Tom Lee Says Bitcoin’s Turn Is Coming After Washington Sent Gold & Silver Soaring | US Crypto News

0

0

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in—markets are moving in ways that leave even seasoned investors squinting at charts. Gold and silver are surging, crypto is wobbling, and Washington’s policy plays are stirring uncertainty. But according to Tom Lee, somewhere in the chaos, a turning point may be quietly forming.

Crypto News of the Day: Tom Lee Says White House Front-Loading Midterm Wins Is Wrecking Markets

Fundstrat Global Advisors’ Tom Lee is sounding a cautious yet optimistic note for crypto investors, arguing that recent turbulence in Bitcoin and Ethereum may be temporary.

Appearing on CNBC’s Squawk Box, Lee attributed the early-year surge in gold and silver prices to Washington, D.C.’s policy maneuvers.

He says the White House’s plays have temporarily “hijacked” risk appetite, creating a “vortex” that drew capital away from crypto despite strong fundamentals.

Gold spiked to $4,954.99 per ounce, a 6.5% daily jump, while silver surged 13.66% to $87.53. This marks the largest single-day gains for both metals since the 2008 financial crisis.

Lee tied this frenzy to crypto’s ill-timed deleveraging in October 2025.

“The crypto industry doesn’t have any leverage right now,” he said. “Gold and silver’s performance sucked all risk appetite towards the precious metals trade.”

Lee also highlighted Washington politics as a central driver of market uncertainty. With midterms approaching, he criticized the White House for “deliberately picking more winners and losers early,” front-loading its agenda and keeping markets “hostage.”

Speculation around the next Federal Reserve chair adds further volatility, with Lee warning that markets will test the appointee’s resolve on policy and rates, echoing patterns seen with former chairs Janet Yellen and Jerome Powell.

While the consensus expects Republicans to lose the House, Lee noted that a GOP retention could deliver a “positive surprise.”

