Tether Amasses 140 Tons of Gold in Swiss Vault Strategy

0

0

This article was first published on The Bit Journal.

Tether has drawn global attention after its chief executive outlined an ambitious plan that blends digital liquidity with rising gold reserves. The comments intensified interest across financial classrooms and crypto circles, as many now wonder whether one private issuer can influence how value is stored in a world debating the future of the dollar.

According to the source, the company’s deeper push toward physical assets reflects a long-term response to geopolitical friction and shifting monetary confidence. Growing market uncertainty has pushed more investors toward hard assets, making the timing of this development especially important.

Analysts note that both digital instruments and traditional commodities are now moving closer in alignment. As this overlap deepens, the company’s commitment to large-scale gold reserves signals a hybrid model in which physical value and blockchain systems support each other.

A Swiss Bunker, 140 Tons of Gold, and the Rise of a Private Gold Power

The organization has accumulated close to 140 tons of gold reserves, stored inside a Cold War-era nuclear bunker in Switzerland. An in-depth financial report published externally shows that this collection ranks among the most significant private bullion holdings outside central banks and institutional investment vehicles. The estimated value now exceeds 23 billion dollars, driven by gold trading above five thousand dollars per ounce.

Gold’s rapid surge forms part of a broader trend. Research from a leading global market resource indicates that precious metals are experiencing their most substantial rally since the 1970s, a period marked by monetary shocks and inflation.

This backdrop strengthens the rationale for the company’s weekly purchases of 1 to 2 tons of gold. Its chief executive confirmed that this pace will continue for months, highlighting a strategy built around durability and trust.

A Strategic Jump Into Trading and Market Influence

The gold reserves are not intended to stay idle. The company plans to participate directly in active bullion trading, entering a space long dominated by major banks. Two senior gold traders from a prominent banking group recently joined the organization to lead this expansion.

Their arrival adds deep market experience in liquidity cycles, pricing behavior, and arbitrage opportunities. An independent economic analysis accessible through a global research site explains that institutions with extensive metal holdings often influence price flows when they enter active markets.

This aligns with the company’s ambition to operate at the intersection of commodities and digital finance. By pairing token liquidity with physical reserves, the organization positions itself to affect both blockchain adoption and traditional trading networks.

Stablecoin Strength, Equity Purchases, and a Growing Financial Blueprint

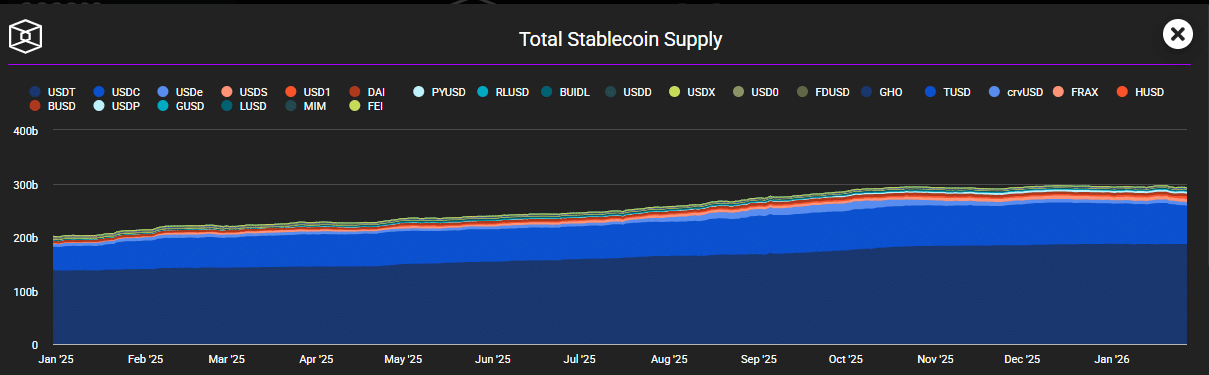

The stability behind this expansion comes from the company’s dominant stablecoin, which remains the largest in circulation worldwide. Its scale provides the organization with the liquidity needed to reinvest aggressively. This includes equity positions in Elemental Altus Royalties and Gold Royalty Corp, two Canadian-listed firms tied to mining royalties and resource exploration.

These moves signal a broader strategy that looks beyond reserves toward supply-chain influence and long-term asset growth. The gold-backed token remains a leading product, holding more than half of the global market for metal-backed stablecoins. Meanwhile, the launch of USAT, a U.S.-compliant dollar-pegged token, expands the company’s regulated footprint.

The appointment of Bo Hines, a former White House crypto policy advisor, strengthens this new division. This layered structure reinforces the organization’s vision for bridging traditional assets, digital settlement channels, and regulated financial environments.

Conclusion

The company’s expanding gold reserves, Swiss vaulting strategy, trading ambitions, equity investments, and stablecoin ecosystem reveal a bold blueprint for the future. As global uncertainty grows and demand for safe-haven assets rises, this hybrid approach may shape how digital and physical value interact.

Some Market analysts believe that this approach can even affect financial confidence well into the future–or ever, once global markets continue to resort to war alternative treasures of value.

Glossary of Key Terms

Stablecoin: A digital token designed to stay at a fixed value.

Bullion Market: The global marketplace for trading precious metals.

Fiat Currency: Government-issued money not backed by physical assets.

Arbitrage: Earning profit by exploiting price differences across markets.

FAQs About Gold Reserves

Why is the company buying gold?

It aims to build stability and long-term confidence through gold reserves.

Where is the gold stored?

The reserves are stored in a secure Swiss bunker facility.

Why enter the gold trading market?

Trading may increase profits and expand influence in traditional finance.

Does this affect stablecoin users?

More substantial reserves improve trust and long-term backing.

Source

Read More: Tether Amasses 140 Tons of Gold in Swiss Vault Strategy">Tether Amasses 140 Tons of Gold in Swiss Vault Strategy

0

0

Tüm kripto, NFT ve DeFi varlıklarınızı tek bir yerden yönetin

Tüm kripto, NFT ve DeFi varlıklarınızı tek bir yerden yönetinKullanmaya başlamak için portföyünüzü güvenli bir şekilde bağlayın.