Michael Saylor Says Strategy Could Sell Its BTC If This Happens

0

0

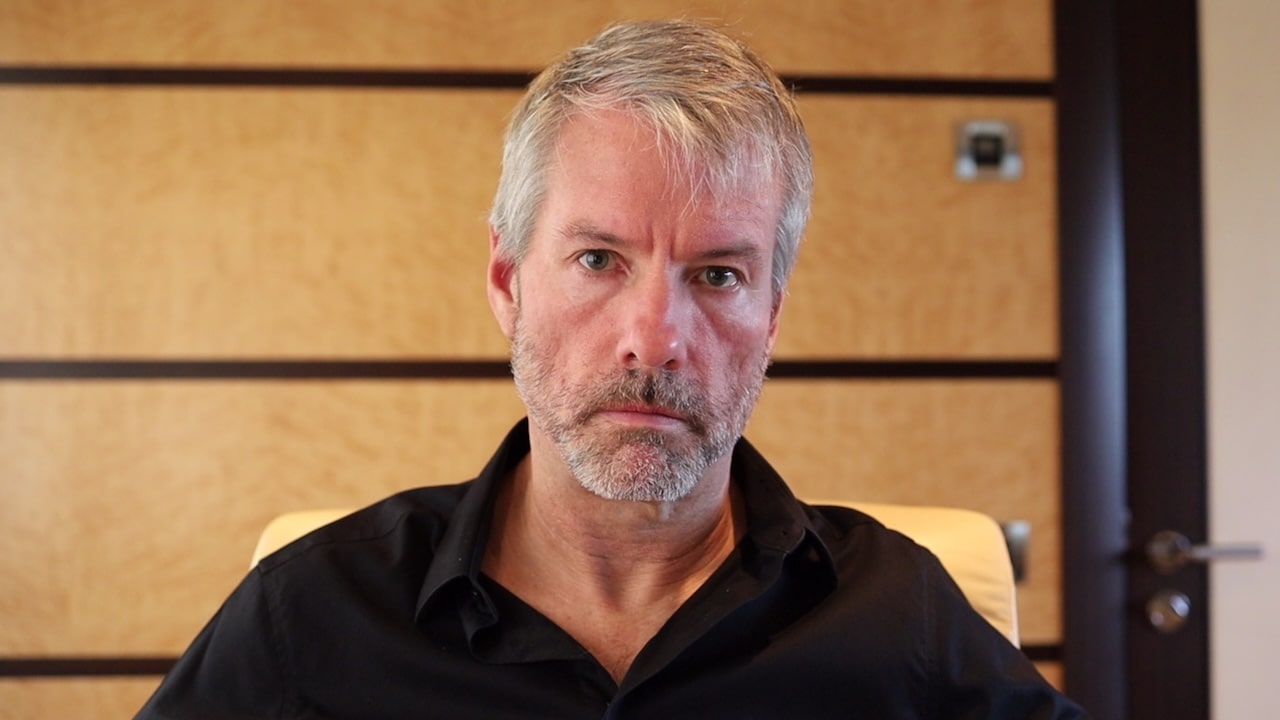

One of the most asked questions involving the business intelligence firm Strategy has been: “Will Strategy sell its bitcoin holdings?” Earlier today, the firm’s founder and executive chairman, Michael Saylor, confirmed that Strategy could sell its BTC holdings or even BTC derivatives.

This reiterates comments from Strategy’s CEO, Phong Le, last week when he noted that the firm could sell BTC. Still, he noted that it would be a last resort.

Why Sell Bitcoin?

In the Company Update 2025 featuring Michael Saylor and Phong Le, the executive chairman stated that the firm’s mNAV (market Net Asset Value) would have to drop below 1x.

The mNAV is an indicator that compares Strategy’s enterprise value to the net value of its BTC holdings. A higher mNAV, typically above 1, implies that the market values the firm at a premium to its BTC stash. As a result, the business intelligence firm can easily raise capital by issuing new shares, as its market valuation exceeds its net BTC holdings.

Conversely, a lower mNAV, typically less than 1, shows that the firm’s market value is at a discount to its BTC stash. In such cases, issuing new equity could lead to greater dilution for existing shareholders.

According to its website, Strategy’s mNAV is currently at 1.10, down 8.33%. This has raised concerns among investors who worry that the metric could decrease further. Although being pro-Bitcoin, Saylor noted that selling the BTC stash would benefit those in the company’s ecosystem.

“We would do that because that’s in the best interest of the shareholders, it’s best for the company, and it’s best for the Bitcoin community as well as the credit community [and] the equity investors,” he said.

Recall that Strategy has funded most of its BTC acquisitions using proceeds from selling debt instruments to investors. Earlier today, it announced its latest BTC acquisition, bringing its total reserve to 650,000 BTC. This represents 3.1% of bitcoin’s total supply.

On the bright side, if the mNAV exceeds 1x, Saylor emphasized that the firm will continue issuing its common equity to investors.

Strategy’s Previous BTC Sale

Since its first BTC acquisition in August 2020, Strategy (formerly MicroStrategy) has committed to a policy of not selling its BTC stash.

However, on December 22nd, 2022, the company sold 704 BTC worth around $11.8 million at the time. The firm used the fund to settle its taxes. Ever since then, Strategy has never sold any BTC.

With its mNAV currently near the 1x target Saylor mentioned, many are wondering if the firm would break its policy by selling portions of its BTC stash. To calm investors, Saylor explained in the company update that BTC would need to fall to $10,400 for Strategy’s total BTC holdings to equal its debt. He added that BTC would have to fall 19% per year over the next decade to reach that price.

Today, BTC trades at $85,400, down 6.4% in the past 24 hours and 22% in the past month. This sharp decline has fueled concerns among onlookers and investors. Still, some market experts remain optimistic that the apex coin will soar to higher price levels once again.

The post Michael Saylor Says Strategy Could Sell Its BTC If This Happens appeared first on CoinTab News.

0

0

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요시작하는 데 사용하는 포트폴리오를 안전하게 연결하세요.