Bitcoin and Ether ETFs See Big Inflows as Fed Chair Powell Signals Rate Cuts

0

0

The crypto market has seen a notable shift in investor sentiment as the Federal Reserve Chief Jerome Powell hinted at potential rate cuts this year. Accordingly, US spot Bitcoin and Ether ETFs have recently experienced inflows, especially in contrast to the outflows on previous days.

After Fed Chair Powell signals a dovish monetary policy stance, investors are positioning for a future rate cut, which could help to keep crypto prices up.

As the Fed’s actions will impact the future of global financial markets, investor attention is on these developments. The inflows into Bitcoin and Ether ETFs indicate interest in digital assets and offer investors a chance to diversify their portfolios and profit.

Fed Chair Powell Reveals Dovish Approach: What It Means for Crypto?

On Tuesday, Fed Chair Powell delivered the much-awaited speech ahead of the central bank’s next pivotal meeting. He indicated that the Fed is nearing the end of its balance sheet reduction effort, also known as “quantitative tightening”, since reserves have moved to a point slightly above its definition of “ample liquidity.”

Additionally, with the labor market starting to weaken, it can also be inferred from Powell’s comments that the Fed is planning for a potential decrease in rates to offset the risks of inflation and unemployment.

Although the bank has already hinted at possible interest rate reductions, concerns linger amid political chaos and economic data blackout. The current government shutdown has severely challenged the Federal Reserve’s decision because important reports like the jobs report for September weren’t received in a timely fashion.

The following report on consumer prices (CPI) is scheduled for release on October 24, just days before the Federal Open Market Committee (FOMC) meeting on October 28-29, where decisions on monetary policy will be made in heavy reliance on this report.

Although there is still a great deal of uncertainty, Fed Chair Powell’s speech has triggered a new round of excitement within the crypto market. Vincent Liu, CIO of the Taiwan-based company Kronos Research, noted,

“An October rate cut will have markets taking flight, with crypto and ETFs seeing liquidity flow and sharper moves. Expect digital assets to feel the lift as capital seeks efficiency in a softer rate environment…Easing US-China tariff tensions and a renewed debasement trade echoed in gold’s strength are fueling fresh demand for digital assets.”

Crypto Market to Rebound

The crypto market is currently at a critical point, having slightly recovered from the recent crypto market crash. Though the industry has soared by 1.35% to reach $3.84 trillion, top assets are still trading in the red zone, facing significant losses.

The potential cuts to interest rates from Fed Chair Powell are going to create a new paradigm for the crypto industry. It will increase liquidity while bringing more clarity for capital allocators into a higher-risk asset like cryptocurrencies. This anticipated liquidity will increase both demand and supply, leading to higher prices for digital assets, specifically Bitcoin and Ether.

