HTX (Huobi) Review 2025: Is This Exchange Still Worth Using?

0

0

Anyone looking for a reputable cryptocurrency exchange is spoilt for choice since there are many options for traders to select from. However, with so many choices, choosing the right one becomes a tricky affair. In this HTX exchange review, we take you through an all-inclusive tour of the exchange, previously traded as Huobi.

By the time you finish reading our guide, you’ll have had a perfect picture of HTX exchange, its history, and key features. We also reveal its benefits, fee structure, and drawbacks. Since an informed decision is key, please read our review to determine whether HTX is a safe option for you.

HTX Exchange Review: At a Glance

| Crypto Exchange | HTX, formerly Huobi |

| Launch year | 2013 as Huobi, became HTX in 2023 |

| Founder | Leon Li, a former Oracle engineer and graduate of Tsinghua University. |

| Headquarters | Victoria, Seychelles |

| Trading options | Spot trading

Margin trading (5x) Futures trading (200x) Copy trading Trading bots |

| Supported cryptocurrencies | 700+ |

| Global presence | 160+ countries |

| Security measures | Cold storage, Security Reserve Fund, Proof of Reserves (PoR), Regular security audits, Advanced encryption, DDoS protection, Two-Factor Authentication (2FA), Know Your Customer (KYC) and Dynamic permission validation: |

| Accepted Payment Methods | Credit/debit cards, Bank transfers, local payment systems like iDeal, SEPA, PIX, UPI and Payment gateways like Alchemy Pay, Banxa, Mercuryo, and Simplex. |

| Native Token | HTX token |

| Fiat currencies supported | 100+ fiat currencies, including USD, EUR, and CAD among others |

| Trading fees | Spot: 0.2% maker/taker Futures:- USDT-Margined Contracts: 0.02% maker, 0.06% taker – Coin-Margined Contracts: 0.02% makers, 0.05% takers |

| Restricted Countries | United States, Mainland China, North Korea, Singapore, Iran, Cuba, Syria, Venezuela and other countries. |

| Mobile App Ratings | 4.0 ★ on Google play 3.7 ★ on Apple Store |

What is HTX (Huobi Rebrand)?

HTX is a centralized global cryptocurrency exchange platform, originally based in China, where it was founded in 2013 by Leon Li, a former Oracle computer engineer. It began as a Bitcoin trading hub under the name Huobi and quickly became one of the top exchanges in the Chinese crypto market. However, following China’s 2017 ICO ban, the platform moved its operations overseas. In 2023, Huobi officially rebranded to HTX and is now registered in Seychelles. While it previously had its headquarters in Singapore and expanded across various Asian and global markets, HTX is currently blocked in several countries, including the United States, North Korea and mainland China.

HTX currently supports over 700 cryptocurrencies and offers competitive fees and trading tools ideal for both beginners and expert traders. From copy trading to staking and API integration, HTX provides a wide range of advanced trading strategies. Traders can use the desktop browser version designed for active traders in need of advanced social trading tools and bots. Alternatively, the HTX mobile App is offering a simple, user-friendly interface for users interested in trading on the move. The platform’s affordable fee structure has made it a popular option among day traders looking to maximize their gains.

Pros of HTX

- Wide Selection of Supported Assets: Supports over 700 cryptocurrencies and at least 800+ trading pairs.

- Advanced Trading Tools: Offers advanced tools like futures, margin, copy trading, and automated trading bots.

- High Liquidity: The platform’s daily trading volumes exceed $4 billion.

- Security Features: Offers robust security features such as cold storage, 2FA, PoR, and withdrawal whitelists.

- Mobile App: HTX has an intuitive, user-friendly, and feature-rich mobile App for on-the-go trading.

- HT Token Benefits: Users of the native HT token enjoy fee discounts and staking rewards.

Cons of HTX

- Mixed User Reviews: Websites like Trustpilot have given low ratings, citing withdrawal issues and poor customer support.

- Restrictions: Services are not available in China and the US due to regulatory constraints.

- Past Security Incidents: While they have been addressed, past security breaches may concern cautious users.

- High Withdrawal Fees: Relatively high withdrawal fees, especially for BTC and ETH.

