CLASH OF THE TITANS: BANKING VS. EXCHANGES

1

0

When Banks Go Crypto and Customer Loyalty is Put to the Test

Introduction: From Suspicion to Direct Competition

BANKING VS. EXCHANGES — For years, the relationship between traditional banking (TradFi) and cryptocurrency exchanges (CeFi/CEX) has been awkward at best. Banks viewed cryptocurrencies as a regulatory and business threat, while exchanges represented financial freedom.

However, the approval of listed products (such as Bitcoin and Ethereum ETFs) has marked a turning point. Institutional capital is flowing in, and banks can no longer afford to be mere spectators. Today, banks are not just custodians and facilitators; they are becoming direct rivals to exchanges, using their historical advantage and, above all, their customer information.

This article analyses how this new rivalry is developing and the challenge it poses for exchange platforms:

1. The Institutional Landfall: Banking Knocks on Crypto’s Door

The entry of banks into the crypto world is a multifaceted phenomenon, driven by two main factors:

- Custody and Services (B2B): Initially, large banks acted as custodians for asset managers launching crypto ETFs, thus legitimising the asset without exposing themselves directly.

- Direct Offering (B2C): Increasingly, traditional banks and brokers are launching their own products that allow their customers to buy, hold and even generate returns with cryptocurrencies without leaving their usual financial ecosystem.

This integration means that customers see cryptocurrency not as a radical asset, but as just another asset class, accessible from their own banking app, undermining the ‘ease’ advantage that exchanges previously offered.

2. Information Asymmetry: The Secret Weapon of Banks

Herein lies the key to the new competition: banks have access to their customers’ transaction data, an advantage that exchanges do not have in reverse.

Every time a traditional bank customer transfers fiat money to an exchange (such as Binance, Kraken or Coinbase), the bank records this action.

- Identification of the ‘Crypto Customer’: The bank knows precisely which customers are active in the crypto ecosystem, their approximate investment volume (based on transfer flows) and their level of exposure.

- Personalised Marketing: Armed with this information, banks can launch hyper-targeted marketing campaigns, directly addressing customers who buy crypto on exchanges. The message is clear: ‘We see that you invest in crypto, why not do it with us, under the regulation and security you already know?’

- Trust-Based Loyalty: The bank leverages the regulatory trust it already has with the customer to offer crypto products with a lower ‘perceived risk’ than a global platform that is sometimes perceived as less regulated.

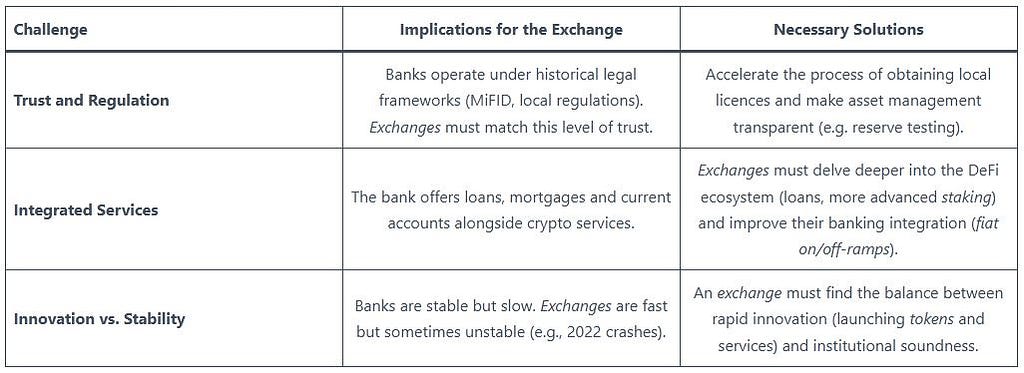

3. The Challenge for Exchanges: Adapt or Lose Market Share

This onslaught by banks is forcing centralised exchanges to redefine their value proposition. Their main challenges are:

Conclusion: The Future of the Crypto-Financial Landscape

The rivalry between banks and exchanges is excellent news for consumers, as it drives service improvements, lower costs and, above all, regulatory transparency.

For customers, the decision will focus on choosing between:

- Security and Convenience (Banking): Crypto services integrated into a well-known and highly regulated platform.

- Innovation and Performance (Exchanges): Access to more complex trading, a wider range of tokens, and advanced DeFi yields.

In this new landscape, the survival of exchanges will depend on their ability not only to compete on price, but also to offer a superior user experience and regulatory transparency that meets the growing demands of institutional and retail customers.

Disclaimer: The information set forth herein should not be taken as financial advice or investment recommendation. All investments and trading involve risk and it is the responsibility of each individual to do his or her due diligence before making a decision.

1

0

Управляйте всей своей криптовалютой, NFT и DeFi из одного места

Управляйте всей своей криптовалютой, NFT и DeFi из одного местаБезопасно подключите используемый вами портфель для начала.