Bitcoin and Ether ETFs See Increasing Inflows

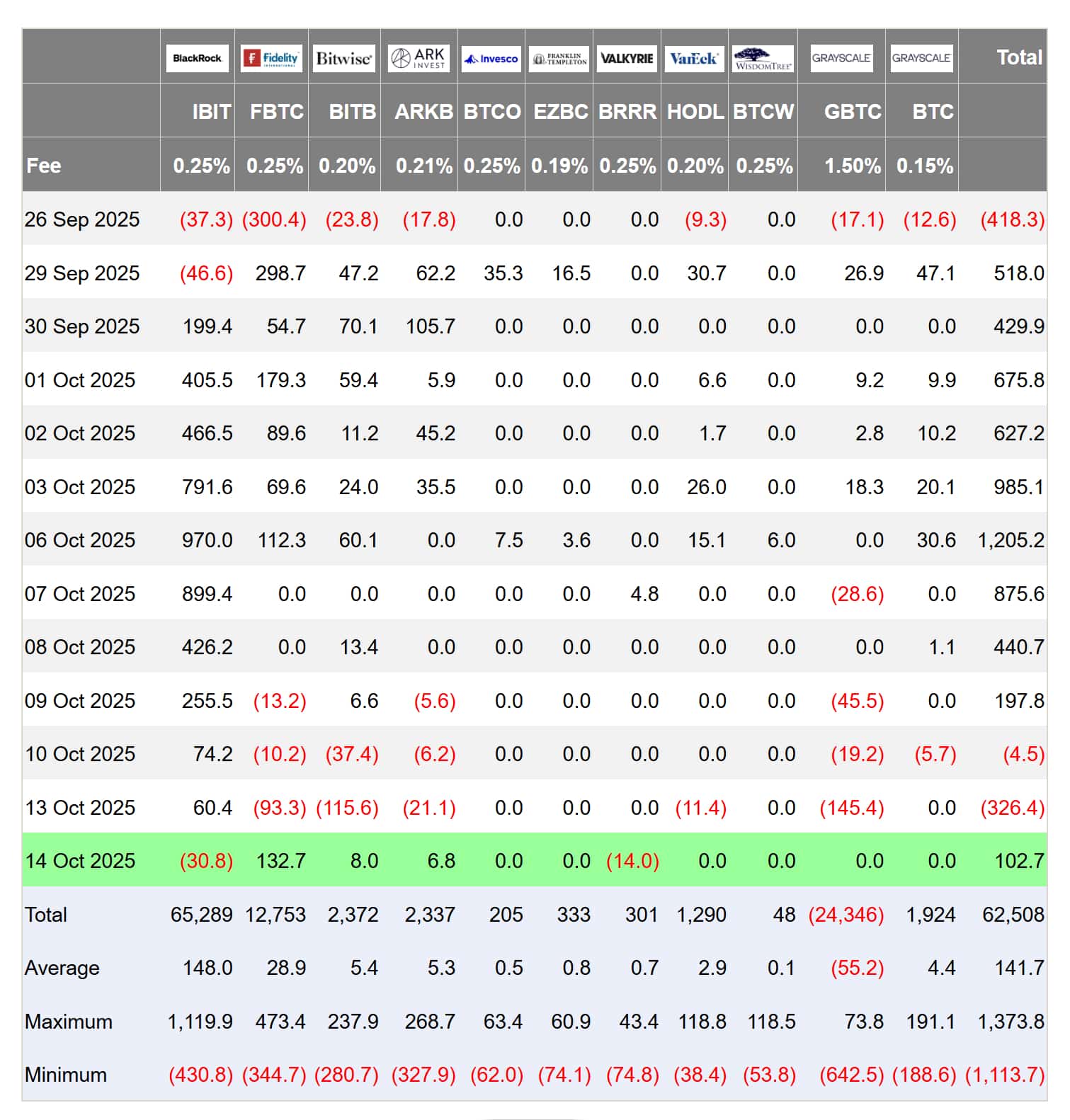

In response to the Fed Chair Powell’s dovish stance, US Bitcoin and Ether exchange-traded funds saw significant inflows on Tuesday. This influx stands in contrast to the previous day’s massive outflows. Following the market crash, these funds together experienced a substantial negative flow of over $755 million on Monday.

The latest reports state that the Bitcoin ETFs recorded $102.58 million in net inflows, a notable rebound from the $326 million outflow on the previous day. Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the gains with $132.67 million in inflows. In contrast, BlackRock’s iShares Bitcoin Trust (IBIT) saw a modest outflow of $30.79 million.

Meanwhile, Ether ETFs also saw a turnaround, with $236.22 million in net inflows after a $428 million outflow on Monday, driven largely by Fidelity’s Ethereum Fund (FETH) with $154.62 million in inflows.

Conclusion

To sum up, there may now be a second wave of enthusiasm in the crypto market, thanks to the fact that the Federal Reserve may cut interest rates, as shown by the inflows into US Bitcoin and Ether ETFs. The expectation of easier monetary policy should drive a crypto market recovery, as greater liquidity and pent-up investor demand increase prices.

Frequently Asked Questions

- Why did Bitcoin and Ether ETFs see sudden inflows?

Due to Fed Chair Jerome Powell noting the potential for interest rate cuts, which increased investor confidence for risk-on assets like crypto. - How does interest rate reduction affect the crypto market?

Lowering rates increases liquidity and leads to an increased investor’s willingness to deploy capital into assets like Bitcoin and Ether. - Is a crypto market rebound expected in the near future?

Yes, a market rebound is expected based on the ETFs continued inflow, and a more supportive monetary policy environment.

Glossary

Federal Reserve: The central bank of the United States, tasked with implementing monetary policy.

Dovish stance: A type of policy that prefers low interest rates and stimulus instead of a restrictive policy.

Exchange-traded fund or ETF: A fund that is listed on stock exchanges that tracks the price of an underlying asset, such as Bitcoin or Ether.

Net inflows: Net Inflows refer to the money flowing into the investment fund after redemptions.

Liquidity: It refers to how quickly and efficiently the assets can be bought and sold in the market without causing the price to move significantly.

Read More: Bitcoin and Ether ETFs See Big Inflows as Fed Chair Powell Signals Rate Cuts">Bitcoin and Ether ETFs See Big Inflows as Fed Chair Powell Signals Rate Cuts

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.