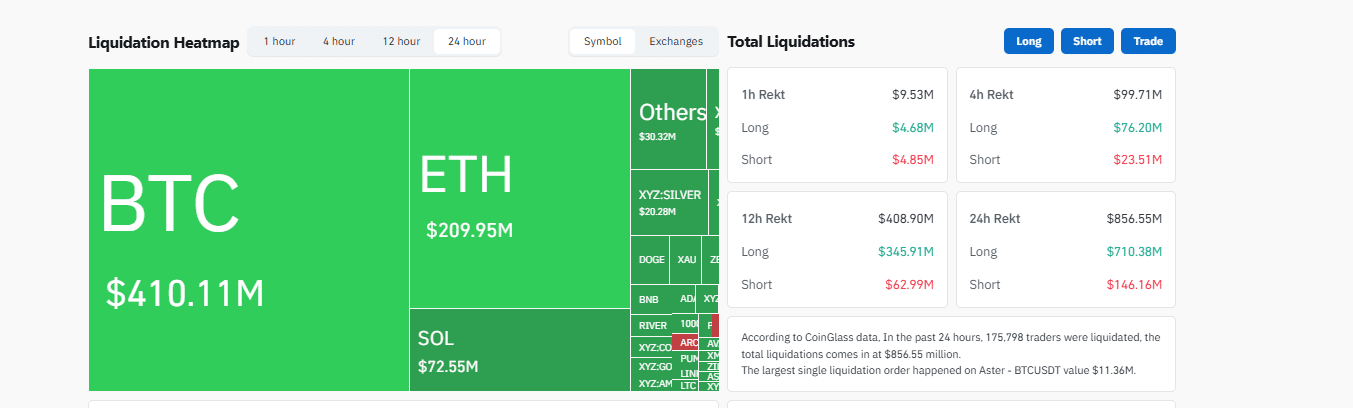

From a technical angle, Bitcoin price turned decisively bearish once it lost the $71,000 support zone. Sellers are taking control, and miners are stopping their operations. Block times stretched toward 20 minutes, squeezing profitability and putting stress as more than $700 million in long leveraged positions were liquidated, ripping off a financial bandage in just a single violent move.

Fear is loud right now, and as usual, we get another Tether and Binance FUD. USDT briefly slipped to “$0.998,” and bears say it’s depegging. Good joke when nothing is interesting, right?

BREAKING: Tether tumbles to $0.9980, its weakest peg in over 5 years. Some analysts warn a full untethering could hit soon, which could cripple the crypto market, as 87%+ of trading volume flows through USDT. pic.twitter.com/X1eUwFH4Qs

— SwanDesk (@SwanDesk) February 5, 2026

Then there is renewed talk around Brock Pierce, helping the bears to exceed their target. But wait, history also has a sense of humor. In prior cycles, these moments of panic lined up well with local Bitcoin price bottoms, once equity markets stopped bleeding.

Multicoin Capital co-founder Kyle Samani stepping away to focus on AI and robotics fueled speculation about capital rotating out of crypto. Then, the NexFundAI wash-trading scandal, which led to charges against 15 entities, took another hit.

0/ A personal update

I have decided to step back from @multicoin. It's a bittersweet moment for me because my time at Multicoin has been some of the most meaningful and rewarding of my life. That said, I am excited to take some time off and explore new areas of technology.…

— Kyle Samani (@KyleSamani) February 4, 2026

Another bearish news comes from Bhutan, the country reportedly shifted about $22 million worth of Bitcoin to exchanges during the dip. Bhutan’s decision comes while political heat rose, US lawmakers probed crypto ties linked to World Liberty Financial and a $500 million UAE stake.

If You’re In It to Get Rich, You’ve Already Lost – Charles Hoskinson of Cardano

DISCOVER: 10+ Next Crypto to 100X In 2026

Ethereum Price Lose Footing

Ethereum broke below $2,100 price level before staging a bounce above, if we call it a bounce. More than $210 million in ETH positions were liquidated as long positions keep being butchered.

In this environment, the Ethereum Price needs a real catalyst, or maybe more, to reclaim momentum. The FUD around Vitalik’s selling is just not helping. If this were my opinion piece, I’d say it’s baseless.

Vitalik sold 34.091 ETH ($76.29k)

Vitalik sold 70.313 ETH ($157.34k)

Vitalik sold 11.364 ETH ($25.35k)

Vitalik sold 16.529 ETH ($36.83k)

Vitalik sold 70.313 ETH ($158.74k)

Vitalik sold 34.091 ETH ($76.96k)

Vitalik sold 70.313 ETH ($159.37k)

Vitalik sold…

— shah (@shahh) February 4, 2026

If the tech selloff drags on, though, bearish scenarios can further push the Bitcoin price to $60,000 and Ethereum closer to $1,800. We talked about it yesterday, the Ethereum price bottom range is at $1,800 at its lowest, according to me.