HTX Review: Trading Features

HTX users can enjoy a wide range of trading features, including spot and futures trading, margin and copy trading, and numerous automated tools. Among the most popular features are the following:

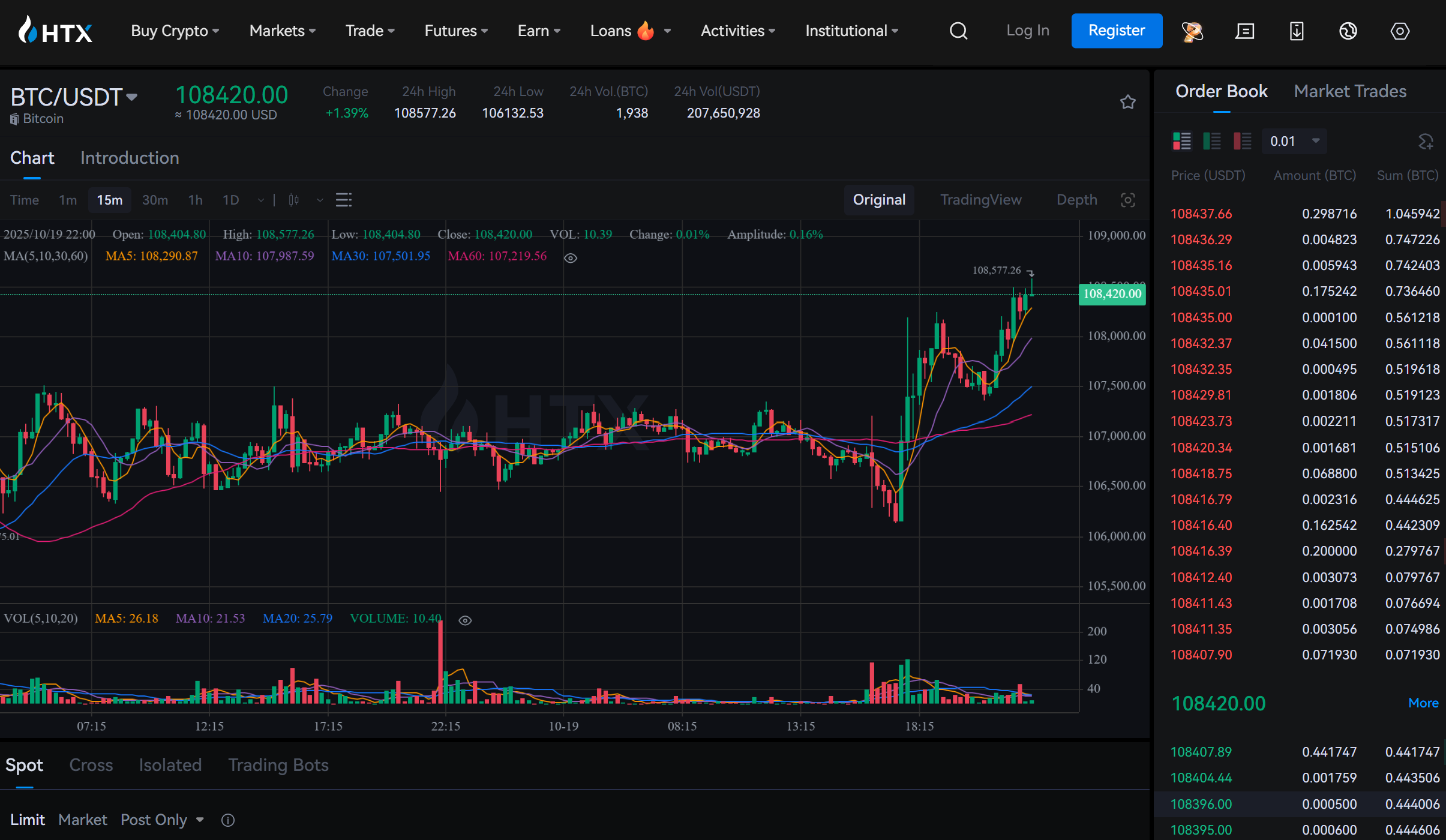

1. Spot trading

HTX spot trading involves the immediate buying and selling of crypto at the current market price on the exchange. Spot trading differs from derivatives trading since the trader owns the underlying asset directly. The feature works via the “spot price”, also known as the current market price driven by real-time supply and demand between buyers and sellers.

2. Margin Trading

The Margin trading feature enables users to boost their trading power by borrowing funds from the exchange to trade larger amounts. This multiplies the profit and loss potential and supports at least 80 crypto assets with up to 5x on spot markets. Users can choose between Cross Margin – using all available funds to cover losses, or Isolated Margin – borrowing limited to a single trade.

