Crypto Markets Bifurcate With Institutions Focusing on BTC and ETH While Retail Chases Alts: Wintermute

18

3

The crypto market is splitting in two.

Institutional and retail investors are taking increasingly different paths, with institutional players anchoring themselves in bitcoin BTC and Ethereum's ether ETH while retail investors pour into altcoins and memecoins, according to a mid-year report from crypto trading firm Wintermute.

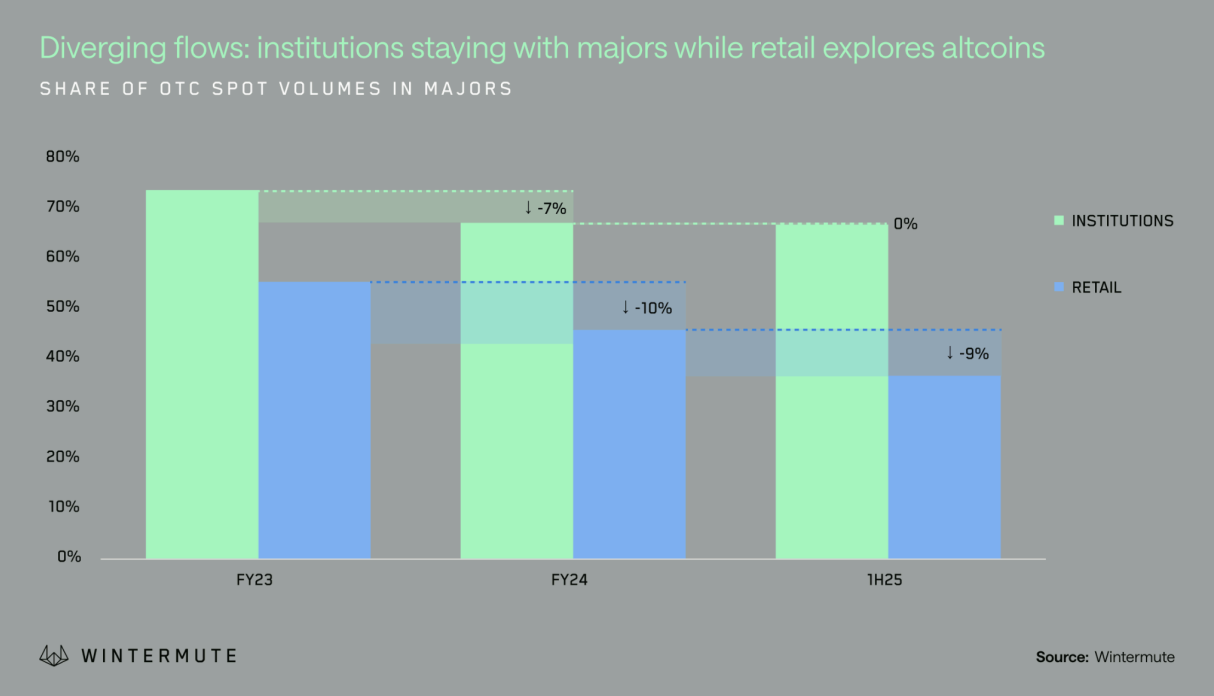

Analyzing over-the-counter spot trading volumes, institutional trading volumes with the two largest tokens held steady at 67%, likely backed by ETF inflows and structured accumulation vehicles, the report said. Meanwhile, retail investors dropped their BTC and ETH exposure from 46% to 37%, shifting capital toward newer, more speculative tokens.

"This divergence isn’t a temporary thing; It’s the sign that we are experiencing a more mature, sophisticated and specialized crypto market," said Evgeny Gaevoy, CEO and founder of Wintermute.

"Investors are no longer chasing the same trend," he added. "Institutions are treating crypto as a macro asset, while retail traders continue to gravitate to innovation."