Now, on the flip side, flushed leverage historically set the stage for rebounds. Some optimists are already eyeing $90,000 for Bitcoin. Mining difficulty is expected to drop around 14%, easing pressure and potentially restoring hashpower, as it is not looking good for miners.

(source – Blockchain)

Stablecoin negotiations with banks could also calm regulatory nerves. For now, crypto remains tightly correlated with equities, but it could decouple anytime. If you are in love with crypto and want to stay, DCA is the best bet. Again, this is not financial advice.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Clearly, it is a rough day on the charts. Bitcoin, Ethereum, and most of the top 10 assets are in the red, extending losses from the end of 2025. Whether this state of affairs will continue remains to be seen. What’s evident, however, is that the Bitcoin price is dropping so fast and by so much that gains from late 2024 have been completely reversed. There are now concerns that the BTC USD price could sink below today’s lows toward $50,000, a key psychological support level. This possibility alone would be a massive blow to the industry, likely wiping out tens of billions of dollars worth of leveraged bets. Thus far, as the Bitcoin price tanked towards the $70,000 level, over $850M in leveraged trades were liquidated on multiple exchanges, mostly Binance, Bybit, and Hyperliquid. (Source: Coinglass) These liquidations affected more than 175,000 traders across these platforms. A big chunk of these liquidations was Bitcoin and Ethereum longs. Bhutan, a tiny South Asian country, reportedly sold about $22.4 million worth of Bitcoin this week, extending a quiet but steady pattern of state-level BTC USD selling. With the Bitcoin price now trading dangerously close to $70,000, many are left wondering whether crypto will recover in 2026. Arkham Intelligence data has shown that Bhutan has been selling Bitcoin

accrued from mining activities in $50M clips since September 2025, and with its latest sales, the nation still holds $405M in BTC at current prices of $71,100. Bhutan is selling Bitcoin. pic.twitter.com/WDuUQmBZsU — Arkham (@arkham) February 4, 2026 This mix of falling prices and sovereign nations selling can feel scary. Bhutan’s sale of its stake, while significant, doesn’t compare to the US, China, and the UK, which hold far more BTC than Bhutan, and if they began selling, the Bitcoin price would likely crash even harder. The Fear and Greed Index is currently sitting at 12/100, right in the depths of ‘Extreme Fear’ and underscores current market sentiment as traders like you and I wait for a local bottom to form and better days to come. Read the full story here. These are hard times for crypto holders as Bitcoin keeps falling again and again, now hitting a new yearly low at $70,500. Ethereum is also following the same path, briefly trading below $2,100. A company that went full ETH maxi is now watching losses pile up. Tom Lee’s ETH exposure hit BitMine stock, with BMNR sliding alongside ETH and leaving about $6 billion in paper losses. Remember Tom lee? he bought ETH at 4k, now he’s down $6,700,000,000 (-43.04%) on $ETH holdings. pic.twitter.com/RWcLi4JiTO — hødl (@hodl_strong) February 2, 2026 By late 2024, the company transitioned from a traditional mining firm into an “ETH treasury” strategy, adopting a philosophy they call the “Alchemy of 5%.” Their goal is to eventually own 5% of the total Ethereum supply. BitMine is not the only company to take this path. After spot Ethereum ETFs won approval in 2024, large institutions poured more than $10 billion into regulated ETH products. Now, those same companies are facing real pressure as prices continue to plummet, especially after Treasury Secretary Scott Bessent made it clear that banks will not bail out crypto-linked firms. Read the full story here. Public companies are not just assessing crypto potential; they are buying in. Since the approval of spot ETFs in 2024 and throughout 2025, multiple firms in the US have been actively purchasing and adding top cryptos to their balance sheets. Strategy, formerly MicroStrategy, is well known for its Bitcoin holding plans. They now hold over $50Bn of the digital gold. Though they might be under pressure now that their Bitcoin cost basis is higher than spot rates, they are not capitulating and are inspiring other firms. Unlike Bitcoin, holding HYPE or ETH and staking them translates to consistent yearly or monthly revenue. It is a strategy that Hyperion DeFi, a public firm trading on the Nasdaq (HYPD), is tapping into to boost revenue. At press time, HYPE is one of the top performers, up nearly +3% in the last 24 hours. Read the full story here.Serious $50K Bitcoin Warning Rattles Market as Crash Fears Grow

Bhutan Keeps Selling BTC USD: Will Crypto Recover in 2026?

Tom Lee Defends BitMine’s $6B ETH Loss

Hyperliquid Treasury Eyes Yield by Using HYPE as Options Collateral

The post Crypto Market News Today, February 5: I Am Free, Freefalling! 8% Drop in Bitcoin and Ethereum Price appeared first on 99Bitcoins.

0

0

Gestisci cripto, NFT e DeFi in un unico luogo

Gestisci cripto, NFT e DeFi in un unico luogoConnetti in sicurezza il portafoglio che usi per iniziare.