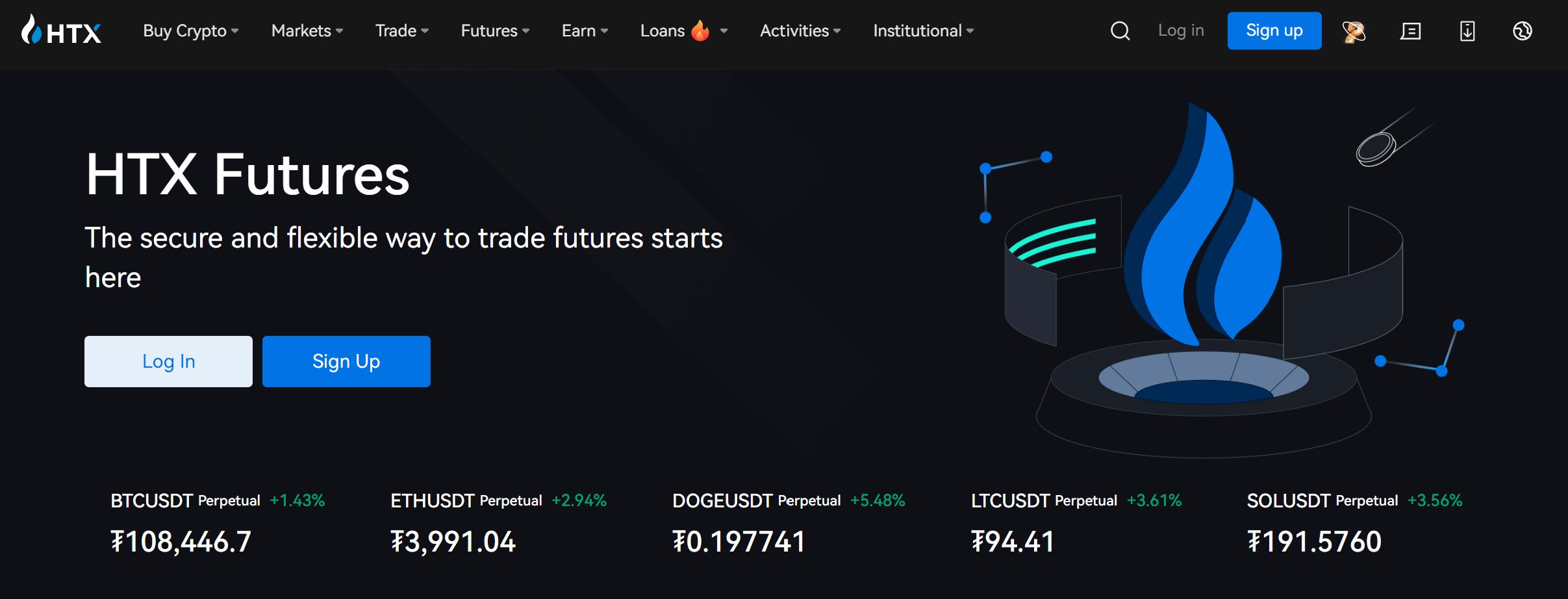

3. Futures Trading

HTX offers derivative trading with products ranging from Traditional Futures to Perpetual Swaps, Coin-Margined Futures, and USDT-Margined Futures. Some derivatives products offer up to 200x leverage with margins mostly available via a tiered structure based on trading volumes. The Futures contract trading feature is available 24/7, allowing users to categorize their trading types as opening or closing positions and further divide them into longs and shorts.

4. Leveraged trading

HTX Leveraged trading involves using funds borrowed from the exchange to boost your trading position, profit, and potential. It’s a high-risk strategy as it also amplifies the magnitude of potential losses. The product available through futures contracts and margin trading works by requiring the trader to put up the initial capital, called margin. For example, with 10x leverage on a $1,000 margin, the exchange lends you additional funds to open a $10,000 position.

5. Automated & advanced tools

Futures Grid 2.0: The automated strategy allows you to place buy and sell orders on a perpetual contract to profit from market volatility, potentially

- Copy Trading: HTX copy trading allows users to automatically replicate the trade strategies of experienced traders by mirroring their accounts.

- Smart Trading: The platform offers robust advanced services for institutional clients seeking to automate their trades and access high-volume options. These include building and integrating custom strategies with HTX’s API, which provides real-time market data streaming and WebSocket support.