Signs Point to a Crypto Bottom Amid Gold and Silver Frenzy

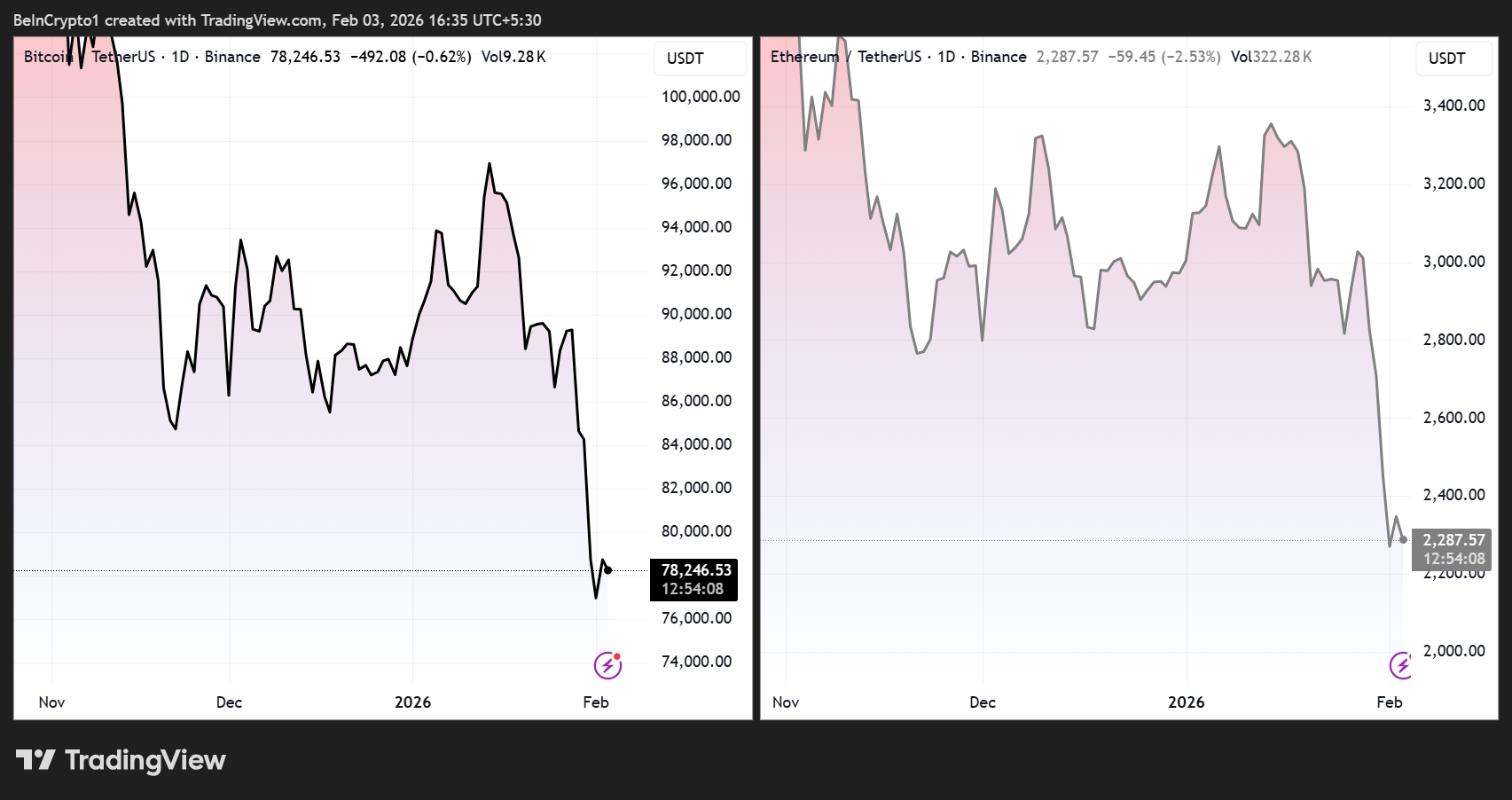

Despite near-term headwinds, Lee sees signals that crypto may be bottoming. Fundstrat advisor Tom DeMark believes “time and price” alignment has been reached, with Bitcoin back above $78,000 and Ethereum nearing $2,300.

Bitcoin and Ethereum Price Performance. Source: TradingView

Bitcoin and Ethereum Price Performance. Source: TradingView

Lee added that Ethereum’s active addresses are “going parabolic,” as Wall Street increasingly integrates digital assets.

“All the pieces are in place for crypto to be bottoming right now,” he said, contrasting price weakness with network activity.

This view aligns with analysts’ notes on potential capital rotation, with some highlighting gold’s 11% rebound from recent lows, adding $3.07 trillion, and silver’s 20% surge, reclaiming $800 billion.

Analyst Bull Theory compares this setup to August 2020, when gold topped at $2,075, Bitcoin fell 20%, then rallied 559% over eight months as capital flowed back into risk assets.

With the ISM Manufacturing Index at 52.6%, the analyst suggested a similar rotation may be underway:

“Gold likely topping, and Bitcoin already having corrected, we could now see a rotation into risk-on assets,” they said.

However, not all commentary is bullish. Analyst Wimar.X warns that the metals’ surge signals a “broken system,” echoing pre-crash conditions in 2000, 2007, and 2019.

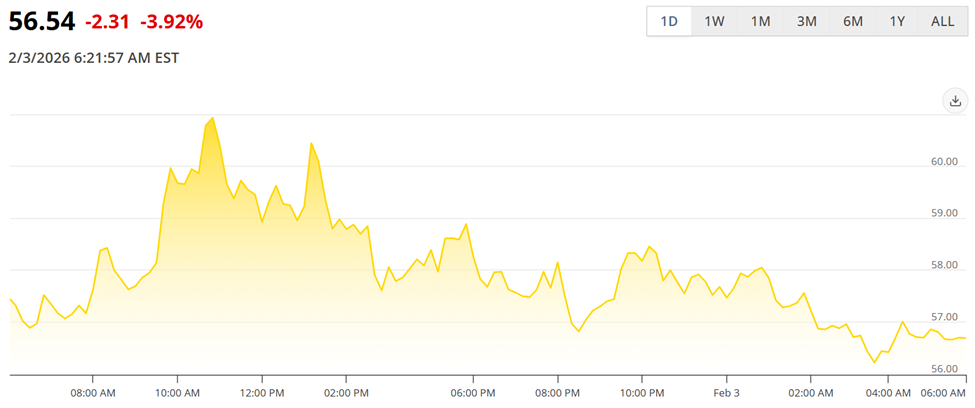

With the gold-to-silver ratio near 56, they argued that institutions are “exiting the casino,” potentially foreshadowing a 2026 collapse.