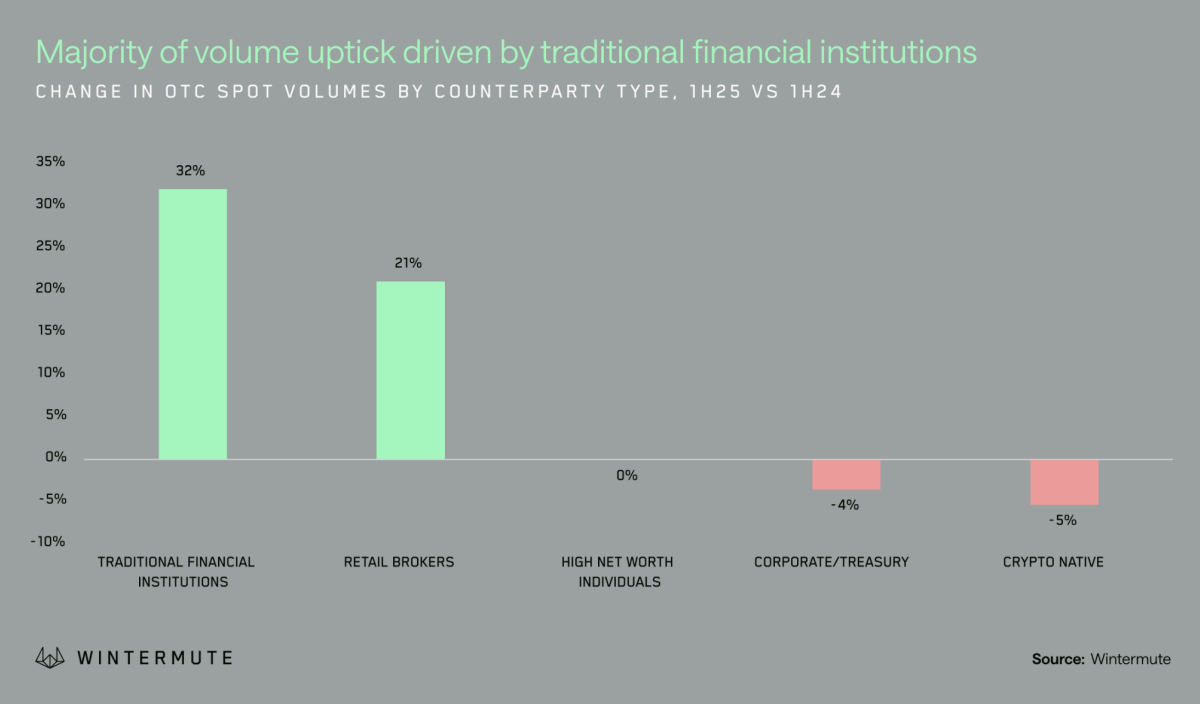

Overall, traditional finance (TradFi) firms were the fastest-growing cohort in OTC trading volumes, growing 32% year-over-year. That growth was being fueled by regulatory developments like the U.S. GENIUS Act and the EU’s ongoing MiCA rollout, which have given larger firms more confidence to participate, the report said.

Retail brokers also saw strong activity, with a 21% rise in volume over the same period. Meanwhile, crypto-native firms dialed back, down 5%.

OTC options volume jumped 412% compared to the first half of 2024, as institutions embraced derivatives for hedging and yield generation, the report noted. Meanwhile, Contracts for Difference (CFDs) doubled in variety, offering access to less liquid tokens in a more capital-efficient way.

Wintermute said its own OTC desk saw spot trading volumes grow at more than twice the pace of centralized exchanges, signaling a shift toward more discreet, large-volume trading favored by traditional finance.

The firm noted that memecoin activity has become more fragmented. While overall retail trading in memecoins declined, the number of tokens traded by individual users doubled, signaling a broadening appetite for micro-cap assets in the long tail of the market.

With that, legacy names like dogecoin DOGE and shiba inu SHIB lost ground to a growing list of niche tokens such as bonk BONK, dogwifhat WIF and popcat POPCAT, the report noted.

Looking ahead to the second half of 2025, Wintermute analysts said to keep an eye on spot dogecoin ETF filings with spot with a final regulatory decision expected by October.

"The outcome could significantly impact the retail market and set a precedent for other alternative assets," the report said.

18

3

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plek

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plekVerbind de portfolio die je gebruikt veilig om te beginnen.