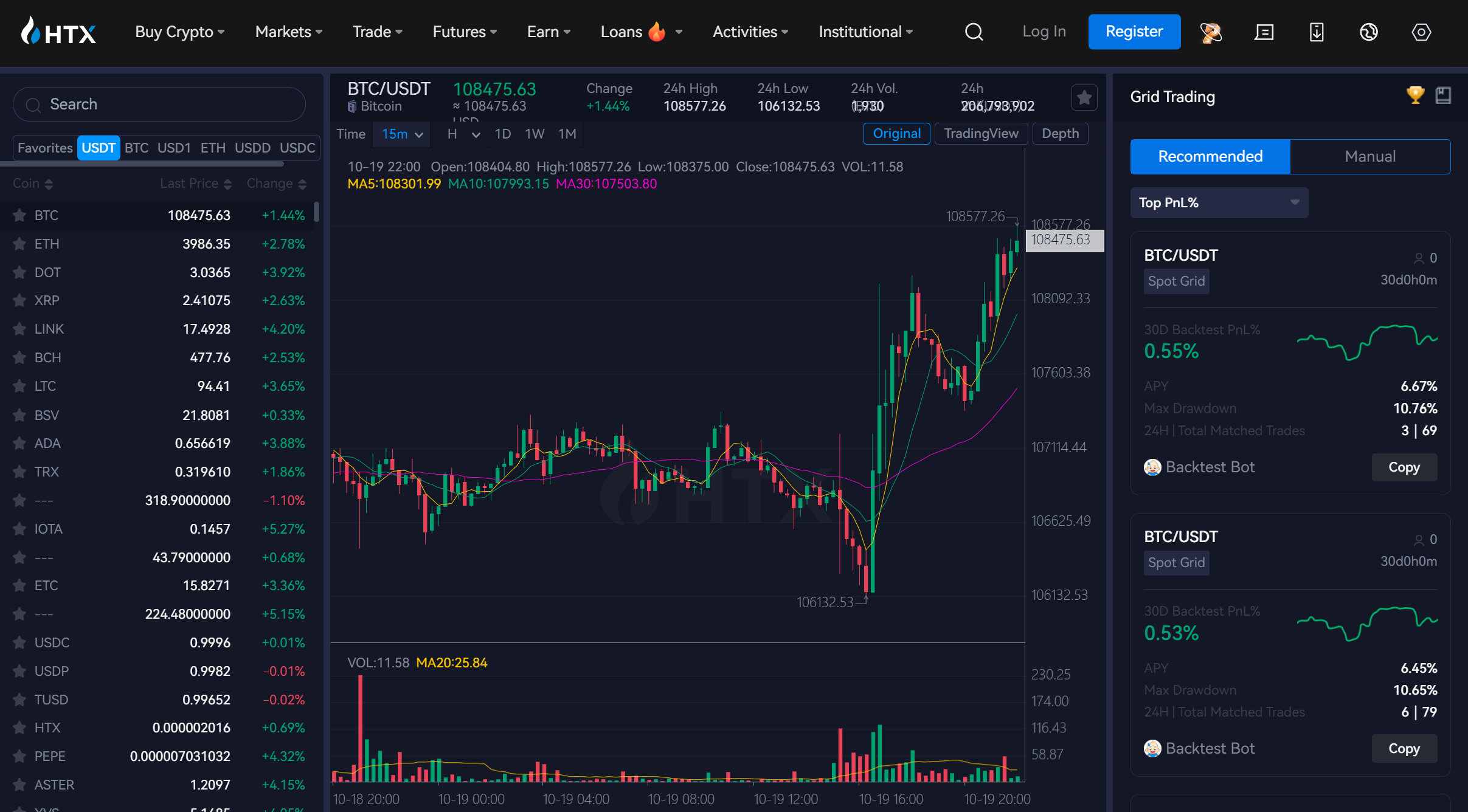

6. Trading Bot

Traders can use HTX trading bots to automate their trading strategies, facilitating 24/7 buying and selling based on pre-set rules. The feature supports the “Grid Trading Bot,” allowing users to set prices and place buy and sell orders within their preferred ranges. You don’t have to watch the market all the time because the bot repeatedly buys low and sells high.

HTX Features and Services

The HTX trading platform offers a wide-ranging suite of financial and trading services for cryptocurrencies, which include the following:

1. HTX Token

The Huobi Token (HTX) is the native token of the Huobi Token company and is designed to fuel the entire platform’s ecosystem. The ERC-20 token, available on popular networks like BEP-20 and TRC-20, offers utility in terms of rewards, fees, and access to airdrops. Holders are encouraged to regularly visit the HTX zone for news on tasks and airdrops associated with using the HTX token. Moreover, the exchange offers HTX token holders trading fee discounts, governance rights, and other rewards.

2. Crypto Loans

HTX offers a crypto loans product with an excellent earning potential for users within the cryptocurrency space. Users can take out loans to invest in opportunities they believe will yield high ROIs. Daily interests begin at 0.02% of the borrowed amount, and borrowers can choose between 30 and 90 repayment days. This option allows users to leverage their assets to enhance their trading strategy.

3. HTX Earn

HTX Earn refers to a suite of financial services and products through which users can earn passive income from their crypto assets. Among the available financial products are flexible and fixed-term deposits, staking, and structured investment options, including:

- Auto-Earn: This automated feature places a trader’s idle spot account into related Flexible Earn products hourly to maximize earning potential.

- Diversified products: HTX offers a range of products through this feature to meet traders’ varying investment strategies and risk appetites.

- Flexible Earn: Traders can subscribe and redeem assets at will, earning compound interest with the products’ Annual Percentage Yield (APY) fluctuating with market conditions.

- Fixed Earn: Requires users to lock their assets for a specific period in exchange for a higher and fixed APY. No early redemption is possible with these products.

Other Features

- Structured products: HTX offers several other advanced investment opportunities, including the following:

- Shark Fin: Provides a guaranteed basic return without a principal loss and potential for higher market-based ROIs.

