Bitcoin Price Surge Could Break Records if Fed Expands Liquidity, Arthur Hayes Says

0

0

This article was first published on The Bit Journal.

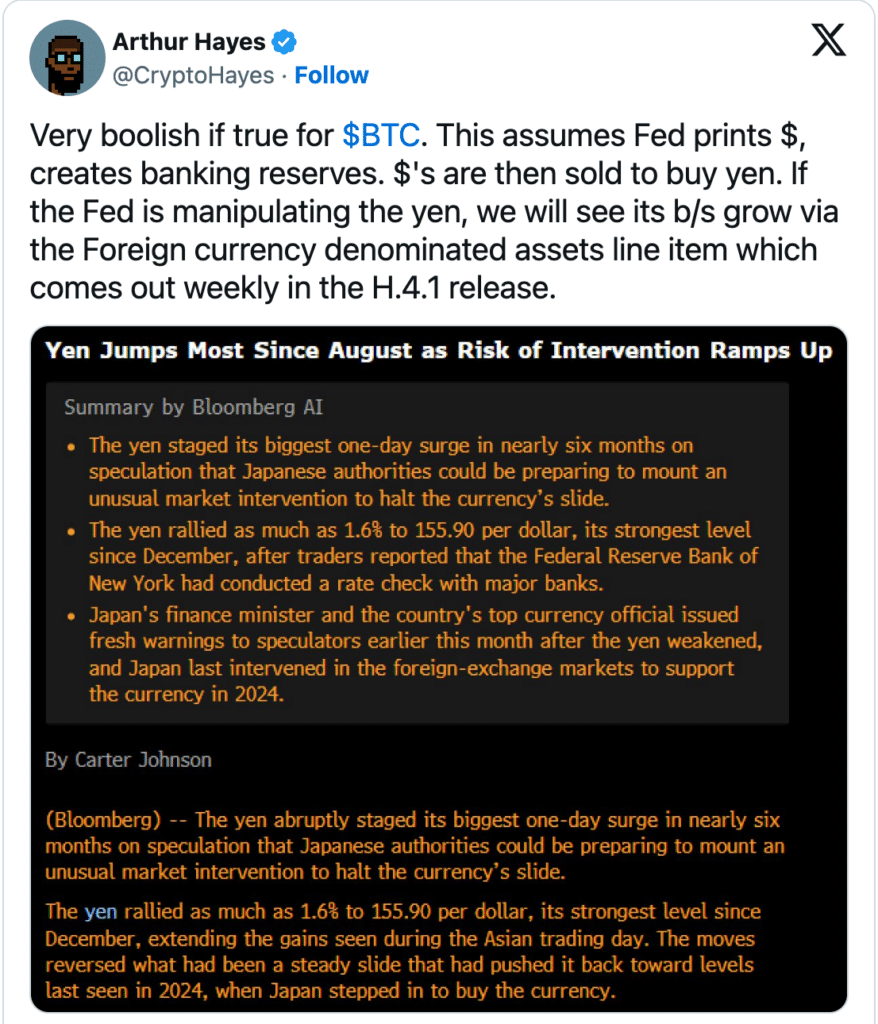

Bitcoin might be gearing up for its next explosive price surge, and the trigger could be thousands of miles away in Japan. Arthur Hayes, BitMEX co‑founder, warns that stress in the yen and Japanese Government Bonds (JGBs) could push the Fed to unleash fresh liquidity.

“Will a meltdown of the yen and JGB markets cause some sort of money printing by the BOJ [Bank of Japan] or the Fed? The answer is yes,” said Hayes.

He calls it a “woomph,” a quiet pressure building before an avalanche, hinting that Bitcoin breakout potential is quietly stacking up as central banks weigh intervention.

