$27.3M Crypto Theft Exposes Major Weakness in Multisig Wallet Security

0

0

This article was first published on The Bit Journal.

A large case of crypto theft has emerged after blockchain security firm PeckShield detected the loss of about $27.3 million from a multi-signature wallet. The incident unfolded over several transactions. On-chain data suggests the attacker maintained full control of the wallet for an extended period.

The crypto theft was identified after analysts noticed unusual fund movements on the blockchain. The attacker did not move funds in a single transfer. Instead, assets were shifted gradually. This pattern indicates deliberate action rather than a rushed exploit.

Multisig Wallet Design Fails to Prevent Advanced Exploit

This exploit highlights growing risks in wallet management and operational security. Multi-signature wallets are designed to reduce single points of failure. However, this case shows that design alone does not eliminate risk. Human and system weaknesses remain a major concern.

Blockchain records revealed repeated interactions with the compromised wallet. PeckShield noted that the attacker reused the wallet across multiple steps. Such behavior is common in advanced Crypto theft incidents. It usually signals access to signing authority or private keys.

Funds Enter the DeFi Ecosystem

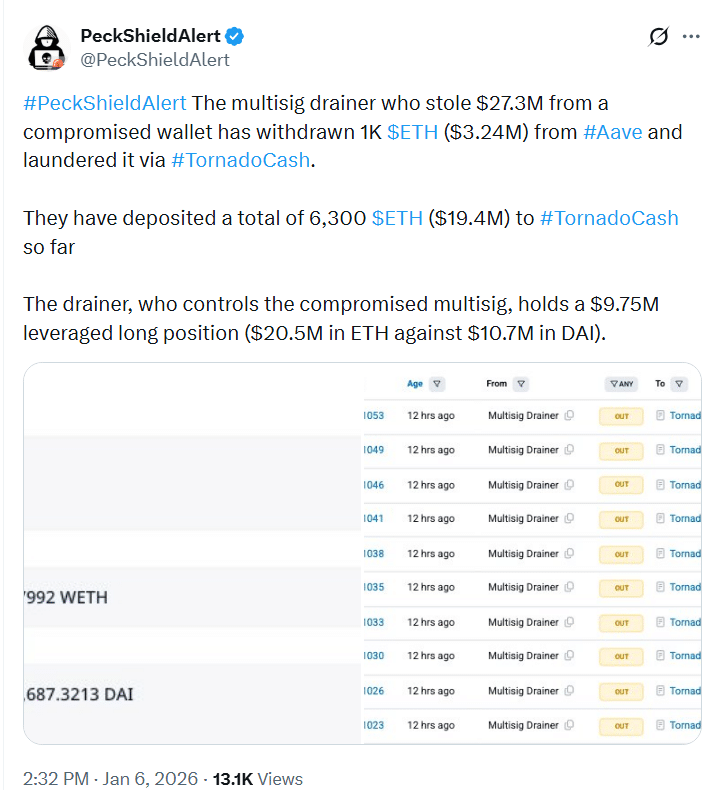

After gaining control, the attacker moved part of the stolen assets into decentralized finance platforms. About 1,000 ETH, valued near $3.24 million, was withdrawn from a lending protocol. This transfer marked a key stage in the crypto theft.

Also Read: Crypto Hack Loss Drop 60% in December to $76M, PeckShield Reports

Privacy Tools Used to Hide Transaction Trails

Soon after the withdrawal, the funds were sent through a crypto mixing service. PeckShield confirmed that around 6,300 ETH has passed through the mixer so far.

This represents most of the stolen value. The use of privacy tools is common in crypto theft cases. It breaks the visible link between deposits and withdrawals.

The attacker did more than move funds. PeckShield reported that the wallet also opened leveraged long positions worth about $9.75 million.

These positions involve borrowed assets. This shows the crypto theft included active trading, not just concealment. However, leverage increases the risk of liquidation.

Liquidation Risk Does Not Reduce Damage

If prices move sharply, the attacker could lose part of the stolen funds. Margin calls may force liquidation. Even so, the damage to the original owners remains. Crypto theft losses are counted at the time of theft. Later trading outcomes do not change that impact.

Multisig Wallet Security in Focus

The incident has renewed attention on multi-signature wallet security. These wallets require multiple approvals to move funds. They are widely used by institutions.

Yet crypto theft cases show that compromised key holders can bypass safeguards. PeckShield did not disclose how access was gained.

Common Attack Methods Under Review

In past investigations, similar breaches involved leaked private keys. Social engineering has also played a role. Compromised signing services are another factor. Crypto theft investigations often take time. Tracking funds becomes harder once privacy tools are involved.

Regulatory and Compliance Concerns Grow

The use of mixing services raises legal questions. Several jurisdictions monitor or restrict such tools. Once funds pass through these systems, recovery becomes unlikely.

This challenge appears frequently in major crypto theft incidents. Regulators continue to study possible responses.

PeckShield continues to track the attacker’s addresses. The firm has urged protocols and users to review wallet setups. Regular audits and strict key management are essential. Crypto theft risks grow as attackers become more sophisticated.

Conclusion

This case underscores a clear lesson for the industry. Advanced wallet design is not enough. Operational discipline matters. The latest crypto theft shows that even trusted security models can fail without strong controls and constant oversight.

Also Read: How to Secure Crypto Wallet From Hacks and Scams: What Every Holder Must Know

Appendix: Glossary of Key Terms

Multisig wallet: A wallet which needs multiple stakeholders to approve transactions.

On-chain activity: Transactions and information that have been permanently stored on the blockchain.

Private key: A secret code that permits the spending or transferring of crypto assets.

DeFi (Decentralized Finance): Financial services on the blockchain not conducted by traditional intermediaries.

Cyrpto mixer: A service that makes it hard to trace the origin and destination of crypto funds.

Leveraged position: A trade involving borrowed assets to amplify the size of a cache.

Liquidation: The forced closing of a position because there is not enough collateral.

Operational security – Security measures deployed to protect systems, access and digital keys.

Frequently Asked Questions About Crypto Theft

1- What is Crypto theft in this case?

It refers to the unauthorized draining of digital assets from a wallet.

2- How much value was stolen?

About $27.3 million worth of crypto assets.

3- Why were funds moved in multiple steps?

Multiple transfers suggest long-term wallet control.

4- Why are privacy tools used after Crypto theft?

They make tracking and recovery more difficult.

Reference

Read More: $27.3M Crypto Theft Exposes Major Weakness in Multisig Wallet Security">$27.3M Crypto Theft Exposes Major Weakness in Multisig Wallet Security

0

0

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요시작하는 데 사용하는 포트폴리오를 안전하게 연결하세요.