- Staking: Users can earn rewards from proof-of-stake (PoS) cryptocurrencies by staking their holdings.

- HTX Prime pool: Offers short-term staking opportunities with the potential for even higher returns.

HTX App Review: User Experience

HTX offers a mobile app for Android and iOS, allowing users to trade and manage assets on the go. It’s beginner-friendly, fast, and packed with advanced tools. Key features include:

- Extensive Trading Options: The HTX mobile App supports numerous trading pairs, including spot, futures, margin, and derivative trading, covering over 700 cryptocurrencies.

- User-friendly interface: The App’s layout features an intuitive and responsive interface that’s easy for both beginner and expert traders to navigate. The exchange introduced an updated v11.0 version in July 2025 with refined aesthetics for a smoother experience.

- Advanced trading tools: The App features customizable trading charts and technical indicators for different order types, including grid trading bots and copy trading.

- Secure account management: The mobile App integrates high-tech security features such as fingerprint and Face ID logins and two-factor authentication.

- Portfolio and market insights: The App’s users can easily track their asset portfolios in real time, access educational content, and set customizable price alerts.

- Seamless cross-platform syncing: The App’s account information and trading layouts are easily synced between the mobile and web platforms for smoother running.

HTX Security Measures

HTX exchange takes matters of user data and user funds seriously and employs a robust system to ensure nothing is compromised or lost. Among the measures the exchange employs are the following:

- Two-factor authentication (2FA): HTX encourages users to implement two-factor authentication as an additional security layer alongside a strong password.

- Cold Storage: The platform holds over 98% of its crypto holdings in cold wallets. The offline storage ensures the majority of the funds are secure from the possibility of online attacks.

- Multi-Signature Wallets: HTX utilizes multi-signature technology, meaning more than one key will be used to transfer any funds. This measure helps prevent any one individual or hacker from stealing funds with ease.

- Investor Protection Fund: Since January 2018, the exchange has been investing at least 20% of its quarterly earnings in a fund as a reserve for emergencies. The fund would be helpful if something went wrong, such as during a hacking incident.

- SSL Encryption: HTX exchange uses SSL encryption to secure all data, including user login information, transmitted to the website, preventing access by hackers.

- Anti-DDOS Protection: The platform has strategies to prevent Distributed Denial of Service (DDOS) attacks, whereby fraudsters bombard a website to bring it down.

- KYC Verification: All users must undergo mandatory Know Your Customer (KYC) regulations and provide ID and address proof when signing up. The measure aims to prevent fraud and illicit use on the site.

- Anti-phishing Code: The platform uses an anti-phishing code that helps users identify any phishing attempts.

Is HTX Safe Exchange?

Yes, HTX is generally considered a safe exchange today, despite past security incidents. It now uses strong security measures such as 2FA, cold wallet storage, multi-signature access, anti-phishing codes, and a reserve fund to protect users and their assets.