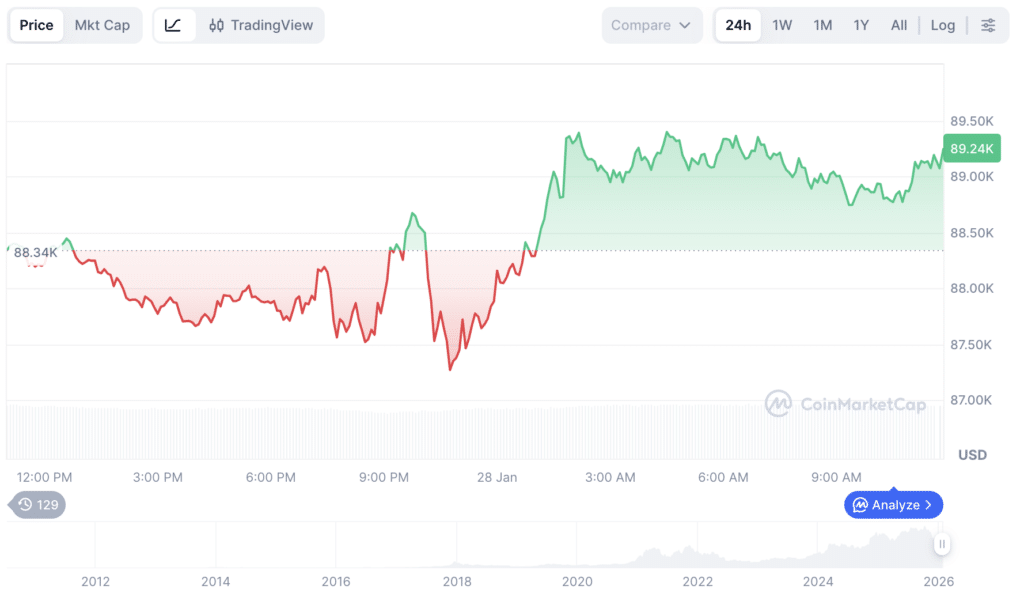

Current Bitcoin Market Snapshot

As of today, Bitcoin is trading at around $89,090 USD, up approximately 1% in the last 24 hours, with a 24-hour trading volume of around $38.2 billion USD. Its market cap is approximately $1.78 trillion USD, with a circulating supply of around 19,981,403 BTC and a max supply of 21 million coins. These figures highlight Bitcoin’s resilience and position it for potential movement, particularly if macro liquidity events or a Fed intervention trigger a Bitcoin price surge or a notable Bitcoin breakout.

Fed Decision Could Be the Macro Catalyst Behind Bitcoin Price Surge

The market often reacts sharply to central bank actions, and a Fed decision could act as a powerful catalyst. Experts, including Arthur Hayes, highlight that balance sheet expansions or interventions to stabilise foreign currency markets could direct liquidity toward risk assets, including Bitcoin.

Such measures could trigger a Bitcoin price surge 2026 Fed yen JGB macro trigger Arthur Hayes, with traders and investors positioning for potential Bitcoin breakout opportunities in response to global macro shifts.

Arthur Hayes Bitcoin Thesis: Liquidity Meets Risk Appetite

Arthur Hayes has repeatedly emphasised that macro liquidity drives asset price dynamics, especially in crypto markets. A strategic Fed intervention; such as balance sheet expansion or foreign asset purchases, could inject fresh capital into risk assets.

Historically, Bitcoin benefits when liquidity is abundant, making these conditions ripe for a Bitcoin price surge. Analysts are noting that Hayes’ macro insights provide a blueprint for anticipating a Bitcoin breakout, particularly if global investors seek alternatives to stressed fiat currencies.

Yen Market Stress and JGB Dynamics as Hidden Triggers

Volatility in the Japanese yen and Japanese Government Bonds (JGBs) has sparked intervention speculation. If the Fed coordinates with other central banks to stabilise these markets, increased liquidity could flow into global assets. Bitcoin, viewed as a hedge against traditional market volatility, could experience substantial upward momentum.

This aligns with the Fed yen intervention Bitcoin prediction Arthur Hayes macro analysis scenario, reinforcing the plausibility of the next Bitcoin price surge.

Fed Balance Sheet Expansion’s Role in Bitcoin Rally Prediction

Expanding the Fed’s balance sheet is more than a technical exercise; it sends signals of confidence and liquidity into financial markets. Hayes notes that such interventions could drive capital toward risk assets, supporting a Bitcoin rally prediction in 2026.

Historical trends suggest that Bitcoin reacts strongly to these macro liquidity injections, positioning the market for a potential Bitcoin price surge and a significant Bitcoin breakout if central banks deploy unconventional monetary tools.

Market Reactions to Central Bank Actions and Macro Liquidity Flows

Macro liquidity movements influence both traditional and crypto markets. As the Fed adjusts its stance shifting from tightening to potential intervention; traders are monitoring the impact on Bitcoin. Anticipated liquidity boosts could trigger speculative positioning and catalyse a Bitcoin price surge, reinforcing expectations of a Bitcoin breakout.

The interplay between macro liquidity, central bank policy, and market psychology creates conditions for rapid price action in Bitcoin.

Comparative Analysis: Past Interventions and Crypto Trends

Historical data shows that previous central bank liquidity injections often lead to gains in equities, commodities, and cryptocurrencies. Bitcoin, in particular, responds when monetary conditions ease globally. Comparing these episodes with current macro risks, including yen market stress and JGB volatility, supports the theory that a Fed intervention could act as a trigger for a Bitcoin price surge, validating the analytical frameworks provided by Hayes and other macro commentators.

Risk Considerations Before the Next Bitcoin Price Surge

While the prospects of a Bitcoin breakout are enticing, risks remain. Market expectations may already price in some Fed action, and unexpected macroeconomic shifts could alter outcomes. Traders should remain cautious, balancing bullish sentiment with the possibility of delayed intervention or muted liquidity effects.