Gold to Silver Ratio. Source: JM Bullion

Gold to Silver Ratio. Source: JM Bullion

Lee, however, emphasized that the broader economic backdrop remains strong. Stocks were up 1% in January, historically correlating to 18% annual S&P gains in similar periods since 1950.

Even as AI and tech valuations may mean-revert, he sees precious metals taking a “breather” as healthy for markets, potentially clearing the way for crypto’s next move.

The question now is whether Washington-driven flows will continue to favor metals or if Bitcoin and Ethereum are ready for a rebound.

Chart of the Day

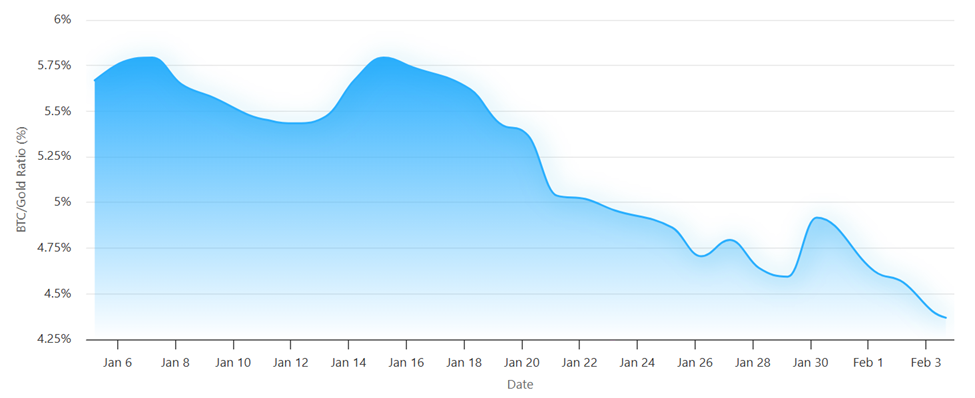

Gold to Bitcoin Ratio in 2026. Source: Milk Road

Gold to Bitcoin Ratio in 2026. Source: Milk Road

The Gold to Bitcoin dominance ratio compares the market cap of both assets.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Bitcoin’s safety net comes into view as Galaxy Digital warns of deeper pullback.

- Ethereum price warning: $1,500 risk appears as a bullish metric drops 90%.

- Bitcoin slips below $80,000 as large holders exit — But bounce signals are emerging.

- XRP price under pressure: ETF outflows, holder losses, and a possible rebound.

- MicroStrategy (MSTR) stock barely escapes cost-basis scare — A 20% price swing awaits?

- Why Vitalik Buterin sold over 700 Ethereum (ETH) despite market recovery.

Crypto Equities Pre-Market Overview

| Company | Close As of February 2 | Pre-Market Overview |

| Strategy (MSTR) | $139.66 | $140.80 (+0.82%) |

| Coinbase (COIN) | $187.86 | $189.53 (+0.89%) |

| Galaxy Digital Holdings (GLXY) | $26.44 | $26.95 (+1.93%) |

| MARA Holdings (MARA) | $9.12 | $9.18 (+0.66%) |

| Riot Platforms (RIOT) | $15.32 | $15.53 (+1.37%) |

| Core Scientific (CORZ) | $17.87 | $18.05 (+1.01%) |

0

0

Gestisci cripto, NFT e DeFi in un unico luogo

Gestisci cripto, NFT e DeFi in un unico luogoConnetti in sicurezza il portafoglio che usi per iniziare.