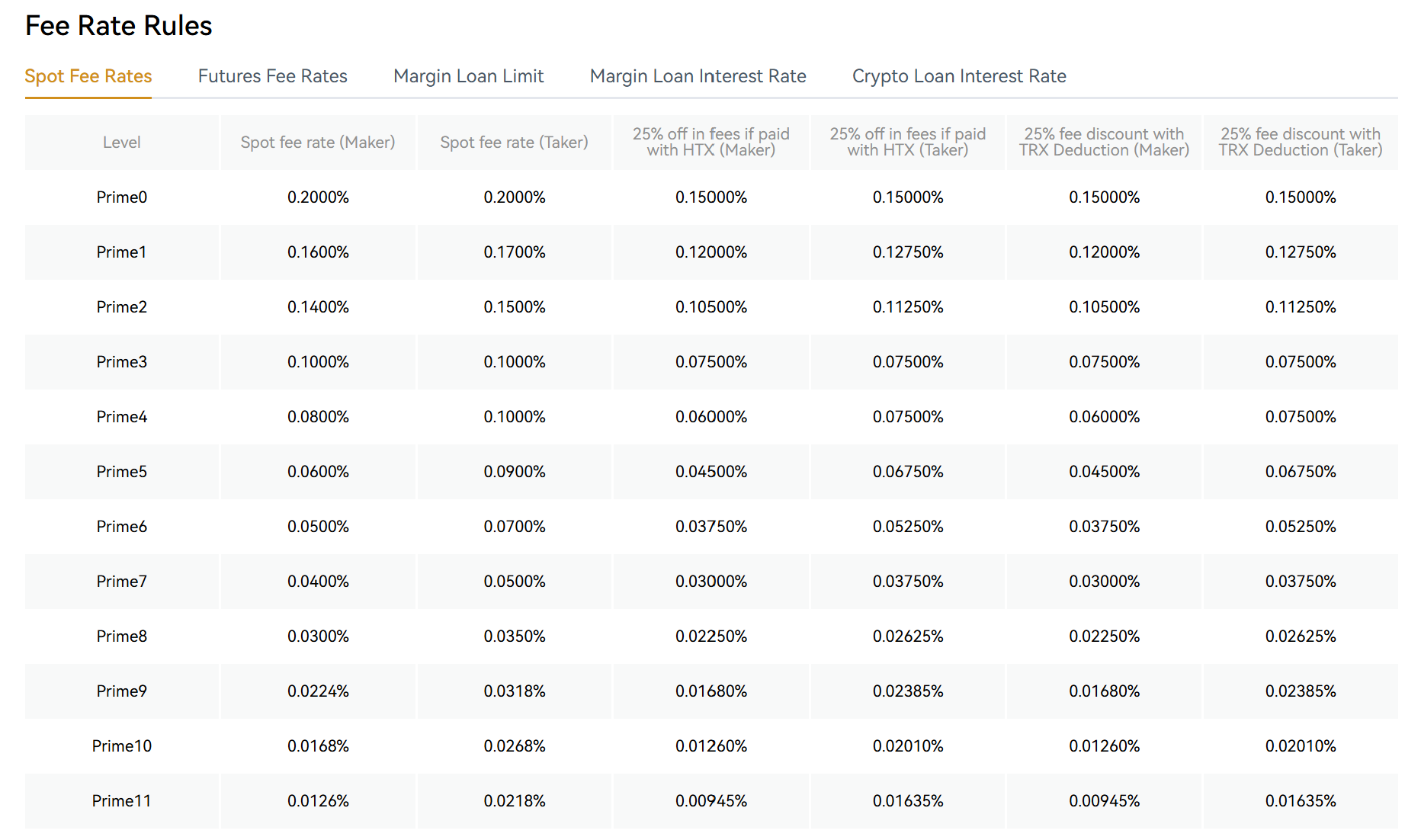

HTX Fees Review

Trading Fees

HTX uses a dynamic tiered “Prime” system to determine trading fees, offering reduced rates to users with higher trading volume or larger token holdings. As users move up the Prime levels based on 30-day trading volume, total asset value, or HTX token balance, they gain access to progressively lower fees for both spot and futures trading.

Spot Trading Fees (Prime 0)

- Maker Fees: 0.20%

- Taker Fees: 0.20%

As traders move up the VIP levels (Prime 1 through 11), fees decrease, with the highest tier receiving the lowest rates.

Futures Trading Fees (Prime 0)

- USDT-Margined Contracts

- Maker: 0.02%

- Taker: 0.06%

- Coin-Margined Contracts

- Maker: 0.02%

- Taker: 0.05%

Top-tier futures traders can achieve even lower fees, including maker rebates.

Deposits and Withdrawal Fees

Users depositing cryptocurrencies to the HTX accounts do not incur any fees. As a result, you can transfer BTC, ETH, or any other crypto asset to your account or HTX wallet without paying a dime.

However, withdrawing cryptocurrency from your HTX account to a different exchange or wallet will attract a fee. The exact amount to be charged will vary based on the particular cryptocurrency withdrawn and the condition of the blockchain network. For example, withdrawal fees for Bitcoin are 0.00025 BTC, while ETH is charged 0.0021 ETH.

Note that the figures mentioned here are guidelines, as they may change over time and could increase due to network congestion. You should get the correct withdrawal fees figures by visiting the “Withdrawal” section of the HTX website.

How to Use HTX Exchange?

To use HTX, you need to open an account through the official HTX website or mobile App and complete KYC verification. The following is the step-by-step process:

How to Open an HTX Account?