Monitoring macro indicators, yen movements, and Fed communications remains crucial for effectively anticipating the next Bitcoin price surge.

Bitcoin Breakout Psychology and Trader Positioning

Traders looking for a Bitcoin breakout are increasingly focusing on macro triggers rather than purely technical factors. Hayes’ analysis underscores the importance of Fed decisions, balance sheet expansions, and global liquidity.

Positioning strategically in anticipation of these signals could influence market sentiment and amplify Bitcoin’s movements, reinforcing the possibility of a sustained price surge if the Fed acts decisively.

Macro Analysis: Fed Yen Intervention Bitcoin Prediction Arthur Hayes

The Fed yen intervention Bitcoin prediction by Arthur Hayes combines macroeconomics with crypto market dynamics. Central bank support for volatile currencies, coupled with liquidity injections, may indirectly fuel Bitcoin demand.

This is not purely a speculative thesis; it reflects the growing correlation between macro liquidity and Bitcoin performance, suggesting a scenario where a Bitcoin breakout could align with strategic Fed action and broader macroeconomic trends.

Bitcoin Rally Potential Tied to Fed Liquidity Expansion in 2026

Looking ahead, the Bitcoin rally potential tied to Fed liquidity expansion in 2026 highlights the significance of timing and market perception. Strategic Fed interventions addressing yen and JGB market stress could lead to sustained upward momentum for Bitcoin.

Analysts anticipate that macro liquidity injections could create ideal conditions for both a Bitcoin price surge and a Bitcoin breakout, reinforcing Arthur Hayes’ thesis on the interconnectedness of macroeconomic policies and crypto performance.

What If No Fed Action Is Taken?

Arthur Hayes has outlined a bold scenario where Bitcoin could surge to around $500,000 by year-end if global liquidity expands significantly. This outcome, however, depends heavily on Fed decisions, institutional capital flows, and broader geopolitical stability. Meanwhile, if no intervention occurs, Bitcoin may remain range-bound between approximately $70,000 and $100,000, delaying the next Bitcoin breakout.

Traders and investors should monitor key resistance levels carefully, as a push above $91,000 could trigger a stepwise rally toward $98,000 and beyond, setting the stage for a potential Bitcoin price surge.

Conclusion

Central bank decisions remain among the most powerful macro forces shaping financial markets, and in 2026, the interplay between the Federal Reserve, yen market stress, and liquidity measures could be a key determinant of Bitcoin’s next major move.

Given Bitcoin’s current price levels and market dynamics, a strategic Fed intervention, particularly one involving expanded balance sheet activity, might act as the catalyst for a Bitcoin price surge or even a full-blown Bitcoin breakout. Traders and analysts must continue to monitor macro liquidity trends and central bank communications closely to position for possible outcomes.

Appendix: Glossary of Key Terms

Bitcoin Price Surge: A significant upward movement in Bitcoin’s value.

Bitcoin Breakout: A price movement above resistance levels with strong volume.

Fed Decision: Actions by the U.S. Federal Reserve that influence markets.

Arthur Hayes: Co‑founder of BitMEX and macro analyst on crypto.

Fed Intervention: Central bank actions to stabilise markets via liquidity.

Yen Market Stress: Volatility or instability in the Japanese currency markets.

Japanese Government Bonds (JGBs): Debt securities issued by Japan’s government.

Fed Balance Sheet Expansion: Increase in assets held by the Federal Reserve.

Macro Liquidity: Availability of funds in the global financial system.

Bitcoin Rally Prediction: Forecasts suggesting upward price movements in Bitcoin.

Frequently Asked Questions About Bitcoin Price Surge

What triggers a Bitcoin price surge?

Macro liquidity injections, Fed decisions, yen stress, and JGB volatility can catalyse significant Bitcoin price movement.

How does Fed intervention impact Bitcoin?

Liquidity expansions and policy signals can weaken fiat, boost risk assets, and drive Bitcoin rallies.

Why is Arthur Hayes’ analysis relevant?

Hayes provides macro-focused insight connecting Fed policy, liquidity events, and crypto market responses.

Is Bitcoin’s price surge guaranteed in 2026?

No; market reaction depends on actual Fed actions, macro trends, and investor sentiment.

What should traders monitor next?

Key metrics include Fed balance sheet updates, yen and JGB market stress, and macro liquidity flows.

References

Read More: Bitcoin Price Surge Could Break Records if Fed Expands Liquidity, Arthur Hayes Says">Bitcoin Price Surge Could Break Records if Fed Expands Liquidity, Arthur Hayes Says

0

0

Administra todas tus criptomonedas, NFT y DeFi desde un solo lugar

Administra todas tus criptomonedas, NFT y DeFi desde un solo lugarPara comenzar, conecta de forma segura el portafolio que estés utilizando.