SEC Drops Gemini Lawsuit After $940M Crypto Restitution

0

0

This article was first published on The Bit Journal.

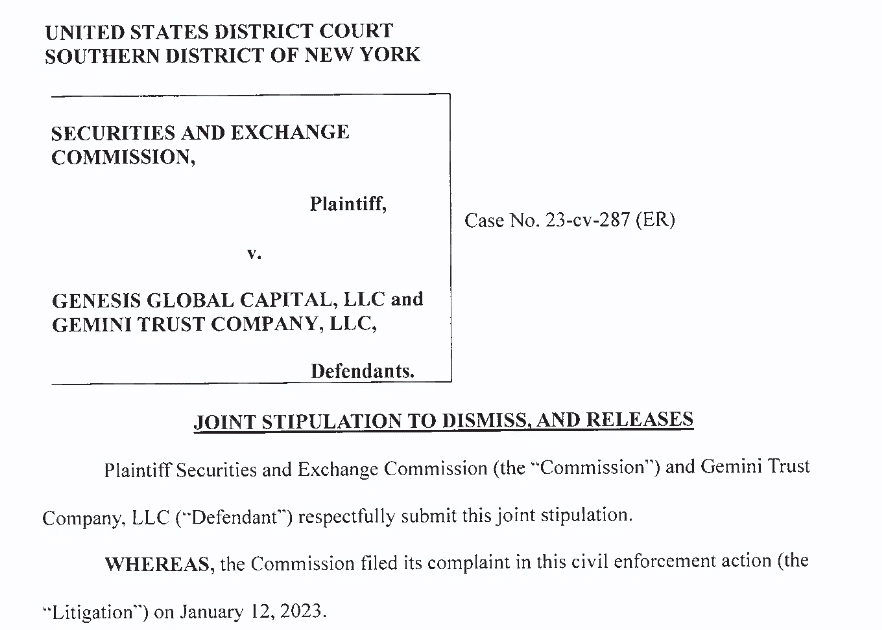

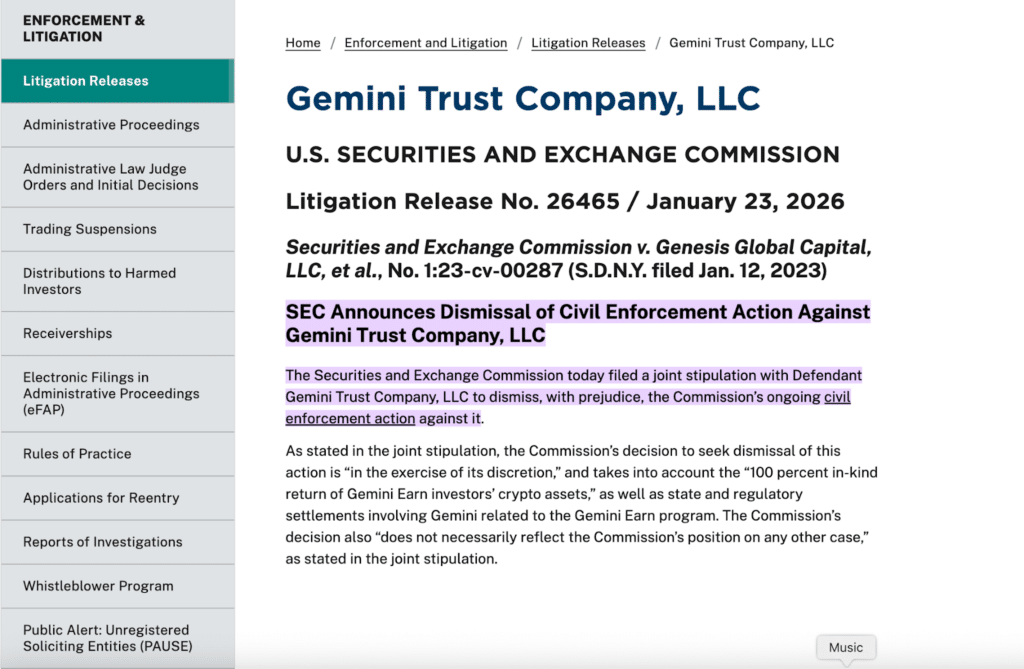

After a three-year legal battle, the US Securities and Exchange Commission (SEC) has officially dropped its case against Gemini Trust Company regarding the Gemini Earn programme. The dismissal, filed with prejudice on 23 January 2026, follows the full restitution of approximately $940 million in cryptocurrency to investors.

The Gemini lawsuit, which originated in early 2023, accused Gemini and Genesis Global Capital of offering unregistered securities through the Earn programme, which had frozen user funds amid the 2022 crypto market collapse. This outcome signals a pivotal moment in crypto legal news and highlights a pragmatic approach in SEC enforcement crypto when investor harm is fully addressed.

Genesis Bankruptcy and $940M Investor Recovery

The turning point in the Gemini lawsuit came through Genesis’s bankruptcy proceedings. When the FTX collapse triggered Genesis to halt withdrawals in November 2022, over $940 million in user funds were locked in the Gemini Earn programme. Through a court-approved plan in May–June 2024, investors received their original cryptocurrencies in-kind, not cash equivalents, fulfilling full restitution.