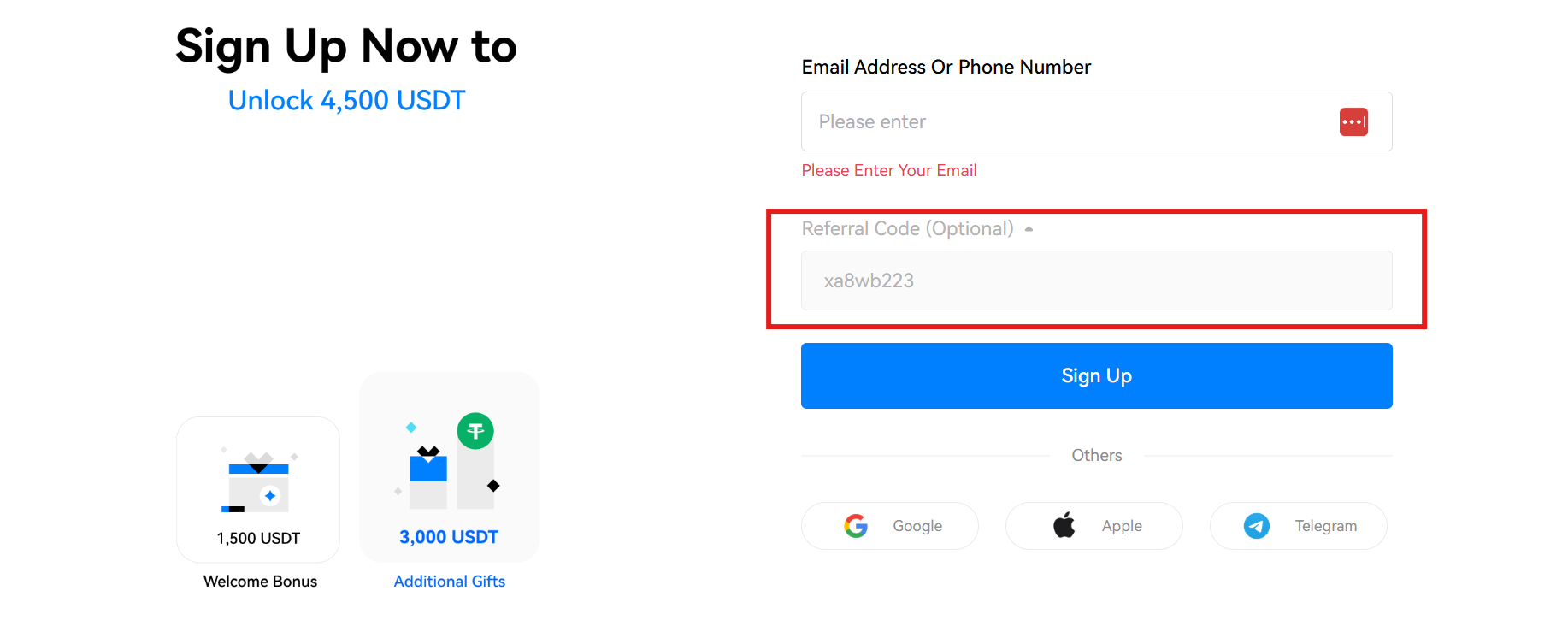

- Sign up for an account: Navigate to the HTX website and click “Sign Up.” Enter your email or mobile number and make sure to use the referral code “xa8wb223” during registration to unlock bonus rewards.

- Complete identity verification (KYC): To get full access to all features like fiat deposit and withdrawal, complete the KYC verification process. Three verification levels require different documents and offer varying transaction limits.

- Deposit funds: Once you’re verified, fund your account with crypto or fiat currency to begin trading.

How to Trade on the HTX Platform?

- Navigate the website or App to the “Trade” or “Spot” section.

- Select that trading pair you want to trade, for example, BTC/USD.

- Choose an order type: Market Order to buy or sell at the current market price, or Limit Order to set a specific buy or sell price for your Order.

- Enter the desired crypto amount and confirm your Order to complete the transaction.

How to Deposit & Withdraw at HTX?

Crypto Deposit

- Log in to your account and navigate to the “Balances” or “Wallet” section.

- Select “Deposit” and choose the asset you want to transfer.

- Choose an appropriate network, e.g., ERC20 or TRC20.

- Copy the generated HTX wallet address.

- Navigate to your exchange or external wallet, paste the address, and send crypto to your account.

Fiat deposit

- Navigate to the “Buy Crypto” section and choose “Fiat deposit.”

- Select your currency and payment method.

- Enter the desired deposit amount and follow the prompts to complete the transaction.

Withdraw funds

- Navigate to “Wallet” or “Balance” and select “Withdraw.”

- Select the asset you want to withdraw, and enter the correct blockchain network.

- Enter the wallet address to send funds.

- Double-check to confirm correctness and complete the transaction.

- To withdraw fiat currency, follow the same procedure and select the desired currency and bank account.

HTX Regulatory Compliance

HTX implements several measures designed to fulfill different regulatory requirements. The platform also regularly educates users on changes related to existing and emerging regulatory measures.

In addition to observing stringent security and custody requirements, KYC ensures its stablecoin reserves are secure. The company is also actively engaged with dynamic global regulations, such as the EU’s MiCAR, to align innovation with market sustainability. This requires implementing onchain compliance measures and creating secure systems to safeguard user assets and prevent illicit trade activities.

HTX Customer Support & User Feedback

HTX provides a solid customer support system to help users navigate the platform and resolve issues efficiently. Support is available through several channels:

- 24/7 Live Chat: HTX support via live chat includes multiple languages and is available from the mobile App of the HTX website.

- Support Ticket System: Addresses complex issues that require detailed investigation and includes sharing account-specific information for up to 24 hours.

- Email Support: Available for users who prefer email communication. It may be used for more detailed correspondence and follow-ups.

- Social Media Support: The platform has an active presence and communities on platforms like X (Formerly Twitter) and Telegram.

- Educational Resources: The platform disseminates information via HTX Learn, featuring regularly updated articles and Trading Guides that offer step-by-step tutorials. The exchange provides more information through video tutorials and the HTX blog, which offers trading tips and platform updates.

The platform’s Help Center also includes a detailed FAQ section addressing common questions.

While many users appreciate the range of support and educational tools, some have reported delayed withdrawals or frozen funds linked to flagged activity. Trustpilot reviews highlight occasional slow responses and automated replies, pointing to areas where HTX could improve its service quality.

Best Alternatives to HTX for Crypto Trading

| Exchange | Established | Supported

Cryptos |

24 Hrs.

Volume |

Key Features | Supported

Fiat Currencies |

KYC Required | Accepted Payment Methods |

| HTX | 2013 | 700+ | $2.51B+ | Established since 2013

Grid & DCA bots |

100+ | Yes | Credit/debit cards

P2P trading Third-party merchants |

| MEXC | 2018 | 3100+ | $2.51B+ | Most cryptos

Lowest fees Deep liquidity |

50+ | Yes | Credit/debit cards (Visa, Mastercard)Bank transfers

Third-party services |

| Bybit | 2018 | 729+ | $2.53B+ | Highest trading volume

Advanced features Multiple trading bots |

25+ | Yes | Bank transfers

Card payments Cash |

| Blofin | 2019 | 564+ | $379.32M+ | No KYC required

Multiple fiat options |

85+ | No | Credit/debit cards

Bank transfers (like SEPA and PIX) E-wallets |

| Kraken | 2011 | 450+ | $2.47B+ | Leading security

Deep liquidity Wide range of trading options |

10+ | Yes | Apple Pay or Google Pay

Debit or Credit Card Account Balance |

| Binance | 2017 | 350+ | $43.62B+ | Binance Earn

Staking Savings accounts |

100+ | Yes | credit/debit cards,

Bank transfers (local and international) Peer-to-peer (P2P) |

Conclusion: Is HTX a Good Exchange?

HTX stands out as one of the largest cryptocurrency exchanges, patronized by millions of traders globally, especially in the Asian market. The platform supports a decent number of tradable cryptocurrencies using a professional-grade, user-friendly interface. The exchange also has an excellent mobile app that is ideal for both beginners and experts to trade on the go. While there’s still room for improvement, HTX is mostly ranked among the top ten most prominent and most trusted trading platforms.

With at least 10 million users worldwide and a daily trade volume exceeding $2 billion, the platform offers deep liquidity. The wide range of robust trading products and services makes HTX a popular choice among traders, especially those interested in day trading. Additionally, the exchange enables users to earn passive income through staking, copy trading, and accelerate gains through HTX Earn. With a broad global reach of over 160 countries, whatever your idea of an exchange is, HTX will give you peace of mind and meet your cryptocurrency trading needs.

FAQs

Is HTX available in the United States?

No, existing regulatory restrictions have made US-based crypto traders unable access the HTX exchange. As a result, the platform specifically mentions the United States jurisdiction as one of the areas where its services are prohibited.

Is HTX better than Binance?

Binance exchange is listed as the biggest cryptocurrency exchange globally in terms of trade volume and handles at least 1.4 million orders per second. It is also recognized as the fastest crypto trading platform worldwide. HTX, on the other hand, offers spot trading with up to 5x leverage and is popular especially in the Asian market. Comparing the two, Binance may be ahead of HTX since the former charges lower fees and is regulated in many more jurisdictions. Binance also offers more Earn products and has many more features.

Is OKX better than HTX?

According to many users, OKX is more popular and widely adopted than HTX. Among the reasons OKX may be superior to HTX are offering more tradable cryptos and markets, as well as deeper liquidity. HTX provides more features and products beyond just crypto trading.

Does HTX offer staking or rewards?

Yes, HTX cryptocurrency exchange offers staking services and various related reward programs that enable users to earn passive income on their crypto holdings. The exchange provides numerous flexible and fixed staking products that include rewards for holding the platform’s native token. When it comes to staking, users can earn from “numerous other yield-generating products. Traders can earn staking rewards from several popular crypto assets while maintaining their assets’ liquidity, depending on the specific product.

Does HTX Require KYC?

Yes, users must complete KYC verification, especially if they want to deposit and trade crypto. Users will be asked to submit government ID documents, such as a driver’s license or a passport, in addition to proof of address.

The post HTX (Huobi) Review 2025: Is This Exchange Still Worth Using? appeared first on NFT Plazas.

0

0

Gerencie todo seu criptograma, NFT e DeFi de um só lugar

Gerencie todo seu criptograma, NFT e DeFi de um só lugarConecte com segurança o portfólio que você está usando para começar.