This exceptional recovery, exceeding expectations, addressed the core concerns of the SEC lawsuit and demonstrated that complete investor payout can influence enforcement outcomes. Gemini also contributed $50 million to the settlement, reinforcing its commitment to users.

How the Gemini Lawsuit Reflects Broader Regulatory Trends

The Gemini lawsuit underscores a shift in cryptocurrency regulation. Previously, SEC enforcement focused heavily on prosecuting unregistered securities without considering investor recovery.

In this case, full restitution played a decisive role in the dismissal. Comparatively, other crypto platforms facing litigation may now observe that returning investor funds can impact regulatory outcomes. Analysts suggest that this case may act as a blueprint for the SEC in 2026, balancing enforcement rigour with practical remedies, marking an evolution in crypto industry news 2026.

Gemini Earn Programme: From Legal Pressure to Resolution

The Earn programme allowed users to lend crypto to Genesis in exchange for interest yields, attracting over 200,000 participants. When withdrawals froze, the SEC filed a lawsuit alleging securities violations.

However, the full repayment of assets, combined with Gemini’s proactive measures, shifted the narrative. The SEC determined that the claims were no longer worth pursuing. For the exchange, this outcome marks both a legal victory and an opportunity to restore trust. It also illustrates how properly structured investor payout crypto mechanisms can mitigate the risk of prolonged litigation.

Market and Industry Implications

The dismissal of the Gemini lawsuit has ripple effects across the crypto sector. Other exchanges and lending platforms may prioritize transparent recovery plans to avoid regulatory penalties. Institutional and retail investors are likely to view such enforcement outcomes as confidence-building signals, encouraging participation in regulated crypto products. The resolution highlights the importance of integrating compliance, operational transparency, and contingency plans into platform design, providing lessons for ongoing and future SEC enforcement crypto actions.

Strategic Growth Opportunities for Gemini

With the lawsuit behind it, Gemini can now focus on growth and innovation. The exchange recently secured CFTC approval to launch prediction markets, expanding beyond spot trading. Freed from the uncertainty of litigation, Gemini is positioned to pursue new products while adhering to cryptocurrency regulation.

For industry observers, this demonstrates how resolving major legal disputes can unlock strategic opportunities and influence investor confidence, reinforcing the importance of proactive compliance in preventing prolonged legal entanglements.

Comparative Analysis: Enforcement Versus Restitution

This case provides a rare lens into how SEC enforcement crypto strategies are adapting. Unlike earlier enforcement actions that prioritized punitive measures, the Gemini lawsuit illustrates that regulators are increasingly factoring in restitution outcomes.

Comparisons with past litigation show that full investor recovery can directly affect whether enforcement continues or is terminated. The implications are profound: cryptocurrency platforms that design products with built-in investor protection mechanisms may experience more favourable regulatory outcomes.

Lessons for Investors and Platforms

The Gemini lawsuit sets clear lessons for both investors and platforms. Investors should evaluate risk and recovery potential when engaging with lending programmes, ensuring that counterparties have solid contingency plans.

Platforms, meanwhile, must prioritize transparent communication, regulatory alignment, and robust repayment mechanisms to safeguard users. The resolution demonstrates that Gemini Earn investors get full crypto back, reinforcing trust and showing that thorough preparation can positively influence regulatory negotiations.

Conclusion

The Gemini lawsuit ends after full payout, marking a milestone in cryptocurrency regulation and enforcement. The SEC’s dismissal following the $940 million restitution underscores a pragmatic approach, showing that investor protection can be a determining factor in legal outcomes. As crypto adoption grows, exchanges and investors must prioritize transparency, compliance, and structured recovery mechanisms.

This case serves as a blueprint for the sector, proving that restitution and regulatory cooperation can resolve disputes efficiently, protecting both investors and market integrity.

Appendix: Glossary of Key Terms

Gemini lawsuit: Legal action brought by the SEC against Gemini Trust Company regarding unregistered securities through the Earn programme.

Cryptocurrency regulation: Legal frameworks governing crypto trading, lending, and investor protection.

SEC enforcement crypto: Regulatory actions targeting crypto platforms for potential securities violations.

Investor payout crypto: The return of digital assets to investors following bankruptcy or settlement.

Earn programme lawsuit: Legal disputes arising from crypto lending programmes.

$940M crypto repayment SEC case: Reference to the Gemini lawsuit resulting in the return of $940 million to investors.

Frequently Asked Questions About the Gemini Lawsuit

What was the Gemini lawsuit about?

The SEC alleged that the Earn programme offered unregistered securities and froze investor funds during Genesis’s bankruptcy.

How much was returned to investors?

Approximately $940 million in cryptocurrency was returned in-kind to investors, fulfilling full restitution.

Does this dismissal affect other SEC cases?

No, the dismissal applies only to Gemini. Other ongoing SEC enforcement actions remain unaffected.

Why did the SEC drop the case?

The SEC concluded that full investor restitution addressed the core investor harms, making continued litigation unnecessary.

What does this mean for crypto platforms?

Platforms can reduce regulatory risk by prioritizing investor protection, transparent repayment mechanisms, and proactive compliance.

References

SEC (Litigation Release No. 26465)

Read More: SEC Drops Gemini Lawsuit After $940M Crypto Restitution">SEC Drops Gemini Lawsuit After $940M Crypto Restitution

0

0

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.Connectez de manière sécurisée le portefeuille que vous utilisez pour commencer.